-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Corporate Debt Surge Weighs on Tsys

- MNI DATA: Large Upward Revisions For Construction Spending

- MNI BRIEF: ECB Projections Useful Guide For Rate Cuts–De Cos

- MNI US: House Maj Ldr. Scalise Endorses Trump For President

- MNI SECURITY: Maersk Pauses Red Sea Shipping; Iran Sends Warship To Area

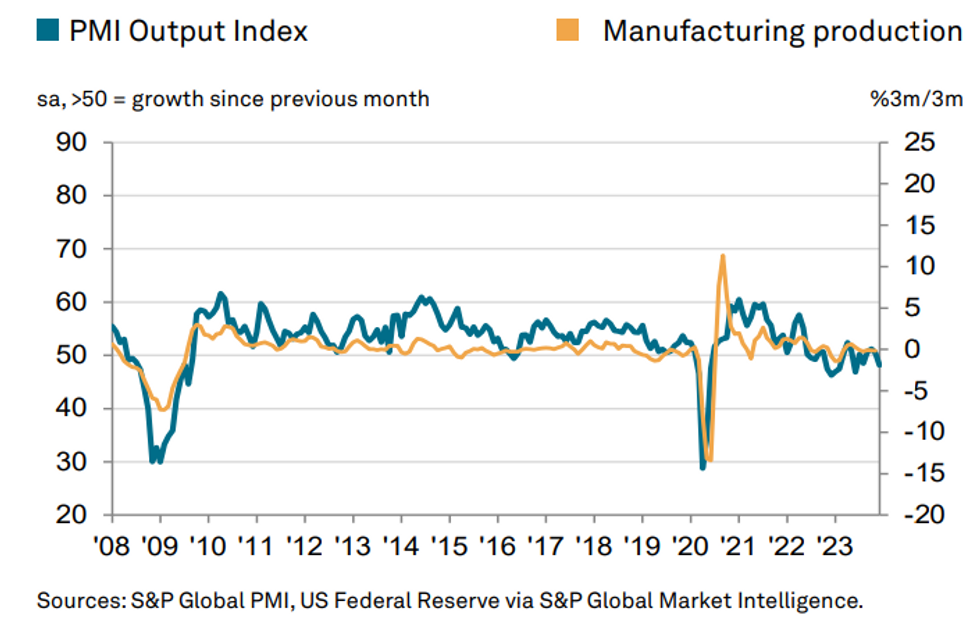

- MNI DATA: S&P Mfg PMI Offers Stagflationary Report

US Corporate Bond Issuance Anchored Tsys, Focus on Wednesday FOMC Minutes

- Still weaker, Tsy futures pared losses after month-over-month Construction Spending comes out lower than expected: 0.4% vs. 0.5% est), and S&P Global US Manufacturing PMI comes out lower than expected (47.9 vs. 48.4 est) this morning.

- From the press release: “Output fell at the fastest rate for six months as the recent order book decline intensified”, with manufacturing likely have acted as a drag on the economy in Q4.

- Corporate debt issuance returned from a three week hiatus with over $30B issuing today, corporate rate locks kept a lid Treasury futures across the curve.

- Treasury futures are well within technical levels after the close: support at 111-31+/111-23+ (Low Dec 14 / 20-day EMA); resistance well above at 113-12+ 1.764 proj of the Oct 19 - Nov 3 - Nov 13 price swing.

- Wednesday Data Calendar: ISMs, JOLTS, December FOMC Minutes.

NEWS

EU (MNI): ECB Projections Useful Guide For Rate Cuts–De Cos

Market pricing for rate cuts in 2024 inside the European Central Bank December projections are a “useful reference” for when the ECB will begin to cut and how much this year, Bank of Spain Governor Pablo Hernandez de Cos wrote in an article on Tuesday.

SECURITY (MNI): Maersk Pauses Red Sea Shipping; Iran Sends Warship To Area

Danish shipping giant Maersk have issued a statement confirming that following the attacks on the Maersk Hangzhou over the weekend, the firm will continue to pause all cargo movement through the Red Sea/Gulf of Aden "while we further assess the constantly evolving situation."

US (MNI): House Maj Ldr. Scalise Endorses Trump For President:

US House of Representatives Majority Leader Steve Scalise (R-LA) has given his official endorsement to former President Donald Trump in his bid to regain the White House in this November's election reports Fox News.

