-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Dec Hike Debate Post Jobs; CPI Next Focus

EXECUTIVE SUMMARY

US

FED: Federal Reserve officials may clash at the December meeting over whether to slow the pace of interest rate hikes despite persistently high readings for key inflation measures and a strong job market, former Richmond Fed research director John Weinberg told MNI.

- “That’s going to be a lively discussion in December,” he said in an interview with MNI’s FedSpeak podcast following this week’s FOMC decision to raise interest rates by 75 basis points for a fourth consecutive meeting.

- “There’s likely to be a number of committee members who think that even with the picture that we have now, as long as rates continue going up and are moving toward a sufficiently restrictive stance, that they can afford to slow the pace. So I wouldn’t be surprised to see them do that.” For more see MNI policy main wire at 1127ET.

FED: It’s too soon to say how high interest rates need to rise in order to tame inflation near 40-year highs but the risks of overtightening rise as monetary policy becomes restrictive, Boston Fed President Susan Collins said Friday.

- “It is premature to signal how high rates should go,” she said in prepared remarks to the Brookings Institution. “The median path in September’s Summary of Economic Projections can be taken as a starting point of my current thinking, with the possibility of a higher path depending on incoming information.”

- Those projections foresaw interest rates peaking at 4.6% though Fed Chair Jerome Powell signaled at this week’s press conference the terminal rate was likely already higher. Ex-officials have told MNI rates need to peak at 5% or higher.

- “With rates now in restrictive territory, I believe it is time to shift focus from how rapidly to raise rates, or the pace, to how high – in other words, to determining what is sufficiently restrictive,” Collins said. “Down the road, when we get there, in my view we’ll need to shift again to focus on how long to hold rates at that level.” For more see MNI policy main wire at 1000ET.

EUROPE

EU: EU officials will make a fresh bid at Monday’s Eurogroup meeting of eurozone finance ministers to persuade member states to better align their fiscal policies and energy support measures with the European Central Bank’s monetary policy stance, officials told MNI, admitting that their chances of success were modest.

- While Eurogroup Chair Paschal Donohoe has repeatedly urged finance ministers to make fiscal support for consumers and business “temporary and targeted,” his advice has so far fallen on deaf ears.

- “It’s no secret that measures have not been as targeted and as temporary as we would like. Most have been broad based, which are the easiest to implement of course, but not sustainable. We need more targeted and more income- than price-based measures,” one EU official said. For more see MNI policy main wire at 1251ET.

CANADA

CANADA: Canada's labor market smashed expectations with 108,300 new jobs in October while wage gains were about the fastest since 1997, bucking signs the economy is teetering on the edge of recession and adding to pressure for another out-sized rate increase.

- Higher-paying full-time jobs grew by 119,300 and part-time work declined by 11,000 according to a Statistics Canada report Friday. Economists predicted only 5,000 new jobs.

- Canada’s population is about one-ninth the size of the U.S., suggesting the current job gain is on par with an American payrolls change of about 950,000. For more see MNI policy main wire at 0831ET.

US TSYS: Oct Jobs Strong, But Off Mid-Yr Pace, Short End Firm on Dovish Fedspeak

Tsy futures mixed after the bell, well off post-data lows: yield curves broadly steeper - near highs (2s10s +7.322 at -50.00 vs. -61.953 low) as earlier dovish Fed speak gained traction again: short end higher (Dec 2022: cumulative hikes slips 57.3 to 4.40% as Terminal Funds rate holds at 5.155% in June'23).

- Earlier comments from Fed speakers: Boston Fed Collins and Richmond Fed Barkin also helped stocks rally on the day. “I believe it is time to shift focus from how rapidly to raise rates, or the pace, to how high – in other words, to determining what is sufficiently restrictive,” Collins said. “Down the road, when we get there, in my view we’ll need to shift again to focus on how long to hold rates at that level.”

