-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI ASIA OPEN: February PCE Price Deflators Soft

EXECUTIVE SUMMARY

Tsys Near Wk Highs Into Month/Quarter End

- Treasury futures are pushing late session highs, volumes climbing into the month/quarter end, front month 10Y futures traded over 300k from 114-28 to 115-01 high (+14.5), 10Y yield down to 3.4752% low.

- Little market reaction to NY Fed Williams' economic outlook speech to the Housatonic Community College in Connecticut. "I expect inflation to decline to around 3-1/4 percent this year, before moving closer to our longer-run goal in the next two years," he added, slightly increasing his forecast a quarter point since mid-February.

- Fed speakers still scheduled for this evening: Fed Gov Cook, eco outlook/mon-pol, Midwest Economics Assn at 1745ET; Fed Gov Waller re: Phillips curve, text, no Q&A at 2200ET.

- Yield curves flat to mildly steeper (2s10s -57.487 +.205), well off session lows as Jun'23 2Y futures making new late session highs (TUM3 103-08, +3.0), 2Y yield marks session low of 4.0459%.

- Implied May Fed hike pricing fell from 16bp to 13.5bp after that soft Feb PCE report, but it's since bounced back to 14.4bp. The soft services ex-housing number is key to any Fed pause narrative but as we noted earlier, the April 28 PCE release will carry far more weight for FOMC Fed going into the May 3 decision. Let alone the rest of the year, for which 55bp of cuts from peak are priced (basically unchanged from pre-data).

US

FED: Federal Reserve Bank of New York President John Williams Friday said inflation remains a top concern and he will focus on credit conditions to measure the path of interest rates, reiterating guidance that further tightening may be appropriate.

- "Our policy decisions will be driven by the data and the achievement of our maximum employment and price stability mandates," he said according to prepared remarks. "I will be particularly focused on assessing the evolution of credit conditions and their effects on the outlook for growth, employment, and inflation."

- Inflation reached a 40-year high of 7 percent this past June, he said, and while it has since moderated to 5%, it is still well above the Fed's longer-run goal. "Without price stability, we cannot achieve maximum employment on a sustained basis. That is why it’s so important for the FOMC to use its monetary policy tools to bring inflation down."

- "While the FOMC has taken decisive steps to bring inflation down, lags exist between policy actions and their effects," he said in a speech to the Housatonic Community College in Connecticut. "I expect inflation to decline to around 3-1/4 percent this year, before moving closer to our longer-run goal in the next two years," he added, slightly increasing his forecast a quarter point since mid-February.

FED: Federal Reserve Governor Lisa Cook said Friday she's closely monitoring financial conditions to judge how much a pullback in lending after the collapse of two U.S. banks could slow the economy and aid the Fed's efforts to bring inflation back to 2% without significantly higher interest rates.

- The FOMC this month signaled rates would peak at 5%-5.25% and softened its guidance to say “some additional policy firming may be appropriate,” as it sought to calibrate monetary policy to be sufficiently restrictive amid economic uncertainty.

- "The incoming data would suggest a somewhat higher inflation rate for this year and stronger economic growth. However, I am closely watching developments in the banking sector, which have the potential to tighten credit conditions and counteract some of that momentum," she said in remarks prepared for the Midwest Economics Association.

- "If tighter financing conditions restrain the economy, the appropriate path of the federal funds rate may be lower than it would be in their absence. On the other hand, if data show continued strength in the economy and slower disinflation, we may have more work to do," she said. For more see MNI Policy main wire at 1745ET.

- "Measures of longer-term inflation expectations have remained contained, while shorter- term expectations had moved up in 2021 and have partially reversed their earlier increases," Waller said in prepared remarks for a speech at a San Francisco Fed conference.

- "A steep Phillips curve means inflation can be brought down quickly with relatively little pain in terms of higher unemployment. Recent data are consistent with this story."

- Waller made no reference to the recent banking turmoil that has gripped financial markets this month, curtailing expectations for further Fed hikes. He also did not address the prospect of future tightening. Markets see a roughly 50-50 chance of one last 25bp increase in May versus a pause at the current 4.75% to 5% range, according to CME FedWatch. For more, see MNI Policy main wire at 2200ET Friday.

