-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN - Barkin Says More Progress Needed on Jobs

EXECUTIVE SUMMARY:

- MNI: FED'S BARKIN PREFERS SIMPLE, FLEXIBLE TAPER

- BARKIN SAYS FED HAS NOT YET MET EMPLOYMENT PROGRESS GOAL

- BOC REVEALS CORPORATE BOND BUY LIST

- BOJ SWITCHES TO QUARTERLY JGB OPS GUIDE

NORTH AMERICA

US (MNI): Fed's Barkin Prefers Simple, Flexible Taper

Federal Reserve Bank of Richmond President Tom Barkin told an MNI webcast on Tuesday he prefers a simple, flexible approach to winding down the central bank's bond purchases and for the process to begin after millions more people return to work. He would be "open minded" about phasing out mortgage bond purchases faster or sooner than Treasuries, and would ideally like to complete tapering before raising interest rates, he added.

CANADA (MNI): Rocky Canada Re-Opening on Supply Shortages- GDP likely shrank in April and May amid lockdowns.

Canada's economic restart may not be quick or smooth as firms struggle to hire back workers and face supply shortages that drive up costs, dimming optimism around the accelerating vaccine rollout, industry sources tell MNI.

CANADA (MNI): Lasting Canada Stimulus Seen on Lagging Rebound

Canada faces long-term weakness in business investment and productivity that will encourage policy makers to keep stimulus in place through the burst where firms re-open following pandemic lockdowns, Craig Alexander, chief economist at Deloitte Canada, told MNI. The Bank of Canada will likely wait until the fourth quarter of next year to raise its 0.25% rate, said Alexander, who has testified half a dozen times to parliament's economic committees. That timing is towards the end of Governor Tiff Macklem's guidance period for a move in the second half of 2023. Expanded government spending won't be significantly wound down until 2023, he predicts.

CANADA (MNI): BOC Reveals Corporate Bond Buys - Bell, RioCan

The Bank of Canada bought debt in some of the nation's largest corporations under a market stabilization program it discontinued earlier this year, including telecom giant Bell Canada, RioCan Real Estate Investment Trust, and energy producers Enbridge and Pembina, according to a disclosure published Wednesday.

EUROPE

SWEDEN (MNI): Riksbank To Weigh 2024 Liftoff In Projection

The Riksbank's updated collective rate projection could show rates beginning to edge higher in three years for the first time in this cycle on Thursday, but such an outcome is not a done deal, with some policymakers calling in public for policy to be left on hold for longer even if inflation overshoots targets.

GERMANY (MNI): Sound Fiscal Stance Needed For L-T Goals: Merkel

The EU must pursue fiscal policies in order to create the space to achieve its longer-term and strategic goals, German Chancellor Angela Merkel said Tuesday. "We have to pursue sound fiscal policies in order to have the room for manoeuvre to achieve these policy goals," such as climate and digital transition, Merkel told the Brussels Economic Forum.

UK (MNI): UK Average House Price At New Record High

Annual UK house price growth rose at the fastest rate in June since November 2004, rising 13.4% y/y. The strength "is partly due to base effects, with June last year unusually weak due to the first lockdown," according to group Chief Economist Robert Gardner. However, the housing market remains strong with monthly prices rising by 0.7%, Gardener added.

ASIA

JAPAN (MNI): BOJ Switches To Quarterly JGB Ops Guide

The BOJ Cuts Short-Term JGB buys to JPY450 Bln from JPY475 Bln

The BOJ cuts Longer-End JGB buys to JPY150 Bln from JPY200 Bln

The Bank of Japan is changing is guidance period for Japanese government bond buying operations to a quarterly basis from the current monthly basis, the bank said Tuesday. The BOJ said it would leave the frequency of JGB purchases unchanged in July from June's levels, as officials feel an environment for JGB yields to move flexibly is already in place.

