-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Decently Dovish Data Deluge

- MNI US FED: More good data to gain inflation confidence-Fed minutes

- MNI US: President Biden: "I'm In This Race To The End And We're Going To Win"

- MNI US FED: NY Fed Williams Pushes Back On Higher R* Estimates

- MNI US DATA: A Large ISM Services Miss As New Orders Plunge

US

US FED (MNI): More good data to gain inflation confidence-Fed minutes

Federal Reserve officials need additional signs that inflation is heading back toward their 2% target before considering any interest rate cuts, according to minutes from the central bank’s June meeting released Wednesday that showed increasing concern over signs of economic weakness.

- “Participants affirmed that additional favorable data were required to give them greater confidence that inflation was moving sustainably back to 2%,” the minutes said.

- “A number of participants remarked that monetary policy should stand ready to respond to unexpected economic weakness.”

- Most FOMC members – but not all -- believe monetary policy is restrictive and helping to gradually cool the economy and lower inflation.

US FED (MNI): NY Fed Williams Pushes Back On Higher R* Estimates

NY Fed’s Williams (voter) said in prepared remarks at a panel on R* that “the low r-star regime endures” according to macro model-based estimates as opposed to relying on financial market or survey data.

- “This finding runs counter to recent commentary suggesting that r-star has risen due to persistent changes in the balance between the supply and demand for savings, such as higher investment in AI and renewable energy, as well as larger government debt. In fact, some measures of longer-run r-star have risen to levels well above those directly prior to the pandemic.”

- He is of course though careful to warn that “the high degree of uncertainty about r-star means that one should not overly rely on estimates of r-star in determining the appropriate setting of monetary policy at a given point in time”.

NEWS

US (MNI): President Biden: "I'm In This Race To The End And We're Going To Win"

Elena Schneider at Politico reporting on X that President Biden told campaign staff in a recently concluded call with Vice President Kamala Harris: "Let me say this as clearly as I possibly can as simply and straightforward as I can: I am running…no one’s pushing me out. I’m not leaving. I’m in this race to the end and we’re going to win.”

US (MNI): President Biden And VP Harris Brief Campaign Staff Amid Doubts Over Biden's Candidacy

Beltway journalists reporting that President Biden and Vice President Kamala Harris are currently participating in an all-staff call with their campaign team in Wilmington, Delaware amid rapidly escalating concerns over Biden's re-election campaign.

US (RTRS): “Vice President Kamala Harris is the top alternative to replace U.S. President Joe Biden if he decides not to continue his reelection campaign, according to seven senior sources at the Biden campaign, the White House and the Democratic National Committee with knowledge of current discussions on the topic.” No surprise given her standing as VP and current betting market odds.

ISRAEL (MNI): Defence Min-We Will Reach State Of Readiness To Take Action In Lebanon

Wires carrying comments from Israeli Defence Minister Yoav Gallant stating that Israel "will reach a state of full readiness to take any action required in Lebanon", adding that "we'd prefer to reach a negotiated arrangement, but if needed we know how to fight."

CHINA-RUSSIA (MNI): Putin And Xi To Meet At SCO Summit In Kazakhstan

Wires reporting confirmation from Chinese state media that Chinese President Xi Jinping and Russian President Vladimir Putin will hold a bilateral meeting on the margins of the Shanghai Cooperation Organisation summit which got underway in Astana, Kazakhstan today.

US TSYS Tsys Well Bid Post Minutes, Focus Turns to Friday's NFP

- Treasuries held near session highs into the early pre-4th of July holiday close, little reaction to the FOMC June minutes release -- nothing new that hasn't been relayed by Fed speakers the last couple weeks:

- “Participants affirmed that additional favorable data were required to give them greater confidence that inflation was moving sustainably back to 2%,” the minutes said. “A number of participants remarked that monetary policy should stand ready to respond to unexpected economic weakness.” Most FOMC members – but not all -- believe monetary policy is restrictive and helping to gradually cool the economy and lower inflation.

- Wednesday saw a deluge of data, initial support after ADP employment modestly lower than expected in June at 150k (cons 165k) after a slightly upward revised 157k (initial 152k) in May.

- Initial jobless claims were slightly higher than expected at 238k (sa, cons 235k) in the week to Jun 29 after a marginally upward revised 234k (initial 233k).

- Main mover: Treasuries gapped higher after ISM Services index data came out lower than expected (48.8 vs. 52.6). Still well off last week's levels, Tsys are back near late Friday's prices: TYU4 tapped 110-04 high - through initial technical resistance of 109-30 (20-day EMA), trades109-29 last (+14), next resistance at 110-16 (Jun 28 high), before settling back to 109-30.5 after the bell.

