-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

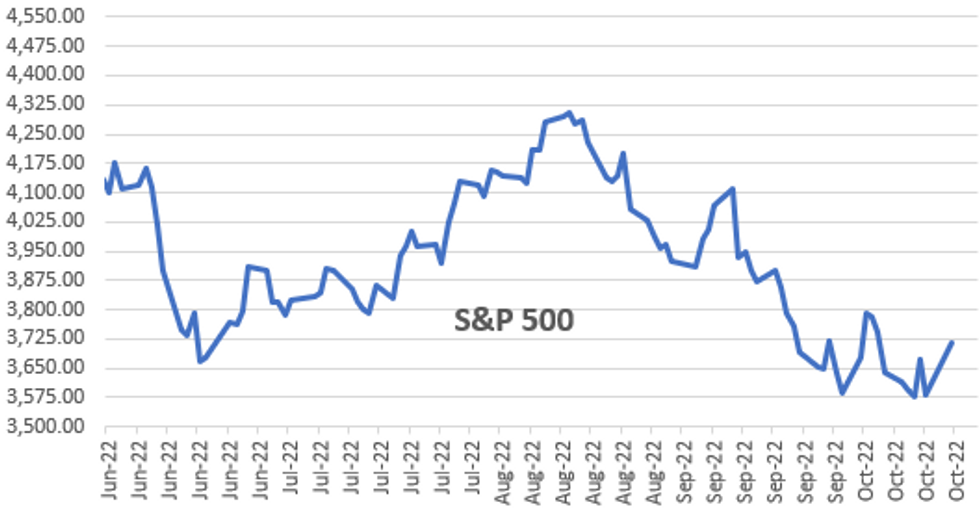

Free AccessMNI ASIA OPEN: Bear Market Rally?

EXECUTIVE SUMMARY

US

FED: The board of directors of the Federal Reserve banks of New York and San Francisco last month voted in favor of a smaller 50 basis point hike in the discount rate charged to banks for emergency loans, according to the latest discount rate meeting minutes published Tuesday.

- Directors of the Minneapolis Fed bank, in contrast, wanted a super-sized 100 bp hike in the discount rate. All other Fed bank directors voted in favor of a 75 bp hike for the discount rate. The FOMC hiked interest rates by 75 bps for a third meeting in a row in September.

- "In light of strong aggregate demand, tight labor markets, and elevated inflation, the directors of nine Federal Reserve Banks favored increasing the primary credit rate," the minutes said.

UK

BOE: An unwind of the Bank of England's pile of giits will begin in the week of Oct 31, it announced on Tuesday, confirming the first sale will be held on Nov 1. (See MNI POLICY: BOE To Examine Gilt Sales Plan In Wake Of Turmoil).

- The Bank's Executive met Tuesday and decided that the first sales will take place the day after the government’s Oct 31 fiscal announcement, it said. On Sept 28, the BOE had already pushed back the sales by a month and stepped in to buy longer-dated gilts due to market “dysfunction” following the government's Sept 23 mini-budget, many of whose measures have now been reversed.

- With the BOE looking to unwind recent weeks’ bond purchases as soon as possible, the sales authorised by the Monetary Policy Committee in September will now consist of only short- and medium-term auctions, although sales in Q4 will be conducted at a similar scale and pace to the GBP10 billion originally outlined.

US TSYS: Sovereign Issuance, BOE Gilt Sale Annc Weighs on Tsys

Inside range session for Tsy - well off late morning lows after the bell, US$ index midrange (DXY +.050 at 112.089) while stocks are firmer, they remain off highs after Apple annc production cuts for IPhone.

- Tsys extended session lows in late morning trade - partially tied to larger than expected $5B Saudi 2pt debt issuance as participant hedged/rate locked prior to launch after noon hour.

- Rates staged a modest midday rebound until reversing lower again after BoE confirms resumption of Gilt sales to November 1. Review: Bonds had extended highs overnight after FT article reported the BoE would pause Gilt sales past current Oct 31 resumption date. Bounce short-lived as rates steadily pared gains after the BOE issued statement the FT article was "inaccurate".

- Limited reaction to earlier data: INDUSTRIAL PROD +0.4%; CAP UTIL 80.3%; NAHB HOUSING MARKET INDEX 38 well below 43 est. Later this afternoon: Net Long-term TIC Flows ($21.4B, --) Total Net ($153.5B, --) at 1600ET.

- Fed Speakers: Nothing new from Atlanta Fed Bostic: INFLATION `TOO HIGH', HAVE TO GET `UNDER CONTROL' Bbg, while MN Fed Kashkari speaks on economy participates in moderated Q&A at 1730ET.