- Barkin headlines from CNBC: "UNSURE OF DECEMBER FOMC MOVE, MORE DATA STILL COMING .. CAN CREDIBLY SAY FED HAS `FOOT ON THE BRAKE'".

- Tsys sold-off after Oct NFP climbed +261k higher than estimated +195k, while Sep up-revised to +315k, Aug to +292k. Unemploy rate climbs to 3.7% - sources say "for the wrong reasons as the labor force participation rate and the share of workers with a job declined."

- Look ahead: Fed speakers and Tsy auctions outweigh data in the first half of next week. Focus on Oct CPI Wed morning: MoM 0.6% est vs. 0.4% prior

OVERNIGHT DATA

- NY Fed reverse repo usage climbs to $2,230.840B w/ 108 counterparties vs. $2,219.791B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

- BLS NET REVISIONS FOR SEPT, AUG PAYROLLS +29K

- US OCT. UNEMPLOYMENT RATE RISES TO 3.7% VS 3.5%

- Notable job gains occurred in health care, professional and technical services, and manufacturing. Hurricane Ian had no discernible effect

- Employment-population ratio, at 60.0 percent was about unchanged in October and have shown little net change since early this year

- Early signs of labour market adjustments due to housing market slowdown: "gains in insurance carriers and related activities (+9,000) and in securities, commodity contracts, and investments (+5,000) were partially offset by a job loss in rental and leasing services (-8,000).

- CANADA OCT JOBS +108.3K VS FORECAST +5K, SEP +21.1K

- CANADA OCT JOBLESS RATE 5.2% VS FORECAST 5.3%, SEP 5.2%

- CANADA HOURLY WAGES +5.6% YEAR-OVER-YEAR

- CANADA FULL-TIME EMPLOYMENT +119.3K VS PART-TIME -11K

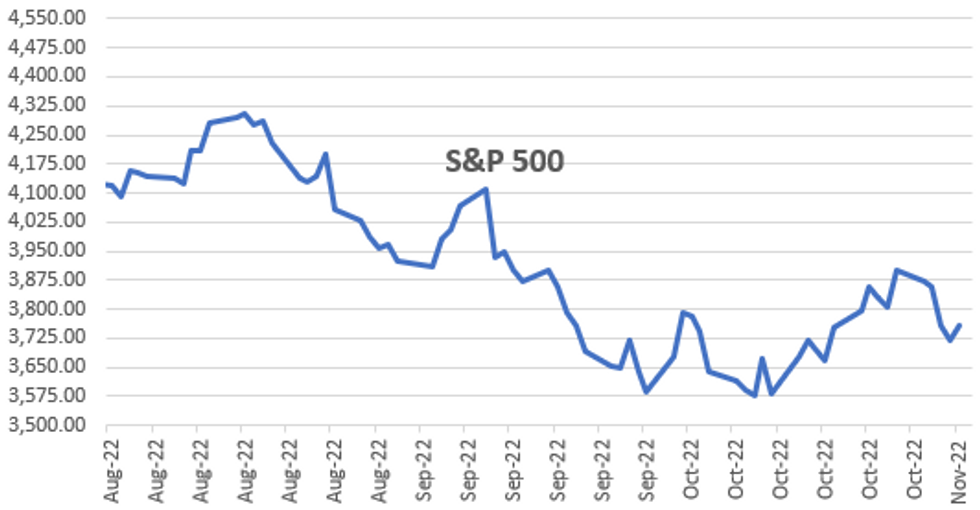

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 276.81 points (0.87%) at 32283.3

- S&P E-Mini Future up 38.75 points (1.04%) at 3767

- Nasdaq up 92.7 points (0.9%) at 10438.29

- US 10-Yr yield is up 0.9 bps at 4.1563%

- US Dec 10Y are up 0.5/32 at 110-1.5

- EURUSD up 0.0208 (2.13%) at 0.9957

- USDJPY down 1.54 (-1.04%) at 146.72

- WTI Crude Oil (front-month) up $4.58 (5.19%) at $92.74

- Gold is up $50.89 (3.12%) at $1680.45

- EuroStoxx 50 up 95.15 points (2.65%) at 3688.33

- FTSE 100 up 146.21 points (2.03%) at 7334.84

- German DAX up 329.66 points (2.51%) at 13459.85

- French CAC 40 up 173.16 points (2.77%) at 6416.44

US TSY FUTURES CLOSE

- 3M10Y +2.891, 3.998 (L: -3.605 / H: 5.577)