SECURITY (MNI): Top Hamas Official Suspected Killed In Israeli Drone Strike In Beirut

Local journalists and newswires reporting that high-ranking Hamas official Saleh al-Arouri is suspected to have been killed in an Israeli drone strike in the southern suburbs of the Lebanese capital Beirut. The strike comes as regional tensions are elevated in response to a blockade of the Red Sea by Iranian-backed Houthi rebels in Yemen.

US (MNI): Senate Intelligence Committee Codel To Travel To Middle East Tomorrow

Senator Kirsten Gillibrand (D-NY) has told reporters that she will depart the US this evening ahead a bipartisan Congressional delegation (codel) of Senate Intelligence Committee members to the Middle East to meet with Israeli Prime Minister Benjamin Netanyahu and officials in Jordan and Saudi Arabia.

OVERNIGHT DATA

US DATA: The S&P Global US manufacturing PMI was revised down from an initial 48.2 to 47.9 (cons 48.4) in the finalized December reading, for a larger than first thought decline from 49.4 in November.

- It leaves it at August’s level but still off lows of just over 46 in both Jun’23 and Dec’22.

- From the press release: “Output fell at the fastest rate for six months as the recent order book decline intensified”, with manufacturing likely have acted as a drag on the economy in Q4.

- A contributor was “a sharper fall in new orders during December. The decrease in sales quickened and was the fastest since August. Many companies stated that weak client demand stemmed from lower purchasing power at customers and global economic uncertainty. External demand conditions also faltered, as new export orders [just about] returned to contraction territory.”

- “Inflationary pressures intensified, meanwhile, as cost burdens rose at a sharper pace and selling prices increased at the quickest rate since April.”

US DATA: Construction spending was softer than expected in November as it increased 0.4% M/M (cons 0.6) but the miss was more than offset by a large upward revision to 1.2% in Oct (initial 0.6) plus 0.4% in Sept (initial 0.2).

- The past two months have been driven by residential construction (+3.1% cumulative increase) with non-resi construction plateauing (+0.5% cumulative) but that masks two very different years with resi construction spending having increased 3.7% Y/Y vs 18.1% Y/Y for non-resi.

- This indicator should feed into the Atlanta Fed GDPNow estimate for Q4 released later today, updating the 2.3% seen with the Dec 22 update. Subsequent information also includes a larger than expected goods trade deficit and softer than expected retail inventories.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 86.18 points (-0.23%) at 37604.38

- S&P E-Mini Future down 52.5 points (-1.09%) at 4767.75

- Nasdaq down 319.9 points (-2.1%) at 14692.98

- US 10-Yr yield is up 6.2 bps at 3.9407%

- US Mar 10-Yr futures are down 18/32 at 112-10.5

- EURUSD down 0.0096 (-0.87%) at 1.0949

- USDJPY up 1.04 (0.74%) at 141.93

- WTI Crude Oil (front-month) down $1.12 (-1.56%) at $70.54

- Gold is down $2 (-0.1%) at $2061.13

- European bourses closing levels:

- EuroStoxx 50 down 8.84 points (-0.2%) at 4512.81

- FTSE 100 down 11.72 points (-0.15%) at 7721.52

- German DAX up 17.72 points (0.11%) at 16769.36

- French CAC 40 down 12.32 points (-0.16%) at 7530.86

US TREASURY FUTURES CLOSE

- 3M10Y +3.894, -143.778 (L: -146.95 / H: -139.208)

- 2Y10Y -1.9, -39.188 (L: -40.067 / H: -35.785)

- 2Y30Y -2.959, -25.329 (L: -26.27 / H: -21.196)

- 5Y30Y -2.397, 15.545 (L: 14.731 / H: 18.001)

- Current futures levels:

- Mar 2-Yr futures down 5.25/32 at 102-25.375 (L: 102-24.125 / H: 102-31)

- Mar 5-Yr futures down 13.5/32 at 108-11.25 (L: 108-08 / H: 108-24)

- Mar 10-Yr futures down 18/32 at 112-10.5 (L: 112-04 / H: 112-26.5)

- Mar 30-Yr futures down 34/32 at 123-28 (L: 123-08 / H: 124-21)

- Mar Ultra futures down 45/32 at 132-6 (L: 131-07 / H: 133-11)

US 10Y FUTURE TECHS: (H4) Corrective Pullback Persists

- RES 4: 115-00+ 2.236 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 114-06+ 2.00 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 2: 114-00 Round number resistance

