-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Mind the UK Yield Gap

EXECUTIVE SUMMARY

MNI INTERVIEW: Fed May Need Unemployment To Rise To 7% - Ball

MNI: Fed's Collins Says Modest Economic Slowdown Achievable

MNI INSIGHT: Emergency Hike Out Of Character For BOE

EU-RUSSIA: EU To Delay Russian Oil Price Cap

US

FED: The Federal Reserve’s view the jobless rate will rise to 4.4% over the next two years is a step in the right directions but is unlikely to be enough to stem underlying inflationary pressures in the U.S. economy that could require unemployment rising to 7%, former Fed visiting scholar and consultant for the IMF Laurence Ball told MNI.

- The Fed last week not only increased borrowing costs by 75 basis points for a third meeting in a row but also projected the unemployment rate will slope upward 0.7ppts from now to 4.4% before staying put for about two years.

- "That's a step towards realism, but I would say that is still too low to be a likely path that would bring inflation down to target," said Ball who recently produced a Brookings paper on inflation during the pandemic with IMF cowriters Daniel Leigh and Prachi Mishra. "We have started redoing some of our analysis with a 4.4% unemployment peak, and it makes some difference but it doesn't change the basic conclusion."

FED: Boston Fed President Susan Collins in her first public speech Monday said the central bank can achieve its target of 2% inflation without causing severe damage to the U.S. economy but it will require the unemployment rate moving higher.

- "As monetary policy moves to a restrictive stance to transition the economy to more sustainable labor market conditions, there is apprehension about the possibility of a significant downturn. I do believe the goal of a more modest slowdown, while challenging, is achievable," she said, stressing that price stability sets the foundation for sustainable maximum employment.

- "Inflation remains too high," she noted in prepared remarks to the Greater Boston Chamber of Commerce, adding that she anticipates "accomplishing price stability will require slower employment growth and a somewhat higher unemployment rate." For more see MNI Policy mainwire at 1000ET.

UK

BOE: Markets are alive with chatter about an emergency Bank of England rate hike following the plunge in sterling and gilts, but such a move would be out of character for the BOE, which aims to set policy based on a full appraisal of the economic outlook and has no interest in defending particular exchange rate levels.

- Sterling hit an all-time low on Monday in response to Friday’s government announcements of unfunded spending and tax cuts, but, while the BOE would act to ensure market functioning it has no mandate for defending the currency. It is theoretically possible that Chancellor Kwasi Kwarteng could instruct the Bank to buy sterling, but the UK’s last attempt at intervention, when it defended the pound’s membership of the European Exchange Rate Mechanism in 1992, ended in expensive failure and its current stocks of international reserves would not long survive any tussle with speculators.

- Only in the event that selling became unidirectional, prompting liquidity shortages in sterling markets, would the Bank’s markets division feel obliged to step in, as market maker of last resort. But there appears to be no evidence of this so far, with the repricing of gilts appearing to be a response to what is perceived as adverse economic news. For more see MNI Policy mainwire at 0900ET Monday.

EUROPE

EU-RUSSIA: EU To Delay Russian Oil Price Cap Bloomberg has reported that the European Union will likely sideline attempts to impose a price cap on Russian oil products due to pushback from Hungary and Cyprus.

- A price cap was expedited by an extraordinary EU Council on the margins of the UNGA in New York last week after Russian President Vladimir Putin ordered a partial mobilisaion and moved to ratify "sham" referenda in occupied territories.

- EU sanctions packages required unanimity, a procedural hurdle which has repeatedly handed Budapest a veto in measures against Russia.

- Bloomberg: "Countries may push to have a preliminary deal ahead of an informal gathering of EU leaders in Prague on Oct. 6."

- Hungary PM Viktor Orban said today that sanctions on Russia have "backfired" and will press ahead with a "national consultation" on sanctions. The move has been described as a propaganda drive with no binding legal relevance but Orban is likely hoping that a domestic mandate to oppose the EU will allow him to obfuscate sanctions.

