-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI ASIA OPEN: Balanced Fed Talk, Debt Negotiations To Resume

- MCCARTHY: DECISIONS HAVE TO START BEING MADE, Bbg

- MNI US: Biden To Meet Speaker McCarthy For Debt Limit Talks Around 1730ET

- BULLARD: EXPECTING TWO MORE RATE HIKES THIS YEAR, Bbg

- FED'S BULLARD: US RECESSION PROBABILITIES ARE OVERSTATED, Bbg

- PENTAGON SPOKESPERSON SAYS NO EXPLOSION HERE THIS MORNING, Bbg

cropfilter_vintageloyaltyshopping_cartdelete

US TSYS: Yields Inch Higher, Markets Skittish As Debt Default Nears

Treasury futures holding mildly weaker levels after the close, lower half of a modest session range after a couple brief rounds of volatility. Cautious trade with no economic data to react to Monday, participants are eager for a breakthrough in US debt ceiling negotiations (talks resume tonight around 1730ET).- Aside the potential default risk, markets are eager for the release of May FOMC minutes this Wed at 1400ET. Early Fed speak proved balanced to mildly hawkish.

- SOFR futures are trading weaker in the very short end after MN Fed President Kashkari commented on CNBC that the June rate decision is a “close call” for him, broadly reiterating his comments to WSJ published Sunday. While Kashkari told WSJ he is "open to the idea that we can move a little bit more slowly from here", the focus is on "I would object to any kind of declaration that we're done."

- Federal Reserve Bank of Atlanta President Raphael Bostic said Monday he's comfortable waiting to see how the economy is reacting to past interest rates increases before entertaining any further hikes.

- Early knee-jerk risk-off moves, rates gapped back to pre-open levels at midmorning, stocks ticked lower following social media posts that a "large explosion" near the Pentagon complex had occurred. Markets snapped back just as quickly as the rumors proved false.

- Decent volumes (TYM3 1.6m) driven by a pick-up in Jun/Sep Treasury futures rolling ahead first notice date of May 31.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00418 to 5.09791 (+.03682 total last wk)

- 3M -0.01262 to 5.15085 (+.09367 total last wk)

- 6M -0.00735 to 5.13918 (+.16106 total last wk)

- 12M +0.00969 to 4.88735 (+.27652 total last wk)

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00315 to 5.06214%

- 1M -0.00872 to 5.12686%

- 3M -0.01800 to 5.37471% */**

- 6M -0.01171 to 5.45486%

- 12M -0.01357 to 5.43100%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.39271% on 5/19/23

- Daily Effective Fed Funds Rate: 5.08% volume: $132B

- Daily Overnight Bank Funding Rate: 5.07% volume: $287B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.363T

- Broad General Collateral Rate (BGCR): 5.02%, $578B

- Tri-Party General Collateral Rate (TGCR): 5.02%, $572B

- (rate, volume levels reflect prior session)

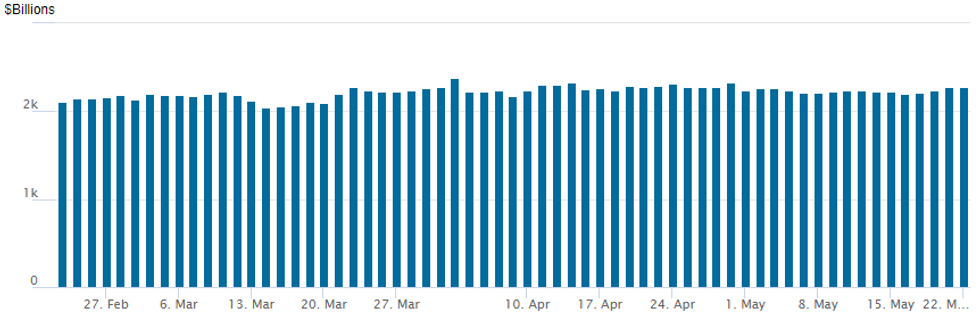

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $2,275.311B w/ 105 counterparties, compares to prior $2,276.720B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Better Treasury call trade continued through the NY session, SOFR option trade mixed on modest overall volumes with underlying futures trading weaker but off lows. Risk appetite is tepid with debt ceiling negotiations ongoing.- SOFR Options:

- 2,000 SFRM3 94.87/95.00 put spds ref 94.825

- 4,000 SFRM3 94.93/95.06 call spds ref 94.835

- Block/screen, 13,000 SFRM3 94.93/95.06 call spds

- 8,000 SFRM3 94.75/94.81/94.87/94.93 put condors, ref 94.855 to -.835

- Treasury Options:

