-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Speakers Maintain Cautious Policy View

- MNI INTERVIEW: Fed Highlights Risk of Weakening Job Market

- MNI FED: Fed Gov Cook Says Achieving Price Stability To Take Caution

- MNI Chicago FED Goolsbee: Probably At Dovish End Of Dot Plot 3-Cut Median

- MNI US DATA: New Home Sales Steady, As Market Continues To Loosen

US

INTERVIEW (MNI): Fed Highlights Risk of Weakening Job Market: The Federal Reserve judges the danger of deterioration in the U.S. labor market as now roughly similar to that of inflation reaccelerating, an indication that policy is at the right setting, former Fed Board research director David Wilcox told MNI.

- Fed Chair Jerome Powell's notable new comment last week that an "unexpected weakening" in the labor market could bring forward rate cuts is less indicative of the Fed's knowing something we don't know and more a statement on equally balanced risks, Wilcox said in an interview.

- The Fed has held the fed funds rate at the current 23-year high of 5.25%-5.5% since July without knowing whether that's likely to be the peak for the cycle. “They’re now more convinced than before that policy is roughly where it needs to be, and it’s clear the risk of the next move being up has receded some," Wilcox said.

FED (MNI): Fed's Cook Says Achieving Price Stability To Take Caution: Federal Reserve Governor Lisa Cook said Monday officials must cautiously balance the risk of easing monetary policy too much or too soon, allowing inflation to linger above target, and taking too long to ease, which could harm the economy needlessly and deprive people of economic opportunities.

- "The risks to achieving our employment and inflation goals are moving into better balance," she said in prepared remarks in a speech at Harvard University, that focused on the Fed's dual mandate. "Nonetheless, fully restoring price stability may take a cautious approach to easing monetary policy over time."

NEWS

US FED (MNI): Chicago's Goolsbee Probably At Dovish End Of Dot Plot 3-Cut Median: Not particularly dovish comments from Chicago Fed Pres Goolsbee in a Yahoo Finance interview this morning, but he's probably (still) on the more dovish side of the 3 cut FOMC median - noting that while the Fed needs to see more disinflationary progress before cutting, the "story" doesn't seem to have "fundamentally changed" in recent months despite an apparent stalling of inflation metrics at elevated levels.

US (MNI): Appeal Court Reduces Trump Bond In Civil Case, Hush Money Trial Set April 15: New York Supreme Court Justice Juan Merchan has set a date of April 15 to begin the criminal trial of former President Donald Trump on charges related to hush-money paid to an adult film star. Merchan's ruling resisted a call from Trump's legal team to further delay the trial, which was originally scheduled to get underway today.

POLITICAL RISK (MNI): UK & US Warn On Alleged Chinese Hacks: The US and UK have accused Chinese state-affiliated groups of being involved in hacking of senior officials as well as data related to millions of individuals.

ISRAEL (MNI): PM Cancels Delegation's DC Visit After US Abstains On UN Gaza Resolution: The UN Security Council has adopteda resolution calling for an 'immediate' ceasefire in Gaza during the holy month of Ramadan, with 14 votes in favour and an abstention from the United States.

ISRAEL (MNI): Netanyahu-'US Change In Position Hurts War Effort': Wires reporting comments from Israeli PM Benjamin Netanyahu saying that the "US change in position hurts [the] war effort and efforts to release hostages."

Tsy Yields Rebound, Little React to Data, Fed Speak

- Treasuries scaled back from early overnight highs, holding a moderately weaker range late Monday. Little react to this morning's lower than expected New Home Sales at 662k vs. 675k est (prior up-revised to 664k from 661k), MoM -0.3% vs. 2.1% est (prior up-revised to 1.7% from 1.5%).

- Federal Reserve Governor Lisa Cook said Monday officials must cautiously balance the risk of easing monetary policy too much or too soon, allowing inflation to linger above target, and taking too long to ease, which could harm the economy needlessly and deprive people of economic opportunities.

- Futures remain mildly weaker, near low end of narrow session range: TYM4 -7.5 at 110-16.5 vs. 110-15 low, w/ technical support well below at 109-24+ (Low Mar 18 and the bear trigger). Curves steeper: 2s10s +1.501 at -37.818.