- RES 1: 113-12+ 1.764 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- PRICE: 112-10+ @ 10:46 GMT Jan 02

- SUP 1: 111-31+/111-23+ Low Dec 14 / 20-day EMA

- SUP 2: 111-09+ High Dec 7

- SUP 3: 109-31+Low Dec 11 and key short-term support

- SUP 4: 110-15 50-day EMA

The corrective pullback for Treasuries persists to begin 2024. Nonetheless, the broader technical picture remains positive. Resistance at 111-09+, the Dec 7 high, has been cleared. This confirmed a resumption of the uptrend and an extension of the price sequence of higher highs and higher lows. Sights are on 113-12+, a Fibonacci projection point. Key short-term support is at 109-31+, the Dec 11 low. Initial firm support is at 111-09+, the Dec 7 high.

SOFR FUTURES CLOSE

- Current White pack (Mar 24-Dec 24):

- Mar 24 -0.045 at 94.970

- Jun 24 -0.070 at 95.415

- Sep 24 -0.085 at 95.820

- Dec 24 -0.095 at 96.175

- Red Pack (Mar 25-Dec 25) -0.12 to -0.11

- Green Pack (Mar 26-Dec 26) -0.12 to -0.10

- Blue Pack (Mar 27-Dec 27) -0.095 to -0.07

- Gold Pack (Mar 28-Dec 28) -0.065 to -0.045

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00628 to 5.34844 (-0.00064 total last wk)

- 3M -0.00407 to 5.32733 (-0.01971 total last wk)

- 6M -0.00461 to 5.15311 (-0.02954 total last wk)

- 12M -0.00091 to 4.77007 (-0.03171 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.38% (-0.02), volume: $1.702T

- Broad General Collateral Rate (BGCR): 5.33% (-0.02), volume: $611B

- Tri-Party General Collateral Rate (TGCR): 5.33% (-0.02), volume: $594B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $59B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $110B

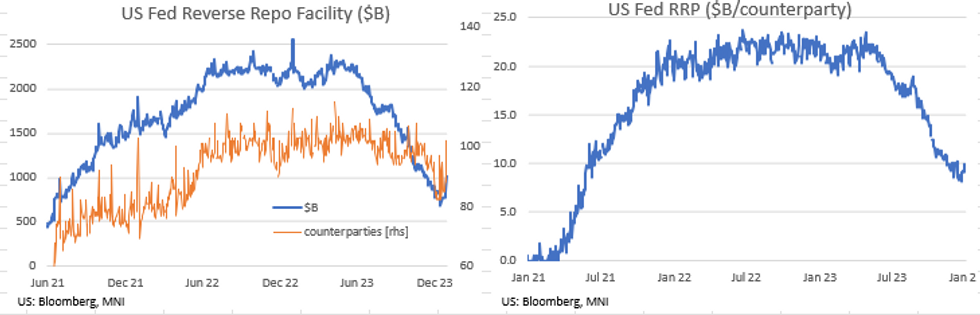

REVERSE REPO OPERATION

- After climbing back over $1T last Friday, RRP usage collapses back near mid-December lows with $704.064B vs. $1,018.483B on Friday. Latest level compares December 15 when usage fell to the lowest level since mid-June 2021: $683.254B.

- The number of counterparties falls to the lowest level since early April 2022 with 78 vs. 102 in the prior session.

PIPELINE: Over $25B Corporate Bonds to Price

Still nearly a half dozen to launch, that said, $24.55B total high-grade corporate issuance on the day led by $7.5B supra-sovereign United Mexican States.

- Date $MM Issuer (Priced *, Launch #)

