-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI ASIA OPEN: Debt Ceiling Talks Hit Snag

- MNI US: GOP Negotiator Graves Indicates Lack Of Progress In Debt Limit Talks

- MNI US: Biden's G7 Schedule Complicates Negotiations As GOP Withdraws From Talks

- POWELL: HAVEN'T MADE A DECISION ABOUT FUTURE POLICY TIGHTENING, Bbg

- POWELL: FED WAS EXPECTING FURTHER TIGHTENING UNTIL RECENTLY, Bbg

- ECB LAGARDE: INTEREST RATES STILL NEED TO BE SUSTAINABLY HIGH .. ECB NEEDS TO BUCKLE UP AND DELIVER INFLATION TARGET, Bbg

US TSYS: Debt Ceiling Headline Risk Overshadows Powell/Bernanke Policy Forum

Treasury futures look to finish weaker for the most part, near the middle of a moderate session range after some late morning volatility tied to debt ceiling headlines.- Rate futures extended lows after (10s marked 113-11 low, -18.5, yield rising to 3.7186% high) on carry-over optimism over the last 36 hours that a debt ceiling negotiations to avoid a default were close to an agreement.

- That was until late morning when headlines hit that GOP negotiators walked out of debt talks with no follow-up scheduled. Punchbowl News' Jake Sherman tweeted ""We're at an impasse," a source involved with the talks tells me. Not one issue, but multiple issues have proven problematic, I am told."

- The impasse spurred a fast risk-off move as Treasury futures rallied (10s bounced to 114-01.5) and stocks reversed modest gains: SPX falling to 4192.0 low after marking 4227.0 high in early trade.

- The headlines completely overshadowed headlines of Fed Chairman Powell amid former chair Bernanke at a policy forum scheduled at the same time. Federal Reserve policy is already restrictive, allowing caution about whether more tightening is needed given the lagged effects of past rate hikes, Chair Powell said.

- "We've come a long way in policy tightening and stance of policy is restrictive and we face uncertainty about the lagged effects our tightening so far and about the extent of credit tightening from recent banking stresses," he said.

- Markets settled near midrange through the second half, decent overall volumes (TYM>1.75M) tied to a pick-up in Jun/Sep quarterly futures rolls. Focus turns to May 3 FOMC minutes release next Wednesday.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.01161 to 5.09373 (+.03682/wk)

- 3M +0.03411 to 5.16347 (+.09367/wk)

- 6M +0.05277 to 5.14653 (+.16106/wk)

- 12M +0.08100 to 4.87766 (+.27652/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00472 to 5.06529%

- 1M -0.00872 to 5.139271%

- 3M +0.01357 to 5.39271% */**

- 6M +0.04143 to 5.46657%

- 12M +0.05214 to 5.44457%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.39271% on 5/19/23

- Daily Effective Fed Funds Rate: 5.08% volume: $127B

- Daily Overnight Bank Funding Rate: 5.07% volume: $289B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.401T

- Broad General Collateral Rate (BGCR): 5.02%, $586B

- Tri-Party General Collateral Rate (TGCR): 5.02%, $577B

- (rate, volume levels reflect prior session)

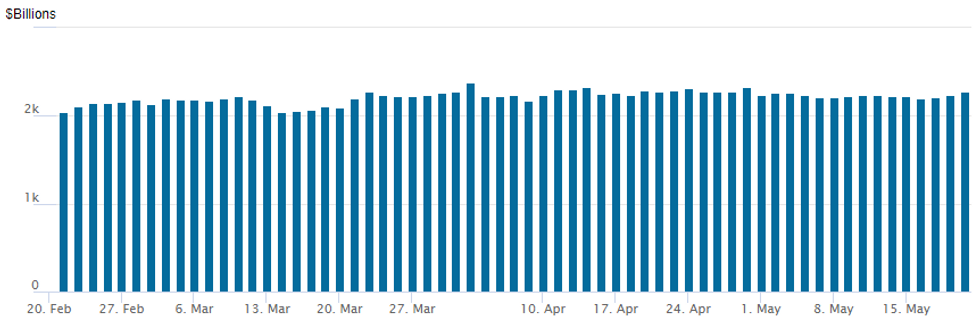

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,276.720B w/ 106 counterparties, compares to prior $2,238.266B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

- SOFR Options:

- 4,300 SFRU3 94.81/94.93/95.06 put flys ref 95.055

- over 5,000 SFRM3 94.75/94.81/94.87/94.93 put condors ref 94.8525

- -19,500 SFRZ3 96.75/97.75 call spds ref 95.465

- +6,000 SFRM3 94.81/94.93/95.06 put flys, 4.25

- 5,000 SFRM3 94.68/94.81 2x1 put spds, ref 94.815

- Block, 25,000 SFRM3 94.37/94.50/94.56/94.68 put condors, 2.0 ref 94.8075

- +10,000 SFRU3 95.75/96.50 call spds, 6.5

- +2,500 SFRN3 95.00/95.25/95.50 call flys, 3.0

- 3,000 SFRV3 94.87/95.12 2x1 put spds, ref 95.385

- 2,500 OQQ3 97.00/97.50/97.75 broken put flys ref 96.60

- 1,200 SFRZ3 94.75/95.00/95.50 put flys, ref 95.44

- Block, 2.500 SFRU3 94.62/94.87 put spds 5.0 over 95.37/95.62 call spds ref 95.05