EUROPE

ITALY: The Italian government is preparing legislation to make it more attractive for smaller companies to raise shares and to make it easier for pension funds to offer a broader range of investments to their clients, according to a draft seen by MNI.

- The financial sector reform is part of the right-wing government’s push to direct more of the nation’s savings into investment at home, and to lure back funds currently leaving the country, an official close to the project said.

- One measure would amend the legal definition of small- and medium-sized companies to include firms with capitalisations above EUR1 billion, double the current limit. This would make it easier for many smaller firms to list uncertified shares, a cheaper and less bureaucratic process than issuing certified stock.

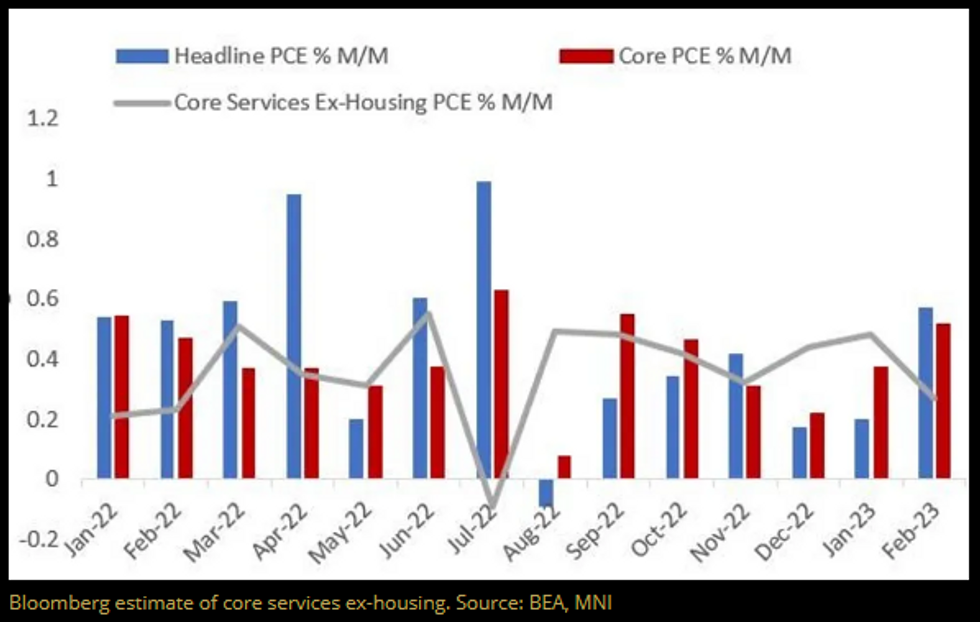

PCE Deflators Softer In Feb, Including Key Fed Metric

The February PCE price deflators came in on the soft side in February vs consensus:

- Unrounded headline PCE deflator: +0.263% M/M (prior +0.573%, expected +0.3%)

- Unrounded core PCE deflator: +0.300% M/M (to be even more specific, 0.2998% - prior +0.519%, expected +0.4%)

- Note also a downward revision to core PCE prices (Jan to 0.5% from 0.6% prior) as well as the slightly softer-than-expected Feb print of 0.3% (vs 0.4%).

- The Bloomberg-calculated PCE Core Services Ex-Housing - the Fed's favored metric - fell to +0.27% M/M in Feb from +0.48% prior. That's the weakest such reading since a contraction in July 2022 and the second-weakest since Feb 2022.

- Cumulatively, that's a decent miss. With the revisions taken into account the undershoot was on the order of the +0.2% downside read we'd noted in our PCE preview that would be required to move the needle (and indeed, US rates have rallied.)

- The softness in core-core services is notable for giving the Fed scope to pause on May 3, but the April 28 PEC reading will be more definitive in that regard.

OVERNIGHT DATA

- US FEB PERSONAL INCOME +0.3%; NOM PCE +0.2%

- US FEB PCE PRICE INDEX +0.3%; +5.0% Y/Y

- US FEB CORE PCE PRICE INDEX +0.3%; +4.6% Y/Y

- US FEB UNROUNDED PCE PRICE INDEX +0.263%; CORE +0.300%

- MNI MAR CHICAGO BUSINESS BAROMETER 43.8 VS FEB 43.6

- MNI CHICAGO: MAR PRICES PAID 65.6 VS FEB 65.3

- MNI CHICAGO: MAR EMPLOYMENT 42.7 VS FEB 37.3

- MNI CHICAGO: MAR PRODUCTION 41.0 VS FEB 38.4

- MNI CHICAGO SURVEY PERIOD MAR 1 to 13.