- The Tsy $66B 2Y note auction (91282CKH3) drew 4.595% high yield vs. 4.592% WI; 2.62x bid-to-cover vs. 2.49x prior. Despite the small tail, futures drew modest short cover support on stronger peripheral support: Indirect take-up at 65.76% vs. 65.16% prior, directs took 20.88% vs. 20.11% last month, primary dealer take-up 13.36% vs. 14.73% prior.

- Projected rate cut pricing continued to cool: May 2024 at -12.9% vs. -14.5% this morning w/ cumulative -3.2bp at 5.296%; June 2024 -65.8% vs. -66.7% w/ cumulative rate cut -19.7bp at 5.132%. July'24 cumulative at -30.6bp vs. -32.0bp.

OVERNIGHT DATA

US DATA (MNI): New Home Sales Steady, As Market Continues To Loosen: New home sales were basically unchanged in February at 662k annualized (677k expected, 664k January upwardly revised from 661k), maintaining their fairly narrow 600-700k range since the end of 2022. This is in some contrast to existing home sales which have seen a jump recently (a 12-month high of 4.38mln in February) as mortgage rates dipped, ostensibly reducing the opportunity cost to moving for existing homeowners with low-rate mortgages.

CHICAGO FED FEB. NATIONAL ACTIVITY INDEX AT 0.05

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 164.59 points (-0.42%) at 39313.96

- S&P E-Mini Future down 10.5 points (-0.2%) at 5282.75

- Nasdaq down 17 points (-0.1%) at 16411.83

- US 10-Yr yield is up 5.1 bps at 4.2493%

- US Jun 10-Yr futures are down 7.5/32 at 110-16.5

- EURUSD up 0.0032 (0.3%) at 1.084

- USDJPY up 0.04 (0.03%) at 151.45

- WTI Crude Oil (front-month) up $1.44 (1.79%) at $82.07

- Gold is up $6.94 (0.32%) at $2172.40

- European bourses closing levels:

- EuroStoxx 50 up 13.04 points (0.26%) at 5044.19

- FTSE 100 down 13.35 points (-0.17%) at 7917.57

- German DAX up 55.37 points (0.3%) at 18261.31

- French CAC 40 down 0.32 points (0%) at 8151.6

US TREASURY FUTURES CLOSE

- 3M10Y +5.726, -113.51 (L: -127.033 / H: -112.522)

- 2Y10Y +1.715, -37.604 (L: -40.027 / H: -37.258)

- 2Y30Y +1.207, -20.13 (L: -22.927 / H: -19.792)

- 5Y30Y -0.332, 19.065 (L: 17.116 / H: 19.854)

- Current futures levels:

- Jun 2-Yr futures down 1.625/32 at 102-10 (L: 102-09 / H: 102-12.625)

- Jun 5-Yr futures down 4.25/32 at 106-30.25 (L: 106-28.5 / H: 107-05.75)

- Jun 10-Yr futures down 7.5/32 at 110-16.5 (L: 110-15 / H: 110-30)

- Jun 30-Yr futures down 15/32 at 119-10 (L: 119-06 / H: 120-06)

- Jun Ultra futures down 21/32 at 127-2 (L: 126-29 / H: 128-11)

US 10Y FUTURE TECHS (M4) Gains Considered Corrective

- RES 4: 112-04+ High Mar 8 and bull trigger

- RES 3: 111-24 High Mar 12

- RES 2: 111-00 50-day EMA

- RES 1: 110-30+ High Mar 21 & 22

- PRICE: 110-16 @ 10:38 GMT Mar 25

- SUP 1: 109-24+ Low Mar 18 and the bear trigger

- SUP 2: 109-14+ Low Nov 28

- SUP 3: 109-12+ 1.764 proj of Dec 27 - Jan 19 - Feb 1 price swing

- SUP 4: 108-25+ 2.00 proj of Dec 27 - Jan 19 - Feb 1 price swing

Despite recent gains, Treasuries maintain a softer tone and the latest move higher is considered corrective. Moving average studies are in a bear-mode position and this highlights a downtrend. Key short-term resistance to watch is 111-00, the 50-day EMA. A clear break of this average is required to suggest scope for a stronger recovery. On the downside, the bear trigger is unchanged at 109-24+.