- Focus turns to the next headline employment data release on Friday morning.

OVERNIGHT DATA

US DATA (MNI): A Large ISM Services Miss As New Orders Plunge

The ISM Services index was far weaker than expected in June at 48.8 (cons 52.7) after 53.8 in May. It more than reverses the 4.4pt increase in May, leaving it at its lowest since May’20 in contrast to the just published 55.3 for the services PMI being the highest since Apr’22.

- New orders are the most eye-catching: 47.3 (cons 53.6) after 54.1, it’s first sub-50 reading since Dec’22 (followed by a 14pt lurch higher), Apr/May 2020 and before that mid-2009.

- Employment also sees a large miss: 46.1 (cons 49.5) after 47.1, reversing a tentative improvement in May for one of its lowest over the past year and coming ahead of Friday’s payrolls release.

- Prices paid soften more than expected: 56.3 (cons 56.7) after 58.1. Not a huge change in trend terms, averaged 58.3 in 1H24 after 57.4 in 2H23.

US DATA (MNI): Continuing Claims Again Offer The Main Dovish Take But Initial Also Still Trend Higher

Initial jobless claims were slightly higher than expected at 238k (sa, cons 235k) in the week to Jun 29 after a marginally upward revised 234k (initial 233k).

- It sees the four-week average drift higher again to 239k (+3K) for a fresh high since late Aug 2023.

- New York accounted for 4.5k of the 13.0k national increase in NSA initial claims, although that’s typical for the usual early summer pick-up.

- Once again, continuing claims lead the push higher with a new recent high of 1858k (sa, cons 1840k) after a downward revised 1832k (initial 1839k). It remains the highest since Nov 2021.

- The NSA initial claims data remain rangebound but the continuing claims data have clearly continued to push higher relative to ‘normal’ recent years – see charts.

- The uptick in NSA continuing claims looks somewhat broad-based across the largest states.

US DATA (MNI): A Modestly Dovish ADP Report With The Usual NFP Correlation Caveats

ADP employment was modestly lower than expected in June at 150k (cons 165k) after a slightly upward revised 157k (initial 152k) in May.

- The miss isn’t large considering at times loose correlation with private payrolls but the composition also read a little dovish. This from the ADP chief econ: "Job growth has been solid, but not broad-based. Had it not been for a rebound in hiring in leisure and hospitality [+63k], June would have been a downbeat month."

- The separate pay insights report showed signs of cooling: Job stayer median Y/Y pay growth slowed a tenth to 4.9% (slowest since Aug 2021) after three months of 5.0% Y/Y. Job changer pay growth also slowed a tenth to 7.7% Y/Y but remains above the 7.3% Y/Y seen in January.

US DATA (MNI): Challenger Job Cuts Maintain Broadly Similar Profile To 2023

Challenger job cuts bounced back to a 20% Y/Y increase in June after the -20% Y/Y in May. The dropping out of a favorable base effect from tech layoffs played a role (shifted from -66% Y/Y to -1% Y/Y in June) but ex-tech layoffs still increased from -2% Y/Y to 23% Y/Y.

- Broadly speaking, the seasonal trend seen in 2023 looks intact, i.e. consolidating the increase in layoffs compared to those seen in pre-pandemic years but not pushing higher still. These are still low levels compared to historical times of stress.

US DATA (MNI): Mortgage Applications Reverse Latest Increase As Rates Tick Back Above 7%

MBA composite mortgage applications fell a seasonally adjusted 2.6% last week. It more than reverses the prior two weekly gains although only chips away at the 15.6% jump three weeks ago.

- The latest decline was led by purchases (-3.3%) compared to refis (-1.5%) after purchases outperformed the previous two weeks.

- The downward pressure on applications came as the 30Y conforming rate increased 10bps to 7.03% after two weeks just under the 7% handle.

- Having shown some sign of relative tightening in mid-May to mid-June, the regular-jumbo spread has increased to -8bps for its joint highest reading of the year-to-date.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 23.85 points (-0.06%) at 39308

- S&P E-Mini Future up 21.5 points (0.39%) at 5590.25

- Nasdaq up 159.5 points (0.9%) at 18188.3

- US 10-Yr yield is down 7.3 bps at 4.3587%

- US Sep 10-Yr futures are up 16/32 at 109-31

- EURUSD up 0.0036 (0.34%) at 1.0781

- USDJPY up 0.21 (0.13%) at 161.65

- WTI Crude Oil (front-month) up $1 (1.21%) at $83.82

- Gold is up $26.11 (1.12%) at $2355.57

- European bourses closing levels:

