-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Jackson Hole, Where Hawks Roost

EXECUTIVE SUMMARY

- MNI INTERVIEW: Fed Sept SEP Must Reflect Rate Hike Pain-Dudley

- MNI: Central Banks Should Revisit Hot Economy Frameworks - IMF

- MNI ECB: Some Central Bank Officials Want To Discuss QT This Year

- MNI: Supply Woes Mean No More Central Bank Multi-Tasking- BIS

- US AND CHINA REACH PRELIMINARY AGREEMENT ON AUDIT INSPECTIONS - bbg

- DEAL IS STEP TO AVOIDING DELISTING OF 200 CHINESE FIRMS FROM US - bbg

US

FED: The Federal Reserve’s next round of economic projections in September are likely to show more persistent inflation and higher unemployment to reflect the greater pain that will result from the central bank’s aggressive monetary tightening campaign, former NY Fed President William Dudley told MNI.

- “This is a different message about how we have to be restrictive and we’re going to need to be restrictive for some time and there’s going to be some pain and the unemployment rate is going to have to go up,” Dudley said. “The interesting thing is will you be able to see this in the Summary of Economic Projections for September because the June projections were still quite optimistic.”

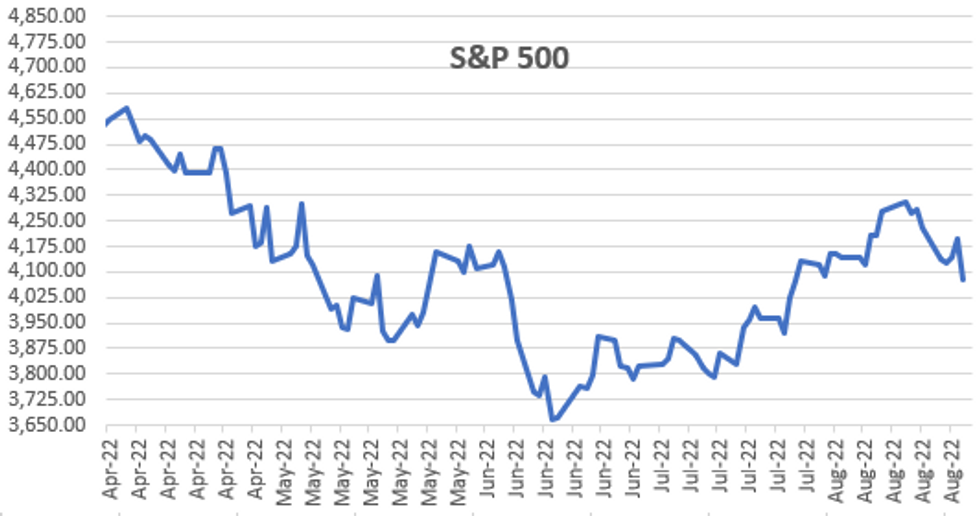

- Fed Chair Powell delivered a strong and succinct message at this year’s Jackson Hole conference: interest rates will have to rise to restrictive levels and then stay there for longer. Markets reacted swiftly, with the Dow Jones industrial average diving 1,000 points with two-year bond yields rising to 3.4%, the highest level since June and edging closer to highs not seen since the global financial crisis of 2008. For more see MNI Policy main wire at Friday 1645ET.

IMF: Central banks should revisit policy strategies that focus on running the economy hot given more palpable upside inflation risks, said International Monetary Fund First Deputy Managing Director Gita Gopinath.

- "Policy strategies based on a flat Phillips curve, including 'running the economy hot' and 'looking through' temporary supply shocks, should be revisited," said Gopinath, the IMF's former chief economist, in a speech prepared for the Fed's annual Jackson Hole symposium. "While running the economy hot can indeed have important benefits, and is sometimes appropriate, we need to rethink the benefits and costs in light of the more evident inflation risks."

