-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Core-CPI Miss, Rental Inflation Rises

- MNI US DATA BRIEF: US July CPI In Line; September Fed Cut On Track

- MNI US POLITICAL RISK: US VP Harris To Give Policy Speech Friday

- MNI US DATA: CPI Core & Supercore Latest Trends

US

US DATA BRIEF (MNI): US July CPI In Line; September Fed Cut On Track

- U.S. CPI rose 0.155% in July and core CPI added 0.165%, in line with Wall Street expectations and keeping the Federal Reserve on track for lowering interest rates next month. Over the past 12 months, headline CPI inflation dipped to 2.9% and core 3.2%, the lowest since March and April 2021, respectively.

- Shelter rose 0.4% in July, accounting for nearly 90% of the monthly increase in the headline index, the Bureau of Labor Statistics said Wednesday. Energy prices were softer than expected, unchanged over the month after falling in the two previous months. Core goods prices fell 0.32% as the used car index lost 2.3%.

US TSYS Early Volatility After Core-CPI Miss, Rental Inflation Rise

- Treasuries are looking mostly higher after the bell -- very near the middle of this morning's wide post-data range. Curves twist flatter, however, with short end rates underperforming as projected rate cut pricing gradually cooled post-CPI.

- Early volatility: Treasury futures gapped higher - extended highs after the modest miss on a core CPI unrounded basis and Y/Y also missing. Tsy Sep'24 10Y traded up to 114-02 high -- nearly breaching technical resistance at 114-03/115-03+ (High Aug 6 / 5 and the bull trigger).

- Futures quickly reversed lower/extending session low to 113-13.5 as markets focused on above-expected including core services (+0.32%), OER and Rents. The reversal didn't last long, however, futures recovering to near midrange as rental inflation deemed more localized.

- Earlier data, MBA composite mortgage applications jumped a seasonally adjusted 16.8% last week. It was again driven by particularly strong refinancing activity (34.5% after 16%) which has jumped higher on the almost 50bp decline in 30Y mortgage rates over the past month (although the rate only dipped 1bp to 6.54% in the latest week).

- Short end rates finish weaker as CPI raises the bar for 50bp cut in Sep. Current projected rate cuts vs. early morning levels (*) post-CPI: Sep'24 cumulative -37.2bp (-39.7bp), Nov'24 cumulative -72.4bp (-74.2bp), Dec'24 -106.2bp (-108.1bp).

- Looking ahead, deluge of early data Thursday includes Weekly Claims, Retail Sales, Import/Export Prices, IP and Cap-U.

NEWS

US POLITICAL RISK (MNI): US VP Harris To Give Policy Speech Friday

On Thursday, US President Joe Biden will appear alongside Vice President Kamala Harris for the first time since he withdrew from the presidential race. Harris is expected to use the event to moderate some of her previously liberal policy positions ahead of her first major policy speech on Friday. A “tax policy arms race” between Harris and former President Donald Trump could add trillions to the federal government deficit.

SECURITY (MNI): Zelenskyy Discusses Setting Up Military Administration For Kursk

Reuters reporting that Ukrainian President Volodymyr Zelenskyy says he discussed with top officials the humanitarian situation in Kursk region, and "creation of military administrations if necessary."

THAILAND (MNI): House Of Representatives To Convene 16 Aug To Select New PM:

Members of the Thai House of Representatives will convene on Friday 16 August to elect a new prime minister following the removal from office of incumbent Srettha Thavisin due to a court ruling earlier today.

OVERNIGHT DATA

US DATA (MNI): CPI Core & Supercore Latest Trends

Core CPI (SA): % M/M: 0.165 in Jul'24 after 0.065 in Jun '24; % 3mth ar: 1.6 in Jul'24 after 2.1 in Jun '24; % 6mth ar: 2.8 in Jul'24 after 3.3 in Jun '24

CPI Core Services Non-Housing (SA): % M/M: 0.207 in Jul'24 after -0.052 in Jun '24; % 3mth ar: 0.4 in Jul'24 after 1.4 in Jun '24; % 6mth ar: 3.4 in Jul'24 after 4.8 in Jun '24

US DATA (MNI): Unexpectedly Weak Core Goods CPI Offset By Upside Services Surprise

Headline and core M/M below expected medians, supercore basically in-line. Core goods very soft (-0.32%) driven by even more deflation in used cars than expected (-2.3%). Otherwise categories were above-expected including core services (+0.32%), OER and Rents, Lodging, Airfares (slightly), and car insurance. For headline, food was basically in line but energy was on the soft side of expectations.

