-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Gov Waller, Need More Than 1 Data Point

EXECUTIVE SUMMARY

US

US: A plan to vastly increase central clearing of U.S. Treasuries and repos will make markets safer but more expensive to participants, as well as potentially creating a new concentration of risk, current and former Federal Reserve economists, market participants and their advisers told MNI.

- The proposal by the Securities and Exchange Commission would lessen the chances of contagion from failed trades and improve overall market resilience, and support a move to "all-to-all" trading where investors like pension funds and mutual funds can transact directly with each other without relying on big banks.

- But it will do little to improve declining Treasury market liquidity, a key concern for the global financial system -- while potentially creating new problems by concentrating risk in clearinghouses. For more see MNI Policy main wire at 0844ET.

US TSYS: Terminal Rates vs. Pace of Rate Hike Step-Down

Tsys moderately weaker after the bell, upper half of session range as focus remains on Fed speak and inflation metrics after last Thu's softer than anticipated CPI.

- Fed Gov Waller eco-outlook from Australia last night: ""We're at a point we can start thinking maybe of going to a slower pace," Waller said, but "we're not softening...Quit paying attention to the pace and start paying attention to where the endpoint is going to be. Until we get inflation down, that endpoint is still a ways out there" DJ reported.

- Rates bounced after Fed VC Brainard eco-outlook comments: "PROBABLY APPROPRIATE TO SOON MOVE TO SLOWER HIKE PACE".

- Flipside: jump in median inflation expectations (1-Year: 5.94% in Oct vs 5.44% Sep) in the NY Fed's consumer survey looks largely a result of a rebound in food and energy price expectations.

- Short end selling evaporated after the Brainard comments, Fed funds implied hike in Dec'22 steady at 50.9bp, Feb'23 cumulative 86.9bp to 4.717% vs. 86.9bp earlier, terminal slips to 4.93% in Jun'23 (5.08% pre-CPI).

- Current 2-Yr yield is up 7.6bps at 4.4077%, 5-Yr is up 6.8bps at 4.0055%, 10-Yr is up 6.4bps at 3.8761%, and 30-Yr is up 4.7bps at 4.0625%.

OVERNIGHT DATA

- NEW YORK FED SAYS INFLATION EXPECTATIONS RISE IN OCTOBER

- NY FED: OCT. INFLATION EXPECTATIONS ONE YEAR AHEAD 5.9% VS 5.4%

- NY FED: OCT. INFLATION EXPECTATIONS 3 YEARS AHEAD 3.1% VS 2.9%

- Median inflation expectations for the year-ahead increased 0.5ppt to 5.9%, the three-year-ahead increased 0.2ppt to 3.1%, and the five-year-ahead edged up 0.2ppt to 2.4%, the New York Fed said. Expectations about year-ahead food prices rose by 0.7ppt to 7.6%, while the median expected change in gas prices rose by 4.3ppts to 4.8%—the largest one-month increase on record.

- As household income growth expectations increased to a new series high, views about the labor market soured in October, the NY Fed survey showed, as expectations the U.S. unemployment rate will be higher one year from now increased to 42.9%, the highest reading since April2020, from 39.1% in September. The University of Michigan's preliminary November Survey of Consumers report released Friday also showed an increase in inflation expectations and consumers increasingly expect unemployment to rise in the year ahead.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 9.09 points (0.03%) at 33756.21

