-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - RBA Holds, Communication Turns Slightly Dovish

MNI China Daily Summary: Tuesday, December 10

MNI ASIA OPEN: Fed Past Hikes, Inflation Stabilizing

- US (MNI): Inflation Looks To Be Stabilizing-Fed Economist

- US (MNI POLICY): Fed Convinced Past Hikes' Full Effect Still To Hit

- EU (MNI): Doubts Grow Over EU Fiscal Rules Deal This Year - Officials

- MNI: S&P Affirm Italy at BBB, Outlook Stable

- GREECE: Rating Raised to Investment Grade by S&P, Bbg

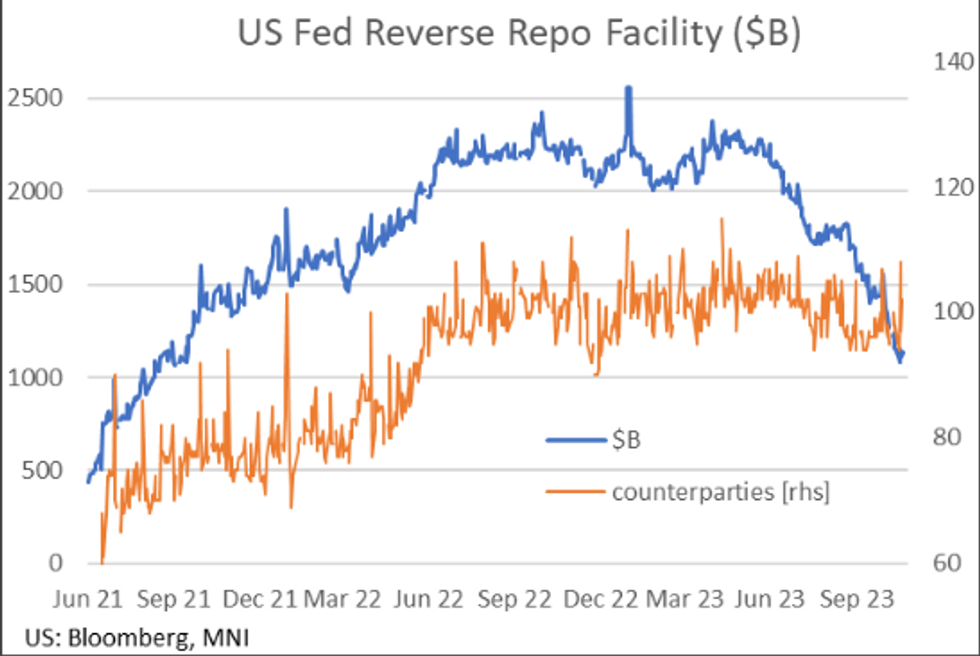

- US (MNI) RRP Uptake Stabilizes After Sliding In Prior Weeks

NEWS

US (MNI): Inflation Looks To Be Stabilizing-Fed Economist

U.S. inflation appears to be showing less volatility in a promising sign for the Federal Reserve’s battle to rein in price pressures, Richmond Fed economist Alexander Wolman told MNI. Wolman has devised a new way of measuring inflation variance: tracking the monthly inflation rate against the share of relative price changes in particular goods or services. In other words, he examined how swings in the cost of individual items in the PCE basket like gasoline or furniture relate to the overall movement of consumer prices.

US (MNI) RRP Uptake Stabilizes After Sliding In Prior Weeks

RRP usage increased $25B to $1,139B today, consolidating a week that saw a drop to new recent lows of $1,082B. Usage is down circa $300B from a similar time last month. The number of counterparties increased by 5 to 102 having seen some volatility this week around the time GSEs tend to use the facility.

US (MNI): Fed's Harker Makes Case For Holding Rates

The Federal Reserve should keep interest rates on hold because the inflation outlook has improved significantly and the full effects of an aggressive monetary tightening have yet to be felt, Philadelphia Fed President Patrick Harker said Friday.

US (MNI): Fed's Mester: Rates 'Likely Near Or At A Holding Point'

Federal Reserve Bank of Cleveland President Loretta Mester said Friday interest rates are "likely near or at a holding point" as the Fed closes in on the end of the tightening cycle.

US (MNI POLICY): Fed Convinced Past Hikes' Full Effect Still To Hit

The Federal Reserve appears increasingly inclined to be done raising interest rates barring a reacceleration of inflation, in part because of something Fed Chair Jerome Powell highlighted Thursday – there is still a significant drag on the economy to come from past tightening.

US (MNI) Fed Says Yield Spike Straining Equity Valuations, Banks

Financial markets and parts of the banking system are coming under increasing pressure while businesses and consumers are generally in better shape, according to the Federal Reserve's latest report on financial stability published Friday. The banking system is sound and resilient, the Fed said, but ripples from the turmoil that swept through regional banks in March are still being felt.

