-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: EU Bank Panic Eased by Swiss Officials

EXECUTIVE SUMMARY

- MNI INTERVIEW: Fed To Add SVB To Statement-Ex Treasury Aide

- MNI INTERVIEW: Fed Should Pause, Assess Two-Way Risk-Rosengren

- MNI INTERVIEW: Banks Need Not Deter Fed Inflation Fight-Lacker

- MNI ECB WATCH: Turmoil Raises Doubts Over 50Bp Guidance

- MNI BRIEF: UK Budget Measures Aim To Boost Supply Side

- MNI: Market Turmoil Threatens To Delay Italy Retail Bond-Source

US TSYS: Swiss Officials Will Provide Liquidity to Credit Suisse

- US rates surged higher Wednesday, breaching Monday's highs by midday on the back of softer than expected data and a sharp sell-off in European banks overnight, particularly Credit Suisse with Knock-on pressure experienced by BNP Paribas and Societe Generale.

- Rates scaled back support later in the session on reports that Swiss officials FINMA will provide liquidity to Credit Suisse after shares fell approximately 30% earlier.

- Exceptionally wide ranges (front Jun'23 SOFR futures halted for 2 minutes after hitting 50Bp range circuit breaker) and heavy volume on the day as front month Tsy futures extending highs after lower than expected PPI (MoM -0.1% vs. 0.3%; YoY 4.6% vs. 5.5% est), Empire State -24.6 vs. -7.9 expected, Retail Sales in line (-0.4%).

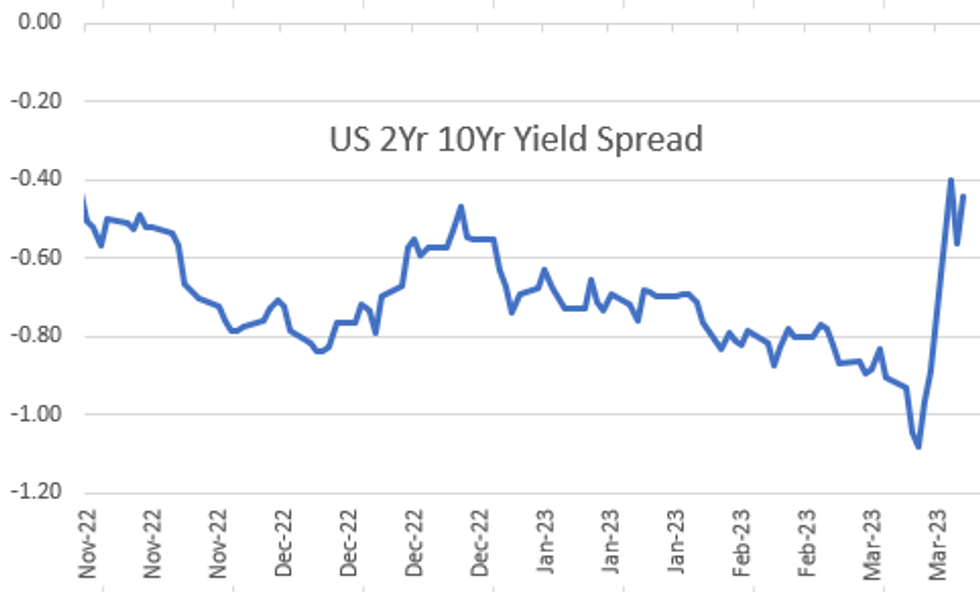

- Yield curves see-sawed higher as short end support outpaced bonds in the first half, 2s10s climbed to -29.397 - highest since mid-October, front month 2Y futures tapped 104-01.62 high w/ 2Y yields back below 4% at 3.7115% low (vs. 4.4070% overnight high).

- Short end rates, meanwhile, have gone back to Monday's implied hike levels anticipating rate cuts by mid-year, December cumulative at -84.0 to 3.741 while Fed terminal rate running at 4.835% in May.

US

FED: The Federal Reserve will likely add language about market turmoil to its decision next week though it appears premature to alter the path of monetary policy itself, former top Treasury official Mark Sobel told MNI.

- The collapse of Silicon Valley Bank and signs of trouble at Credit Suisse mean any changes to Fed policy next week are still evolving on a day-to-day basis, Sobel said by phone Wednesday from Washington.

- "Given the market turmoil set off by SVP and continuing today with Credit Suisse, you’d have to say it’s the elephant in the room and I don’t think the Fed statement can ignore the elephant in the room,” said Sobel, U.S. Chairman at the OMFIF (Official Monetary and Financial Institutions Forum) think-tank. He previously was Treasury Deputy Assistant Secretary for international monetary and financial policy.

- U.S. moves around Silicon Valley Bank "implicitly guaranteed the entirely of deposits in the banking system, and that should quell the discomfort,” Sobel said. “Given what’s going on in the markets today, it would be vastly premature” to say the moves so far are enough to be effective, he said. For more see MNI Policy main wire at 1359ET.

