-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak Data-Tied Rally Stalls in Second Half

EXECUTIVE SUMMARY

US TSYS: Off Highs/Narrow Range Since Weak Data, More Housing Tue

Tsy futures trade higher after the bell, holding to narrow range since scaling back from midmorning high soon after the NAHB Housing data miss, yield curves holding mildly steeper. Tsy 30YY fell to low of 3.0503%, running at 3.098% at the moment

- Low volume session w/ TYU2 just over 840k vs 640k at late morning after Tsys extended early highs after the NY Fed Empire State index gapped -31.5 vs. 5.0 estimate - "with sharp declines in orders and shipments" for the second largest monthly decline since May 2020; August read of NAHB Housing Market Index is 49 vs. 54 est.

- Moderate option-tied and supply related hedging contributed to two-way flow on the session Tsys bill sales include $54B 13W and $42B 26W up shortly, high-grade corporate issuance resumed: $3B Amgen 3pt, $2.25B Rabobank 3pt launched while $3B KFW 2Y SOFR was rolled to Tuesday.

- Starting to see the start of Sep/Dec Tsy futures rolling ahead Aug 31 first notice when Dec takes lead quarterly position, roll volumes still muted.

- Data on tap for Tuesday (est, prior): Building Permits (1.696M rev, 1.640M), MoM (0.1% rev, -3.3%), Housing Starts (1.559M, 1.528M), MoM (-2.0%, -2.0%), Industrial Production MoM (-0.2%, 0.3%), Capacity Utilization (80.0%, 80.2%) and Mfg Production (-0.5%, 0.4%).

- The 2-Yr yield is down 4.6bps at 3.1967%, 5-Yr is down 4.6bps at 2.91%, 10-Yr is down 4.3bps at 2.7878%, and 30-Yr is down 1.1bps at 3.0972%.

EUROPE

EU/IRAN: Iranian Foreign Minister Hossein Amir-Abdollahian has told reporters that, "the people want results from us" ahead of a final decision on the revised Joint Comprehensive Plan of Action nuclear accords which is expected before a midnight deadline tonight Tehran time: 00:00 IDT 20:30 BST 15:30 ET. The presser is the firmest indication yet that Iran may agree to the revised text of the JCPOA accords which was negotiated this month in Vienna through EU mediation.

Sina Toossi of Foreign Policy has posted a twitter thread with a summary of Abdollahian's comments:

Abdollahian: "Parliament says that the draft text has problems, but the other side of course has its own demands."

Abdollahian: "The other side, 6 countries, has its own considerations. The agreement is the result of the conflict of views between us & the P5+1."

Abdollahian: "We have a draft text that is 100% based on our national interests."

Abdollahian: "What the people want from us today is the results of the negotiations. They say you negotiated & talked enough. The people want results from us."

Toossi: "Abdollahian said at the latest Iran will give its response to draft text by tonight midnight Tehran time. He said 3 issues remain & in the "coming days" Iran will "announce its final views."

CANADA

CANADA: Canada is much more likely to face a recession in the near term than a wage-price spiral as the central bank takes needed action to pull demand back in line with supply, a labour market adviser to federal and provincial governments told MNI.

- “The probability that we’ll enter or are in a recession right now is pretty high given what central banks here in Canada and around the world are doing,” Tony Bonen, executive director of the Labour Market Information Council, whose board is comprised of officials from every province, Statistics Canada and the federal labour department. Central bankers in Canada “are taking that action to constrain growth, precisely because markets are overheated. The labor market response to that will show up in the data with a bit of a delay.”