JAPAN (MNI) BOJ Can Live With Modest Yen Fall; Ex-BOJ Aide

The Bank of Japan will look through any further modest yen decline though it is unlikely the currency will weaken sufficiently to prompt a policy response, a former senior official told MNI Monday, without elaborating on what level would spur the central bank into action. "Judging from the existing conditions, an acceleration of a weakening yen move is unthinkable," said Hiroshi Ugai, now managing director and chief economist at J.P. Morgan in Tokyo.

DATA

US NY FED WEEKLY ECONOMIC INDEX +9.9% IN WK ENDED JUN 26

US APR CASE-SHILLER UNADJ HOME INDEX +2.1% M/M; +14.9% Y/Y

- NATIONAL IDX +1.6% SA, +2.1% NSA, +14.6% Y/Y

- SEAS ADJ HOME PRICE INDEX +1.6% M/M

US APR FHFA HPI SA +1.8% V +1.6% MAR; +15.7% Y/Y

MNI: US REDBOOK: JUN STORE SALES +16.7% V YR AGO MO

STORE SALES +18.2% WK ENDED JUN 26 V YR AGO WK

MNI: GERMANY JUN FLASH CPI +0.4% M/M, +2.3% Y/Y; MAY +2.5% Y/Y

GERMANY JUN FLASH HICP +0.4% M/M, +2.1% Y/Y; MAY +2.4% Y/Y

US TSYS SUMMARY: Curve Modestly Steepens, Early Pressure on Treasuries Fades

- US Treasury futures traded inside an eight tick range Tuesday, with early pressure on prices fading as the session progressed.

- Key speaker Tuesday was Richmond Fed President Barkin, who stated that he prefers a simple, yet flexible approach to any tapering of asset purchases, but maintains an open mind about phasing out mortgage bond purchases. He also added that he favours concluding tapering before raising interest rates.

- Treasuries initially dipped as Salesforce launched an $8bln six-parter, which offered a 70bps premium over Treasuries for the 10y line and a sizeable yield of 115bps above the 40y Treasury.