- 1/2 $7.5B #United Mexican States $1B 5Y +115, $4B 12Y +215, $2.5B 30Y +235

- 1/2 $3.8B #Lloyds $1.5B 4NC3 +137.5, $300M 4NC3 SOFR+158, $2B 11NC10 +175

- 1/2 $2.25B #Rabobank $1B 2Y +55, $750M 2Y SOFR+71, $500M 5Y +90

- 1/2 $2.1B #Williams Cos $1.1B 5Y +102, $1B 10Y +122

- 1/2 $2B #Enterprise Products $1B each 3Y +55, 10Y +95

- 1/2 $1.75B #John Deere $750M 3Y +45, $1B 3Y SOFR, 5Y +62.5

- 1/2 $1.3B #MetLife $750M 5Y +93, $550M 10Y +113

- 1/2 $1.1B #Duke Energy $550M each: 3Y +7, 5Y +95

- 1/2 $1B #Virginia Electric $500M each 10Y +115, 30Y +127

- 1/2 $650M *PPL Electric 10Y +92

- 1/2 $600M *Consumers Energy 5Y +73

- 1/2 $500M #Caterpillar 3Y +45

- 1/2 $Benchmark BNP Paribas 6NC5 +125

- 1/2 $Benchmark Santander Holdings 6NC5 +250a

- 1/2 $Benchmark Ford Motors 3Y +175, 3Y SOFR, 7Y +215

- 1/2 $Benchmark UBS 6NC5 +170a, 6NC5 SOFR, 11NC10 +200a

- 1/2 $Benchmark Toyota Motors 2Y +50, 2Y SOFR, 5Y +75, 10Y +87.5

- Expected to issue Wednesday:

- 1/3 $Benchmark World Bank 7Y SOFR+57a

EGBs-GILTS CASH CLOSE: Yields Retrace Higher To Open The Year

European bonds weakened to start 2024, though yields finished off session highs.

- Some of the late 2023 bullishness in rates corrected at the open. As trading picked up following the holiday period, the weakness continued, spurred in part by a 3+% jump in oil prices.

- The oil rise completely reversed later in the session, helping yields retrace lower in the afternoon.

- Gilts underperformed Bunds on the day, with the UK curve bear steepening (+6 to 12bp) and Germany's fairly flat (+4 to 5bp).

- Periphery spreads were mostly tighter, with Italy outperforming and Portugal lagging.

- Manufacturing PMIs for December were final for the UK and Eurozone, with the readings for Italy beating and Spain missing - none moved the needle. Eurozone M3 / lending data was largely in line.

- Wednesday's slate is light, with Spanish and German labour market featuring. Germany sells Schatz, while syndication for a new 10Y EUR Slovenian benchmark looks likely to be conducted.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 4.8bps at 2.452%, 5-Yr is up 4.3bps at 1.991%, 10-Yr is up 4.1bps at 2.065%, and 30-Yr is up 4.7bps at 2.31%.

- UK: The 2-Yr yield is up 6.6bps at 4.05%, 5-Yr is up 7.6bps at 3.539%, 10-Yr is up 9.7bps at 3.634%, and 30-Yr is up 12.3bps at 4.265%.

- Italian BTP spread down 2.9bps at 164.7bps / Portuguese up 0.6bps at 63.8bps

FOREX Greenback Trades On Firmer Footing Amid Higher Core Yields

- Both European and US bonds weakened to start 2024, and despite yields finishing off session highs, price action has worked in favour of the greenback with a notable 0.85% recovery for the USD index.

- Weakness for major equity and a significant reversal lower for oil have bolstered the dollar bid, which now sees the DXY over 1.5% above last week’s lows.

- Underperforming in the G10 currency space are the New Zealand dollar and the Swiss Franc, both declining around 1.1%, however, losses have been broad based. As such, EURUSD has slipped back below 1.0950 and USDJPY hovers just below 142.00 after printing a 142.21 high around the new York crossover.

- CHF has reversed a small part of the impressive rally into the end of 2023. USD/CHF is around 175 pips off the 2023 and cycle low, however CHF weakness looks technically corrective in nature the longer USDCHF fails to break back above 0.8549.

- AUD has been a marginal outperformer on a relative basis, with technical conditions for AUDUSD remaining firmly in bullish territory and short-term weakness considered corrective. Despite today’s pullback, sights are on 0.6900, the Jun 16 high and the next key resistance. On the downside, Initial firm support is at 0.6714, the 20-day EMA.

- Spanish and German unemployment data will cross on Wednesday, along with Swiss manufacturing PMI. A busy data docket in the US will be highlighted by ISM Manufacturing figures and November JOLTS data. The minutes of the Federal Reserve’s December meeting will also be released.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/01/2024 | 0855/0955 | ** |  | DE | Unemployment |

| 03/01/2024 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 03/01/2024 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 03/01/2024 | 1330/0830 |  | US | Richmond Fed's Tom Barkin | |

| 03/01/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 03/01/2024 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 03/01/2024 | 1500/1000 | *** |  | US | JOLTS jobs opening level |

| 03/01/2024 | 1500/1000 | *** |  | US | JOLTS quits Rate |

| 03/01/2024 | 1900/1400 | *** |  | US | FOMC Minutes |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.