- Reminder: Fed goes into media Blackout at midnight Friday, through Nov 3, day after the next FOMC policy annc.

OVERNIGHT DATA

- US SEP INDUSTRIAL PROD +0.4%; CAP UTIL 80.3%

- US AUG IP REV TO -0.1%; CAP UTIL REV 80.1%

- US SEP MFG OUTPUT +0.4%

- US NAHB HOUSING MARKET INDEX 38 IN OCT

- US NAHB OCT SINGLE FAMILY SALES INDEX 45; NEXT 6-MO 35

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 299.53 points (0.99%) at 30483.99

- S&P E-Mini Future up 36.5 points (0.99%) at 3724.75

- Nasdaq up 77.8 points (0.7%) at 10753.26

- US 10-Yr yield is down 1.8 bps at 3.9922%

- US Dec 10Y are up 7/32 at 110-29.5

- EURUSD up 0.0011 (0.11%) at 0.9852

- USDJPY up 0.17 (0.11%) at 149.21

- WTI Crude Oil (front-month) down $2.37 (-2.77%) at $83.09

- Gold is up $1.09 (0.07%) at $1651.13

- EuroStoxx 50 up 22.19 points (0.64%) at 3463.83

- FTSE 100 up 16.5 points (0.24%) at 6936.74

- German DAX up 116.58 points (0.92%) at 12765.61

- French CAC 40 up 26.34 points (0.44%) at 6067

US TSY FUTURES CLOSE

- 3M10Y -13.432, 8.35 (L: 3.714 / H: 15.126)

- 2Y10Y -0.151, -43.859 (L: -46.566 / H: -40.201)

- 2Y30Y +1.474, -41.239 (L: -44.47 / H: -36.72)

- 5Y30Y +2.097, -19.095 (L: -22.27 / H: -15.893)

- Current futures levels:

- Dec 2Y up 1.125/32 at 102-9.875 (L: 102-07.625 / H: 102-12.125)

- Dec 5Y up 4.25/32 at 106-22.25 (L: 106-14.25 / H: 106-27.75)

- Dec 10Y up 7.5/32 at 110-30 (L: 110-14.5 / H: 111-04.5)

- Dec 30Y up 5/32 at 123-17 (L: 122-12 / H: 123-31)

- Dec Ultra 30Y up 2/32 at 131-14 (L: 129-22 / H: 131-31)

US EURODOLLAR FUTURES CLOSE

- Dec 22 +0.015 at 94.925

- Mar 23 +0.035 at 94.825

- Jun 23 +0.045 at 94.90

- Sep 23 +0.045 at 95.065

- Red Pack (Dec 23-Sep 24) +0.020 to +0.025

- Green Pack (Dec 24-Sep 25) +0.015 to +0.020

- Blue Pack (Dec 25-Sep 26) +0.020 to +0.025

- Gold Pack (Dec 26-Sep 27) +0.025 to +0.025

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00143 to 3.06229% (-0.00385/wk)

- 1M +0.00928 to 3.48914% (+0.04614/wk)

- 3M +0.01600 to 4.24257% (+0.04886/wk) * / **

- 6M +0.04129 to 4.71500% (+0.02971/wk)

- 12M +0.02642 to 5.33886% (+0.05572/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.24257% on 10/18/22

- Daily Effective Fed Funds Rate: 3.08% volume: $103B

- Daily Overnight Bank Funding Rate: 3.07% volume: $275B

- Secured Overnight Financing Rate (SOFR): 3.05%, $979B

- Broad General Collateral Rate (BGCR): 3.00%, $389B

- Tri-Party General Collateral Rate (TGCR): 3.00%, $373B

- (rate, volume levels reflect prior session)

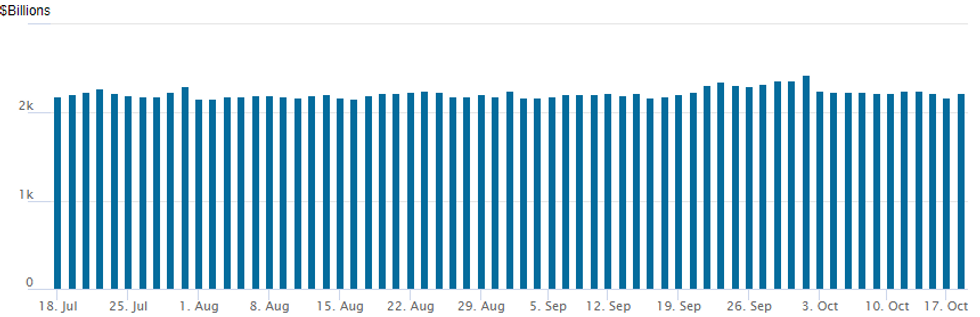

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage rebounds to $2,226.725B w/ 99 counterparties vs. $2,172.301B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

