-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Atlanta Fed Bostic Offers Alternative

EXECUTIVE SUMMARY

US

FED: The Federal Reserve might raise interest rates more than anticipated to combat high inflation but officials can slow the pace of tightening next month, Atlanta Fed President Raphael Bostic said in a speech on Saturday.

- “Inflation has been more persistent than most have forecast, and so we might find that a higher ‘landing rate’ is necessary,” Bostic said. Another 75 to 100 basis points of tightening may be needed before the Fed can pause, he said, adding policymakers are nowhere near reversing course.

- Fed policymakers penciled in a median 4.6% peak fed funds rate in their September projections, a figure likely to be revised higher in December, with fed funds futures expectations hovering near 5%. For more see MNI Policy main wire at 1345ET.

FED: Federal Reserve Bank of Boston President Susan Collins said Friday that recent positive data has not changed her view of what is needed to return inflation to 2% over time.

- In remarks prepared for delivery at a Boston Fed conference focused on labor markets, Collins said restoring price stability "will require additional increases in the federal funds rate, followed by a period of holding rates at a sufficiently restrictive level for some time.

- "The latest data have not reduced my sense of what sufficiently restrictive may mean, nor my resolve," she said, without offering her view of what that level may be. The Fed, Collins said, is committed to returning inflation to the 2% target "in a reasonable amount of time." For more see MNI Policy main wire at 0841ET.

CANADA

BOC: The Bank of Canada will raise its key interest rate a final half point Dec 7 and hold at 4.25% over the foreseeable future, Conference Board of Canada economist Pedro Antunes told MNI, with tight policy needed to keep inflation on a downward path in an economy he says will defy predictions of a painful recession.

- Inflation will keep cooling as the lagged effect of the 350bps of hikes so far takes hold, said Antunes, a former economist in the BOC's domestic forecasting arm who advises lawmakers overseeing the central bank. While October's inflation rate was unchanged at 6.9% after fading from June's four-decade peak of 8.1%, Antunes joined other advisers in highlighting softer monthly data such as seasonally-adjusted prices excluding food and energy.

- “Looking at the top line number on inflation right now, probably we will see another 50-basis-point increase in December and at the end of that maybe a pause to see how much impact this is going to have,” Antunes said. Economists surveyed by MNI are split on whether the next move is 50 or another step down to 25 from the Bank's moves of 100 in July, 75 in September and a smaller-than-expected 50 last month.

EUROPE

UK: The fall in UK government debt yields in the short time since the Office for Budget Responsibility prepared forecasts accompanying this week’s Autumn Statement has roughly doubled the amount of headroom for the government to meet its goal of getting debt-to-GDP declining five years ahead, David Miles, a member of the OBR's three person Budget Responsibility Committee, told MNI.

- The OBR’s forecasts, based on data from the 10 working days to Nov 4, showed only GBP9 billion in headroom compared to the government’s fiscal goal, but gilt yields have fallen markedly since, and with debt approaching 100% of GDP, the difference is substantial, said Miles.

- “Nine billion of headroom relative to the risks that could play out over five years is very, very small. If our central forecast was based on the past few days of gilt yields, just updating the interest rates, you could double the headroom from nine to almost twenty billion," Miles said.

US TSYS: Fed Terminal Up To 5.06% in June 2023

Tsys hold weaker levels after the bell, near lows/narrow range after nearly testing overnight lows through the second half. Limited reaction to existing home sales data: -5.9% less than estimated -7.1%, Oct leading indicator off more than estimated -0.4% to -0.8% MoM.

- Tsys saw renewed selling after comments from Boston Fed Pres Collins that 75bp NOT off the table - adding to decline of year-end step-down expectations after StL Fed Bullard's hawkish comments early Thursday.

- Fed Dec hike pricing up to appr 55bp now priced on OIS, or about 20% probability implied or about +1.5bp today or 2.5bp since before Bullard opined on 7% rates yesterday. Recall that pricing went as low as 51bp in the aftermath of the October CPI reading. Terminal pricing continues to rise above 5% mid-2023 to 5.06% (5.08% pre-CPI).