- "Until we can see how much demand destruction has actually occurred as a result of what's happened in financial markets over the last week, it doesn't make sense to be considering raising rates," he said in an interview. Financial problems present two-way risks to the economy that could eventually force the Fed to cut rates or leave officials on track to hike again, Rosengren said.

- "We're going to need several weeks to see if the financial markets stabilize without having significant demand destruction," he said. "If it turns out that they are able to quickly stabilize the situation and that the real economy as a result isn't slowing down significantly, then it's quite possible in the future they'll need to raise rates once again." For more see MNI Policy main wire at 1350ET.

- However, a history of caving to market pressures for bailouts and rate-related interventions means Fed officials have to redouble their message about the primacy of the inflation fight, Lacker said in an interview.

- “It shouldn’t affect the monetary policy equation very much at all, but it’s likely that the Fed has conditioned people to expect an effect and that’s unfortunate,” Lacker said. “Because markets think the Fed is going to give them a 'Greenspan put' as it were, now they’ve got a bigger hole to dig out. They’ve got to walk markets back up again. They’ve got to redo all the work they did to convince the markets they mean business.”

- Lacker said the February CPI report out this week, which showed a 0.5% monthly jump in prices excluding food and energy, was a worrisome sign that price pressures remain broad and persistent. For more see MNI Policy main wire at 1336ET.

EUROPE

EU: The European Central Bank had been on course to raise its deposit rate by 50 basis points to 3% on Thursday in line with its guidance, but concern building over Credit Suisse in the wave of the collapse of Silicon Valley Bank has seen market rate expectations pared back sharply.

- Earlier this week, policymakers had calculated that risks of contagion into Europe from SVB’s downfall were limited, which would allow them to remain focused on bringing inflation back to 2% in a “timely” fashion, but news that Saudi National Bank was not open to making a further capital injection into Credit Suisse sent market implied rates for Thursday down to 2.717% by 2 pm in London. (MNI SOURCES: ECB Clings To 50Bp Hike Plan Amid Market Turmoil)

- Now the ECB faces the dilemma of whether to hike into market turbulence or take a hit to its inflation-fighting credibility if it raises rates by only 25 basis points, or even keeps them unchanged. A rates move could potentially be accompanied by steps to reassure markets over banks’ access to cheap funding. For more see MNI Policy main wire at 1028ET.

- The measures are designed to strengthen the economy while alleviating inflationary pressure, with a mix of a three-month extension of the household energy price guarantee and a freeze on fuel and alcohol duty combined set to lower CPI inflation by almost 0.75 pp and other measures designed to tackle rising economic inactivity, Chancellor Jeremy Hunt said. These measures will be closely eyed by the Bank of England ahead of their March 23 meeting.

- In another attempt to boost the supply side Hunt set out plans to try and reduce declining labour force participation, with a raft of steps including a support package for disabled people seeking work, a scheme for those who leave work due to health conditions and a pre-announced extension of childcare.

- The financial market sell-off could "affect the calendar provisioning," of the bond, the source said. Preparation will continue for the sale of the bond, which would incorporate features of Italy’s existing BTP Italia and BTP Futura retail bonds, the source said. (See MNI: Italy Considers Partially-Indexed Retail Bond In 2023).

- The new bond would continue to incorporate a loyalty premium for holding it to maturity and some kind of indexation between a combination of macro indicators such as GDP or inflation.

OVERNIGHT DATA

- US FEB FINAL DEMAND PPI -0.1%, EX FOOD, ENERGY +0.0%

- US FEB FINAL DEMAND PPI EX FOOD, ENERGY, TRADE SERVICES +0.2%

- US FEB FINAL DEMAND PPI Y/Y +4.6%, EX FOOD, ENERGY Y/Y +4.4%

- US FEB PPI: FOOD -2.2%; ENERGY -0.2%

- US FEB PPI: GOODS -0.2%; SERVICES -0.1%; TRADE SERVICES -0.8%

- US FEB RETAIL SALES -0.4%; EX-MOTOR VEH -0.1%

- US JAN RETAIL SALES REVISED +3.2%; EX-MV +2.4%

- US FEB RET SALES EX GAS & MTR VEH & PARTS DEALERS +0.0% V JAN +2.8%

- US FEB RET SALES EX MTR VEH & PARTS DEALERS -0.1% V US FEB +2.4%

- US FEB RET SALES EX AUTO, BLDG MATL & GAS +0.0% V JAN +2.9%

- US NY FED EMPIRE STATE MFG INDEX -24.6 MAR

- US NY FED EMPIRE MFG NEW ORDERS -21.7 MAR

- US NY FED EMPIRE MFG EMPLOYMENT INDEX -10.1 MAR

- US NY FED EMPIRE MFG PRICES PAID INDEX 41.9 MAR

- US NAHB HOUSING MARKET INDEX 44 IN MAR

- US NAHB MAR SINGLE FAMILY SALES INDEX 49; NEXT 6-MO 47

- US JAN BUSINESS INVENTORIES -0.1%; SALES +1.5%

- US JAN RETAIL INVENTORIES +0.2%

MARKETS SNAPSHOT

- Key late session market levels:

