-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed on Demand Driven Inflation

- MNI INTERVIEW: Demand-Driven Inflation Rising -Fed's Shapiro

- MNI US-CHINA: Sentiment Improves After Blinken-Xi Meeting, But Defense Issues Remain

- MNI US: Bouncing NAHB Sentiment Adds To Housing Bottom Evidence

NAHB SENTIMENT

NAHB SENTIMENT

US

FED: Demand factors are increasingly responsible for persistently high inflation since 2022, offsetting some of the price relief from easing supply disruptions, Federal Reserve Bank of San Francisco economist Adam Shapiro told MNI.

- His analysis adds to arguments that the U.S. central bank will need to tighten further to slow the economy and bring down stubbornly elevated inflation. The FOMC last week signaled strong support for two or more quarter-point increases this year even as officials opted not to raise rates in June.

- The 0.7pp fall in core PCE inflation since its peak of 5.4% in Feb 2022 is "almost all due to supply-driven inflation declining," Shapiro said, adding that this had contributed -1.2pp to the reduction. Meanwhile, "demand-driven inflation has risen, counteracting this disinflationary process." The contribution of demand factors to year-over-year core PCE inflation is up 0.5pp during this period.

- Demand-driven inflation has been "more or less steady over the last three to four months but relative to a year ago, it's higher," Shapiro said. "You'd certainly want that to come down and stop rising for inflation to be coming down." For more see MNI Policy main wire at 0846ET.

US: Chinese Foreign Minister Qin Gang has confirmed to reporters that he has accepted an initiation from US Secretary of State Antony Blinken to visit the US.

- Qin's comments follow a meeting with Blinken and Chinese President Xi Jinping which has prompted modest optimism that regular cabinet-level meeting will resume after six-months of tense relations.

- Qin notes that, "stabilising the relationship and preventing a downward spiral" is a sentiment shared by both sides, and states "Blinken's visit marks a new beginning."

- Deep fissures remain in defence and security. Blinken told reporters after meeting Xi, it is “absolutely vital that the US and China have military-to-military communications,” but, “at this moment China has not agreed to move forward with that.”

- According to Qin, the resumption of military-to-military contact is in part due to the "unilateral sanctions of the US," likely a reference to new Chinese Defence Minister Li Shangfu who is currently subject to US sanctions for a defence deal made with Russia. A refusal to remove the sanctions led Beijing to stonewall US requests for a meeting between US Defense Secretary Lloyd Austin and Li at the recent Shangri La Security Dialogue.