US DATA (MNI): Mortgage Refinancing Doubles Over Past Year

MBA composite mortgage applications jumped a seasonally adjusted 16.8% last week. It was again driven by particularly strong refinancing activity (34.5% after 16%) which has jumped higher on the almost 50bp decline in 30Y mortgage rates over the past month (although the rate only dipped 1bp to 6.54% in the latest week).

- New purchase applications meanwhile increased 2.8% after 0.8% following an 8% cumulative decline over the prior three weeks.

- MBA’s VP and deputy chief economist Kan: “The refinance index also saw its strongest week since May 2022 and was 117% higher than a year ago, driven by gains in conventional, FHA, and VA applications."

- Putting the latest increases into perspective, it leaves purchases at 53% of 2019 levels and refis at 51%.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 213.16 points (0.54%) at 39976.4

- S&P E-Mini Future up 8.75 points (0.16%) at 5467.25

- Nasdaq down 52.4 points (-0.3%) at 17133.89

- US 10-Yr yield is down 1.5 bps at 3.8276%

- US Sep 10-Yr futures are up 2.5/32 at 113-22.5

- EURUSD up 0.002 (0.18%) at 1.1013

- USDJPY up 0.44 (0.3%) at 147.28

- WTI Crude Oil (front-month) down $1.13 (-1.44%) at $77.20

- Gold is down $19.46 (-0.79%) at $2445.63

- European bourses closing levels:

- EuroStoxx 50 up 32.68 points (0.7%) at 4727.6

- FTSE 100 up 45.82 points (0.56%) at 8281.05

- German DAX up 73.55 points (0.41%) at 17885.6

- French CAC 40 up 57.49 points (0.79%) at 7333.36

US TREASURY FUTURES CLOSE

- 3M10Y -4.302, -138.474 (L: -139.914 / H: -133.177)

- 2Y10Y -3.738, -12.819 (L: -13.595 / H: -8.809)

- 2Y30Y -6.104, 16.376 (L: 15.656 / H: 22.518)

- 5Y30Y -3.861, 44.654 (L: 43.604 / H: 48.7)

- Current futures levels:

- Sep 2-Yr futures down 0.875/32 at 103-11.75 (L: 103-09.125 / H: 103-18)

- Sep 5-Yr futures up 0.5/32 at 109-7.5 (L: 109-00.75 / H: 109-17.75)

- Sep 10-Yr futures up 2.5/32 at 113-22.5 (L: 113-13.5 / H: 114-02)

- Sep 30-Yr futures up 15/32 at 124-15 (L: 123-27 / H: 124-25)

- Sep Ultra futures up 30/32 at 132-31 (L: 131-29 / H: 133-11)

US 10Y FUTURE TECHS: (U4) Bullish Theme

- RES 4: 116-00 Round number resistance

- RES 3: 115-30+ 2.764 proj of the Apr 25 - May 16 - 29 price swing

- RES 2: 115-17 2.618 proj of the Apr 25 - May 16 - 29 price swing

- RES 1: 114-03/115-03+ High Aug 6 / 5 and the bull trigger

- PRICE: 113-22+ @ 1530 ET Aug 14

- SUP 1: 112-11 20-day EMA

- SUP 2: 111-10+ 50-day EMA values

- SUP 3: 110-18+ Low Jul 22

- SUP 4: 110-07 Low Jul 9

A bullish theme in Treasuries remains intact following recent gains and this week’s recovery is seen as a positive development. Moving average studies are in a bull-mode position and the recent breach of 111-01, the Jun 14 high, confirmed a resumption of the uptrend. Scope is seen for 115-17, a Fibonacci projection. The recent move down is considered corrective. Initial support to watch is 112-11, the 20-day EMA.