- DJIA down 280.83 points (-0.87%) at 31874.57

- S&P E-Mini Future down 30.25 points (-0.77%) at 3924

- Nasdaq up 5.9 points (0.1%) at 11434.05

- US 10-Yr yield is down 22.1 bps at 3.4679%

- US Jun 10-Yr futures are up 43.5/32 at 115-7

- EURUSD down 0.0151 (-1.41%) at 1.0582

- USDJPY down 0.97 (-0.72%) at 133.25

- WTI Crude Oil (front-month) down $3.2 (-4.49%) at $68.15

- Gold is up $13.45 (0.71%) at $1917.32

- European bourses closing levels:

- EuroStoxx 50 down 144.55 points (-3.46%) at 4034.92

- FTSE 100 down 292.66 points (-3.83%) at 7344.45

- German DAX down 497.57 points (-3.27%) at 14735.26

- French CAC 40 down 255.86 points (-3.58%) at 6885.71

US TREASURY FUTURES CLOSE

- 3M10Y -8.574, -124.05 (L: -141.104 / H: -114.383)

- 2Y10Y +11.472, -45.272 (L: -72.043 / H: -29.397)

- 2Y30Y +18.959, -26.378 (L: -62.737 / H: -8.263)

- 5Y30Y +13.858, 8.71 (L: -12.064 / H: 17.587)

- Current futures levels:

- Jun 2-Yr futures up 19.875/32 at 103-20.5 (L: 102-20 / H: 104-01.625)

- Jun 5-Yr futures up 1-02.5/32 at 109-25.75 (L: 108-06.25 / H: 110-13.75)

- Jun 10-Yr futures up 1-11.5/32 at 115-07 (L: 113-08.5 / H: 115-31)

- Jun 30-Yr futures up 2-03/32 at 132-01 (L: 129-01 / H: 133-02)

- Jun Ultra futures up 2-30/32 at 142-30 (L: 138-26 / H: 144-15)

US 10YR FUTURE TECHS: Effortlessly Clears Monday High

- RES 4: 116-28+ High Jan 19 and key resistance

- RES 3: 116-08 High Feb 2

- RES 2: 116-00 Round number resistance

- RES 1: 115-31 High Mar 15

- PRICE: 115-09 @ 1600ET Mar 15

- SUP 1: 113-08+ Intraday low

- SUP 2: 113-01+ 50-day EMA

- SUP 3: 112-21 Low Mar 13

- SUP 4: 112-09+ 20-day EMA

Treasury futures continue to trade in a volatile manner and the contract recovered convincingly from Wednesday’s intraday low of 113-08+. The rally took out Monday’s high of 115-13 with little effort to confirm an extension of the recent impulsive bull cycle and open the 116-00 handle next. On the downside, key support top watch is 113-01+, the 50-day EMA. A clear break would be seen as a bearish development.

EURODOLLAR FUTURES CLOSE

- Mar 23 +0.271 at 95.134

- Jun 23 +0.275 at 95.170

- Sep 23 +0.40 at 95.775

- Dec 23 +0.330 at 95.905

- Red Pack (Mar 24-Dec 24) +0.165 to +0.285

- Green Pack (Mar 25-Dec 25) +0.065 to +0.135

- Blue Pack (Mar 26-Dec 26) +0.045 to +0.065

- Gold Pack (Mar 27-Dec 27) +0.065 to +0.110

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00614 to 4.55971% (+0.00257/wk)

- 1M -0.01914 to 4.70857% (-0.09000/wk)

- 3M -0.03386 to 4.90714% (-0.23100/wk)*/**

- 6M -0.13443 to 4.83400% (-0.59429/wk)

- 12M -0.26386 to 4.72843% (-1.00971/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.15371% on 3/9/23

- Daily Effective Fed Funds Rate: 4.58% volume: $79B

- Daily Overnight Bank Funding Rate: 4.57% volume: $252B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.203T

- Broad General Collateral Rate (BGCR): 4.53%, $491B

- Tri-Party General Collateral Rate (TGCR): 4.53%, $476B

- (rate, volume levels reflect prior session)