- Any recession that emerges should be less damaging than the Global Financial Crisis around 2008 or Canada's deep slump in the early 1990s, Bonen said. The job market is a big part of the cushion, he said, with wages rising at a 5% annual pace, record vacancies and a historically low unemployment rate. For more see MNI Policy main wire, Monday at 0722ET

OVERNIGHT DATA

- US NY FED EMPIRE STATE MFG INDEX -31.3 AUG

- US NY FED EMPIRE MFG NEW ORDERS -29.6 AUG

- US NY FED EMPIRE MFG EMPLOYMENT INDEX 7.4 AUG

- US NY FED EMPIRE MFG PRICES PAID INDEX 55.5 AUG

- US NAHB HOUSING MARKET INDEX 49 IN AUG (cons 55)

- US NAHB AUG SINGLE FAMILY SALES INDEX 57; NEXT 6-MO 47

MARKETS SNAPSHOT

Key late session market levels:

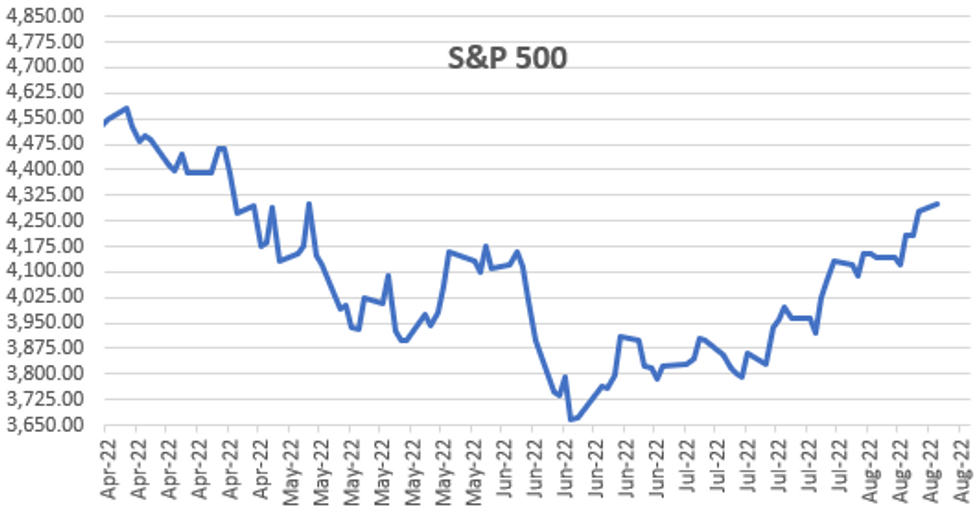

- DJIA up 165.48 points (0.49%) at 33928.03

- S&P E-Mini Future up 21.5 points (0.5%) at 4302.75

- Nasdaq up 96.1 points (0.7%) at 13144.55

- US 10-Yr yield is down 4.3 bps at 2.7878%

- US Sep 10Y are up 14.5/32 at 119-23

- EURUSD down 0.0098 (-0.96%) at 1.0161

- USDJPY down 0.11 (-0.08%) at 133.31

- WTI Crude Oil (front-month) down $2.85 (-3.09%) at $89.24

- Gold is down $22.09 (-1.23%) at $1780.37

- EuroStoxx 50 up 12.81 points (0.34%) at 3789.62

- FTSE 100 up 8.26 points (0.11%) at 7509.15

- German DAX up 20.76 points (0.15%) at 13816.61

- French CAC 40 up 16.09 points (0.25%) at 6569.95

US TSY FUTURES CLOSE

- 3M10Y -6.631, 18.143 (L: 16.187 / H: 26.822)

- 2Y10Y +0.625, -41.509 (L: -43.903 / H: -40.213)

- 2Y30Y +3.906, -10.569 (L: -17.338 / H: -10.361)

- 5Y30Y +3.729, 18.551 (L: 12.507 / H: 18.64)

- Current futures levels:

- Sep 2Y up 3.25/32 at 104-23.125 (L: 104-18.5 / H: 104-24.5)

- Sep 5Y up 9.25/32 at 112-18.5 (L: 112-06.75 / H: 112-23.75)

- Sep 10Y up 14.5/32 at 119-23 (L: 119-04.5 / H: 119-31)

- Sep 30Y up 31/32 at 141-18 (L: 140-13 / H: 142-03)

- Sep Ultra 30Y up 15/32 at 154-12 (L: 153-17 / H: 155-21)