- S&P E-Mini Future down 6.75 points (-0.17%) at 3993.25

- Nasdaq down 43.5 points (-0.4%) at 11279.85

- US 10-Yr yield is up 6.4 bps at 3.8761%

- US Dec 10Y are down 8/32 at 112-2

- EURUSD down 0.0004 (-0.04%) at 1.0344

- USDJPY up 1.06 (0.76%) at 139.86

- WTI Crude Oil (front-month) down $3.59 (-4.04%) at $85.37

- Gold is up $1.67 (0.09%) at $1772.98

- EuroStoxx 50 up 19.01 points (0.49%) at 3887.51

- FTSE 100 up 67.13 points (0.92%) at 7385.17

- German DAX up 88.44 points (0.62%) at 14313.3

- French CAC 40 up 14.55 points (0.22%) at 6609.17

US TSY FUTURES CLOSE

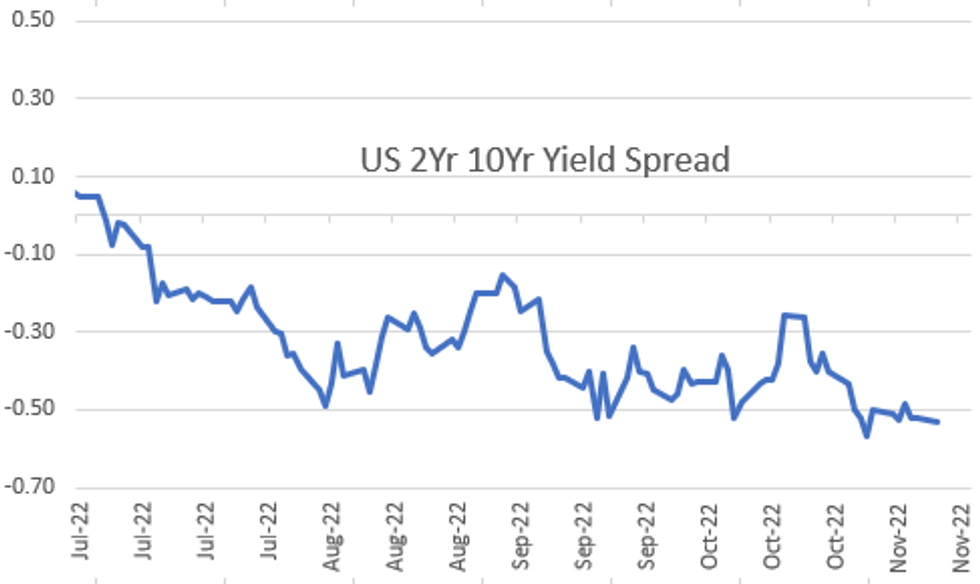

- 3M10Y +5.893, -30.642 (L: -35.664 / H: -27.611)

- 2Y10Y -1.405, -53.786 (L: -56.083 / H: -49.151)

- 2Y30Y -3.049, -35.15 (L: -39.232 / H: -29.928)

- 5Y30Y -2.072, 5.53 (L: 2.451 / H: 8.508)

- Current futures levels:

- Dec 2Y down 3.125/32 at 102-10.625 (L: 102-09 / H: 102-12.75)

- Dec 5Y down 5.75/32 at 107-20.25 (L: 107-16 / H: 107-24.75)

- Dec 10Y down 8/32 at 112-2 (L: 111-27.5 / H: 112-06.5)

- Dec 30Y down 8/32 at 123-18 (L: 122-28 / H: 123-28)

- Dec Ultra 30Y down 26/32 at 130-3 (L: 129-23 / H: 131-08)

US 10YR FUTURE TECH: (Z2) Testing Resistance At The 50-Day EMA

- RES 4: 115-14+ 50.0% retracement of the Aug 2 - Oct 21 downleg

- RES 3: 114-17 High Sep 20

- RES 2: 113-30 High Oct 4 and a key resistance

- RES 1: 112-19 High Oct 27 and a key resistance

- PRICE: 112-04 @ 1500ET Nov 14

- SUP 1: 111-00/109-10+ 20-day EMA / Low Nov 04

- SUP 2: 108-26+ Low Oct 21 and the bear trigger

- SUP 3: 108-06+ Low Oct 2007 (cont)

- SUP 4: 107.12 3.0% 10-dma envelope

Treasuries traded sharply higher last Thursday, resulting in a break of resistance at 111-31, the Oct 27 high. The contract has also pierced the 50-day EMA, at 112-12+. A clear break of the EMA would strengthen the case for short-term bulls and open 113-30, the Oct 4 high and a key resistance. On the downside, key support has been defined at 108-26+, the Oct 21 low. Initial support lies at 111-00, the 20-day EMA.

