-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed More Balanced as Data Weighs on Tsy Ylds

- MNI: Fed’s Cook Sees 'Two-Sided' Risks On Policy, Growth

- MNI INTERVIEW: Optimal QT Reserve Buffer USD60B-Fed's Haubrich

- MNI INTERVIEW: Robust Wages To Keep Inflation Elevated-ADP

- NAHB Index Misses With Some Regional Dispersion

- MNI Jobless Claims Surprise Higher, Continuing Highest Since Nov’21

US

FED: Federal Reserve officials must balance the risk that its aggressive monetary tightening will unduly hurt the economy with the possibility that not raising interest rates enough will allow inflation to remain above the 2% target, Fed Governor Lisa Cook said Thursday.

- “We need to seek a policy stance that is sufficiently restrictive to bring inflation back to 2% over time. I see risks as two sided, requiring us to balance the risk of not tightening enough against the risk of tightening too much,” she told a San Francisco Fed conference.

- Strong growth and consumer spending despite more than 5 percentage points of rate hikes pose the risk that the recent pace of disinflation might not last, she said. (See MNI: Fed's Barkin Not Yet Convinced Inflation On Path To 2%)

- “There is a risk that such continued momentum in demand could keep the economy and labor market tight and slow the pace of disinflation,” Cook said. “But I am also attuned to the risk of an unnecessarily sharp decline in economic activity and employment. Some parts of the economy are showing strain from tighter financial conditions.” For more see MNI Policy Main Wire at 1201ET.

FED: The Federal Reserve will require only a relatively small buffer of about USD60 billion to cover daily fluctuations in the banking system once its QT program ends, Cleveland Fed economist Joseph Haubrich told MNI, a finding that suggests the Fed could shrink its balance sheet more than previously estimated.

- The Fed has said it intends to reduce its government debt holdings until bank reserves are somewhat above "ample" – a level that ensures it can effectively control its benchmark fed funds and other short-term rates through its administered rates: the interest paid on reserve balances (IORB) and the overnight reverse repo facility (RRP) -- plus an appropriate buffer to cover volatility.

- The New York Fed's working assumption is that reserves are ample at around USD2 trillion or 8% of GDP, and when reserves fell below that point in September 2019 the fed funds rate spiked sharply. An appropriate buffer on top of that has yet to be determined, but one paper from the Fed Board in September put it at several hundred billion dollars, consistent with New York Fed projections and market expectations. For more see MNI Policy Main Wire at 0811ET.

US: A strong labor market with lingering worker shortages is likely to keep wage growth brisk and price pressures elevated, making it hard for the Federal Reserve to achieve a soft landing, ADP chief economist Nela Richardson told MNI.

- Wage gains have moderated as the job market cools, but employment conditions remain very tight, particularly in sectors like leisure and hospitality where workers are in short supply.

- “Wage growth is still way too high to be consistent with a 2% inflation target, but on the other hand it’s not strong enough to threaten a wage-price spiral. It’s going to keep, in our view, inflation higher for longer,” Richardson said in an interview.

- Employment growth has slowed as 2023 progresses, but only from fiscal-stimulus-boosted levels widely seen as unsustainable. Job growth has averaged 212,000 over the last four months, about double the level seen as needed to keep up with the steady increase of the population. For more see MNI Policy Main Wire at 1118ET.

US TSYS Higher Than Expected Weekly Claims Buoys Tsys Yet Again

- Treasury futures extended highs early and held the range through much of the day (TYZ3 +19 at 108-26 vs. 108-30 high) after higher than expected Initial Jobless Claims (231k vs. 220k est, 218k prior revised) the highest since September 8, poking back above the 218k averaged in 2019, and Continuing Claims (1.865M vs. 1.843M est, 1.833m prior/rev) marking a new ytd high and indeed the highest since Nov’21.

- Industrial production was softer than expected in October as it fell -0.6% M/M (cons -0.4) after a downward revised 0.1% (initial 0.3). The latest trends seen industrial production up 1.1% annualized on a 3M/3M basis and manufacturing -0.2% annualized. Capacity utilization meanwhile surprisingly fell to 78.9% (cons 79.4) from a downward revised 79.5 (initial 79.7%) for its lowest since June and before that Dec’22.

- Fed speakers appeared more balanced on the session compared to slightly more hawkish tone earlier in the week. Cleveland Fed’s Mester (’24 voter retiring in June) says she needs to see more evidence inflation is on the way to 2% and that she’d be concerned if inflation progress stalls.

