-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY177.8 Bln via OMO Wednesday

MNI ASIA OPEN - China Cuts Mortgage Rates in Stimulus Drive

EXECUTIVE SUMMARY:

- LABOR MARKET GRADUALLY COOLING - DVORKIN

- BOSTIC SAYS FED RESTRICTIVE ENOUGH TO GET INFLATION TO 2%

- ECB MINUTES REINFORCE DATA DEPENDENCE FOR SEPTEMBER DECISION

- CHINA REDUCES DOWN PAYMENT, MORTGAGE RATES IN STIMULUS EFFORT

- USDMXN SPIKES AS BANXICO REDUCES HEDGE PROGRAM

- MNI CHICAGO BUSINESS BAROMETER™ AT HIGHEST LEVEL SINCE AUGUST 2022

NEWS

FED (MNI): Labor Market Gradually Cooling - Dvorkin

The U.S. labor market shows signs of a gradual cooling as higher interest rates feed through to the economy, while a substantial moderation in wage growth over the past year also lends optimism on the fight against inflation, Federal Reserve Bank of St. Louis economist Max Dvorkin told MNI.

FED (MNI): Bostic Says Fed Restrictive Enough To Get Inflation To 2%

Federal Reserve Bank of Atlanta President Raphael Bostic Thursday reiterated his view that monetary policy is already restrictive enough to get inflation on track toward 2%, adding he doesn't see the need for easing policy any time soon. "Based on current dynamics in the macroeconomy, I feel policy is appropriately restrictive. I think we should be cautious and patient and let the restrictive policy continue to influence the economy, lest we risk tightening too much and inflicting unnecessary economic pain," he said in prepared remarks.

US (BBG): Biden Proposes Base Pay Rise of 4.7% for Federal Employees

“I have determined that for 2024, the across-the-board base pay increase will be 4.7% and locality pay increases will average 0.5%, resulting in an overall average increase of 5.2% for civilian Federal employees, consistent with the assumption in my 2024 Budget,” Biden says in his letter.

ECB (MNI): Sticky EZ Inflation Gives ECB Pause For Thought

Mixed messages for European Central Bank policymakers in the August inflation data, but a tick lower in the core rate to 5.3% y/y will offer some respite, although the hawks will continue to point to the continuing elevated levels.

ECB (MNI): ECB's July Meet Outlines Debate For Coming Weeks

The ECB's September staff projections could well show inflation heading back to target without the need for a further interest rate hike, but too much importance shouldn't be placed on one meeting or one set of outlooks, the central bank's account of the July policy meeting show. Whatever decision is to be taken in September, data would be the key driver, the account confirmed.

ECB (MNI): Data-led Approach Key To Policy Moves: Schnabel

The ECB could pause or continue to raise rates at its next monetary policy meeting, Executive Board member Isabel Schnabel said in a speech Thursday, with high levels of uncertainty over the pace of disinflation supporting a data-dependent, meeting-by-meeting approach. “Should we judge that the policy stance is inconsistent with a timely return of inflation to our 2% target, a further increase in interest rates would be warranted,” she said. “By contrast, should our assessment of the transmission of monetary policy suggest that the pace of disinflation is proceeding as desired, we may afford to wait until our next meeting to gather more evidence on how the slowdown in aggregate demand will feed through to price and wage-setting over time.”

CHINA (MNI): U.S. China Top Concern For FDI - MOFCOM

Foreign companies view China U.S. relations as their biggest risk when considering investment into China, according to Shu Jueting, Spokesperson for the Ministry of Commerce (MOFCOM). Speaking at a press conference on Thursday, Shu said foreign companies had told MOFCOM they were eager to expand business in China, but were worried about geo-political rivalry between the world's two largest economies.

CHINA (BBG): China Cuts Down Payment, Mortgage Rates in Stimulus Drive

China allowed large cities to cut down payments for homebuyers and encouraged lenders to lower rates on existing mortgages in its latest attempts to halt a slide in the country’s residential property market. The nationwide minimum down payment will be 20% for first-time buyers and 30% for second-time purchasers, according to a joint statement from the People’s Bank of China and National Administration of Financial Regulation on Thursday.

MEXICO (MNI): USDMXN Spikes As Banxico Reduces Hedge Program

The FX hedging program was initially installed to promote a more orderly FX market in Feb 2017, at which Banxico placed $5.5bln via various auctions. During COVID in March 2020 additional auctions were announced of $1.99bln to total the program at $7.5bln, with terms of one to twelve months. Banxico now deem liquidity to be 'adequate' meaning the Commission have instructed Banxico to reduce the amount of the FX hedging in force gradually, seeking in all time to maintain the orderly operation of the exchange market.