US EURODOLLAR FUTURES CLOSE

- Dec 22 -0.033 at 94.983

- Mar 23 -0.055 at 94.780

- Jun 23 -0.075 at 94.780

- Sep 23 -0.075 at 95.035

- Red Pack (Dec 23-Sep 24) -0.085 to -0.07

- Green Pack (Dec 24-Sep 25) -0.065 to -0.055

- Blue Pack (Dec 25-Sep 26) -0.065 to -0.06

- Gold Pack (Dec 26-Sep 27) -0.06 to -0.06

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00371 to 3.81857% (-0.00143 total last wk)

- 1M +0.01128 to 3.88657% (+0.01715 total last wk)

- 3M +0.03772 to 4.64386% (+0.05585 total last wk) * / **

- 6M +0.01986 to 5.10386% (+0.07271 total last wk)

- 12M +0.03228 to 5.48357% (-0.21514 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.64971% on 11/10/22

- Daily Effective Fed Funds Rate: 3.83% volume: $97B

- Daily Overnight Bank Funding Rate: 3.82% volume: $283B

- Secured Overnight Financing Rate (SOFR): 3.78%, $987B

- Broad General Collateral Rate (BGCR): 3.75%, $411B

- Tri-Party General Collateral Rate (TGCR): 3.75%, $395B

- (rate, volume levels reflect prior session)

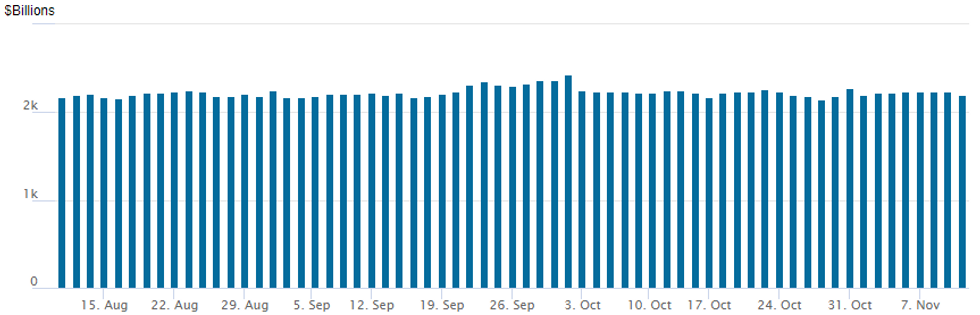

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,200.586B w/ 95 counterparties vs. $2,237.812B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

PIPELINE: Starting To Launch

- Date $MM Issuer (Priced *, Launch #)

- 11/14 $2B #Intesa Sanpaolo $750M 3Y +285, $1.25B 11NC10 +440

- 11/14 $1.5B #Societe Generale PerpNC5.5 9.375%

- 11/14 $1.2B #Thermo Fisher $600M 5Y +80, $600M 10Y +110

- 11/14 $Benchmark Republic of Panama +12Y +290a

- 11/14 $750M #Caterpillar Financial Services 2Y +53

- 11/14 $500M #Penske Trucking 5Y +195

- 11/14 $Benchmark BNG Bank 1.5Y SOFR+18a

- 11/14 $Benchmark Huntington National Bank 3NC2 +130, +7Y +175

- 11/14 $Benchmark National Securities Clearing 2Y +70a, 5Y +115a

- 11/14 $Benchmark CAF 3Y SOFR+125a

- 11/14 $Benchmark Philip Morris 2s-10s investor calls

EGBs-GILTS CASH CLOSE: ECB Dec Hike In Focus

European yields reversed a an early drop with a sharp rise in the afternoon, leaving them largely flat on Monday's session.

- ECB hike pricing faded and EGB yields fell mid-morning amid comments by ECB's Panetta (who said aggressive tightening is not advisable) and an MNI sources story pointing to a 50bp December hike with some risks of 75bp.

- A jump in equities in the afternoon put the pressure back on core FI, and yields erased most of their earlier drop, though largely shrugged off a dip in US yields toward the cash close.