- Mester hasn’t decided whether another rate hike is still needed (she said in opening remarks earlier today that it will depend on the data, having pre-payrolls and CPI thought we were within 1 hike of the peak for rates) with the debate now about how long to keep rates restrictive.

OVERNIGHT DATA

US DATA: Initial jobless claims increased to a seasonally adjusted 231k (cons 220k) in the week to Nov 11 - just shy of the payrolls reference week - after 218k (initial 217k), for its highest since mid-August.

- The four-week average lifts 7k to 220k for its highest since Sep 8, poking back above the 218k averaged in 2019.

- Continuing claims increased to a seasonally adjusted 1865k (cons 1843k) in the week to Nov 4 after 1833k (initial 1834k).

- It sees continuing claims poke above the 1861k of April for a new ytd high and indeed the highest since Nov’21.

- US OCT IMPORT PRICES -0.8%

- US OCT EXPORT PRICES -1.1%; NON-AG -1.0%; AGRICULTURE -1.1%

- US NOV PHILADELPHIA FED MFG INDEX -5.9

US DATA: Industrial production was softer than expected in October as it fell -0.6% M/M (cons -0.4) after a downward revised 0.1% (initial 0.3)

- The manufacturing sub-component saw a similar result, falling -0.7% M/M (cons -0.4) after a downward revised 0.2% (initial 0.4) rather than it being particularly biased by the noisy utilities category.

- The latest trends seen industrial production up 1.1% annualized on a 3M/3M basis and manufacturing -0.2% annualized.

- Capacity utilization meanwhile surprisingly fell to 78.9% (cons 79.4) from a downward revised 79.5 (initial 79.7%) for its lowest since June and before that Dec’22.

- Present sales fell to 40 (-6pts) and future sales to 39 (-5pts) for the lowest since January, whilst prospective buyer traffic fell to 21 (-5pts) for the lowest since Dec’22.

- The regional breakdown showed the south and west again lead the declines (this time -8pts in both) followed by the midwest (-5pts) whilst the northeast bucked the trend (+7pts) although this is the smallest region by sales.

- The standard deviation of monthly changes across these four regions is the highest since Nov’22.

- The S&P 500 homebuilders price to book ratio has however since bounced strongly with the pullback in Treasury yields, suggesting some upside for homebuilder sentiment in the short-term.

CANADA DATA: October Housing Starts +1% To 275K Units. Seasonally adjusted starts +1% to 274.7K units after +8% in Sept. 6M moving average +1% to 256.3K units from +3.9% in Sept. Increase led by multi-unit construction like in Sept. Homebuilding remains well short of pace agency says is needed to restore affordability over next decade. Actual year-to-date housing starts -7%.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 127.78 points (-0.37%) at 34862.76

- S&P E-Mini Future down 3.5 points (-0.08%) at 4515.25

- Nasdaq down 9.2 points (-0.1%) at 14094.22

- US 10-Yr yield is down 9.2 bps at 4.4394%

- US Dec 10-Yr futures are up 20/32 at 108-27

- EURUSD up 0.0009 (0.08%) at 1.0857

- USDJPY down 0.77 (-0.51%) at 150.59

- WTI Crude Oil (front-month) down $3.83 (-5%) at $72.83

- Gold is up $24.07 (1.23%) at $1983.91

- European bourses closing levels:

- EuroStoxx 50 down 13.08 points (-0.3%) at 4302.45

- FTSE 100 down 75.94 points (-1.01%) at 7410.97

- German DAX up 38.44 points (0.24%) at 15786.61

- French CAC 40 down 41.21 points (-0.57%) at 7168.4

US TREASURY FUTURES CLOSE

- 3M10Y -7.286, -96.906 (L: -97.945 / H: -90.341)

- 2Y10Y -1.764, -40.021 (L: -40.427 / H: -36.542)

- 2Y30Y -0.455, -22.316 (L: -24.356 / H: -18.1)

- 5Y30Y +1.802, 19.25 (L: 16.241 / H: 21.367)

- Current futures levels:

- Dec 2-Yr futures up 4.5/32 at 101-19.75 (L: 101-15.125 / H: 101-21)

- Dec 5-Yr futures up 13.25/32 at 105-31.5 (L: 105-18.5 / H: 106-01.25)

- Dec 10-Yr futures up 21/32 at 108-28 (L: 108-07 / H: 108-30)