US 10YR FUTURES TECHS: (U2) Recoups Friday Losses

- RES 4: 122-29+ High Mar 31

- RES 3: 122-16 2.0% 10-dma envelope

- RES 2: 120-29/122-02 High Aug 4 / High Aug 02

- RES 1: 120-22 High Aug 10

- PRICE: 119-26 @ 15:36 BST Aug 15

- SUP 1: 118-30+/30 Low Aug 12 / Jul 22

- SUP 2: 118-05 50.0% retracement of the Jun 14 - Aug 2 bull cycle

- SUP 3: 117-14+ Low Jul 21 and key near-term support

- SUP 4: 117-07 61.8% retracement of the Jun 14 - Aug 2 bull cycle

Treasuries bounced through late Monday hours, erasing the weak close on Friday. Nonetheless, the contract has breached trendline support at 119-16. The trendline is drawn from the Jun 16 low. The recent move lower is still considered corrective, however, the trendline break suggests a deeper retracement is likely near-term. This has opened 118-05, a Fibonacci retracement. Initial resistance to watch is 120-22, the Aug 10 high. A break would signal a possible bullish reversal.

US EURODOLLAR FUTURES CLOSE

- Sep 22 +0.018 at 96.653

- Dec 22 +0.040 at 96.120

- Mar 23 +0.055 at 96.130

- Jun 23 +0.065 at 96.230

- Red Pack (Sep 23-Jun 24) +0.070 to +0.085

- Green Pack (Sep 24-Jun 25) +0.085 to +0.090

- Blue Pack (Sep 25-Jun 26) +0.085 to +0.095

- Gold Pack (Sep 26-Jun 27) +0.090 to +0.095

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00400 to 2.31886% (+0.00286 total last wk)

- 1M -0.00715 to 2.37971% (+0.01743 total last wk)

- 3M +0.02029 to 2.94186% (+0.05486 total last wk) * / **

- 6M +0.02371 to 3.53300% (+0.08372 total last wk)

- 12M +0.03557 to 3.99457% (+0.09914 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 2.94186% on 8/15/22

- Daily Effective Fed Funds Rate: 2.33% volume: $97B

- Daily Overnight Bank Funding Rate: 2.32% volume: $286B

- Secured Overnight Financing Rate (SOFR): 2.28%, $966B

- Broad General Collateral Rate (BGCR): 2.26%, $396B

- Tri-Party General Collateral Rate (TGCR): 2.26%, $380B

- (rate, volume levels reflect prior session)

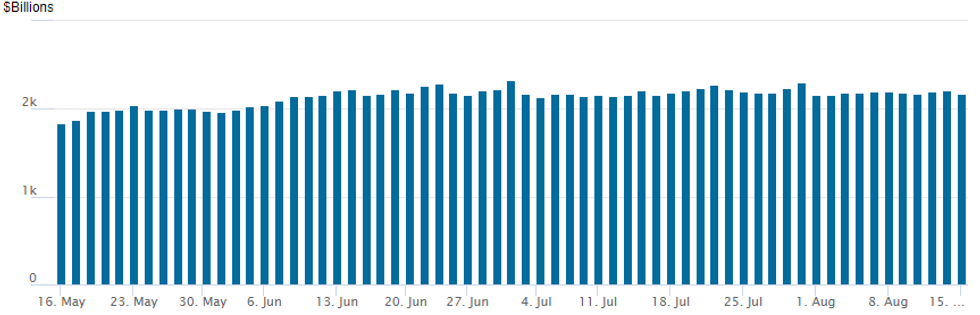

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage falls back to $2,175.857B w/ 102 counterparties vs. $2,213.193B prior session. Record high still stands at $2,329.743B from Thursday June 30.

