-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: 2025 Rate Cut Projections Abate

MNI BRIEF: Canada Says Has Leverage Against Trump Tariffs

MNI ASIA OPEN: Disinflation Challenge Remains for Fed

- MNI FED: FOMC-Disinflation Taking Longer, Hikes Mentioned-Minutes

- MNI POLICY: BOE To Proceed As Planned Despite Elections

- MNI US: White House Opposes Crypto Bill, Stops Short Of Veto Threat

- MNI US DATA: A Small Miss For Existing Home Sales, Price Growth Accelerates Despite Higher Supply

US

FED (MNI): FOMC-Disinflation Taking Longer, Hikes Mentioned-Minutes: Federal Reserve officials believe the fight against inflation is going to take longer than previously expected based on a resurgence of price pressures at the start of the year, minutes from the Fed’s May meeting showed Wednesday.

- “Participants noted disappointing readings on inflation over the first quarter and indicators pointing to strong economic momentum, and assessed that it would take longer than previously anticipated for them to gain greater confidence that inflation was moving sustainably toward 2%,” the minutes said.

- Some officials also appeared willing to contemplate interest rate increases if conditions appear to worsen.

NEWS

BOE POLICY (MNI): BOE To Proceed As Planned Despite Elections: The Bank of England’s June meeting is likely to go ahead as planned despite general elections called for July 4, with precedent showing that Monetary Policy Committee votes have been held in the midst of political campaigning.

- While in 2010 when an election was called for May 6 the Bank delayed a decision which had been slated for the same day until May 10, on other occasions barring a direct clash it has proceeded as planned despite national votes. The May 2017 MPC meeting was held a week after the formal dissolution of parliament. On that occasion, the MPC voted 7-1 to maintain Bank rate at 0.25%.

US (MNI): White House Opposes Crypto Bill, Stops Short Of Veto Threat: The White House has issued a statement of administration policy opposing a bill to make the CFTC, rather than the SEC, the primary regulator of cryptocurrency. The bill is discussed in previous bullet here. White House: "The Administration opposes passage of H.R. 4763... [which] in its current form lacks sufficient protections for consumers and investors who engage in certain digital asset transactions."

US (MNI): House Of Reps To Vote Today On Bill Making CFTC Primary Crypto Regulator: The US House of Representatives will vote today on a bill - Financial Innovation and Technology for the 21st Century Act (FIT21) - which would make the Commodity Futures Trading Commission, rather than the Security and Exchanges Commission, the primary regulator of cryptocurrency.

UK (MNI): Speculation Surrounding Snap Election Escalates After Low Inflation Print: Media speculation surrounding the prospect of PM Rishi Sunak calling a snap general election in the summer has intensified following the low inflation print recorded this morning.

UK (MNI): PM-'Election Will Take Place In Second Half Of Year': Speaking in the House of Commons, PM Rishi Sunak fails to confirm or deny the rumours surrounding the calling of a snap general election for 4 July.

US TSYS Weaker But Off Lows, Little React to May 1 FOMC Minutes

- Treasuries drifting near midrange for the day after the bell, not a major reaction to the May 1 FOMC minutes.

- Tsys largely mirrored moves in EGBs during overlapping hours - trading weaker after higher than expected inflation data via UK CPI overnight. Treasury futures climbed off early session lows to late morning session highs, in-line with a recovery in Gilts.

- Little react to Existing home sales miss in April at 4.14m (cons 4.23m) after an upward revised 4.22m in March (initial 4.19m). The latest profile leaves sales -1.9% M/M in April after a smaller than first thought decline of -3.7% M/M in March, still retracing the surprise 9.5% jump in Feb.

- Main focus was on the FOMC minutes: “Participants noted disappointing readings on inflation over the first quarter and indicators pointing to strong economic momentum, and assessed that it would take longer than previously anticipated for them to gain greater confidence that inflation was moving sustainably toward 2%,” the minutes said. Some officials also appeared willing to contemplate interest rate increases if conditions appear to worsen.