- Dec 30-Yr futures up 1-03/32 at 115-11 (L: 114-06 / H: 115-18)

- Dec Ultra futures up 1-15/32 at 119-28 (L: 118-11 / H: 120-05)

(Z3) Bullish Outlook

- RES 4: 110-07+ High Sep 14

- RES 3: 110-00 Round number resistance

- RES 2: 109-20 High Sep 19

- RES 1: 108-31 High Nov 14

- PRICE: 108-24 @ 1230 ET Nov 16

- SUP 1: 107-00 Low Nov 13

- SUP 2: 105-27+/105-10+ Low Nov 1 / Low Oct 19 and bear trigger

- SUP 3: 105-25 2.0% 10-dma envelope

- SUP 4: 104-26 2.00 proj of the Jul 18 - Aug 4 - Aug 10 price swing

Short-term bullish conditions in Treasuries remain intact following Tuesday’s rally and the contract is trading closer to its recent highs. Price has pierced resistance at 108-25, Nov 3 high. A clear break of this hurdle would signal scope for an extension towards 109-20, Sep 19 high. Key short-term support has been defined at 107-00, the Nov 13 low. A reversal lower and a break of this support, would instead highlight a bearish threat.

SOFR FUTURES CLOSE

- Current White pack (Dec 23-Sep 24):

- Dec 23 +0.008 at 94.630

- Mar 24 +0.035 at 94.780

- Jun 24 +0.060 at 95.050

- Sep 24 +0.075 at 95.355

- Red Pack (Dec 24-Sep 25) +0.095 to +0.125

- Green Pack (Dec 25-Sep 26) +0.120 to +0.130

- Blue Pack (Dec 26-Sep 27) +0.110 to +0.115

- Gold Pack (Dec 27-Sep 28) +0.105 to +0.105

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00148 to 5.33107 (+0.00871/wk)

- 3M -0.00227 to 5.36710 (-0.01054/wk)

- 6M -0.00576 to 5.37501 (-0.03976/wk)

- 12M +0.00753 to 5.23693 (-0.04952/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $96B

- Daily Overnight Bank Funding Rate: 5.32% volume: $248B

- Secured Overnight Financing Rate (SOFR): 5.32%, $1.543T

- Broad General Collateral Rate (BGCR): 5.30%, $598B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $585B

- (rate, volume levels reflect prior session)

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

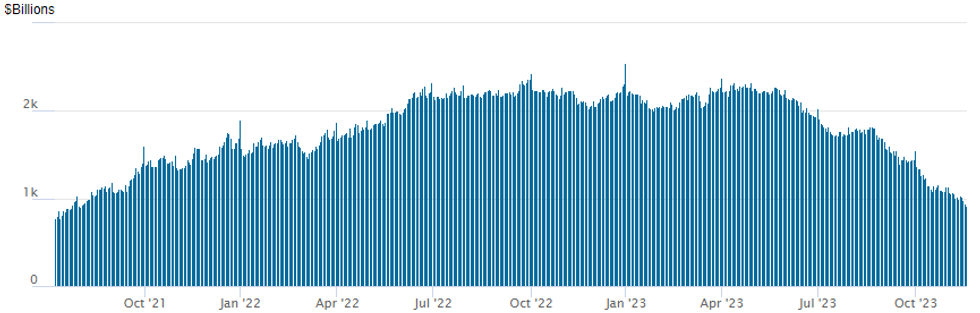

The NY Fed Reverse Repo operation usage continues to fall to new lows not seen since early August 2021 w/ $912.010B w/93 counterparties today vs. $944,241B in the prior session. Usage fell below $1T for the first time since August 2021 last Thursday, November 9: $993.314B.

PIPELINE $5.75B Bayer 5Pt Debt Issuance Launched

- Date $MM Issuer (Priced *, Launch #)

- 11/16 $5.75B #Bayer US $1B 3Y +155, $1B +5Y +185, $1.25B 7Y +200, $1.75B 10Y +210, $750M 30Y +225

- 11/16 $2.5B #Banco Santander $1.15B PerpNC5.5 9.625%, $1.35B Perp NC10 9.625%

- 11/16 $1.5B #State Street $1B 6NC5 +125, $500M 11NC10 +167

- 11/16 $1.4B *FHLB 3Y +9.5

- 11/16 $500m *QIB Sukuk +115

- 11/16 $500M Blackstone 5Y +315

- Expected to launch Friday:

- 11/17 $750M American Airlines 5.5NC2

EGBs-GILTS CASH CLOSE: Curve Bellies Rally On Soft US Jobs Data, Oil Drop

European yields pulled back Thursday, resuming the strong rally begun after the soft US CPI data Tuesday.