US (BBG): House Speaker Failures Create New Wave of Contenders

House Republicans have dispensed with Jim Jordan as their nominee for the US speakership and now several more are preparing to enter the fray. The new field began to take shape minutes after the party voted by secret ballot to rescind Trump loyalist Jim Jordan’s nomination to the leadership post. Republicans plan to hold another candidate forum on Monday with another nomination vote held as early as Tuesday.

US (MNI): Fed Asks Banks For Data On Higher Capital Proposal

The Federal Reserve on Friday asked large banks to voluntarily submit data by Jan. 16 showing how they would be affected by the Basel III endgame proposal to raise capital requirements. U.S. regulators also extended until the same date the comment period on the capital proposal to allow banks more time to respond.

EU (MNI): Doubts Grow Over EU Fiscal Rules Deal This Year - Officials

The chances of a deal on overhauling the European Union’s fiscal rules this year took a further blow this week as EU finance ministers' exasperation with the handling of the talks by Spain spilled over into the open after failure to make progress at a meeting in Luxembourg.

UK (MNI): UK Has Little Fiscal Space Even If Rules Change

Any moves by a future UK government to tweak the current fiscal rules or to put more emphasis on public sector net worth will fail to disguise the lack of space for additional spending, Institute for Fiscal Studies senior research economist Ben Zaranko told MNI.

ITALY (MNI): S&P Affirm Italy at BBB, Outlook Stable

S&P: ITALY 'BBB/A-2' RATINGS AFFIRMED; OUTLOOK STABLE (BBG)

The following commentary was attached to the report: "By 2025, S&P project that Italy's real GDP growth will recover to above 1%, helped by accelerated deployment of the Next Generation EU funds, which we believe will likely extend beyond 2026. Economic growth will decelerate in 2023 and 2024 on the back of rising private sector savings, tightening credit conditions, slowing manufacturing, and weakening global trade: S&P".

GREECE: Rating Raised to Investment Grade by S&P, Bbg

"Greece's long-term foreign currency debt rating was upgraded by S&P to BBB-, the lowest investment grade score, from BB+, outlook to stable from positive. Significant budgetary consolidation has placed Greece's fiscal trajectory onto a firmly improving track: S&P. S&P estimates the Greek net government debt stock will fall to about 146% of GDP by year-end, which would represent a marked improvement from the peak of 189% of GDP in 2020."

CHINA (MNI): China Banks Increase Loans To Developers: NAFR

(MNI)Beijing - China's commercial banks increased credit support to developers this year, officials of National Administration of Finance Regulation told reporters on Friday in a briefing, with lenders' net profits expanding at a faster pace than in the first three quarters.

JAPAN (MNI): Uncertainties Over Economy, Markets Very High – Ueda

Bank of Japan Governor Kazuo Ueda said on Friday that uncertainties over economy and financial markets at home and overseas are extremely high, thoughts echoed in the central bank's latest Financial Stability Report.

ISRAEL-HAMAS (BBG): American Mother and Daughter Freed from Hamas Captivity

Hamas militants freed an American woman and her daughter almost two weeks after they were taken captive during the militant group’s deadly raid on southern Israel, the Israeli government said. A statement from President Joe Biden said the US had secured the release of two Americans but didn’t identify them. The White House also said that Biden spoke with Netanyahu about efforts to secure hostage releases and make sure US citizens in Gaza get safe passage out.

US-ISRAEL (BBG): US Presses Israel to Delay Gaza Invasion to Get Hostages Out

US and European governments have been putting pressure on Israel to delay its ground invasion of Gaza to buy time for secret talks underway via Qatar to win the release of hostages held by Hamas, according to people familiar with the efforts.

US (BBG): Automakers Raise Wage Offers to 23%, UAW Now Demands More

Stellantis NV is raising its wage offer to 23%, matching General Motors Co. and Ford Motor Co. as negotiations with the United Auto Workers heat up, people familiar with the discussions said. The offer may not be enough to assuage the UAW, which is now asking for a 25% increase, according to the people, who were not authorized to speak publicly.

DATA

MNI: US SEP TREASURY BUDGET -171B

US TSYS: Ending The Week Notably Steeper

- Treasuries are off session highs although have given back some of the losses seen after the release of two US citizens held hostage in Gaza and the US pushing Israel to delay its invasion.

- With cash benchmarks trading 2.5-9.5bp richer (5Y leads, 30Y underperforms), the day’s rally can be attributed to a mix of positioning ahead of weekend worry re: the Israel-Hamas conflict and several cycle highs across the core global FI yield landscape presenting enticing entry points for participants (a case in point being the 10Y rising to 4.993% but not quite breaching 5% and now back to 4.92%).

- 2s10s at -16.4bps is near unchanged on the day, close to recent steeps of -14.5bps

- TYZ3 trades at 105-31+ below session highs of 106-06 but having lifted off Thursday’s post-Powell low of 105-10+. Resistance is seen at 106-15+ (Oct 18 high).

- In DC, the hunt for a House Speaker will continue next week with Jordan losing the nomination after failing a new conference vote following unsuccessful attempts, whilst Biden’s $105B funding request for Ukraine (the bulk at $61.4B), Israel and other foreign policy objectives compared to the $100B touted.