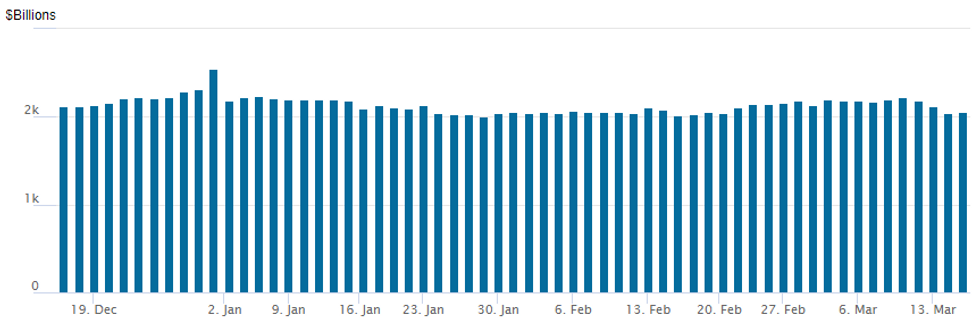

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,055.823B w/ 101 counterparties vs. prior session's $2,.042.579B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE

No new corporate bond issuance so far this week, several interested parties remain sidelined due to market volatility tied to banking stocks sell-off.

EGBs-GILTS CASH CLOSE: Bank Panic Spurs Record German Rally

German yields across most of the curve dropped the most on record Wednesday as concerns over Credit Suisse spurred further bank-related risk aversion.

- The session began with rates selling off on a Reuters piece pointing to a 50bp ECB hike Thursday (following MNI's / later BBG's reporting), but was quickly consumed by Europe financial sector panic as bank stocks sold off 7% and risk spreads (including BTP periphery bonds) widened.

- The focus was Credit Suisse whose shares collapsed 31% at the lows, as its largest investor said they wouldn't inject more cash into the troubled bank.

- By the end of the session, 2Y, 5Y, and 30Y Bund yields had dropped by a single-day record, with the curve bull steepening sharply as ECB hikes were priced out. That includes just 12% implied prob of a 50bp raise Thursday.

- The CS headlines overshadowed the UK Budget announcement, which held few surprises. Gilts easily underperformed Bunds, with modest bull steepening.

- Attention overnight will remain on any news related to Credit Suisse, ahead of the ECB decision Thursday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 48.3bps at 2.409%, 5-Yr is down 37.5bps at 2.137%, 10-Yr is down 29bps at 2.13%, and 30-Yr is down 26.5bps at 2.145%.

- UK: The 2-Yr yield is down 18.9bps at 3.292%, 5-Yr is down 17.8bps at 3.214%, 10-Yr is down 16.7bps at 3.321%, and 30-Yr is down 13.9bps at 3.755%.

- Italian BTP spread up 13.6bps at 198.1bps / Greek up 18.9bps at 210.2bps

FOREX: EURJPY Partially Recovers After Early Onslaught

- EURJPY came under severe pressure on Wednesday as German yields across most of the curve dropped the most on record as concerns over Credit Suisse spurred further bank-related risk aversion.

- Despite rising overnight to highs of 144.96, financial stability concerns centering around Credit Suisse prompted aggressive JPY strength throughout the European session and crossing over to early US trade. EURJPY briefly traded down over 3% on the session to reach lows of 139.48.

- There was a late reprieve for the struggling pair as Swiss authorities announced they would provide Credit Suisse with liquidity if it was deemed necessary. While not quite the reassurance the market was looking for, equity markets were well supported on the news prompting EURJPY to quickly spike and claw back around 175 pips from the lows.

- The USD index remains up 1.08% approaching the APAC crossover as the overall flight to quality prevailed on Wednesday. Led by EURUSD, the pair sits 180 pips off the overnight highs to trade at 1.0580 ahead of tomorrow’s ECB decision.

- The likes of AUD, NZD and GBP have all declined between 0.7-0.9% amid the market turmoil, but remain relatively less impacted given the focus on Europe today.

- New Zealand GDP and Australian employment data kick off the overnight docket on Thursday. Focus then quickly turns to the ECB to see what impact the most recent developments have had on the governing board’s reaction function.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/03/2023 | 0030/1130 | *** |  | AU | Labor force survey |

| 16/03/2023 | 0700/0800 | ** |  | NO | Norway GDP |

| 16/03/2023 | 0900/1000 | ** |  | IT | Italy Final HICP |

| 16/03/2023 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 16/03/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 16/03/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 16/03/2023 | 1230/0830 | *** |  | US | Housing Starts |

| 16/03/2023 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 16/03/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 16/03/2023 | 1245/1345 | *** |  | EU | ECB Deposit Rate |

| 16/03/2023 | 1245/1345 | *** |  | EU | ECB Main Refi Rate |

| 16/03/2023 | 1245/1345 | *** |  | EU | ECB Marginal Lending Rate |

| 16/03/2023 | 1345/1445 |  | EU | ECB Press Conference Following Rate Decision | |

| 16/03/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 16/03/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 16/03/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.