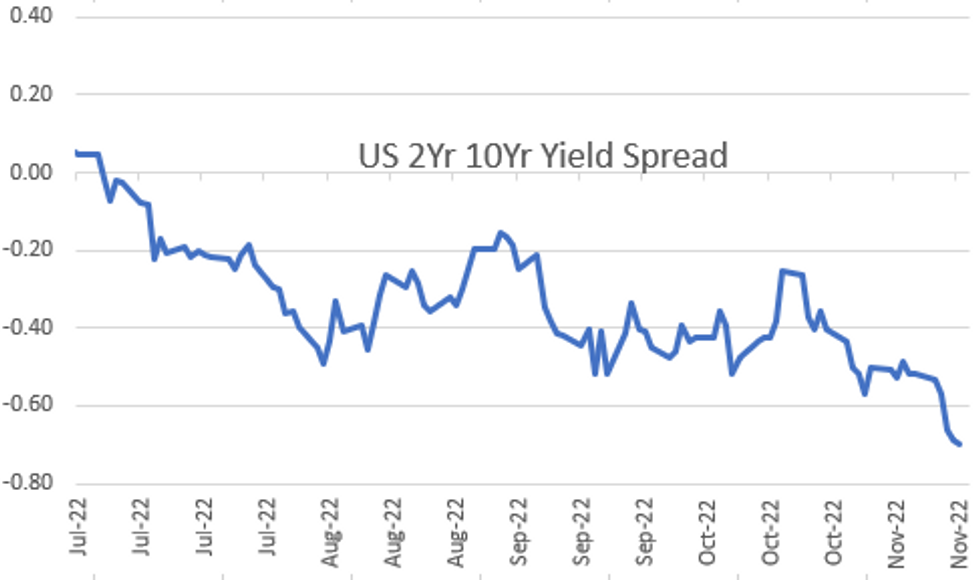

- Of note, the dip in year end policy-pivot expectations has contributed to heavy short end selling which in turn extends 2s10s inversion to new all-time low of 71.410 Friday morning - to -70.307 currently.

- Of note: Fed Chair Powell to speak on Nov 30 at Brookings at 1330ET - prior to this, he didn't have a speaking engagement on the calendar before the Dec FOMC. It will be a must-watch as it comes only 2 days before the pre-meeting blackout period.

OVERNIGHT DATA

- US Oct. Leading Indicator Falls 0.8% M/M; Est. -0.4%

- US NAR: OCT EXISTING HOME SALES FALL 5.9% TO 4.43M SAAR PACE

- US NAR: OCT HOME SALES LOWEST SINCE MAY'20 OR DEC'11 PRE-COVID

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 132.14 points (0.39%) at 33678.09

- S&P E-Mini Future up 8.5 points (0.21%) at 3964.25

- Nasdaq down 21.2 points (-0.2%) at 11124.3

- US 10-Yr yield is up 5.2 bps at 3.8176%

- US Dec 10Y are down 11/32 at 112-9

- EURUSD down 0.0031 (-0.3%) at 1.0331

- USDJPY up 0.12 (0.09%) at 140.32

- WTI Crude Oil (front-month) down $1.88 (-2.3%) at $79.76

- Gold is down $11.43 (-0.65%) at $1748.98

- EuroStoxx 50 up 46.42 points (1.2%) at 3924.84

- FTSE 100 up 38.98 points (0.53%) at 7385.52

- German DAX up 165.48 points (1.16%) at 14431.86

- French CAC 40 up 68.34 points (1.04%) at 6644.46

US TSY FUTURES CLOSE

- 3M10Y +4.823, -43.265 (L: -53.265 / H: -43.006)

- 2Y10Y -0.773, -69.83 (L: -71.41 / H: -65.843)

- 2Y30Y -1.319, -59.434 (L: -61.685 / H: -55.114)

- 5Y30Y -1.268, -7.814 (L: -9.402 / H: -5.412)

- Current futures levels:

- Dec 2Y down 3.75/32 at 102-4.875 (L: 102-04.625 / H: 102-09.25)

- Dec 5Y down 8/32 at 107-20.25 (L: 107-19.25 / H: 107-31.25)

- Dec 10Y down 10.5/32 at 112-9.5 (L: 112-06.5 / H: 112-25.5)

- Dec 30Y down 13/32 at 125-14 (L: 125-09 / H: 126-12)

- Dec Ultra 30Y down 24/32 at 133-3 (L: 132-26 / H: 134-20)

US 10YR FUTURE TECH: (Z2) Bull Cycle Still In Play

- RES 4: 115-14+ 50.0% retracement of the Aug 2 - Oct 21 downleg

- RES 3: 114-17 High Sep 20

- RES 2: 113-30 High Oct 4 and a key resistance

- RES 1: 113-11 High Nov 16

- PRICE: 112-15+ @ 15:44 GMT Nov 18

- SUP 1: 111-17+/110-12+ 20-day EMA / Low Nov 10

- SUP 2: 109+10+ Low Nov 04

- SUP 3: 108-26+ Low Oct 21 and the bear trigger

- SUP 4: 108-06+ Low Oct 2007 (cont)

Treasury futures faded further into the Friday close and the contract continues to trade below this week’s high print of 113-11. The outlook remains bullish. The contract has recently breached resistance at 112-14, the 50-day EMA. A continuation higher would strengthen the case for short-term bulls and open 113-30, the Oct 4 high and a key resistance. On the downside, initial firm support is at 111-17+, the 20-day EMA.