SOFR FUTURES CLOSE

- Sep 24 -0.045 at 95.110

- Dec 24 -0.035 at 95.785

- Mar 25 -0.020 at 96.285

- Jun 25 -0.015 at 96.595

- Red Pack (Sep 25-Jun 26) -0.015 to +0.005

- Green Pack (Sep 26-Jun 27) +0.005 to +0.015

- Blue Pack (Sep 27-Jun 28) +0.015 to +0.025

- Gold Pack (Sep 28-Jun 29) +0.020 to +0.025

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00088 to 5.33689 (+0.00337/wk)

- 3M +0.00207 to 5.11809 (+0.00540/wk)

- 6M +0.00133 to 4.80564 (-0.00033/wk)

- 12M +0.01501 to 4.36296 (+0.00688/Wk)

- Secured Overnight Financing Rate (SOFR): 5.34% (+0.00), volume: $2.082T

- Broad General Collateral Rate (BGCR): 5.34% (+0.01), volume: $808B

- Tri-Party General Collateral Rate (TGCR): 5.34% (+0.01), volume: $780B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $100B

- Daily Overnight Bank Funding Rate: 5.33% (+0.01), volume: $237B

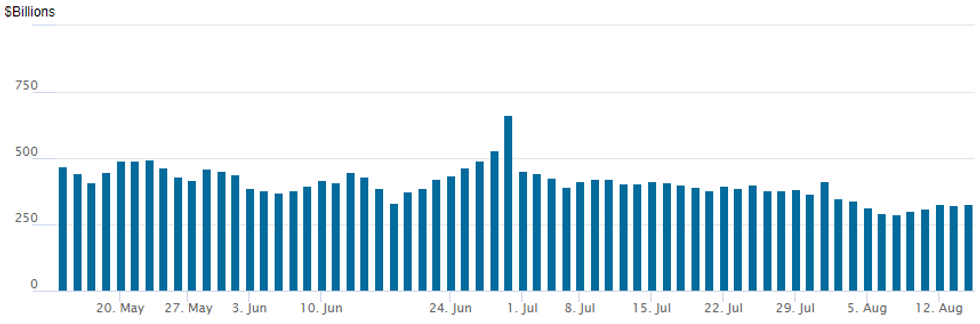

FED Reverse Repo Operation

NY Federal Reserve, MNI

RRP usage inches up to $328.472B from $324.494B Tuesday -- compares to $286.660B on Wednesday, Aug 7 -- the lowest since mid-May 2021. Number of counterparties climbs up to 66 from 62 prior.

PIPELINE: Corporate Debt Issuance Roundup: $6.25B to Price Wednesday

- Date $MM Issuer (Priced *, Launch #)

- 08/14 $3.65B #US LiquidsCo $700M 3Y +120, $1B 5Y +140, $1.25B 10Y +175, $700M 30Y +210

- 08/14 $1.1B #South Bow $450M 30.5NC5.25 7.625%, $650M 30.5NC10.25 7.5%

- 08/14 $1B #State Street 4.5NC3.5 +77

- 08/14 $500M OneMain Finance 7.25NC3 7.125%a

EGBs-GILTS CASH CLOSE: Gilts Outperform After UK CPI Miss

Gilts outperformed global peers Wednesday as UK inflation data came in softer than expected.

- Core instruments strengthened in early trade after UK July CPI aggregates came in lower than expected, though the print didn't look as soft once volatile components (eg airfares) were excluded, and the initial rally faded.

- Later on in the session, US CPI came in largely in line with expectations, initially triggering a dovish reaction in global core FI which quickly reversed, but overall its impact on price action was neutral.

- The German curve twist flattened, with the UK curve bull flattening. 10Y Gilt yields saw their lowest close since Feb 1.

- Periphery EGB spreads closed mixed, with BTPs outperforming and GGBs underperforming in a fairly directionless day for risk assets.