- Gopinath's remarks come just two years after the Federal Reserve unveiled a new policy approach after an 18-month review that was aimed at beating weak inflation that had dogged central bankers for about a decade after the financial crisis. The Fed's 2020 shift toward an average inflation target largely recognized the central bank's persistent shortfalls from the 2% target and a desire to make up for them in the future but the framework has come under increased scrutiny as inflation hits 40-year highs. For more see MNI Policy main wire at 1315ET.

BIS: Bank for International Settlements chief Agustin Carstens on Friday boosted his stark warning to central banks about a shift to a high inflation era, saying policymakers no longer have the luxury of chasing after goals other than slowing rapid price gains.

- The global economy is likely moving into an era where production costs could be driven higher by fraying trade cooperation and a smaller share of the global population available for work, Carstens said in the released text of a speech at the Fed's Jackson Hole conference.

- Reversing decades of progress around "geopolitics, globalization and demographics" that kept inflation in check is something Carstens likened to a "coffin corner" where an airplane pilot risks stalling out and losing altitude. Earlier this year he made a similar but more speculative warning about a high inflation era. For more see MNI Policy main wire at 1500ET.

Europe:

ECB: DISCUSSIONS TO SHRINK ECB BALANCE SHEET SEEN AS LOGICAL STEP (BBG)

- From the Bloomberg article: Some European Central Bank officials want to begin a debate by year-end on when and how to shrink the almost 5 trillion euros ($5 trillion) of bonds accumulated during recent crises.

- The Governing Council hasn't discussed the issue yet, and it's unclear when the best moment would be to start reducing the balance sheet, given the increasing likelihood of a recession in the 19-member euro zone, according to people familiar with the matter.

- These comments followed some headlines crossing the wires from ECB's Holzmann:

- 75 BPS SHOULD BE `PART OF DEBATE' IN SEPTEMBER (BBG)

- 50 BPS HIKE NEXT MONTH IS `THE MINIMUM FOR ME' (BBG)

- Worth noting, the Austrian official is a top ECB hawk who has pushed for outsized rate moves in the past.

US TSYS: Double Shot of Hawkish Policy

FI futures mostly weaker (30Y Ultra still in the green) after the bell, real vol gradually evaporated in the second half as rates scaled off midday highs. Yield curves flatter (but off lows on wide range: 2s10s at -36.154 vs. -39.584 low/-29.102 high) as short end remains under pressure following this morning's hawkish tone from Fed and ECB.

- Volatile pre-Jackson Hole trade after fog of early Fed speak (generally less-hawkish comments from Bostic, Harker and Bullard) saw 30YY slip to initial 3.2298% low (3.2113% low in the last few minutes).

- Fast reversal (30YY bounced back to 3.2704%) well ahead Chairman Powell opening remarks at JH summit. ECB stole the Fed's thunder one desk quipped, others a little indignant at ECB interest over discussing 75bp rate hike next month. Caveat from Reuters story: "I won't necessarily back 75 but there is no reason it shouldn't be discussed," one of the sources, who asked not to be named, said.

- Rates gapped lower again after Chairman Powell's opening remarks deemed hawkish: the Fed needs to get restrictive and STAY restrictive for an extended period of time. Bonds gapped to new session highs briefly following better than expected U-Mich sentiment (58.2 vs 55.5 est).

- Futures continued to gyrate higher into late morning trade - heavy volume more related to Sep/Dec rolling (near 90% complete ahead next Wed's First Notice), not to mention Sep quarterly Tsy option expiration that gave traders fits as underlying futures repeatedly see-sawed through several strikes across the board.

- Jackson Hole eco summit continues Saturday, Link to the: agenda.

- The 2-Yr yield is up 3.5bps at 3.4007%, 5-Yr is up 5.5bps at 3.2068%, 10-Yr is up 1.7bps at 3.0427%, and 30-Yr is down 3.5bps at 3.2062%.