- 3,250 FVQ3 110.5/112.75 call spds ref 109-06.25

- 5,000 TYM3 114.5 calls, 8 ref 113-17

- 9,000 FVM 108.5/109 put spds ref 108-21.25 to -21.5

- 4,400 TYN3/TYU3 113 put spds, 48

- Block, 11,000 TYN3 114/TYU3 112 put calendar diagonal , 4 net July over

- 2,500 TYN3 116/117 call spds, 12 ref 114-08.5

- 5,000 TYU3 119.5/121.5 call spds ref 114-18.5

- 3,500 TYM3 113/115 call spds, ref 113-25

- 3,000 FVU3 108 puts ref 109-16.25

- 2,500 TYM3 113.5 puts, 18 ref 113-25

- 1,250 TYM3 112/114 call spds ref 113-23.5

- 3,000 TYN3 116 calls, 36 ref 114-14

EGBs-GILTS CASH CLOSE: Greece Steals The Show

The German and UK curves bear flattened Monday, with GIlts underperforming. But Greece stole the show, with GGB yields collapsing after a market-friendly legislative election result over the weekend.

- Greek 10Y BTP yields fell 14bp, dropping to the lowest spread vs Bunds since January 2022, and reaching the highest premium vs BTPs in the euro era.

- Otherwise, most European instruments sold off steadily following a constructive start, with most weakness between 1000-1400UK time.

- The largest single move of the day came on false reports on social media of an explosion outside the US Pentagon which were quickly debunked. Bund and Gilt yields dropped 3bp but quickly reversed to set fresh session highs.

- There were few macro catalysts besides. ECB's Villeroy noted a likely peak in rates by September, but this was no surprise and markets were unmoved.

- Tuesday sees several central bank appearances, including ECB's de Guindos, Muller, Villeroy and Nagel, as well as BoE's Bailey and Haskel. Additionally, after a quiet day on the data front, the flow picks up Tuesday with May flash PMIs.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 5.2bps at 2.809%, 5-Yr is up 4.2bps at 2.448%, 10-Yr is up 3.1bps at 2.459%, and 30-Yr is up 3.1bps at 2.634%.

- UK: The 2-Yr yield is up 9.3bps at 4.053%, 5-Yr is up 8.1bps at 3.903%, 10-Yr is up 6.8bps at 4.064%, and 30-Yr is up 3.8bps at 4.452%.

- Italian BTP spread up 1.1bps at 185.5bps / Greek down 17.3bps at 141.8bps

EGB Options: Quieter Session After Massive Upside Plays Last Week

Monday's Europe rates / bond options flow included:

- ERU3 96.25/96.625 cs vs 95.875 puts bought for 3.25 in 2.5k

FOREX: USD Treads Water Amid Debt-Ceiling Negotiations, JPY Under Pressure

- The Dollar index trades at unchanged levels from Friday’s close as markets continue to await concrete progress over the US debt-ceiling negotiations. Hawkish Fed speak weighed on front-end rates in the US, having more of an effect on the Japanese Yen, with USDJPY rising back to 138.50.

- USDJPY has recovered the entirety of Friday’s sharp decline and the pair has spent the majority of late session consolidating around 138.50. Price action reaffirms that bullish conditions remain intact following last weeks’ strong gains. A key resistance zone between 137.77-91, the May 2 and Mar 8 high respectively, has been cleared. The break strengthens bullish conditions and confirms a resumption of the uptrend that started on Jan 16. The focus is on 139.00 and 139.59, a Fibonacci retracement. Initial firm support is seen at 135.78, the 20-day EMA.

- In similar vein, there was some pressure on the Chinese Yuan. USDCNH crept higher to the best levels of the session through the London close, however Friday's highs still sit well above at 7.0750.

- Today's uptick has put the pair back into overbought territory, with the 14d RSI just north of 70 and inline with levels seen late last week. This is the highest level for the technical measure since September last year - which was followed by a ~3% pullback in the pair over the subsequent two weeks. The moves come after the Chinese authorities issued their first warning over the pace of CNY depreciation last week - stating that they will curb speculation "when necessary" and maintain FX stability.

- After a slow session, void of any tier-one data releases, the economic calendar hots up on Tuesday with a host of global flash manufacturing and services PMIs. US new home sales and Richmond manufacturing will also cross. Focus will then quickly turn to Wednesday’s RBNZ decision.