OIL (BBG): Russia Agrees on Further OPEC+ Oil-Export Cuts - Novak

Russia has agreed with its OPEC+ partners on further cuts to its crude exports, Deputy Prime Minister Alexander Novak told President Vladimir Putin. “We have agreed, but we’ll announce main parameters next week,” Novak said at a televised government meeting with Putin.

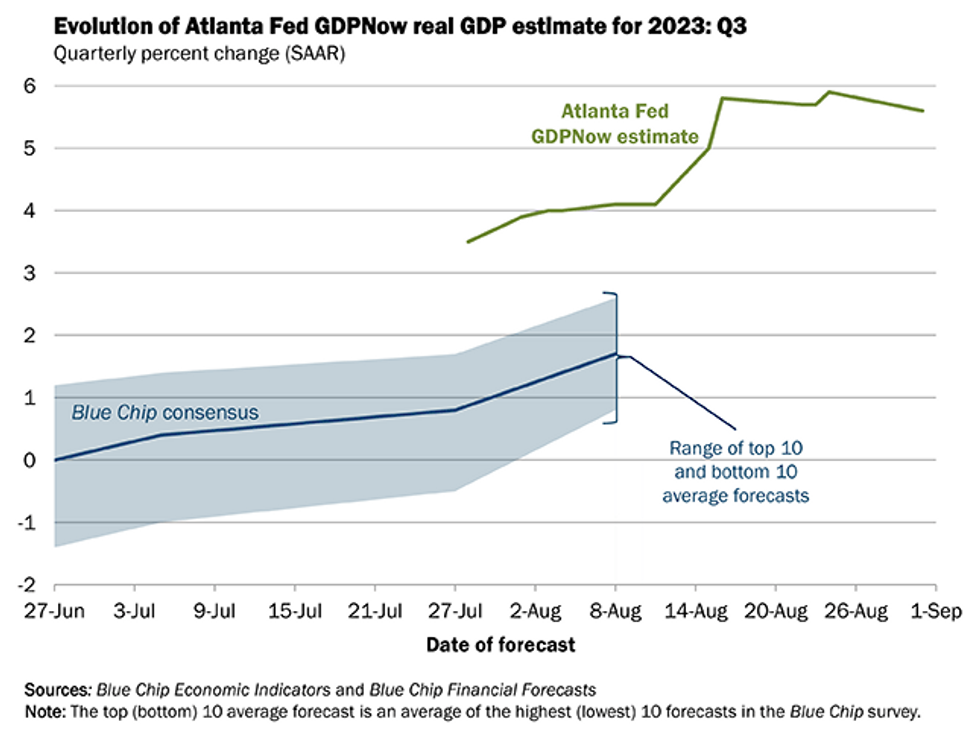

US DATA: Atlanta Fed GDPNow Trimmed from 5.9% to 5.6% For Q3

- The Atlanta Fed GDPNow has been revised lower to 5.63% for Q3 from 5.91% with the Aug 24 release.

- Real personal consumption expenditure growth revised down from 4.8% to 4.3% and real gross private domestic investment growth revised down from 12.3% to 11.8%. These were slightly offset by an upward revised net trade contribution from 0.10 to 0.26pps.

- It follows the 2.06% in Q2 (after yesterday’s downward revision) and 2.00% in Q1.

Source: Bloomberg

Source: Bloomberg

Chicago Business Barometer™ - Increases to 48.7

The Chicago Business Barometer™, produced with MNI, improved by 5.9 points to 48.7 in August. This represents the third consecutive monthly increase and the highest level since August 2022. With the exception of Order Backlogs, all of the subcomponents rose.

- New Orders, Production and Employment all showed significant gains, albeit with the Employment component remaining in contractionary territory.

- New Orders increased by +12.6 points. This was the first time the subcomponent has been above 50 since May 2022.

- Production jumped by +12.0 points to 57.1, also the highest reporting since May 2022.

- Employment rose by +8.6 points to 48.3. Despite the biggest single-month increase since 2017, Employment is at similar levels to May 2023, and remains in contractive territory.

- Order Backlogs was down -6.9 points to the lowest level since May 2020.

- Supplier Deliveries advanced by +0.5 points.

- Prices Paid increased substantially by +11.9 points to 74.0. This was the highest level since October 2022.

- Inventories grew by +9.8 points. Despite remaining in contractionary territory, this was the first time the component rose since March 2023.