OVERNIGHT DATA

US JUL PERSONAL INCOME +0.2%; NOM PCE +0.1%

US JUL PCE PRICE INDEX -0.1%; +6.3% Y/Y

US JUL CORE PCE PRICE INDEX +0.1%; +4.6% Y/Y

US JUL UNROUNDED PCE PRICE INDEX -0.067%; CORE +0.085%

MICHIGAN FINAL AUG. CONSUMER SENTIMENT AT 58.2; EST. 55.5

MICHIGAN AUG. EXPECTATIONS INDEX AT 58 FROM 47.3

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 888.12 points (-2.67%) at 32401.36

- S&P E-Mini Future down 125.5 points (-2.99%) at 4075.25

- Nasdaq down 444.3 points (-3.5%) at 12194.48

- US 10-Yr yield is up 1.7 bps at 3.0427%

- US Sep 10Y are down 9.5/32 at 117-15.5

- EURUSD down 0.0013 (-0.13%) at 0.9962

- USDJPY up 0.96 (0.7%) at 137.45

- Gold is down $21.78 (-1.24%) at $1736.92

- EuroStoxx 50 down 70.86 points (-1.93%) at 3603.68

- FTSE 100 down 52.43 points (-0.7%) at 7427.31

- German DAX down 300.49 points (-2.26%) at 12971.47

- French CAC 40 down 107.3 points (-1.68%) at 6274.26

US TSY FUTURES CLOSE

- 3M10Y +0.982, 20.738 (L: 16.302 / H: 26.116)

- 2Y10Y -1.373, -36.006 (L: -39.584 / H: -29.102)

- 2Y30Y -6.421, -19.569 (L: -22.298 / H: -8.208)

- 5Y30Y -8.817, -0.14 (L: -0.224 / H: 10.627)

- Current futures levels:

- Sep 2Y down 2.5/32 at 104-11.75 (L: 104-09.25 / H: 104-15.625)

- Sep 5Y down 7.75/32 at 111-3.75 (L: 111-01 / H: 111-15)

- Sep 10Y down 9.5/32 at 117-15.5 (L: 117-09.5 / H: 117-29.5)

- Sep 30Y down 8/32 at 137-18 (L: 136-26 / H: 138-08)

- Sep Ultra 30Y up 20/32 at 151-0 (L: 149-00 / H: 151-22)

US 10YR FUTURE TECHS: (U2) Heading South

- RES 4: 120-22 High Aug 10 and a key near-term resistance

- RES 3: 119-31 High Aug 15

- RES 2: 119-14+ High Aug 17

- RES 1: 117-29/118-23+ High Aug 24 / 20-day EMA

- PRICE: 117-19+ @ 1500ET Aug 26

- SUP 1: 117-03+ Low Aug 24 / 25

- SUP 2: 116-26+ Low Jun 29

- SUP 3: 116-11 Low Jun 28

- SUP 4: 116-02+ 76.4% retracement of the Jun 14 - Aug 2 bull run

Treasuries are consolidating, and looked through the Powell speech after a brief interlude of volatility. The outlook remains bearish and the contract is trading closer to its recent lows. 117-07, 61.8% of the Jun 14 - Aug 2 bull cycle, has been pierced. A clear break of this area of support would strengthen the bearish case and signal scope for an extension towards 116-26+ next, the Jun 29 low. On the upside, initial firm resistance is seen at the 20-day EMA, at 118-23+.

US EURODOLLAR FUTURES CLOSE

- Sep 22 -0.003 at 96.623

- Dec 22 -0.015 at 95.980

- Mar 23 -0.005 at 95.955

- Jun 23 -0.030 at 95.995

- Red Pack (Sep 23-Jun 24) -0.055 to -0.05

- Green Pack (Sep 24-Jun 25) -0.075 to -0.055

- Blue Pack (Sep 25-Jun 26) -0.08 to -0.07

- Gold Pack (Sep 26-Jun 27) -0.06 to -0.04

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.01129 to 2.30914% (-0.01200/wk)

- 1M +0.03043 to 2.52386% (+0.09858/wk)

- 3M +0.02643 to 3.06957% (+0.11186/wk) * / **

- 6M +0.03957 to 3.56643% (+0.01886/wk)