- With the FOMC entering media blackout, next week sees advance national accounts for Q3 (real GDP cons 4.5%, Atlanta Fed nowcast 5.4%) on Thursday, which will also give a hint of the potential latest monthly print for September landing the following day.

- Corporate earnings also come more into focus, with Alphabet, Microsoft, Amazon and Meta all reporting in the biggest earnings week of the quarter with 38% of the S&P 500 up.

FOREX: Equities Weakness Further Weighs On NZD

- The late pullback for front-end US yields this week has weighed on the greenback overall, with the USD index set to close around 0.5% lower on the week. However, mixed performance across G10 FX and the ongoing geopolitical uncertainty have contained any downside momentum for the index.

- Weakness for equities on Friday was unable to promote any significant haven demand in currency markets, with most major pairs holding narrow ranges ahead of the weekend close. However, the moves have further weighed on the New Zealand dollar, which has declined 0.35%.

- NZDUSD broke to fresh yearly lows this week below 0.5860 with softer than expected CPI being the catalyst. The pair continues to consolidate this weakness as we approach the weekend close.

- Both EURUSD and USDJPY traded in tight 30-40 pip ranges on Friday, with the latter once again failing to pierce the 150.00 mark as market participants remain wary of further verbal intervention from the MOF, limiting the risk/reward for bulls, despite the attractive carry profile.

- More notable on Friday was the strength for the Mexican peso, which recovered 0.7%, despite the risk off sentiment across major equity benchmarks.

- Eurozone flash PMIs will kick things off next week on Tuesday before Australian CPI on Wednesday. On the central bank slate, the BOC and ECB decisions are highlights amid a number of EM central bank decisions.

EQUITIES: S&P E-mini Sees Renewed Test Of Session Low

- Stocks are finishing on the back foot with the S&P 500 set for its fourth consecutive daily decline.

- ESZ3 trades at 4258 (-1.0%) in a late push back to earlier lows of 4255.25 for what has been another step towards the bear trigger at 4235.50 (Oct 4 low).

- Tech suffers today with the Nasdaq 100 e-mini underperforming (-1.3%) vs outperformance for the Dow (-0.7%) and Russell 2000 (-0.9%).

- Specifically within SPX, energy currently leads the decline (-1.6%), with the fall in WTI futures after a hostage release in Gaza and the US pressing Israel to delay its invasion, closely followed by IT (-1.5%). Financials (-1.3%) mask heavier underperformance for banks (-2.2%). Broader banks see heavier declines, with the KBW index -2.7% and regionals -2.9%.

- Corporate earnings come more into focus next week, with Alphabet, Microsoft, Amazon and Meta all reporting in the biggest earnings week of the quarter with 38% of the S&P 500 up.

COMMODITIES: WTI Sees Drop On Hostage Release, Gold Still Gains

- Crude futures saw a sharp intraday decline to offset earlier as the ongoing conflict in the Middle East sparks huge volatility. The fall followed reports that Hamas has released two US hostages following mediation with Qatar. Despite the drop, WTI remains up around 1% since the start of the week.

- US total rig count increased by 2 on the week to 624, according to Baker Hughes

- Venezuela has released five prisoners, including a well-known opposition figure as part of Washington's demand that certain prisoners be freed this week in return for temporarily eased sanctions on its oil & gas sector.

- JP Morgan does not expect Middle East instability to result in a long-term oil price spike according to a recent research note.

- WTI is -0.7% at $88.75, with resistance seen at $98.58 (76.4% retrace Sep 28 – Oct 6 bear leg) and support at $83.90 (50-day EMA).

- Brent is -0.1% at $92.28 off a high of $93.48, with resistance seen at a bull trigger of $95.35 (Sep 28 high) and support at $87.91 (50-day EMA).

- Gold is +0.4% at $1981.89 off a high of $1996.99 but still holding its clearance of resistance at $1982.4 (Jul 20 high) as geopolitical tensions remain high despite the hostage release. Next resistance is seen at $2003.4 (76.4% retrace of May 4 – Oct 6 bear leg).

- Weekly moves: WTI +1.2%, Brent +1.5%, Gold +2.5%, US nat gas -9.6%, EU TTF nat gas -5.3%

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/10/2023 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 23/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 24/10/2023 | 2200/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 24/10/2023 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 24/10/2023 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 24/10/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 24/10/2023 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 24/10/2023 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 24/10/2023 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 24/10/2023 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 24/10/2023 | 0800/1000 |  | EU | ECB Bank Lending Survey (Q3 2023) | |

| 24/10/2023 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 24/10/2023 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 24/10/2023 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 24/10/2023 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 24/10/2023 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 24/10/2023 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 24/10/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 24/10/2023 | 0900/0500 | * |  | US | Business Inventories |

| 24/10/2023 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 24/10/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 24/10/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 24/10/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/10/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 24/10/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 24/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 24/10/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.