MNI Chicago Survey™: Limited Impact From Financial Conditions So Far

The Chicago Business Barometer™ Survey asked firms in August: "How have changes in financial conditions affected your access to borrowing?"

- 40.0% of respondents saw no impact on their borrowing from changes in financial conditions so far while 32.0% are not looking to utilize credit at the moment.

- Of the remaining 28.0%, 16.0% stated that they were experiencing difficulties with tighter credit conditions while 12.0% said that they were winding down borrowing due to higher costs.

DATA

**MNI: US JUL PERSONAL INCOME +0.2%; NOM PCE +0.8%

US JUL UNROUNDED PCE PRICE INDEX +0.213%; CORE +0.216%

US JUL CORE PCE PRICE INDEX +0.2%; +4.2% Y/Y

US JUL PCE PRICE INDEX +0.2%; +3.3% Y/Y

**MNI: US JUL PERSONAL INCOME +0.2%; NOM PCE +0.8%

**MNI: US JOBLESS CLAIMS -4K TO 228K IN AUG 26 WK

US CONTINUING CLAIMS +0.028M to 1.725M IN AUG 19 WK

US PREV JOBLESS CLAIMS REVISED TO 232K IN AUG 19 WK

MNI BRIEF: Sticky EZ Inflation Gives ECB Pause For Thought

Mixed messages for European Central Bank policymakers in the August inflation data, but a tick lower in the core rate to 5.3% y/y will offer some respite, although the hawks will continue to point to the continuing elevated levels. According to Eurostat's flash inflation print, headline inflation was unchanged at 5.3% y/y in August, with the ex-energy, food, alcohol and tobacco rate at 5.3% y/y. Services inflation also slowed in the month, but remains elevated at 5.5% y/y.

US TSYS: Slightly Richer As Core PCE Mostly Looked Through Ahead Of Payrolls

- Cash Tsys have ultimately seen a broadly parallel rally today, with yields circa 3bps lower and for the most part back near where they were ahead of PCE data after being biased richer through European trade (the very long end being the exception).

- The core PCE data was broadly as expected, including renewed strength in the supercore, although did have about as strong a monthly profile as could have been expected for Q2 after yesterday’s known net downward revision (including June no longer seeing a core PCE M/M rate consistent with the 2% target).

- It meant the curve saw some intraday flattening as the long end rallied in the hours after PCE before the front-end then followed as the relatively modest trimming of cut expectations was then reversed.

- We’re left with Fed Funds implied rates showing cumulative hikes of +3bp for Sep and +11.5bp for Nov to a terminal 5.45%, followed 51bp of cuts to Jun’24 and a cumulative 122bp of cuts to Dec’24.

- TYZ3 equalled yesterday’s high at 111-03+ but failed to push on. Next resistance is seen at 111-13+ (Aug 11 high) although gains are considered corrective with support at 109-18+ (Aug 25 low).

- Tomorrow of course sees the nonfarm payrolls report for August, see the MNI preview here, and is followed by Mester (’24 voter) offering a first reaction to it at 0945ET before ISM mfg at 1000ET.

EGBs-GILTS CASH CLOSE: Bull Steeper As Central Banks Seen Less Hawkish

European curves bull steepened Thursday as central bank hikes got priced out.

- Multiple flashpoints saw implied Eurozone rates fall through the day: ECB's Schnabel commenting on growth concerns, a dovish-leaning account of the July meeting, and core August Eurozone inflation coming in around expected levels with signs of deceleration underway.

- BoE's Pill weighed in with his preference for holding rates higher for longer, as opposed to running the risk of overtightening.

- ECB peak hike pricing pulled back by 7bp and BoE by 9bp on the day.

- German instruments outperformed UK counterparts, though both saw strength in the short-end/belly. Periphery EGB spreads were largely unchanged on the day.

- Attention turns to final European PMIs Friday morning, with US nonfarm payrolls the focus later.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 9.5bps at 2.978%, 5-Yr is down 9.6bps at 2.477%, 10-Yr is down 7.9bps at 2.466%, and 30-Yr is down 5.8bps at 2.591%.

- UK: The 2-Yr yield is down 8.9bps at 5.149%, 5-Yr is down 7.3bps at 4.664%, 10-Yr is down 6.2bps at 4.36%, and 30-Yr is down 4.8bps at 4.608%.

- Italian BTP spread up 0.5bps at 165.3bps / Spanish unchanged at 101.6bps

FOREX: EURJPY Sinks 1.25%, USD Index Retraces Prior Day Declines

- Lower core yields and pressure on European equities, aided by slightly dovish ECB comments have continued to weigh on EURJPY, with the pair looking to cement a 1.25% decline on Thursday. In the process, the pair has pierced initial support at the 20-day EMA, intersecting today at 158.06. More notable support comes into play between 156.87 and 156.42, the Aug 23 low and the 50-day EMA.