- Periphery EGB spreads were mostly flat. Greece bucked the trend with sharp spread narrowing after a successful 10Y reopening operation.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.9bps at 2.216%, 5-Yr is down 0.5bps at 2.082%, 10-Yr is down 1.3bps at 2.147%, and 30-Yr is down 0.9bps at 2.103%.

- UK: The 2-Yr yield is down 0.6bps at 3.159%, 5-Yr is down 0.8bps at 3.359%, 10-Yr is up 1bps at 3.368%, and 30-Yr is up 0.6bps at 3.497%.

- Italian BTP spread unchanged at 204.5bps / Greek down 18.3bps at 219.2bps

FOREX: Greenback Recovery Fades As Equities Pick Up Late Bid

Despite a solid bounce for the US Dollar during the first half of Monday’s session, a late grind through the highs for major equity indices has taken the shine off the greenback recovery. The USD index (0.35%) does look set to halt its losing streak since the US inflation data last week, however, gains appear much more modest approaching the APAC crossover.

- Early USD strength was largely attributed to comments from Fed's Waller, stating that the FOMC need to see more than just a single lower CPI print before being comfortable that inflation is in decline. Waller added that "The market seems to have gotten way out in front on this".

- The JPY (-0.77%) remains the poorest performer in G10 after a near 200-point USDJPY rally from the open met stiff resistance at the 100-dma of 140.82, the first upside technical level of note. The pair has drifted back below 140.00 throughout US hours in line with the general softer tone for the dollar.

- The extension of equity strength continues to underpin both AUD and NZD, rising around a quarter of a percent. Outperforming is the Chinese Yuan, supported by Chinese authorities moving to support the local property market. Regulators rolled out a series of 16 policy measures, from liquidity support to looser pre-payment conditions. USDCNH (+0.65%) traded within close range of the October lows at 7.0127, extending the three-day rally for the Yuan.

- EURUSD continues to trade with a bid tone and is hovering right at significant resistance between 1.0350-1.0368, the latter level representing the August highs, the best level traded since the July breakdown.

- RBA minutes are due overnight before a set of Chinese activity/employment data. The European session features UK employment figures as well as German ZEW sentiment data. In the US, empire state manufacturing and PPI highlight the docket.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/11/2022 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 15/11/2022 | 0200/1000 | *** |  | CN | Retail Sales |

| 15/11/2022 | 0200/1000 | *** |  | CN | Industrial Output |

| 15/11/2022 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate |

| 15/11/2022 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 15/11/2022 | 0700/0800 | *** |  | SE | Inflation report |

| 15/11/2022 | 0745/0845 | *** |  | FR | HICP (f) |

| 15/11/2022 | 0800/0900 | *** |  | ES | HICP (f) |

| 15/11/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 15/11/2022 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 15/11/2022 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 15/11/2022 | 1000/1100 | * |  | EU | Trade Balance |

| 15/11/2022 | 1000/1100 | * |  | EU | Employment |

| 15/11/2022 | 1000/1100 | *** |  | EU | GDP First Estimates |

| 15/11/2022 | 1130/1130 | ** |  | UK | Gilt Outright Auction Result |

| 15/11/2022 | - |  | ID | G20 Summit in Indonesia | |

| 15/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 15/11/2022 | 1330/0830 | *** |  | US | PPI |

| 15/11/2022 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/11/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 15/11/2022 | 1400/0900 | * |  | CA | CREA Existing Home Sales |

| 15/11/2022 | 1400/0900 |  | US | Philadelphia Fed's Patrick Harker | |

| 15/11/2022 | 1400/0900 |  | CA | BOC Deputy Kozicki moderates panel on diversity | |

| 15/11/2022 | 1400/0900 |  | US | Fed Governor Lisa Cook | |

| 15/11/2022 | 1500/1000 |  | US | Fed Vice Chair for Supervision Michael Barr | |

| 15/11/2022 | 1730/1830 |  | EU | ECB Elderson Speech at Euro Finance Week |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.