- Rate cut projections are slightly lower vs. late Tuesday levels (*): June 2024 at -5% w/ cumulative rate cut 0bp at 5.323%, July'24 at -16.0% (-20%) w/ cumulative at -5.2 (-6.3bp) at 5.283%, Sep'24 cumulative -17.8bp (-19.9bp), Nov'24 cumulative -25.6bp (-27.6bp), Dec'24 -40bp (-43.7bp).

OVERNIGHT DATA

US DATA (MNI): A Small Miss For Existing Home Sales, Price Growth Accelerates Despite Higher Supply: Existing home sales were a little weaker than expected in April at 4.14m (cons 4.23m) after an upward revised 4.22m in March (initial 4.19m).

- The latest profile leaves sales -1.9% M/M in April after a smaller than first thought decline of -3.7% M/M in March, still retracing the surprise 9.5% jump in Feb.

- Median prices helped offset the modest miss, accelerating from 4.7% to 5.7% Y/Y to push above the 5.6% in Feb for its highest since Oct’22.

- The strength in house price growth could meet a headwind in the months ahead though after a sizeable shift in relative supply.

- Specifically, months of supply increased from 3.2 in Mar to 3.5 in April vs the 3.0 in Apr’23 and 2.2 in Apr’22. It’s another step towards the 4.0 months averaged through 2017-19.

US DATA (MNI): MBA Mortgage Applications Boosted By Refis: MBA composite mortgage applications increased a seasonally adjusted 1.9% in the week to May 17.

- For the second week running, strong increases in refis (+7.4% after +4.7%) offset weakness in purchases (-1.2% after -1.7%).

- Refis still remain at just 31% of 2019 average levels vs 54% for purchases.

- The 30Y conforming mortgage rate fell 7bps to 7.01%, down from a recent peak of 7.29% from late April.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 209.26 points (-0.52%) at 39663.91

- S&P E-Mini Future down 20.5 points (-0.38%) at 5324.25

- Nasdaq down 46.3 points (-0.3%) at 16785.86

- US 10-Yr yield is up 1.8 bps at 4.4296%

- US Jun 10-Yr futures are down 6/32 at 109-1.5

- EURUSD down 0.0033 (-0.3%) at 1.0821

- USDJPY up 0.52 (0.33%) at 156.69

- Gold is down $41.54 (-1.72%) at $2379.46

- European bourses closing levels:

- EuroStoxx 50 down 21.82 points (-0.43%) at 5025.17

- FTSE 100 down 46.12 points (-0.55%) at 8370.33

- German DAX down 46.56 points (-0.25%) at 18680.2

- French CAC 40 down 49.35 points (-0.61%) at 8092.11

US TREASURY FUTURES CLOSE

- 3M10Y +0.797, -98.23 (L: -101.05 / H: -94.961)

- 2Y10Y -2.924, -44.792 (L: -45.558 / H: -41.208)

- 2Y30Y -4.972, -33.129 (L: -33.438 / H: -27.776)

- 5Y30Y -3.819, 7.503 (L: 7.23 / H: 11.88)

- Current futures levels:

- Jun 2-Yr futures down 2.625/32 at 101-19.25 (L: 101-18.875 / H: 101-22.125)

- Jun 5-Yr futures down 5.25/32 at 105-23.25 (L: 105-21.25 / H: 105-29)

- Jun 10-Yr futures down 6/32 at 109-1.5 (L: 108-28.5 / H: 109-08)

- Jun 30-Yr futures down 1/32 at 117-10 (L: 116-24 / H: 117-17)

- Jun Ultra futures up 4/32 at 124-13 (L: 123-16 / H: 124-20)