- The UK data parade continues Thursday with Q2 GDP data; the schedule also includes the Norges Bank decision.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.4bps at 2.354%, 5-Yr is up 0.1bps at 2.092%, 10-Yr is down 0.6bps at 2.18%, and 30-Yr is down 0.5bps at 2.423%.

- UK: The 2-Yr yield is down 3.9bps at 3.566%, 5-Yr is down 6.3bps at 3.617%, 10-Yr is down 6.3bps at 3.825%, and 30-Yr is down 6.7bps at 4.402%.

- Italian BTP spread down 0.6bps at 138.4bps / Spanish down 0.4bps at 84bps

FOREX: Greenback Treads Water Post-CPI, NZD Remains Under Pressure

- The July US CPI data failed to ignite momentum in currency markets, with slightly weaker headline prints unable to move the dial for short-term Fed pricing and this is well reflected in a broadly unchanged dollar index on Wednesday.

- There was an impressive 100 pip swing for USDJPY in the aftermath of the data, however this remained an outlier across G10, with most pairs holding modest ranges.

- Overall, the New Zealand dollar is the worst performing G10 currency on Wednesday, with the overnight dovish turn from the RBNZ continuing to drive the price action. NZDUSD (-1.3%) continues to plumb fresh session lows as we approach the APAC crossover, notably through the 20-day EMA and the psychological 0.6000 mark.

- The solid backdrop of recent equities outperformance could point to this being a corrective pullback for the pair. However, protracted weakness might signal scope for a move back to key medium-term support of 0.5852.

- GBP has also weakened on Wednesday following softer-than-expected inflation data in the UK. Despite the dip lower for cable, price remains above the 20-day EMA and a resumption of strength would highlight a more significant trend reversal and signal scope for a climb towards 1.2955, a Fibonacci retracement.

- EURUSD resistance at 1.1008, the Aug 5 high, has been cleared and this confirms a resumption of the uptrend. Spot has been contained by 1.1046, the Jan 2 high, and a breach of this level would place the focus on 1.1084, the Dec 29 ‘23 high. Note moving average studies remain in a bull-mode set-up, highlighting a rising trend.

- Focus swiftly turns to another session packed full of US data, highlighted by July retail sales and weekly jobless claims.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/08/2024 | 2350/0850 | *** |  | JP | Japan GDP 1st Estimate |

| 15/08/2024 | 0130/1130 | *** |  | AU | Labor Force Survey |

| 15/08/2024 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 15/08/2024 | 0200/1000 | *** |  | CN | Retail Sales |

| 15/08/2024 | 0200/1000 | *** |  | CN | Industrial Output |

| 15/08/2024 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate M/M |

| 15/08/2024 | 0430/1330 | ** |  | JP | Industrial Production |

| 15/08/2024 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 15/08/2024 | 0600/0700 | ** |  | UK | Trade Balance |

| 15/08/2024 | 0600/0700 | *** |  | UK | GDP First Estimate |

| 15/08/2024 | 0600/0700 | ** |  | UK | Index of Services |

| 15/08/2024 | 0600/0700 | *** |  | UK | Index of Production |

| 15/08/2024 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 15/08/2024 | 0800/1000 | *** |  | NO | Norges Bank Rate Decision |

| 15/08/2024 | - |  | NO | Norges Bank Meeting | |

| 15/08/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 15/08/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 15/08/2024 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 15/08/2024 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 15/08/2024 | 1230/0830 | *** |  | US | Retail Sales |

| 15/08/2024 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/08/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 15/08/2024 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 15/08/2024 | 1310/0910 |  | US | St. Louis Fed's Alberto Musalem | |

| 15/08/2024 | 1315/0915 | *** |  | US | Industrial Production |

| 15/08/2024 | 1400/1000 | * |  | US | Business Inventories |

| 15/08/2024 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 15/08/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 15/08/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 15/08/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 15/08/2024 | 1710/1310 |  | US | Philly Fed's Pat Harker | |

| 15/08/2024 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.