US EURODOLLAR FUTURES CLOSE

- Dec 22 +0.003 at 95.013

- Mar 23 -0.050 at 94.745

- Jun 23 -0.080 at 94.70

- Sep 23 -0.090 at 94.885

- Red Pack (Dec 23-Sep 24) -0.105 to -0.095

- Green Pack (Dec 24-Sep 25) -0.11 to -0.09

- Blue Pack (Dec 25-Sep 26) -0.085 to -0.075

- Gold Pack (Dec 26-Sep 27) -0.08 to -0.07

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00057 to 3.81214% (-0.00272/wk)

- 1M +0.00814 to 3.95671% (+0.07142/wk)

- 3M -0.01057 to 4.66486% (+0.03872/wk) * / **

- 6M +0.02028 to 5.14271% (+0.05871/wk)

- 12M 0.05157 to 5.50943% (+0.05814/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.67543% on 11/17/22

- Daily Effective Fed Funds Rate: 3.83% volume: $99B

- Daily Overnight Bank Funding Rate: 3.82% volume: $279B

- Secured Overnight Financing Rate (SOFR): 3.80%, $1.075T

- Broad General Collateral Rate (BGCR): 3.77%, $419B

- Tri-Party General Collateral Rate (TGCR): 3.77%, $401B

- (rate, volume levels reflect prior session)

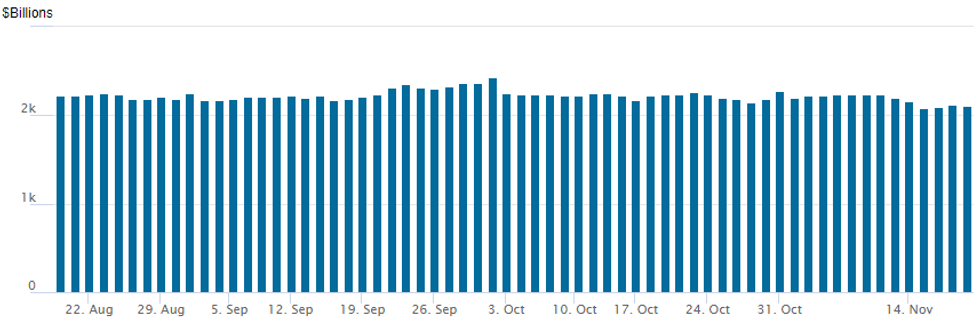

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $2,113.413B w/ 95 counterparties vs. $2,114.345B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EGBs-GILTS CASH CLOSE: BTPs Outperform After Low TLTRO Repayments

Bunds outperformed Gilts Friday with continued flattening in both curves, as ECB TLTRO repayments turned out lower than expected (around E300bln vs E600bln expected), one implication of which was that German bond collateral will remain a scarce commodity.

- Both German and UK yields recovered from session highs by early afternoon.

- Gilts continued to weaken post-Thursday's budget announcement - we discuss the issuance implications of the Autumn Statement here.

- A strong session for stocks and the TLTRO results (which meant Italian paper wasn't about to flood the market) helped BTP spreads tighten further (though

- ECB rate hike pricing dived a few basis points in the wake of the TLTRO results, but bounced back quickly and finished steady on the day. Hawkish comments from ECB's Nagel and Knot helped keep a floor on rates.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.8bps at 2.106%, 5-Yr is down 0.5bps at 1.986%, 10-Yr is down 0.6bps at 2.014%, and 30-Yr is up 0.1bps at 1.929%.

- UK: The 2-Yr yield is up 6.3bps at 3.179%, 5-Yr is up 4bps at 3.295%, 10-Yr is up 3.7bps at 3.239%, and 30-Yr is up 3.5bps at 3.388%.

- Italian BTP spread down 3.3bps at 188.4bps/ Greek down 0.9bps at 225.3bps

FOREX: Greenback Falters, NZD Firms Pre-RBNZ

- The greenback faltered Friday, but respected the recent range to post an uneventful close. The USD faded despite a higher high for 10y yields posted ahead of the London close at 3.8215%.

- CAD was the poorest performer, however the price action is yet to buck the recent bearish price action in USD/CAD, which resulted in new multi-month lows and confirmed a resumption of the current downtrend. This also marks an extension of the bearish price sequence of lower lows and lower highs.

- GBP outperformed for much of the Friday session, getting an early tailwind from marginally better--than-expected retail sales. The price action extended the recovery off the post-Autumn Statement lows, and helped EUR/GBP break lower and out of the recent right range.

- NZD was among the session's best performers, with markets pre-positioning ahead of next week's expected 75bps RBNZ rate hike to 4.25%.

- Focus in the coming week turns to the Riksbank rate decision, at which the bank are expected to raise rates by a further 75bps to put the policy rate at 2.50%.

- Market volumes and liquidity are expected to thin headed into the end of next week, with the US enjoying the Thanksgiving holiday break.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/11/2022 | 0115/0915 |  | CN | PBOC LPR | |

| 21/11/2022 | 0700/0800 | ** |  | DE | PPI |

| 21/11/2022 | 0905/0905 |  | UK | BOE Cunliffe Speech at Warwick Conference | |

| 21/11/2022 | 1530/1530 |  | UK | DMO Announces Agenda for Consultation Meetings | |

| 21/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 21/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 21/11/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 21/11/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.