MICHIGAN FINAL MARCH CONSUMER SENTIMENT AT 62; EST. 63.3

- CANADA JANUARY GDP +0.5% VS +0.4% EXPECTEDCANADA FLASH FEBRUARY GDP +0.3%

- CANADA YOY GROSS DOMESTIC PRODUCT +3.0%

- CANADA JAN GROSS DOMESTIC PRODUCT +0.5% MOM

- CANADA JAN GOODS INDUSTRY GDP +0.4%, SERVICES +0.6%

- CANADA REVISED DEC GROSS DOMESTIC PRODUCT -0.1% MOM

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 302.67 points (0.92%) at 33160.01

- S&P E-Mini Future up 43.5 points (1.07%) at 4123.25

- Nasdaq up 170.2 points (1.4%) at 12182.69

- US 10-Yr yield is down 6.1 bps at 3.4883%

- US Jun 10-Yr futures are up 11/32 at 114-29.5

- EURUSD down 0.0052 (-0.48%) at 1.0852

- USDJPY down 0 (0%) at 132.71

- WTI Crude Oil (front-month) up $1.11 (1.49%) at $75.48

- Gold is down $9.3 (-0.47%) at $1970.97

- EuroStoxx 50 up 29.63 points (0.69%) at 4315.05

- FTSE 100 up 11.31 points (0.15%) at 7631.74

- German DAX up 106.44 points (0.69%) at 15628.84

- French CAC 40 up 59.02 points (0.81%) at 7322.39

US TREASURY FUTURES CLOSE

- 3M10Y -1.957, -134.984 (L: -138.052 / H: -125.673)

- 2Y10Y -0.13, -57.822 (L: -61.807 / H: -54.601)

- 2Y30Y +0.472, -38.801 (L: -43.726 / H: -35.159)

- 5Y30Y +1.72, 6.567 (L: 3.397 / H: 7.923)

- Current futures levels:

- Jun 2-Yr futures up 1.875/32 at 103-6.875 (L: 103-00 / H: 103-07.625)

- Jun 5-Yr futures up 7/32 at 109-16 (L: 109-01 / H: 109-16.75)

- Jun 10-Yr futures up 11.5/32 at 114-30 (L: 114-09 / H: 114-30.5)

- Jun 30-Yr futures up 33/32 at 131-6 (L: 129-22 / H: 131-07)

- Jun Ultra futures up 48/32 at 141-9 (L: 139-06 / H: 141-10)

US 10YR FUTURE TECHS: Watching Support At The 20-Day EMA

- RES 4: 117-29+ High Aug 26 2022 (cont)

- RES 3: 117-14+ High Aug 29 / 30 2022 (cont)

- RES 2: 116-06+/117-01+ High Mar 27 / High Mar 24 and bull trigger

- RES 1: 115-07+ High Mar 28

- PRICE: 114-23+ @ 11:07 BST Mar 31

- SUP 1: 114-07 20-day EMA

- SUP 2: 113-26 Low Mar 22

- SUP 3: 113-26 50-day EMA

- SUP 4: 113-08+ Low Mar 15

Treasury futures are consolidating and price is trading closer to this week’s lows. Attention is on support at the 20-day EMA, which intersects at 114-07. The bearish candle pattern on Mar 24 - a shooting star - remains in play and suggests scope for a continuation lower. Note Monday’s pattern is a bearish engulfing candle - reinforcing a bearish threat. A break of the 20-day EMA would open 113-26, Mar 22 low. Initial resistance is at 115-07+, Mar 28 high.