PIPELINE: $3B USB, $2.5B BoNY Debt Launched

- Date $MM Issuer (Priced *, Launch #)

- 10/18 $5B #Saudi Arabia $2.5B 6Y Sukuk +105, $2.5B 10Y +150

- 10/18 $3B #US Bancorp $1.5B 4NC3 +130, $1.5B 11NC10+185

- 10/18 $2.5B #Bank of NY Mellon $1B 6NC5 +160, $1.5B 11NC10 +185

- 10/18 $1B *Kommunalbanken (KBN) 3Y SOFR+41

- 10/18 $850M #AIA Group 5Y +150

- 10/18 $Benchmark Industrial Bank Korea (IBK) 2Y social +85a

- Seeking higher yield? Cruise line caveat emptor:

- 10/18 $1.25B Carnival Corp 5.5NC2.5 11.25%a

- Rolled to Wednesday:

- 10/19 $1B Export Finance Australia 5Y +70a

- 10/19 $1B Kommuninvest WNG 3Y SOFR+41a

EGBs-GILTS CASH CLOSE: Yields Eventually Shrug Off BoE QT Intrigue

Gilts strengthened again Tuesday, outperforming Bunds. The UK curve bull flattened again, with Germany's bear steepening.

- The main market attention in the morning was an FT article pointing to the BoE postponing QT, but this was subsequently denied by the Bank, leading Gilts to sell off.

- However, yields fell again in the early afternoon as US trading desks came online, and broadly shrugged off a spike in Treasury yields toward the cash close.

- No particular catalyst seen for the sustained afternoon recovery, though falling oil prices were seen underpinning European bonds.

- Periphery spreads were mixed, with the higher-beta instruments (BTPs, GGBs) underperforming.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 2.1bps at 1.975%, 5-Yr is up 0.7bps at 2.087%, 10-Yr is up 1.4bps at 2.283%, and 30-Yr is up 2.7bps at 2.321%.

- UK: The 2-Yr yield is down 2.6bps at 3.563%, 5-Yr is down 4.7bps at 3.895%, 10-Yr is down 3.1bps at 3.946%, and 30-Yr is down 7.6bps at 4.302%.

- Italian BTP spread up 2.2bps at 241bps / Greek up 5.2bps at 272.2bps

FOREX: USD Index Consolidates Leg Lower As Stocks Hold Monday Gains

- Despite a volatile session for equities and a strong reversal from session highs, major benchmarks overall are holding onto gains made on Monday, leading to the greenback consolidating yesterday’s weaker session.

- Topping the G10 leaderboard is Kiwi, with New Zealand's Q3 CPI coming in well ahead of expectations (2.2% Q/Q vs. Exp, 1.5%) and fuelling potential for a further 75bps move at the November 23rd RBNZ decision.

- Both the AUD and Euro are set to modestly extend on Monday’s advance amid the more positive short-term outlook for risk sentiment. The Canadian dollar, however, has fallen 0.45% as oil prices continue their descent and WTI futures pierce through short-term support levels.

- Showing similar weakness is GBPUSD which has also fallen just under half a percent. Early sterling strength faded through the NY crossover and cable remains 0.45% lower on the day as the Bank of England has confirmed it will start its delayed bond sales early next month.

- EUR/GBP briefly tested above the Monday high at 0.8722 with the focus on 0.8738, the 20-day EMA.

- Both UK and Canadian CPI data headline Wednesday’s docket, with US building permits & housing starts data also scheduled for release.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/10/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 19/10/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 19/10/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 19/10/2022 | 0900/1100 | *** |  | EU | HICP (f) |

| 19/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 19/10/2022 | 0900/1100 | ** |  | EU | Construction Production |

| 19/10/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 19/10/2022 | 1230/0830 | *** |  | CA | CPI |

| 19/10/2022 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/10/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 19/10/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 19/10/2022 | 1500/1600 |  | UK | BOE Mann Panels Webinar on ERM Crisis | |

| 19/10/2022 | 1700/1300 |  | US | Minneapolis Fed's Neel Kashkari | |

| 19/10/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 19/10/2022 | 1800/1400 |  | US | Fed Beige Book | |

| 19/10/2022 | 2230/1830 |  | US | St. Louis Fed's James Bullard | |

| 19/10/2022 | 2230/1830 |  | US | Chicago Fed's Charles Evans |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.