- 2Y10Y +8.368, -48.954 (L: -61.953 / H: -48.953)

- 2Y30Y +14.274, -39.618 (L: -58.519 / H: -39.518)

- 5Y30Y +11.456, -7.553 (L: -23.105 / H: -7.376)

- Current futures levels:

- Dec 2Y up 3/32 at 101-27.75 (L: 101-18.375 / H: 101-28.375)

- Dec 5Y up 4.75/32 at 106-7 (L: 105-18.25 / H: 106-11.25)

- Dec 10Y up 0.5/32 at 110-1.5 (L: 109-10.5 / H: 110-12)

- Dec 30Y down 30/32 at 119-12 (L: 118-27 / H: 120-09)

- Dec Ultra 30Y down 2-12/32 at 126-10 (L: 126-03 / H: 128-03)

US 10YR FUTURE TECHS: (Z2) Key Support Remains Exposed

- RES 4: 113-30 High Oct 4 and a key resistance

- RES 3: 112-25+ 50-day EMA

- RES 2: 112-22+ High Oct 6

- RES 1: 110-31+/111-31 20-day EMA / High Oct 27

- PRICE: 109-30+ @ 15:55 GMT Nov 4

- SUP 1: 109-10+ Low Nov 04

- SUP 2: 108-26+ Low Oct 21 and the bear trigger

- SUP 3: 108-06+ Low Oct 2007 (cont)

- SUP 4: 107.08 3.0% 10-dma envelope

Treasuries remain below last week’s high of 111-31 on Oct 27 - a key short-term resistance. A break of this hurdle is required to signal scope for an extension higher near-term and expose the 50-day EMA at 112-25+. However, this week’s bearish extension exposes the key support and bear trigger at 108-26+, the Oct 21 low. A break of this support would confirm a resumption of the primary downtrend.

US EURODOLLAR FUTURES CLOSE

- Dec 22 +0.040 at 94.890

- Mar 23 +0.060 at 94.655

- Jun 23 +0.070 at 94.625

- Sep 23 +0.075 at 94.795

- Red Pack (Dec 23-Sep 24) +0.045 to +0.075

- Green Pack (Dec 24-Sep 25) +0.015 to +0.040

- Blue Pack (Dec 25-Sep 26) -0.02 to +0.005

- Gold Pack (Dec 26-Sep 27) -0.035 to -0.015

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00300 to 3.81629% (+0.75243/wk)

- 1M +0.01157 to 3.85814% (+0.09043/wk)

- 3M +0.01872 to 4.55029% (+0.11072/wk) * / **

- 6M +0.01400 to 5.01129% (+0.08043/wk)

- 12M +0.01286 to 5.66643% (+0.29743/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.55029% on 11/4/22

- Daily Effective Fed Funds Rate: 3.83% volume: $97B

- Daily Overnight Bank Funding Rate: 3.82% volume: $284B

- Secured Overnight Financing Rate (SOFR): 3.80%, $1.074T

- Broad General Collateral Rate (BGCR): 3.76%, $418B

- Tri-Party General Collateral Rate (TGCR): 3.75%, $393B

- (rate, volume levels reflect prior session)