US TSYS: BoE Emergency Action Talk Spurs Higher US Tsy Ylds

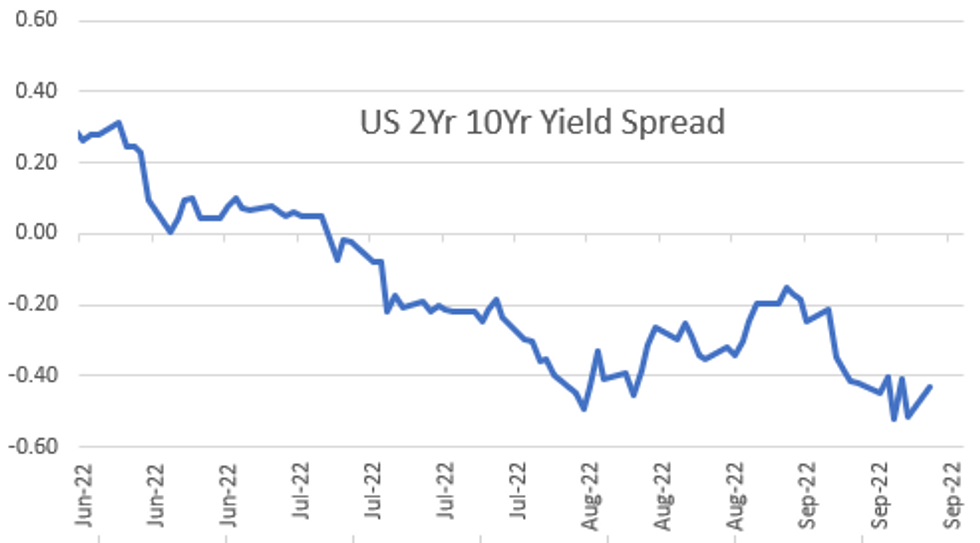

Tsys remain weaker - bonds extending lows through midday, as yield curves bear steepened back near last Thu's inverted highs: 2s10s +9.389 to -43.334 after 2YY made new 15Y high of 4.3450% overnight, currently 4.3147% +.1136.

- Carry-over selling in US FI this morning partially tied to London mkt pricing in chance of BOE emergency rate hike (before next BoE in Nov) in aftermath of UK gov's "Growth Plan" (ie fiscal event) and further comments from the Chancellor over the weekend that more tax cuts are to come.

- Bonds looking to test session lows after latest BOE headlines: "BOE BAILEY WON'T HESITATE TO CHANGE RATES BY AS MUCH AS NEEDED" .. "TO ASSESS POUND DROP, FISCAL PLAN AT NEXT SCHEDULED MEETING", bbg

- Limited react to Fed speak refrain on the day: Atlanta Fed Bostic virtual event:

NEED TO CONTROL INFLATION, WILL BE VOLATILE UNTIL THEN .. WE'VE STILL GOT A WAYS TO GO TO CONTROL INFLATION, Bbg. - Otherwise limited react to second tier data: CHICAGO FED AUG. NATIONAL ACTIVITY INDEX: 0.00, Consensus 0.23 from 0.29 in Jul; US SEPT. DALLAS FED MANUFACTURING INDEX AT -17.2 VS -12.9, consensus -10.

- Tsy futures remained broadly weaker/near lows after $43B 2Y note auction (91282CFN6) tails again: 4.290% high yield vs. 4.275% WI; 2.51x bid-to-cover vs. 2.49x prior.

- Currently, the 2-Yr yield is up 10.3bps at 4.3039%, 5-Yr is up 17.8bps at 4.1567%, 10-Yr is up 19.7bps at 3.8817%, and 30-Yr is up 9.6bps at 3.7018%.

OVERNIGHT DATA

- CHICAGO FED AUG. NATIONAL ACTIVITY INDEX AT 0.00 - bbg. Consensus 0.23 from 0.29 in Jul

- US SEPT. DALLAS FED MANUFACTURING INDEX AT -17.2 VS -12.9 - bbg, consensus -10

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 221.08 points (-0.75%) at 29370.73

- S&P E-Mini Future down 22.5 points (-0.61%) at 3687

- Nasdaq up 4.8 points (0%) at 10874.06

- US 10-Yr yield is up 19.3 bps at 3.8777%

- US Dec 10Y are down 41/32 at 111-11

- EURUSD down 0.0069 (-0.71%) at 0.9619

- USDJPY up 1.25 (0.87%) at 144.56

- WTI Crude Oil (front-month) down $1.95 (-2.48%) at $76.81

- Gold is down $16.21 (-0.99%) at $1627.83

- EuroStoxx 50 down 6.04 points (-0.18%) at 3342.56

- FTSE 100 up 2.35 points (0.03%) at 7020.95

- German DAX down 56.27 points (-0.46%) at 12227.92

- French CAC 40 down 14.02 points (-0.24%) at 5769.39

US TSY FUTURES CLOSE

- 3M10Y +11.612, 60.309 (L: 46.853 / H: 65.319)

- 2Y10Y +9.024, -43.699 (L: -55.982 / H: -42.482)

- 2Y30Y -1.174, -61.765 (L: -68.009 / H: -54.978)

- 5Y30Y -8.314, -45.968 (L: -46.837 / H: -36.857)

- Current futures levels:

- Dec 2Y down 5.375/32 at 102-14.5 (L: 102-11.25 / H: 102-20.875)

- Dec 5Y down 23.75/32 at 106-26.75 (L: 106-22 / H: 107-20)

- Dec 10Y down 1-9/32 at 111-11 (L: 111-05 / H: 112-22.5)

- Dec 30Y down 2-9/32 at 126-16 (L: 126-04 / H: 128-31)

- Dec Ultra 30Y down 2-4/32 at 138-21 (L: 137-30 / H: 140-30)