- EuroStoxx 50 up 59.47 points (1.21%) at 4965.8

- FTSE 100 up 49.92 points (0.61%) at 8171.12

- German DAX up 210.47 points (1.16%) at 18374.53

- French CAC 40 up 93.79 points (1.24%) at 7632.08

US TREASURY FUTURES CLOSE

- 3M10Y -9.483, -103.415 (L: -105.378 / H: -94.508)

- 2Y10Y -3.971, -35.343 (L: -35.924 / H: -30.353)

- 2Y30Y -4.433, -18.433 (L: -19.054 / H: -14.163)

- 5Y30Y -0.878, 20.053 (L: 16.796 / H: 22.369)

- Current futures levels:

- Sep 2-Yr futures up 2.25/32 at 102-4.125 (L: 101-31.75 / H: 102-06.375)

- Sep 5-Yr futures up 9.25/32 at 106-18.75 (L: 106-06.5 / H: 106-23.25)

- Sep 10-Yr futures up 16/32 at 109-31 (L: 109-12 / H: 110-04)

- Sep 30-Yr futures up 1-05/32 at 117-26 (L: 116-19 / H: 118-04)

- Sep Ultra futures up 1-20/32 at 124-23 (L: 123-02 / H: 125-01)

US 10Y FUTURE TECHS: (U4) Bear Threat Remains Present

- RES 4: 111-17+ 1.236 proj of the Apr 25 - May 16 - 29 price swing

- RES 3: 111-13 High Mar 25

- RES 2: 110-16/111-01 High Jun 28 / 14 and the bull trigger

- RES 1: 109-30 20-day EMA

- PRICE: 109-15 @ 11:09 BST Jul 3

- SUP 1: 109-02+/109-00+ Low Jul 1 / Low Jun 10 and key support

- SUP 2: 108-27+ Low Jun 3

- SUP 3: 108-18+ Trendline drawn from the Apr 25 low

- SUP 4: 107-31 Low May 29 and a key support

Treasuries remain vulnerable following Monday’s move lower and the contract is trading just above its recent lows. It is still possible that the recent move down is a correction, however the steep sell-off does suggest scope for an extension - price has breached both the 20- and 50-day EMAs. Sights are on 109-00+, the Jun 10 low. A break would open 108-18+, a trendline drawn from the Apr 25 low. Initial firm resistance to watch is 110-16, the Jun 28 high.

SOFR FUTURES CLOSE

- Sep 24 +0.020 at 94.870

- Dec 24 +0.020 at 95.160

- Mar 25 +0.030 at 95.445

- Jun 25 +0.040 at 95.690

- Red Pack (Sep 25-Jun 26) +0.055 to +0.075

- Green Pack (Sep 26-Jun 27) +0.085 to +0.090

- Blue Pack (Sep 27-Jun 28) +0.085 to +0.085

- Gold Pack (Sep 28-Jun 29) +0.085 to +0.085

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00019 to 5.33211 (-0.00506/wk)

- 3M -0.00391 to 5.31426 (-0.01034/wk)

- 6M -0.01578 to 5.23696 (-0.01775/wk)

- 12M -0.02996 to 5.02033 (-0.01971/wk)

- Secured Overnight Financing Rate (SOFR): 5.35% (-0.05), volume: $2.110T

- Broad General Collateral Rate (BGCR): 5.33% (+0.00), volume: $758B

- Tri-Party General Collateral Rate (TGCR): 5.33% (+0.00), volume: $744B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $85B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $243B

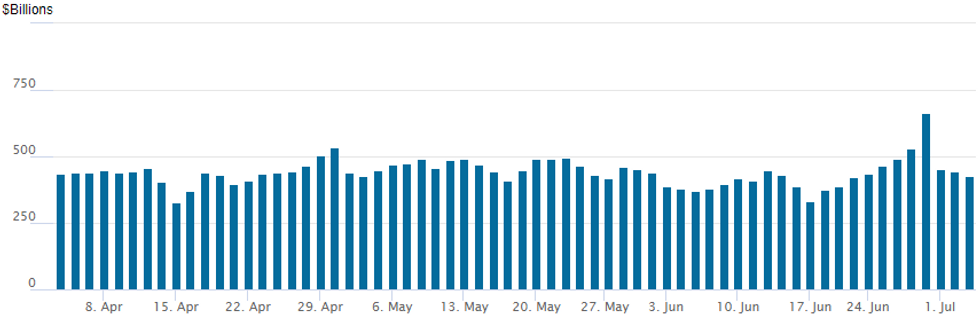

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage continues to recede from last Friday's month-end high of $664.570B, the latest read at $425,898B from $443.369B prior. Number of counterparties falls to 70 from 78 prior. Today's usage compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

EGBs-GILTS CASH CLOSE: OAT And BTP Spreads Tighten For 3rd Straight Day

The German and UK curves flattened Wednesday, with periphery / semi-core EGB spreads tightening for the 3rd consecutive session.