US 10Y FUTURE TECHS: (M4) Pullback Appears To Be A Correction

- RES 4: 110-16 50.0% retracement of the Feb 1 - Apr 25 bear leg

- RES 3: 110-06 High Apr 4

- RES 2: 110-00 Round number resistance

- RES 1: 109-31+ High May 16 and the bull trigger

- PRICE: 109-04+ @ 1220 ET May 22

- SUP 1: 108-29/108-15 20-day EMA / Low May 14 and key support

- SUP 2: 108-06 Low May 3

- SUP 3: 107-25 Low May 2

- SUP 4: 107-04 Low Apr 25 and the bear trigger

Despite the latest pullback in Treasuries - a correction, the short-term trend condition remains bullish. The contract last week moved through resistance at the top of a bear channel, drawn from the Feb 1 high. Note that resistance at 109-09+, the May 3 high, has also been cleared. This strengthens a bullish condition and signals scope for an extension higher. Sights are on the 110-00 handle next. Initial key support is at 108-15, the May 14 low.

SOFR FUTURES CLOSE

- Jun 24 -0.013 at 94.673

- Sep 24 -0.020 at 94.850

- Dec 24 -0.035 at 95.065

- Mar 25 -0.055 at 95.290

- Red Pack (Jun 25-Mar 26) -0.07 to -0.055

- Green Pack (Jun 26-Mar 27) -0.045 to -0.025

- Blue Pack (Jun 27-Mar 28) -0.02 to -0.01

- Gold Pack (Jun 28-Mar 29) -0.01 to steady

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00009 to 5.32216 (+0.00240/wk)

- 3M +0.00139 to 5.33085 (+0.00505/wk)

- 6M -0.00074 to 5.29392 (+0.01071/wk)

- 12M -0.01052 to 5.14754 (+0.02502/Wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.929T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $726B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $715B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $76B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $265B

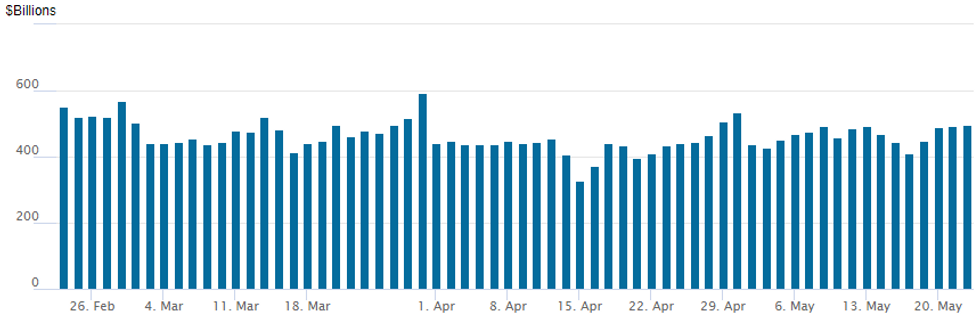

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage inches up to $496.382B from $491.720B prior; number of counterparties 84. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

PIPELINE Over $5B US$ Corporate, Supra-Sovereign Debt Expected to Price

- Date $MM Issuer (Priced *, Launch #)

- 5/22 $1.25B Latvia +10Y +83

- 5/22 $1B *EIB 5Y SOFR+32

- 5/22 $750M #Enact 5Y +180

- 5/22 $700M #RGA Global Funding 5Y +100

- 5/22 $650M #Cencosud 7Y +170

- 5/22 $500M *Tokyo Metro 5Y +64

- 5/22 $500M #MassMutual 5Y +70

- 5/22 $Benchmark Equinix Europe 2 Financing 10Y +117

- Expected tomorrow:

- 5/22 $500M Univision 7NC3

- 5/23 $Benchmark Province of Manitoba 10Y SOFR+81a

EGBs-GILTS CASH CLOSE: Services CPI Surprise Sinks UK Short End

The UK curve bear flattened sharply Wednesday, with Gilts underperforming Bunds, as the April CPI report pushed back the expected timing for the first BoE cut.