US 10YR FUTURE TECHS: (Z2) Bearish Outlook

- RES 4: 116-25+ 50 day EMA values

- RES 3: 115-06+ 20-day EMA

- RES 2: 114.17/115-01 High Sep 20 / 15

- RES 1: 114-00 High Sep 22

- PRICE: 112-06+ @ 15:19 BST Sep 26

- SUP 1: 111-25 Low Sep 23

- SUP 2: 111-08+ 3.0% Lower Bollinger Band

- SUP 3: 110-26+ 3.0% 10-dma envelope

- SUP 4: 111-00 Psychological Support

Treasuries remain soft following last week’s extension of its downtrend. A bearish price sequence of lower lows and lower highs, bearish moving average studies and a lack of any meaningful correction, clearly highlights the markets current bearish sentiment. Prices have shown below the 112-00 handle, thereby opening 111-08+, a lower Bollinger band value. Initial resistance is Thursday high of 114-00.

US EURODOLLAR FUTURES CLOSE

- Dec 22 +0.010 at 95.260

- Mar 23 +0.065 at 95.115

- Jun 23 +0.030 at 95.080

- Sep 23 -0.035 at 95.150

- Red Pack (Dec 23-Sep 24) -0.17 to -0.095

- Green Pack (Dec 24-Sep 25) -0.23 to -0.19

- Blue Pack (Dec 25-Sep 26) -0.24 to -0.23

- Gold Pack (Dec 26-Sep 27) -0.225 to -0.21

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00614 to 3.06329% (+0.75386 total last wk)

- 1M +0.03285 to 3.11314% (+0.06643 total last wk)

- 3M +0.01243 to 3.64086% (+0.06314 total last wk) * / **

- 6M +0.04457 to 4.24586% (+0.07800 total last wk)

- 12M +0.07014 to 4.90500% (+0.16272 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 3.64143% on 9/22/22

- Daily Effective Fed Funds Rate: 3.08% volume: $109B

- Daily Overnight Bank Funding Rate: 3.07% volume: $295B

- Secured Overnight Financing Rate (SOFR): 2.99%, $968B

- Broad General Collateral Rate (BGCR): 2.99%, $382B

- Tri-Party General Collateral Rate (TGCR): 2.98%, $358B

- (rate, volume levels reflect prior session)

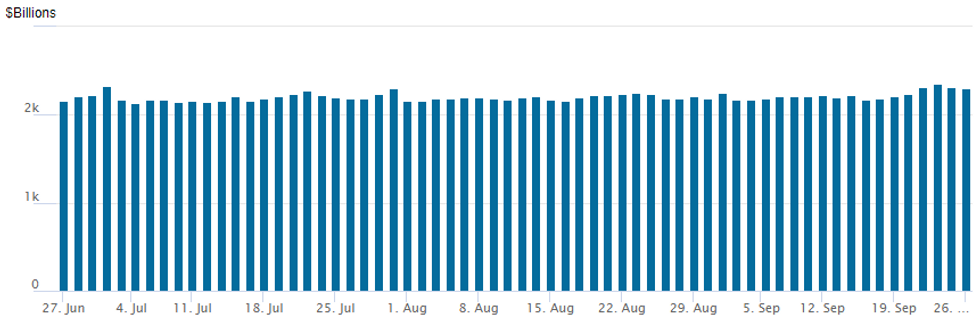

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,299.011B w/ 103 counterparties vs. $2,319.361B in the prior session.

Record high of $2,359.227B marked Thursday, September 22 - first new high since Thursday June 30: $2,329.743B.

PIPELINE: Tsy Yld Surge Sidelines Issuers

No new issuance Monday as ongoing surge in Tsy yields sidelined appr six companies as they await calmer waters. Announced ahead the NY open, frequent borrower IADB expected to issue Tuesday:- Date $MM Issuer (Priced *, Launch #)

- 09/27 $Benchmark IADB 5Y SOFR+35

- 09/23 No new issuance Friday, $13.9B total for week

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/09/2022 | 0600/0800 | ** |  | SE | PPI |

| 27/09/2022 | 0800/1000 | ** |  | EU | M3 |

| 27/09/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 27/09/2022 | 1015/0615 |  | US | Chicago Fed's Charles Evans | |

| 27/09/2022 | 1100/1200 |  | UK | BOE Pill Panels CEPR Barclays Monetary Policy forum | |

| 27/09/2022 | 1130/1330 |  | EU | ECB Lagarde in Panel at Banque de France | |

| 27/09/2022 | 1130/0730 |  | US | Fed Chair Jerome Powell | |

| 27/09/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 27/09/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 27/09/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 27/09/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 27/09/2022 | 1300/1500 |  | EU | ECB de Guindos Speaks at Barclays-CEPR Forum | |

| 27/09/2022 | 1355/0955 |  | US | St. Louis Fed's James Bullard | |

| 27/09/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 27/09/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 27/09/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 27/09/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.