- Core EGBs/Gilts were flat/lower in the morning, with weakness concentrated in at the short end. Then in the afternoon, Treasuries jumped on weak US data including a contractionary ISM Services reading, with the rally spilling over into European FI.

- The 10Y Oat/Bund spread fell another 3bp to 68bp and is now 15bp tighter on the week following Sunday's first-round elections. One trigger: 200 candidates from centrist/left-wing parties have withdrawn from second round elections in order to limit right-wing gains.

- BTP and GGB spreads continued compressing in sympathy. Gilts outperformed Bunds.

- Bank of Latvia Gov Kazaks, and separately Eurosystem sources, told MNI that the ECB was on track to achieve its 2% inflation target.

- The main focus on Thursday will be the UK election (MNI's preview here), though results will only begin to come in after the market close. We also get the accounts of the ECB's June meeting.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.2bps at 2.918%, 5-Yr is down 1.9bps at 2.561%, 10-Yr is down 1.8bps at 2.585%, and 30-Yr is down 5.6bps at 2.743%.

- UK: The 2-Yr yield is down 1.9bps at 4.17%, 5-Yr is down 5.5bps at 4.026%, 10-Yr is down 7.6bps at 4.172%, and 30-Yr is down 8.2bps at 4.665%.

- Italian BTP spread down 5.5bps at 139.7bps / Greek down 5.1bps at 106.9bps

FOREX Greenback Weakens Following Soft ISM, AUDUSD Breaches Resistance

- The greenback came under pressure on Wednesday amid US ISM Services index data coming in far weaker than expected in June at 48.8 (est. 52.7). It more than reverses the 4.4pt increase in May, leaving it at its lowest since May’20. The USD index is 0.45% lower as we approach the APAC crossover ahead of tomorrow’s US Independence Day holiday.

- Gains for major equity indices have underpinned strong moves higher in both AUD and GBP, while the Norwegian Krona is the best performer in G10.

- AUDUSD has made a notable breach of key resistance at 0.6714, the May 16 high. We highlighted that this was an area that could come under threat given the AU/US two-year yield differential is currently close to January levels when AUDUSD was trading above 0.68. The pair reached as high as 0.6734 before retracing roughly 20 pips as the US session winds down. We noted a breach of this level may be required to build momentum for AUD crosses, explored further here.

- USDJPY registered an impressive 117 pip range on the day. Initially, the pair rose to a fresh cycle high at 161.95 before pulling back a touch ahead of the data. With longer-dated US yields extending as much as 8-9bps lower, USDJPY had a sharp move to the downside, briefly reaching 160.78. However, in contrast to other G10 pairs, the greenback bounced back strongly, with USDJPY rising over 75 pips off the lows before consolidating back around 161.50.

- GBPUSD extended above initial firm resistance at 1.2740, the Jun 19 high, registering a fresh two-week high in the process as we approach tomorrow’s UK election. A sustained break of this level would highlight an early reversal signal which may target a move to 1.2860, the Jun 12 high.

- Separately, it is also worth noting, EURGBP failed to recover back above 0.8500 earlier in the week (also 50-day EMA). This remains a key technical pivot for the cross, and while remaining below this level on a closing basis the outlook remains bearish.

- Swiss CPI and the UK election highlight the economic calendar on Thursday. US markets will be closes for the July 04 holiday and focus remains on Friday’s NFP report.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/07/2024 | 0130/1130 | ** |  | AU | Trade Balance |

| 04/07/2024 | 0545/0745 | ** |  | CH | Unemployment |

| 04/07/2024 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 04/07/2024 | 0630/0830 | *** |  | CH | CPI |

| 04/07/2024 | 0730/0930 | ** |  | EU | S&P Global Final Eurozone Construction PMI |

| 04/07/2024 | 0830/0930 | ** |  | UK | S&P Global/CIPS Construction PMI |

| 04/07/2024 | 0830/0930 |  | UK | Decision Making Panel Data | |

| 04/07/2024 | 0900/1100 |  | EU | ECB's Lane Lecture at University of Naples | |

| 04/07/2024 | - |  | UK | General Election | |

| 04/07/2024 | 1415/1615 |  | EU | ECB's Cipollone speech at 15th edition of National Statistics conference |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.