- Treasury Options:

- Near 50,000 TYM3 115/116 call spds 5 ref 113-23.5 to 28.5

- 5,000 TYQ3 116.5/117 call spds 6 ref 114-08

- 7,500 FVM3 108.5/109 put spds, 17 ref 108-18.25

- 3,000 TYM3 115 calls, 5 ref 113-11.5

- over 10,000 TYM3 114.5 calls 10-17, 10 last ref 113-16.5

- 4,000 TYM3 113/113.5 2x1 put spds, 6 net 2-leg over

- 3,700 TYM3 111.5 puts, 1 ref 113-26

- Block, 12,000 FVM3 108 puts, 4.5 ref 108-27.5

- over 15,000 TYM3 112/114 call spds, ref 114-00.5 to -02

- 5,000 TYN3 116/116.5 call spds, 9 ref 114-29

- 1,000 TYM3 113/114 3x1 put spds

- 3,300 FVN3 108.5 puts, 21 ref 109-19.5

EGBs-GILTS CASH CLOSE: Late Recovery

European yields pulled back sharply in the final hours of the week's cash trade, leaving German instruments stronger on the day, and paring Gilt losses.

- Developments in Europe were limited Friday, with the US again dominating market-moving events as reports emerged of debt limit negotiations breaking down in Washington, hammering risk appetite.

- 10Y Gilt yields dropped 10bp in the last two hours of trade (from a 2023 high of 4.093%), with Bunds pulling back 7bp.

- There were few identifiable catalysts for the early weakness, but it came alongside strengthening equities and firming ECB/ BoE hike pricing.

- Peripheries are in focus over the weekend. Moody's review of Italy's credit rating will garner attention after Friday's market close, while Greece holds legislative elections on May 21 (our briefing is here).

- Otherwise, next week gets off to a relatively quiet start, with little data, and mainly ECB speakers of note (Vujcic, Guindos, Holzmann, Lane, Villeroy appear Monday).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 0.5bps at 2.757%, 5-Yr is down 1bps at 2.406%, 10-Yr is down 1.8bps at 2.428%, and 30-Yr is down 2.9bps at 2.603%.

- UK: The 2-Yr yield is up 0.5bps at 3.96%, 5-Yr is up 2.7bps at 3.822%, 10-Yr is up 3.9bps at 3.996%, and 30-Yr is up 3.3bps at 4.414%.

- Italian BTP spread down 2.3bps at 184.4bps / Greek down 0.4bps at 159.1bps

EGB Options: Euro Rate Upside Theme Continues

Friday's Europe rates / bond options flow included:

- ERN3 96.37/96.25/95.75/95.62p condor, sold at 9 in 11.5k

- ERZ4 99.25/100cs 1x2, bought for flat in another 15k. 45k since Thursday

- ERH4 100.50c, bought for 1 in 19k. 110k since Thursday

- RXM3 136/137.5cs, bought for 8, 10.5 and 11. 20k all day

FOREX: Greenback Ends Week On Weaker Note Amid Debt-Ceiling Talks Collapse

- The USD spent the majority of Friday trading on a weaker footing as the currency pulled back a small part of this week's rally. This weakness was exacerbated by a wave of risk-selling following headlines on the debt ceiling. Headlines citing GOP negotiator Graves as stating that talks are at a pause, and the White House are not being reasonable. The USD index is down half a percent as we approach the week’s close, however, does remain stronger on the week by around 0.4%.

- Following the headlines and corresponding sell-off across major equity benchmarks, USDJPY had an impressive slide from levels around 138.50 to a fresh intra-day low of 137.43, before paring some of these losses into the close.

- Separately, the PBoC re-stated their vow to curb speculation in the FX market, urging institutions to maintain FX market stability. The statement sees curbing of speculation "when necessary". USD/CNH traded to fresh daily lows on the back of the headlines – with the pair printing as low as 7.0121 and looking set to snap its 3-day advance.

- Antipodean currencies are firmer, keeping AUD and NZD top of the pile in G10. NZD/USD (+1.05%) has notably cracked the 100-day moving average to the topside. Market moves come ahead of the RBNZ rate decision next week, at which consensus looks for a 25bps hike to 5.50% - with a number of sell-side analysts switching their views to see a peak rate further north of current levels following this week's budget.

- The economic calendar is very light on Monday but hots up Tuesday with a host of European Flash PMIs.