FX: Expiries for May23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0865-80(E607mln), $1.0900-05(E534mln)

- USD/JPY: Y136.50-65($820mln), Y138.00($759mln)

- USD/CAD: C$1.3520-25(C$590mln), $1.3600($1.1bln)

LATE EQUITIES ROUNDUP: Narrow Range, Stocks Still Near 4-Month Highs

Stocks mixed in afternoon trade, Dow Industrials weaker vs. modest gains in SPX and Nasdaq stock, inside narrow ranges as market await another round of debt ceiling negotiations between House Speaker McCarthy and President Biden (pushed back to 1730ET vs. 1630ET).

- At current levels, Eminis are trading near the middle of last Friday's range after tapping the best levels since early February. S&P E-Mini futures are currently up 7 points (0.17%) at 4212; Nasdaq up 72.4 points (0.6%) at 12731.54; DJIA down 102.07 points (-0.31%) at 33323.52.

- Leading gainers: Communication Services, Real Estate and Energy sectors currently outperforming weaker Consumer Staples and Consumer Discretionary sectors.

- For a technical point of view, S&P E-minis traded higher last week and the contract breached key short-term resistance and the bull trigger at 4206.25, the May 1 high.

- Clearance of this level confirms an extension of the bull trend from Mar 13. This opens 4244.00, the Feb 2 high and the next important resistance.

- Key support is at 4062.25, the May 4 low. A move through this level would highlight a bearish threat.

E-MINI S&P TECHS: (M3) Key Resistance Remains Exposed

- RES 4: 4288.00 High Aug 19 2022

- RES 3: 4244.00 High Feb 2 and a medium-term bull trigger

- RES 2: 4231.00 High Feb 3

- RES 1: 4227.25 High May 19

- PRICE: 4211.50 @ 13445ET May 22

- SUP 1: 4119.78/4062.25 50-day EMA / Low May 4 and key support

- SUP 2: 4052.50 Low Mar 30

- SUP 3: 4022.75 50.0% retracement of the Mar 13 - May 1 bull leg

- SUP 4: 4006.00 Low Mar 29

S&P E-minis traded higher last week and the contract breached key short-term resistance and the bull trigger at 4206.25, the May 1 high. Clearance of this level confirms an extension of the bull trend from Mar 13. This opens 4244.00, the Feb 2 high and the next important resistance. Key support is at 4062.25, the May 4 low. A move through this level would highlight a bearish threat.

COMMODITIES: Oil Edges Higher Amidst Debt Talks, $80/bbl Calls Leads The Day For CLN3

- Crude oil has reversed an overnight slide to edge higher along with Treasury yields on some renewed optimism of a debt deal after initially little sound of progress over the weekend.

- Standard Chartered analysts see OPEC nations as likely to act during their next meeting on 3-4 June amid current speculative trading. “The build-up of speculative shorts means positioning is now as bearish as at the start of the pandemic,” … “Saudi Arabia in particular has often expressed its determination not to give speculators free rein to force an extreme price downside.”

- WTI is +0.6% at $72.10 (CLN3) but it doesn’t trouble key short-term resistance at $73.81 (May 10 high). In options space, the day’s most active strikes have been at $80/bbl calls.

- Brent is +0.6% at $76.05, remaining off resistance at $77.60 (May 10 high) and a more notable $78.74 for the 50-day EMA.

- Gold is -0.25% at $1972.8 in a narrow range as the USD index just above claws to gains for the day after opening lower. The yellow metal is stuck between resistance at $1999.0 (20-day EMA) and support at $1952.0 (May 18 low).

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/05/2023 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 23/05/2023 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 23/05/2023 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 23/05/2023 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 23/05/2023 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 23/05/2023 | 0715/0915 |  | EU | ECB de Guindos Address at European Financial Integration Conf | |

| 23/05/2023 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 23/05/2023 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 23/05/2023 | 0800/1000 | ** |  | EU | EZ Current Account |

| 23/05/2023 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 23/05/2023 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 23/05/2023 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 23/05/2023 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 23/05/2023 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 23/05/2023 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 23/05/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 23/05/2023 | 0915/1015 |  | UK | BOE Bailey, Pill, Tenreyro, Mann at MPR Hearing | |

| 23/05/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 23/05/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/05/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/05/2023 | 1300/0900 |  | US | Dallas Fed's Lorie Logan | |

| 23/05/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/05/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 23/05/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 23/05/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 23/05/2023 | 1445/1545 |  | UK | BOE Haskel Panellist at Richmond Fed Conference | |

| 23/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/05/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.