EURODOLLAR FUTURES CLOSE

- Jun 23 -0.005 at 94.780

- Sep 23 -0.015 at 95.125

- Dec 23 +0.015 at 95.435

- Mar 24 +0.040 at 95.825

- Red Pack (Jun 24-Mar 25) +0.045 to +0.065

- Green Pack (Jun 25-Mar 26) +0.060 to +0.065

- Blue Pack (Jun 26-Mar 27) +0.065 to +0.070

- Gold Pack (Jun 27-Mar 28) +0.055 to +0.065

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.01057 to 4.80086% (-0.00800/wk)

- 1M +0.01014 to 4.85771% (+0.02714/wk)

- 3M +0.01614 to 5.19271% (+0.09128/wk)*/**

- 6M +0.04071 to 5.31300% (+0.32571/wk)

- 12M +0.07372 to 5.30529% (+0.46943/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.19271% on 3/31/23

- Daily Effective Fed Funds Rate: 4.83% volume: $95B

- Daily Overnight Bank Funding Rate: 4.82% volume: $240B

- Secured Overnight Financing Rate (SOFR): 4.82%, $1.319T

- Broad General Collateral Rate (BGCR): 4.79%, $505B

- Tri-Party General Collateral Rate (TGCR): 4.79%, $497B

- (rate, volume levels reflect prior session)

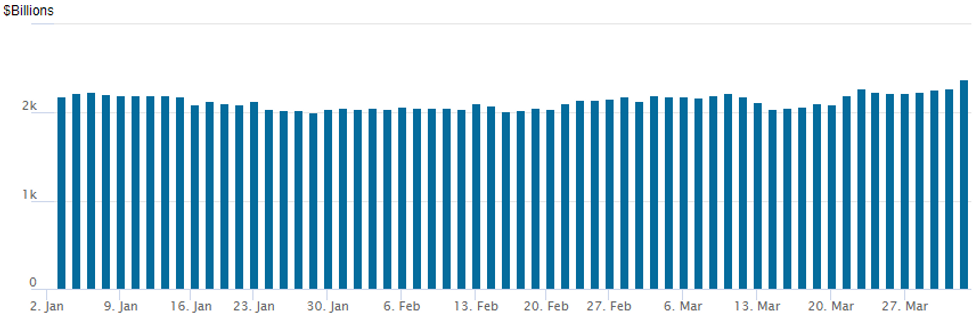

FED Reverse Repo Operation: New 2023 High

NY Federal Reserve/MNI

NY Fed reverse repo usage surged to $2,375.171B a new high for 2023 w/ 108 counterparties, compares to yesterday's $2,271.531B. Record high of $2,553.716B from December 30, 2022 remains intact.

Total Corporate Bond Issuance for March Just Over $122B

- Date $MM Issuer (Priced *, Launch #)

- 03/31 No new corporate issuance Friday, Total $122.05B for March 2023

- $1.25B Priced Thursday

- 03/30 $750M *Western Midstream 10Y +262.5

- 03/30 $500M *Nederlandse Financierings-Maatschappij 2Y SOFR+24

EGBs-GILTS CASH CLOSE: Euro Inflation Seen Giving ECB Less "Way To Go"

Bunds led a broader European bond sell-off in early Friday trade after a stronger-than-expected French inflation print, but soft Italian/European price data mid-morning spurred a strong bounce across the space.

- This pushed back against Thursday's hawkish response to strong German core CPI readings, and for the first time this week, ECB and BoE peak rate pricing pulled back, though only slightly (under 1bp for each).

- Markets interpreted mid-afternoon comments by ECB centrist Villeroy as leaning dovish ("we may possibly still have a little way to go" on rates).

- BTPs outperformed, with the 10Y spread/Bunds compressing sharply after the soft Italian inflation numbers.

- The belly of the German curve outperformed on the day, with the UK's relatively mixed (amid largely directionless rangebound trade led by EGBs).

- A comparatively quiet week lies ahead, with the long Easter weekend starting Friday. French and German industrial production data feature (we get PMIs too but they are finals). BoE 's Tenreyro and Pill also make appearances.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 6.3bps at 2.686%, 5-Yr is down 9bps at 2.316%, 10-Yr is down 7.8bps at 2.296%, and 30-Yr is down 5.5bps at 2.366%.

- UK: The 2-Yr yield is down 0.9bps at 3.446%, 5-Yr is down 1bps at 3.356%, 10-Yr is down 2.7bps at 3.491%, and 30-Yr is down 0.8bps at 3.841%.