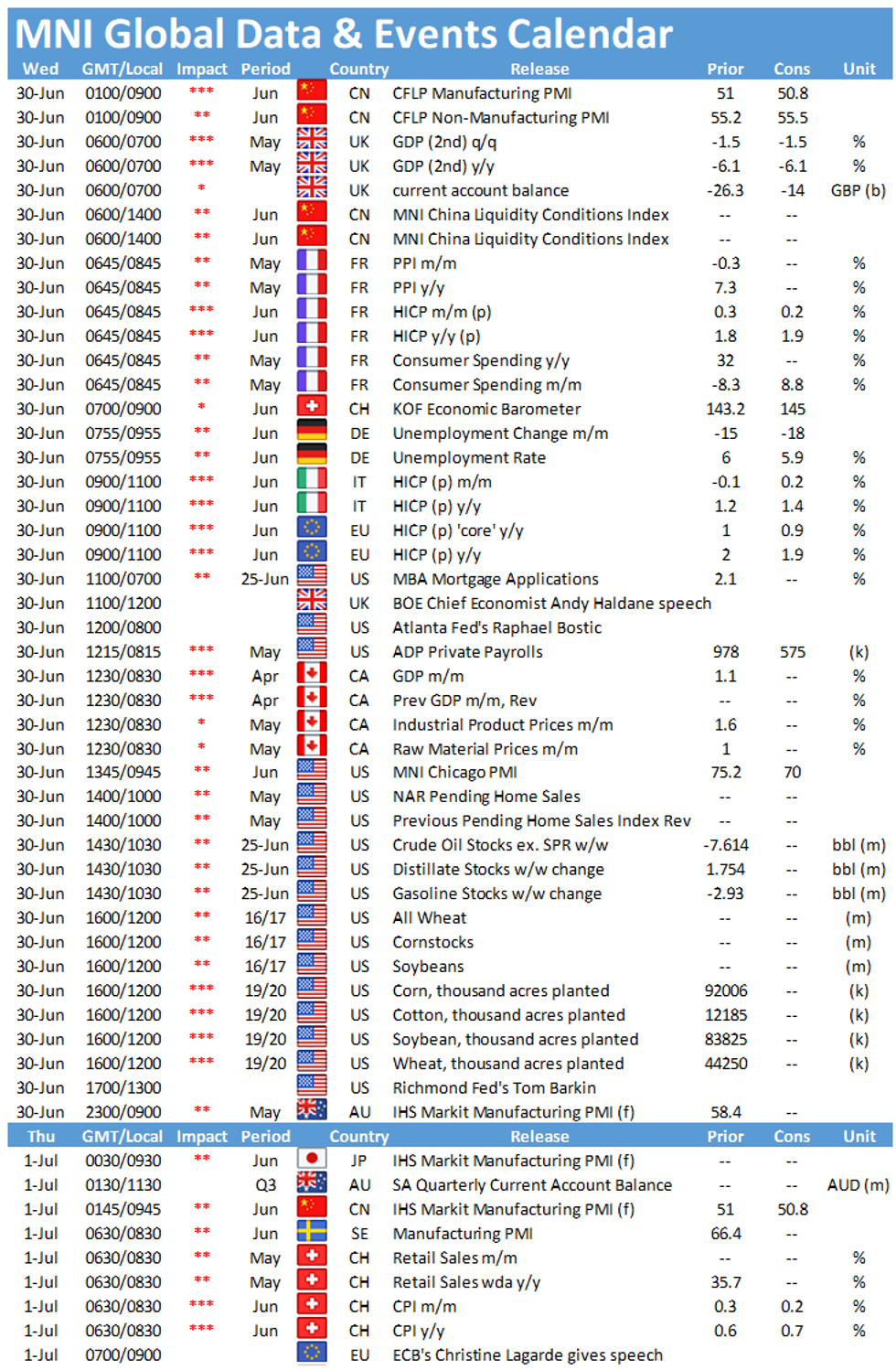

- Data releases pick up Wednesday, with MNI Chicago PMI the highlight. Activity is expected to have slowed to 70.0 from 75.2, while the ADP Employment Change release will be eyed for clues ahead of Friday's payrolls.

- The curve modestly steepened, with 2s10s steeper by around 1bps.

- 2y yield down 0.4bps at 0.250%

- 5y yield down 0.3bps at 0.893%

- 10y yield up 0.7bps at 1.483%

- 30y yield up 0.4bps at 2.099%

FOREX: Antipodeans Resume Decline, AUDUSD Approaches Dec 2020 Low

- AUD (-0.7%) and NZD (0.57%) led weakness in G10 on

Tuesday as the greenback regained some poise. An MNI event with Richmond Fed's

Barkin was a highlight, at which the FOMC voter highlighted further progress

was needed on the Fed's employment goal.

- The dollar index crept gradually higher throughout the day, holding onto 0.2% gains despite a partial reversal approaching the WMR fix. As noted yesterday, Citi's prelim month-end model for June indicates slight USD sales with their signal strength under half the historical norm.

- The Japanese Yen also strengthened leading cross/JPY to extend yesterday's losses. AUDJPY the notable underperformer, currently down 0.78%.

- Technically, the outlook for AUDUSD remains bearish. Recent price action confirmed a resumption of the reversal that occurred Feb 25 and signals scope for a deeper pullback towards 0.7462 next, the Dec 21, 2020 low.

- Despite the firm bounce off the lows in crude benchmarks, CAD was pulled lower in tandem with other risk-tied currencies. USDCAD bounced 0.45% and is approaching the June 22nd highs just above the 1.24 handle. Attention remains higher at 1.2501 resistance, a key Fibonacci retracement.

- Chinese Manufacturing PMI will be released overnight, while Eurozone Flash CPI estimate headlines the European data. During the US session markets will await the ADP Employment figures, Canadian GDP and the MNI Chicago Business Barometer.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.