- Ahead of tomorrow’s key US data, the greenback trades on a firmer footing on Thursday, and the USD index has recovered all of the prior day’s losses.

- Outside of the Euro, most other G10 currencies have shown more moderate adjustments and small appreciations for both AUD and NZD emphasise the mixed performance across the space. It is worth noting that month-end dynamics and the close proximity to NFP data could well have had an impact.

- Measures to stimulate the Chinese economy and property sector in particular have provided a more optimistic backdrop for the Chinese Yuan, rising around 0.4% against the greenback. Reports from Reuters that China's major state-owned banks were seen selling dollars in onshore spot FX market today has underpinned the Yuan rally.

- China’s Caixin manufacturing PMI will be released overnight before Swiss CPI data in Europe. All focus then turns to the US employment report and ISM Manufacturing PMI. Canada GDP is also scheduled.

Expiries for Aug31 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0900(E634mln), $1.0925(E624mln), $1.0975-90(E718mln)

- USD/JPY: Y145.00-10($508mln), Y146.50($1.3bln)

- USD/CNY: Cny7.3000($1.0bln)

US STOCKS: Narrow Ranges For S&P E-mini Ahead Of Payrolls, Nasdaq Outperforms Again

- The S&P e-mini heads towards the end of the session dipping marginally but is near unchanged on the day after a particularly tight range by recent standards as markets await tomorrow’s NFP report.

- It consolidates yesterday’s clearance of the former channel base (at 4520.90 drawn from the Mar 13 low that was breached on Aug 16). The earlier high of 4541.25 forms initial resistance after which lies 4560.75 (Aug 4 high).

- SPX drivers see consumer discretionary (+0.75%), IT (+0.55%) and communication services (+0.55%) outperform, whilst health care (-0.9%), real estate (-0.8%) and utilities (-0.8%) lag.

- Amazon (+2.2%) leads consumer discretionary after announcing an enhanced collaboration with Shopify whilst UnitedHealthcare (-2.4%) drives health care declines on continued weakness through the session.

- Continuing the week’s theme, the Nasdaq outperforms at +0.4% and the Dow underperforms with -0.4%.

COMMODITIES: WTI Sees Second Highest Settle Of The Year

- Crude markets have seen gains after headlines suggesting Russia has agreed on further export cuts with OPEC+ and will announce further steps next week, and continued strongly for the second highest WTI settle of the year.

- Today’s growth-related macro data were on balance beat expectations, with China’s mfg PMI rising to 49.7 (cons 49.2) from 49.3 in July, albeit marking a fifth consecutive contractions, whilst US consumer spending was stronger than expected.

- Kinder Morgan said Wednesday its Port Manatee, Port Sutton and Tampaplex terminals in Florida sustained only minimal damage from Hurricane Idalia hitting the Gulf of Mexico.

- WTI is +2.4% at $83.57, comfortably through $82.05 (Aug 30 high) to push near the bull trigger at $84.16 (Aug 10 high).

- Brent is +1.1% at $86.83, clearing $86.23 (Aug 30 high) to open the psychological $90 resistance.

- Gold back near unchanged at $1941.51 having dipped slightly intraday amidst a recovery for the US dollar. It continues to sit close to resistance at yesterday’s high of $1949.1.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/09/2023 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 01/09/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/09/2023 | 0130/1130 | ** |  | AU | Lending Finance Details |

| 01/09/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/09/2023 | 0630/0830 | *** |  | CH | CPI |

| 01/09/2023 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/09/2023 | 0745/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 01/09/2023 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/09/2023 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/09/2023 | 0800/1000 | *** |  | IT | GDP (f) |

| 01/09/2023 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/09/2023 | 0830/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/09/2023 | 0900/1100 | ** |  | IT | PPI |

| 01/09/2023 | 1000/0600 |  | US | Atlanta Fed's Raphael Bostic | |

| 01/09/2023 | 1000/1100 |  | UK | BoE's Pill speaks at South African Reserve Bank conference | |

| 01/09/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/09/2023 | 1230/0830 | *** |  | US | Employment Report |

| 01/09/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 01/09/2023 | 1345/0945 |  | US | Cleveland Fed's Loretta Mester | |

| 01/09/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/09/2023 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/09/2023 | 1400/1000 | * |  | US | Construction Spending |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.