US DATA

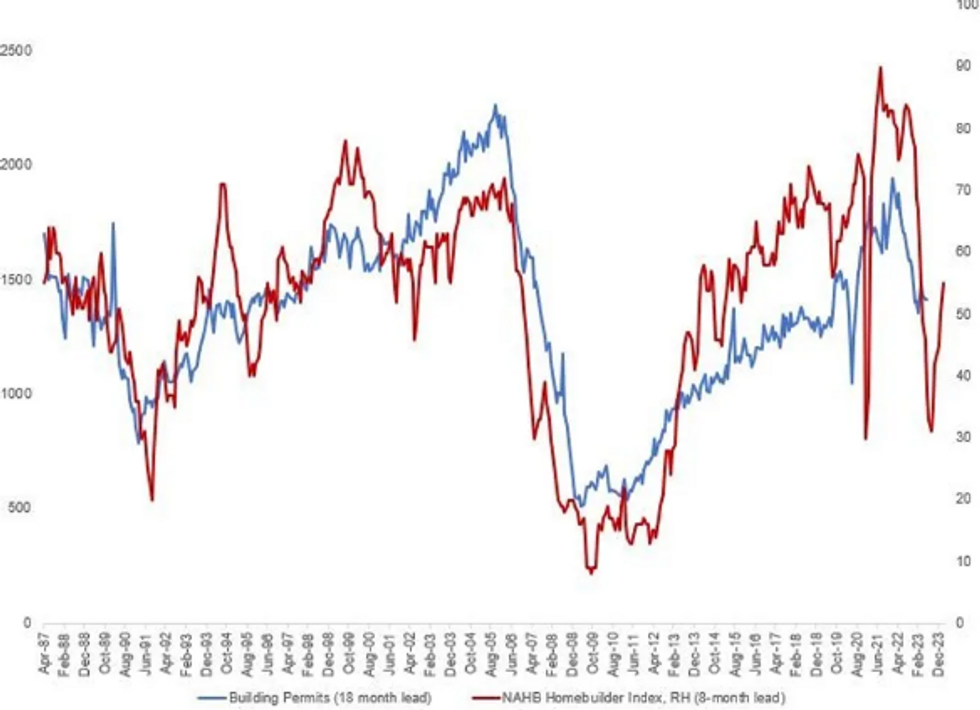

June's NAHB Housing Market Index beat expectations with a 55 reading, vs 51 expected and the first time homebuilder confidence entered positive territory in 11 months (Jul 2022).

- Both the current and future sales components exceeded 60 simultaneously for the first time since June 2022, which the NAHB attributes to "some buyers adjust[ing] to a new normal in terms of interest rates". Prospective buyers' traffic rose to 37 from 33, and was the highest since June 2022.

- While the report's conclusion that the Fed is "nearing the end of its tightening cycle" remains to be seen, today's data adds another piece of evidence that confidence in the US housing market is recovering amid "solid demand, a lack of existing inventory and improving supply chain efficiency".

- The NAHB index has bounced sharply from a low of 31 in December amid slumping sales and weak buying traffic (index dropped to 20).

- That boded poorly for housing activity: housing permits (a leading indicator for construction/completions) peaked at post-GFC highs in April before pulling back, alongside NAHB confidence.

- The NAHB has in turn has historically been a decent leading indicator for permits, and suggests that the sector may bottom out by mid-2024.

MARKETS SNAPSHOT

Key late session levels:

- S&P E-Mini Future down 5.5 points (-0.12%) at 4448.25

- US 10-Yr yield is unchanged 0 bps at 3.7613%

- US Sep 10-Yr futures are down 9.5/32 at 112-24

- EURUSD down 0.0016 (-0.15%) at 1.0921

- USDJPY up 0.17 (0.12%) at 141.99

- WTI Crude Oil (front-month) down $0.49 (-0.68%) at $71.29

- Gold is down $7.49 (-0.38%) at $1950.49

- EuroStoxx 50 down 32.44 points (-0.74%) at 4362.38

- FTSE 100 down 54.24 points (-0.71%) at 7588.48

- French CAC 40 down 74.6 points (-1.01%) at 7314.05

US TREASURY FUTURES CLOSE

- 3M10Y +0, -147.199 (L: -147.199 / H: -147.199)

- 2Y10Y +0, -95.487 (L: -95.487 / H: -95.487)

- 2Y30Y +0, -86.404 (L: -86.404 / H: -86.404)

- 5Y30Y +0, -13.422 (L: -13.422 / H: -13.422)

- Current futures levels:

- Sep 2-Yr futures down 2.25/32 at 102-1.75 (L: 102-01.375 / H: 102-05.375)

- Sep 5-Yr futures down 5.25/32 at 107-19.75 (L: 107-19 / H: 107-29.25)

- Sep 10-Yr futures down 9.5/32 at 112-24 (L: 112-23 / H: 113-07.5)

- Sep 30-Yr futures down 30/32 at 126-13 (L: 126-12 / H: 127-20)

- Sep Ultra futures down 1-8/32 at 135-11 (L: 135-10 / H: 136-26)

SOFR FUTURES CLOSE

- Jun 23 -0.003 at 94.783

- Sep 23 -0.015 at 94.675

- Dec 23 -0.030 at 94.785

- Mar 24 -0.050 at 95.060

- Red Pack (Jun 24-Mar 25) -0.06 to -0.04

- Green Pack (Jun 25-Mar 26) -0.04 to -0.035

- Blue Pack (Jun 26-Mar 27) -0.04 to -0.04

- Gold Pack (Jun 27-Mar 28) -0.045 to -0.045

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- 1M +0.00614 to 5.16271%

- 3M +0.00429 to 5.51429 */**

- 6M -0.00957 to 5.65643%

- 12M +0.01814 to 5.89514%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.54443% on 6/9/23

EGBs-GILTS CASH CLOSE: Peripheries End Week On A High Note

The German curve bull flattened Friday with the UK's bear flattening.