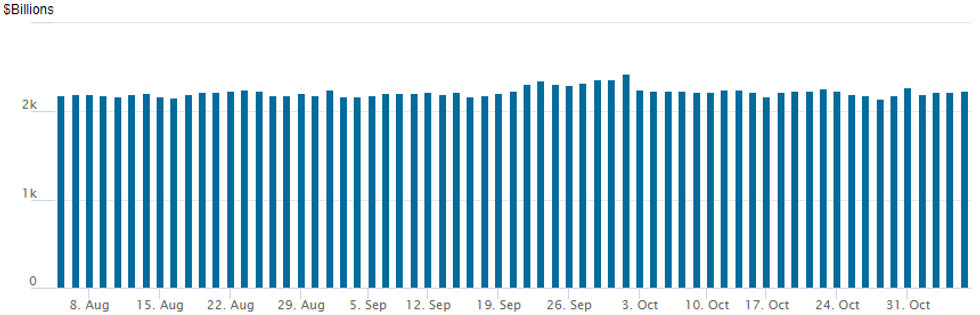

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,230.840B w/ 108 counterparties vs. $2,219.791B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

PIPELINE: November Kicks off w/ $6.2B High-Grade Corporate Issuance

- Date $MM Issuer (Priced *, Launch #)

- 11/04 $700M #PSEG 5Y +155

- $3B Priced Thursday

- 11/03 $1.5B *NatWest 4NC3 +285

- 11/03 $1.5B *Southern California Edison $750M 5Y +150, $750M 10Y +190

- 11/03 Chatter: Dish Network $2B 5NC2 for Friday

- 11/02 Issuers sidelined ahead FOMC

- $2.5B Priced Tuesday

- 11/01 $1.5B *Ford Motor Co 5Y 7.35%

- 11/01 $1B *State Street Bank $500M 4NC3 +125, $500M 6NC5 +155

FOREX: Greenback Weakness Extends Ahead Of The Close, AUDUSD Up 3%

- Friday saw a broadly solid US employment report for October, despite a small miss on the unemployment rate. Despite further solid job gains, the US dollar saw a sharp depreciation on Friday with strength in both equity markets but especially in the commodity complex working against the greenback for the majority of Friday trade.

- Potentially one of the dominant drivers were early headlines about possible easing of China covid curbs attracting dip buyers in equities following the data, weighing on the US Dollar, with price action being exacerbated by short-term positioning.

- The USD index is down just shy of two percent and gains in G10 were broad based. CNH is set to post one of its largest advances on record at 2.10%, which certainly filtered through to the likes of AUD and NZD, rising well over 2.5%.

- In similar vein, EURUSD (+2.10%) bounced two full points to trade back above 0.9950 and GBPUSD (+1.85%) reversed the majority of yesterday’s fall which had been pronounced by the Bank of England’s latest downbeat statement.

- Focus next week turns the US Midterm Election and to Thursday’s US CPI print, which may prove pivotal in determining pricing ahead of the December Fed meeting given many Fed officials have been hinting the pace of rate hikes may need to decelerate, despite also signalling a higher terminal rate.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/11/2022 | 0645/0745 | ** |  | CH | Unemployment |

| 07/11/2022 | 0700/0800 | ** |  | DE | Industrial Production |

| 07/11/2022 | 0730/0730 |  | UK | DMO Announces Second H2-Nov Linker Synd | |

| 07/11/2022 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 07/11/2022 | 0830/0930 |  | DE | S&P Global Germany Construction PMI | |

| 07/11/2022 | 0840/0940 |  | EU | ECB Lagarde Video Message for EC/ECB Conference | |

| 07/11/2022 | 0930/1030 | * |  | EU | Sentix Economic Index |

| 07/11/2022 | 0930/1030 |  | EU | ECB Panetta Panels EC/ECB Conference | |

| 07/11/2022 | - | *** |  | CN | Trade |

| 07/11/2022 | - |  | EU | COP 27 Begins | |

| 07/11/2022 | - |  | EU | ECB Panetta at Eurogroup meeting | |

| 07/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 07/11/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 07/11/2022 | 2000/1500 | * |  | US | Consumer Credit |

| 07/11/2022 | 2040/1540 |  | US | Fed's Loretta Mester and Susan Collins | |

| 07/11/2022 | 2300/1800 |  | US | Richmond Fed's Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.