$2.25B Rabobank 2Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 08/15 $3B #Amgen $1.25B 7Y +120, $750M +10Y +140, $1B +30Y +175

- 08/15 $2.25B #Rabobank $1B 2Y +70, 2Y SOFR, $1.25B 6NC5 +175

- 08/15 $750M #Toyota Motor Cr 3Y +55, upsized from $500M

- 08/15 $500M #Ameren Illinois 10Y +108

- 08/15 $1B Royal Caribbean 5NC2, 11.62%a

- 08/15 $Bemchmark Eaton investment calls

- Expected to issue on Tuesday

- 08/16 $3B KFW WNG 2Y SOFR+15a

- 08/15 $Benchmark ADB 5Y SOFR+43

EGBs-GILTS CASH CLOSE: Steady Rally

European bonds rallied for most of Monday's session following some weakness at the open, amid light trading volume with holidays in several countries (including France, Germany, Italy, and Spain).

- The fall in yields came amid a sharp drop in oil prices (Brent -4%) and unexpectedly weak economic data overnight in China and in the afternoon from the US.

- Apart from the steady drop in yields throughout the session, there were few key themes: German yields outperformed the UK in the short-end/belly, but the converse was true further down the curve.

- No bond issuance (back Tuesday w Gilt and Bobl auctions), key data (UK employment and German ZEW feature Tuesday), or central bank speakers.

- Greek debt underperformed, with the 10Y spread to Bunds nearly 4bp wider (other periphery EGB spreads were relatively unchanged).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 7.8bps at 0.53%, 5-Yr is down 7.7bps at 0.678%, 10-Yr is down 8.7bps at 0.9%, and 30-Yr is down 8.2bps at 1.155%.

- UK: The 2-Yr yield is down 2.1bps at 2.032%, 5-Yr is down 7.6bps at 1.855%, 10-Yr is down 9.4bps at 2.017%, and 30-Yr is down 10.1bps at 2.435%.

- Italian BTP spread down 0.8bps at 207.5bps / Greek up 3.7bps at 228.9bps

FOREX: Firmer Greenback Sees EURUSD Back Below 1.0200

- Dollar indices took their cues from a surging USD/CNH on Monday largely in response to overnight PBOC action on rates and the lower-than-expected Chinese economic activity data. Bullish momentum has been picking up for USDCNH in late trade following the break of the July and August highs around 6.7950. The pair is now trading up 1.12% at 6.8130.

- Dampened risk sentiment bolstered safe haven demand for the greenback and despite lower US yields and recovering stock indices throughout the US session, the USD Index looks set to post a 0.85% advance to start the week.

- Despite AUD and NZD being the weakest major currencies and both falling around 1.3%, the more notable price action has been in the Euro.

- In the process of sliding back below 1.0200, EURUSD has reversed the entirety of the post US CPI gains and has notably rejected the previous breakdown area between 1.0341/59 that had been a strong inflection point earlier this year. Additionally, the pullback highlights - for now - a failure to deliver a clear break of the bear channel resistance, currently at 1.0326. With the 100 pip grind lower on Monday, the pair also narrows the gap with the Aug 3 low at 1.0123.

- The softer single currency was noted last Friday with strong moves lower for some Euro crosses and lingering uncertainties regarding Europe’s energy crisis may be exacerbating the renewed weakness.

- The main beneficiary of lower US yields was understandably the Japanese Yen. USDJPY was well off the 13360 highs approaching the US Empire Manufacturing data, however, the softer prints sparked a swathe of selling down to fresh lows of 132.56. The firmer dollar overall has led to a strong bounce for the pair back to levels close to unchanged, however, significant weakness is noted in the likes of AUDJPY (-1.61%) and EURJPY (-1.12%) with the latter now trading 300 pips off last week’s highs.

- Highlight for Tuesday’s APAC session will be the RBA minutes before UK employment data and Germany’s ZEW sentiment release. Canadian CPI will be the focus for the North American session with US housing starts and IP to also be released.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/08/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 16/08/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 16/08/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 16/08/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 16/08/2022 | 0900/1100 | * |  | EU | Trade Balance |

| 16/08/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 16/08/2022 | 1230/0830 | *** |  | CA | CPI |

| 16/08/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 16/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 16/08/2022 | 1315/0915 | *** |  | US | Industrial Production |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.