- BTP spreads led periphery tightening, falling 6bp on the day to the lowest in over a year. Greece was not far behind.

- This came amid a risk-on move more broadly (European equities gained on the day), but also as ECB hike pricing was relatively flat on the day as traders assessed Thursday's communications added to today's largely hawkish speakers (incl Holzmann, Runsch, Rehn, Villeroy).

- The morning saw Gilts outperforming as an BOE/Ipsos inflation attitudes survey showed expectations falling back, but UK yields resumed their march higher in the afternoon.

- The short-end/belly underperformed with attention turning to the Bank of England decision next week, which comes a day after a seemingly crucial UK CPI reading. BoE hike pricing was pulled back slightly Friday (3-4bp) to end a hawkish week, but 25bp is still 100% priced for next Thursday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.3bps at 3.123%, 5-Yr is down 2.3bps at 2.582%, 10-Yr is down 3bps at 2.474%, and 30-Yr is down 3.4bps at 2.546%.

- UK: The 2-Yr yield is up 3.8bps at 4.945%, 5-Yr is up 3.9bps at 4.574%, 10-Yr is up 2.8bps at 4.412%, and 30-Yr is up 2.3bps at 4.525%.

- Italian BTP spread down 6.3bps at 156.3bps / Greek down 5.1bps at 130.6bps

FOREX: USDJPY Approaches 142.00 Into The Close, Rising 1.10%

- Higher US yields and no surprises from the Bank of Japan continued to pressure the Japanese yen on Friday with USDJPY rising to a fresh trend high of 141.89 approaching the week’s close. This helped the USD index edge a little higher, stemming the significant overall pressure on the greenback in the aftermath of Wednesday’s FOMC decision.

- Price action extends USDJPY’s intra-day rally to 1.10% as of writing, and the week’s advance to around 1.75%. Yen weakness was initially fuelled by the overnight unchanged decision from the Bank of Japan. As a reminder, the board on Friday decided unanimously to keep yield curve control policy and pledged to continue patiently with monetary easing amid high economic and financial market uncertainty. The BOJ also kept the forward guidance for the policy rates and pledged to take additional easing measures if necessary.

- The USDJPY trend condition remains bullish and attention remains on key resistance at the top of a bull channel drawn from the Jan 16 low, which has now been pierced at 141.45. A sustained break of this hurdle would be bullish and open 142.25 the high on Nov 21, 2022.

- Additionally, EURJPY has traded sharply higher as this week’s bull run extended and sees the pair print as high as 155.22. Price has recently cleared key resistance at 151.61, the May 2 high and an important bull trigger for the pair, confirming a resumption of the longer-term uptrend.

- A generally optimistic tone for risk has supported the likes of GBP and CAD, the best performers in G10 on Friday. As a reminder, GBP strength comes hot on the heels of stronger-than-expected UK jobs and wage data on Tuesday, which triggered the biggest selloff in short-dated Gilts in over 8 months. The more hawkish BOE pricing has been underpinning the whole move with the technical outlook for cable improving significantly on the breach of 1.2680 an important medium-term technical break.

- Juneteenth Independence Day holiday in the US on Monday should keep volatility contained. Highlights next week include UK CPI and flash Eurozone PMI. On the central bank slate, the Bank of England, Norges Bank and then SNB will decide on rates.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/06/2023 | 0115/0915 | *** |  | CN | Loan Prime Rate |

| 20/06/2023 | 0600/0800 | ** |  | DE | PPI |

| 20/06/2023 | 0800/1000 | ** |  | EU | EZ Current Account |

| 20/06/2023 | 0900/1100 | ** |  | EU | Construction Production |

| 20/06/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 20/06/2023 | 1030/0630 |  | US | St. Louis Fed's James Bullard | |

| 20/06/2023 | 1230/0830 | *** |  | US | Housing Starts |

| 20/06/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 20/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 20/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 20/06/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.