FX: Expiries for May22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700-10(E1.6bln), $1.0720-25(E678mln), $1.0825-40(E2.3bln), $1.0845-50(E609mln)

- USD/JPY: Y136.00($1.3bln), Y137.50($825mln), Y137.90-05($567mln)

LATE EQUITIES Roundup: Stocks Off 3M Highs as Debt Ceiling Talks Hit Snag

Stocks see-sawing in modestly weaker territory after posting the best levels since early February in the first half as debt ceiling negotiations hit a snag in late morning trade.- "GOP DEBT NEGOTIATORS SAY WHITE HOUSE NOT BEING REASONABLE .. and GOP NEGOTIATORS LEAVE DEBT TALKS" Bbg have triggered late morning unwinds with SPX E-Mini Futures down 11.25 points (-0.27%) at 4205; DJIA down 131.31 points (-0.39%) at 33457.23; Nasdaq down 44.1 points (-0.3%) at 12652.15.

- No substantive reaction to a policy panel event with Fed Chairman Powell, former chair Bernanke highlighting "key issues in monetary policy and the economy and facilitate discussions on the challenges faced by monetary policymakers.

- Echoing previous comments - tighter credit conditions "weigh on economic growth hiring and inflation. As a result, our policy rate may not need to rise as much as it would have otherwise to achieve our goals."

- At the moment: Emini futures have breached key resistance and the bull trigger at 4206.25, the May 1 high. Clearance of this level confirms an extension of the bull trend from Mar 13. This opens 4244.00, the Feb 2 high and the next key short-term resistance. Key support is at 4062.25, the May 4 low. A move through this level would highlight a bearish threat.

E-MINI S&P TECHS: (M3) Resumes Its Uptrend

- RES 4: 4288.00 High Aug 19 2022

- RES 3: 4244.00 High Feb 2 and a medium-term bull trigger

- RES 2: 4231.00 High Feb 3

- RES 1: 4227.25 Intraday high

- PRICE: 4197.00 @ 1435ET May 19

- SUP 1: 4116.32/4062.25 50-day EMA / Low May 4 and key support

- SUP 2: 4052.50 Low Mar 30

- SUP 3: 4022.75 50.0% retracement of the Mar 13 - May 1 bull leg

- SUP 4: 4006.00 Low Mar 29

S&P E-minis traded higher again Thursday and the contract has breached key resistance and the bull trigger at 4206.25, the May 1 high. Clearance of this level confirms an extension of the bull trend from Mar 13. This opens 4244.00, the Feb 2 high and the next key short-term resistance. Key support is at 4062.25, the May 4 low. A move through this level would highlight a bearish threat.

COMMODITIES: Oil Extends Debt Talk Impasse Decline With Sharp Rig Count Decline

- Crude oil is on track to close lower for the second session, as an earlier paring of gains was exacerbated by debt talk impasse headlines. The two-day decline unwinds a large part of Wednesday’s jump on positive Biden/McCarthy headlines on the matter.

- More recently, the sharpest weekly decline in US oil rigs since Sep’21 (-11 to 575) has extended new session lows.

- Further on the supply side, the next OPEC+ ministerial meeting is scheduled for 3-4 June with some early suggestions from Iraq last week that there are no current plans to cut targets further. Iraqi oil minister Hayan Abdel-Ghani affirmed his country's commitment to OPEC+ voluntarily production cuts in a phone call with his Russian counterpart earlier today according to Iraqi state news agency (INA).

- WTI is -1.1% at $71.05, next eyeing support at $69.41 (May 15 low). In options space, by far the most strikes on the day are seen at $65/bbl puts.

- Brent is -0.9% at $75.14, next eyeing support at $73.49 (May 15 low).

- Gold is +1.2% at $1981.74 in a reversal of yesterday’s slide as the USD index pulls back. Resistance is seen at $2022.6 (May 12 high) and support at $1952.0 (May 18 low).

- Weekly moves: WTI +1.5%, Brent +1.4%, Gold -1.4%, US nat gas +14.0%, EU TTF nat gas -7.9%

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/05/2023 | 0900/1100 | ** |  | EU | Construction Production |

| 22/05/2023 | 0900/1100 |  | EU | ECB de Guindos Opens ECB/EIOPA Workshop | |

| 22/05/2023 | 0900/1100 |  | EU | ECB Elderson Guest Lecture Utrecht University | |

| 22/05/2023 | 1230/0830 |  | US | St. Louis Fed's James Bullard | |

| 22/05/2023 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/05/2023 | 1415/1615 |  | EU | ECB Lane Panels OeNB Economics SUERF Conference | |

| 22/05/2023 | 1430/1530 |  | UK | DMO Quarterly Investor/GEMM Consultation Meetings | |

| 22/05/2023 | 1500/1100 |  | US | Fed's Tom Barkin, Raphael Bostic | |

| 22/05/2023 | 1505/1105 |  | US | San Francisco Fed's Mary Daly | |

| 22/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 22/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 22/05/2023 | 1600/1700 |  | UK | DMO Quarterly Investor/GEMM Consultation Meetings | |

| 23/05/2023 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.