- 12M +0.02600 to 4.12329% (+0.10473/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 3.01000% on 8/24/22

- Daily Effective Fed Funds Rate: 2.33% volume: $96B

- Daily Overnight Bank Funding Rate: 2.32% volume: $280B

- Secured Overnight Financing Rate (SOFR): 2.28%, $970B

- Broad General Collateral Rate (BGCR): 2.26%, $396B

- Tri-Party General Collateral Rate (TGCR): 2.26%, $385B

- (rate, volume levels reflect prior session)

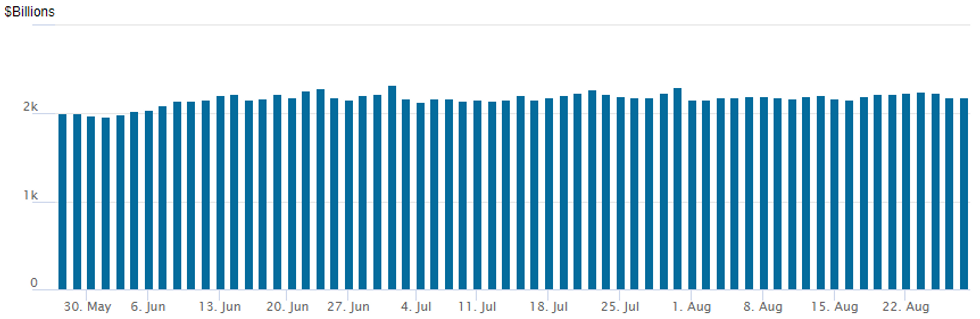

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usages slips to $2,182.452B w/ 98 counterparties vs. $2,187.907B prior session. Record high still stands at $2,329.743B from Thursday June 30.

FOREX: Greenback Ends On Firmer Footing As Equities Plummet

- Lower-than-expected data for US PCE and Core PCE weighed on the greenback ahead of Chair Powell’s address on Friday with a notable kneejerk to the downside as the data was released.

- This dollar weakness was exacerbated by a strong pop higher for the Euro following source headlines suggested some ECB policymakers want to discuss a 75 basis point interest rate hike at the September policy meeting, prompting EURUSD to rally to the best levels of the week above 1.0050.

- Powell’s mention of a restrictive policy ‘for some time’ prompted a kneejerk spike higher for the greenback but the reiteration of data dependency saw the initial move reverse course very swiftly as market participants analysed Friday’s data points.

- Given the earlier moves in the Euro, USDJPY was a good barometer for USD sentiment and an indication of the whippy price action. Opening at 136.70, the pair briefly rallied to 137.30 before sharply plummeting to fresh lows of the day at 136.23. However, with US yields holding at higher levels and subsequent pressure on major equity benchmarks throughout the rest of the US session, the greenback steadily advanced approaching the close.

- The pressure on stocks has seen significant weakness for the likes of NZD (-1.54%) and AUD (-1.29%) and despite more modest daily adjustments, the broad greenback strength saw strong reversals for most other G10 currencies.

- The USD Index has firmed around half a percent on the week and looks set to post the highest weekly close for six weeks.

- Aussie Retail Sales data on Monday is the only notable release on the Calendar. Monday sees the UK out for the bank holiday. The focus will quickly turn to Eurozone inflation data on Wednesday before Friday’s August Employment report from the US.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/08/2022 | 1625/1825 |  | EU | ECB's Isabel Schnabel speaks at Jackson Hole | |

| 29/08/2022 | 0130/1130 | ** |  | AU | Retail Trade |

| 29/08/2022 | 0600/0800 | *** |  | SE | GDP |

| 29/08/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 29/08/2022 | 1300/1500 |  | EU | ECB chief economist Philip Lane speaks | |

| 29/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 29/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 29/08/2022 | 1815/1415 |  | US | Fed Vice Chair Lael Brainard | |

| 29/08/2022 | 2000/1600 | ** |  | US | Dallas Fed manufacturing survey |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.