- Italian BTP spread down 5.7bps at 180.4bps / Spanish down 2bps at 101.2bps

FOREX: Mixed Performance in G10, Greenback Consolidating Weekly Decline

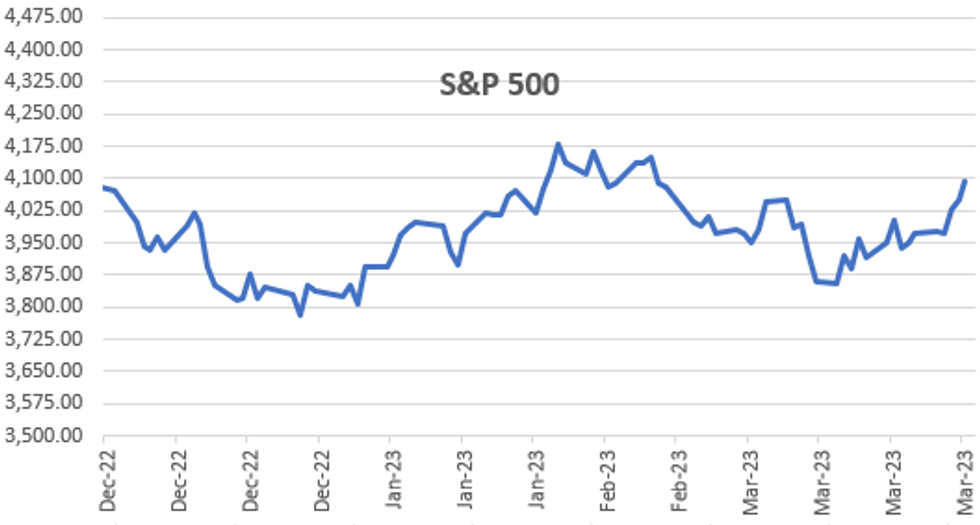

- The USD index is slightly firmer on Friday but looks set to post a 0.65% decline on the week amid a more stable global outlook and an associated ~3% rally for the S&P 500.

- A mixed performance across G10 on Friday with a raft of US data potentially muddied by month-end flows as we approach the weekend.

- Early strength was seen in USDJPY, which showed above 133.50 for the first time since March 17th, largely in response to the BoJ outlining their bond-buying schedule for Q2, expanding the maturity range of purchases to incorporate the super-long end of the curve. The tweaked schedule outlines the ability of the BoJ to remain flexible amid global pressures.

- Despite the firm price action this week for USDJPY, in the face of broad greenback weakness, medium-term bearish signals continue to prevail from a technical perspective. This may have been highlighted by some weakness into the close which sees the pair around 80 pips off best levels at 132.80.

- EURUSD was also unable to gather further topside momentum on Friday, again stalling just short of key short-term resistance at 1.0930, the Mar 23 high. A break of this level is required to reinstate the recent bull theme and signal scope for a climb towards 1.1033, the Feb 2 high.

- Instead, the pair gradually drifted lower, but picked up the pace approaching the WMR month-end fix, which saw the pair trade down to 1.0858. Similar price action for GBPUSD which after failing to make early headway above 1.24, now sits at the day’s worst levels around 1.2340 approaching the close.

- A relatively quiet week lies ahead, with the long Easter weekend starting Friday and China out early next week. Swiss CPI and US ISM Manufacturing PMI will headline Monday’s docket. Monetary policy decisions in both Australia and New Zealand are due on Tuesday and Wednesday respectively.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/04/2023 | 2350/0850 | *** |  | JP | Tankan |

| 03/04/2023 | 0030/1030 | * |  | AU | Building Approvals |

| 03/04/2023 | 0030/1030 | ** |  | AU | Lending Finance Details |

| 03/04/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 03/04/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 03/04/2023 | 0630/0830 | *** |  | CH | CPI |

| 03/04/2023 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/04/2023 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 03/04/2023 | 0745/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 03/04/2023 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 03/04/2023 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 03/04/2023 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 03/04/2023 | 0830/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 03/04/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 03/04/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 03/04/2023 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 03/04/2023 | 1400/1000 | * |  | US | Construction Spending |

| 03/04/2023 | 1430/1030 | ** |  | CA | BOC Business Outlook Survey |

| 03/04/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 03/04/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 03/04/2023 | 2015/1615 |  | US | Fed Governor Lisa Cook |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.