- Following a constructive morning session, which partly retraced Wednesday's weakness, Bunds and Gilts gained sharply in the afternoon on yet more market-friendly US data (higher-than-expected jobless claims). A further drop in oil prices helped the cause.

- While yields retraced higher from session lows by the cash close, both the German and UK curves leaning bull flatter as ECB/BoE cut pricing deepened, with curve bellies outperforming in both cases.

- ECB speakers had little impact, while BOE's Ramsden and Greene warned of the need for restrictive policy for an extended period but markets shrugged it off.

- Periphery spreads tightened, with 10Y BTPs/Bunds touching a fresh post-September low, eyeing the 170bp mark.

- That's ahead of Friday's Italy sovereign ratings review by Moody's, which closes out the week - also Friday we get UK retail sales, final October Eurozone inflation data, and another raft of ECB/BOE speakers (from Lagarde to Ramsden/Greene again).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 5.9bps at 2.951%, 5-Yr is down 6.6bps at 2.519%, 10-Yr is down 5.4bps at 2.59%, and 30-Yr is down 4.4bps at 2.829%.

- UK: The 2-Yr yield is down 7.8bps at 4.544%, 5-Yr is down 8.3bps at 4.15%, 10-Yr is down 7.6bps at 4.151%, and 30-Yr is down 6.3bps at 4.588%.

- Italian BTP spread down 3.4bps at 176.4bps / Spanish down 2.6bps at 100.1bps

FOREX Mixed Performance Across G10, AUDJPY Reverses 1% From 2022 Highs

- Despite the move lower for US yields on the back of softer-than-expected data, the USD index trades in very moderate negative territory on the session amid mixed performance across G10 FX. The likes of AUD, NZD and CAD have all dropped around half a percent (with the decline in oil prices potentially weighing), whereas the Japanese yen outperforms amid the lower core yields.

- This has provided an interesting trading session for AUDJPY, posting a substantial 1% reversal after closely matching the 2022 highs in APAC trade. The move lower came in the face of some stronger-than-expected Australian employment data, with technical levels providing stiff resistance as we approach the weekend.

- Bolstering the turnaround was data from the Chinese National Bureau of Statistics showing China home prices fell the most in eight years in October. This comes despite the government ramping up efforts to revive demand, adding to the increasingly sour outlook of the Chinese property sector.

- Crude futures have fallen by around 5% on the day, as concerns of a tepid demand outlook amid higher US jobless claims, and rising stocks, piled pressure on prices during US trading hours. The price action has weighed on the likes of NOK and CAD, with the former registering the largest decline on the session. This saw EURNOK reverse the entirety of Wednesday’s move lower and should focus market participants back on the technically significant 12.00 level.

- Friday’s calendar will be headlined by UK retail sales data and potential revisions to Eurozone CPI data. In the US, housing starts and building permits data will be published.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/11/2023 | 0700/0700 | *** |  | UK | Retail Sales |

| 17/11/2023 | 0700/0800 | ** |  | SE | Unemployment |

| 17/11/2023 | 0830/0930 |  | EU | ECB Lagarde Keynote Speech at Banking Conference | |

| 17/11/2023 | 0900/1000 | ** |  | EU | EZ Current Account |

| 17/11/2023 | 1000/1100 | *** |  | EU | HICP (f) |

| 17/11/2023 | 1310/1310 |  | UK | BOE's Ramsden keynote speech at Conference | |

| 17/11/2023 | 1330/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 17/11/2023 | 1330/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/11/2023 | 1330/0830 | *** |  | US | Housing Starts |

| 17/11/2023 | 1345/0845 |  | US | Fed Vice Chair Michael Barr | |

| 17/11/2023 | 1430/0930 |  | US | San Francisco Fed's Mary Daly | |

| 17/11/2023 | 1445/0945 |  | US | Chicago Fed's Austan Goolsbee | |

| 17/11/2023 | 1500/1000 | * |  | US | Services Revenues |

| 17/11/2023 | 1500/1600 |  | EU | ECB's Cipollone participates in digital euro round table | |

| 17/11/2023 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.