- An 0.5pp upside surprise to April services CPI was the key detail that triggered a short-end UK selloff as implied BoE cuts were pared sharply.

- There is now a <10% chance seen of a reduction at the June MPC (vs a coin flip prior to CPI), with around 50% chance of a reduction by August (had been basically fully priced).

- Just after the cash close, PM Sunak confirmed earlier rumours by announcing a UK election in July, but this brought little Gilt market impact.

- EGBs were weighed down in the morning by UK CPI reverberations as well as supply (multiple EUR syndications), but pared some losses in late trade.

- Influenced by UK developments, the German curve bear flattened, while periphery EGB spreads tightened modestly after having widened earlier in the session.

- Thursday's schedule includes flash May PMIs and Eurozone negotiated wage data, and a panel appearance by BoE's Pill.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.8bps at 3.008%, 5-Yr is up 4bps at 2.584%, 10-Yr is up 3.5bps at 2.534%, and 30-Yr is up 2.7bps at 2.669%.

- UK: The 2-Yr yield is up 14.2bps at 4.452%, 5-Yr is up 12.5bps at 4.136%, 10-Yr is up 10.2bps at 4.232%, and 30-Yr is up 7.2bps at 4.683%.

- Italian BTP spread down 0.8bps at 129bps / Spanish down 0.3bps at 76.4bps

FOREX GBP Supported Following Hot UK CPI, Election Announcement Has Little Impact

- Higher US yields and slightly lower equities offered moderate support to the greenback on Wednesday as markets awaited the FOMC minutes release. However, action across G10 was mixed amid central bank action and notable data releases.

- GBP was the early outperformer on the back of the hotter-than-expected UK inflation print, with the services CPI component of particular interest, and seen limiting the Bank of England's ability to cut rates as soon as June. Markets now price fewer than 2 full 25bps rate cuts across 2024, helping underpin GBP's outperformance into the NY crossover.

- Despite reversing in early US trade, cable has edged back towards the earlier highs of 1.2761, as the UK announced a snap general election, to be held on July 04. Wednesday’s move lower in EURGBP has resulted in a break of support at 0.8531, the Apr 30 low, and confirms an extension of the reversal that started May 9. The daily low intersects with 0.8504, the Mar 8 low and exposes 0.8498, the Feb 14 low.

- NZD also continues to outperform G10 peers on the more hawkish-than-expected RBNZ decision, at which the bank kept rates unchanged but signalled that policy would be kept much tighter, for much longer, and could even resume raising interest rates until inflation and inflation expectations are curtailed.

- Price action on Wednesday also saw EURNZD trade down to the lowest level since March 11, closely coinciding with a test of trendline support, drawn from the December 2022 lows as well as exactly matching the 38.2 Fibonacci retracement of the Dec 2022/Aug 2023 price swing.

- RBNZ Governor Orr will kick off Thursday’s event risk before New Zealand report retail sales for Q1. Eurozone flash PMIs then headline the calendar before US jobless claims and new home sales also cross.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/05/2024 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 23/05/2024 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 23/05/2024 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 23/05/2024 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 23/05/2024 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 23/05/2024 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 23/05/2024 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 23/05/2024 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 23/05/2024 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 23/05/2024 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 23/05/2024 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 23/05/2024 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 23/05/2024 | 1000/0600 | *** |  | TR | Turkey Benchmark Rate |

| 23/05/2024 | - |  | EU | G7 Finance/CB Meet | |

| 23/05/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 23/05/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 23/05/2024 | 1345/0945 | *** |  | US | S&P Global Manufacturing Index (Flash) |

| 23/05/2024 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 23/05/2024 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/05/2024 | 1400/1000 | *** |  | US | New Home Sales |

| 23/05/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 23/05/2024 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 23/05/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 23/05/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 23/05/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 23/05/2024 | 1900/1500 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.