SOFR FUTURES CLOSE

- Jun 24 -0.020 at 94.890

- Sep 24 -0.035 at 95.180

- Dec 24 -0.035 at 95.480

- Mar 25 -0.035 at 95.745

- Red Pack (Jun 25-Mar 26) -0.04 to -0.035

- Green Pack (Jun 26-Mar 27) -0.035 to -0.03

- Blue Pack (Jun 27-Mar 28) -0.04 to -0.035

- Gold Pack (Jun 28-Mar 29) -0.04 to -0.035

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00346 to 5.33217 (-0.00004 total last wk)

- 3M -0.00493 to 5.30755 (-0.02000 total last wk)

- 6M -0.00740 to 5.22160 (-0.04614 total last wk)

- 12M -0.01086 to 4.99292 (-0.07481 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.796T

- Broad General Collateral Rate (BGCR): 5.31% (+0.01), volume: $679B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.01), volume: $670B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $91B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $249B

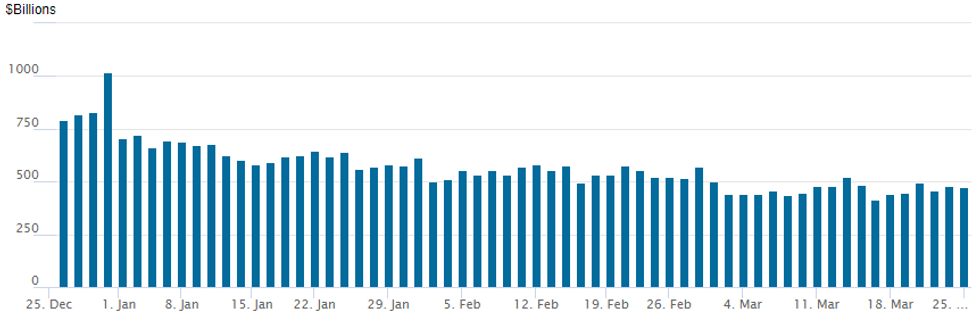

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage slips to $473.787B from $478.531B on Friday. Compares to Friday, March 15 when usage fell to $413.877B - the lowest level since May 2021.

- Meanwhile, the latest number of counterparties steady at 74 (compares to 65 on January 16, the lowest since July 7, 2021)

PIPELINE: $3.25B BMW US Capital 5Pt US$ Debt Launched

- Date $MM Issuer (Priced *, Launch #)

- 3/25 $3.25B #BMW US Capital $600M 2Y +45, $700M 2Y SOFR+55, $650M 3Y +55, $800M 5Y +70, $500M 10Y +90

- 3/25 $1.4B *KNOC (Korean National Oil) $500M 3Y + 70, $300M 3Y SOFR+83, $600M 5Y +80

- 3/25 $1.25B #LSEG (London Stock Exchange) $500M 3Y +65, $750M 10Y +105

- 3/25 $1.25B #PSEG (Public Service Enterprise Grp) $750M 5Y +100, $500M 10Y +122

- 3/25 $750M #Sammons Financial 10Y +265

- 3/25 $750M MGM Resorts 8NC3 6.5%a

- 3/25 $700M AMC Networks 4.75NC1.75

- 3/25 $600M Esab Corp 5NC2 6.25%a

- 3/25 $500M #Penske 5Y +112

- 3/25 $500M #Union Electric WNG 10Y +98

- 3/25 $500M #Penske 5Y +112

- On tap for Tuesday

- 3/26 $Benchmark Quebec 5Y SOFR+53a

EGBs-GILTS CASH CLOSE: Rate Cut Pricing Pared With EZ Inflation Ahead

Bunds and Gilts broke a 5-day streak of gains Monday, ahead of Eurozone inflation data later in the week.

- The pullback in core FI was fairly steady through a quiet session, with a moderate spike in oil prices in the afternoon continuing to apply pressure into the final hours of the cash session.

- An appearance by BoE's Mann - who voted for a pause with the MPC consensus last week, vs a hawkish dissent prior - brought little market reaction, with 2024 BoE cut pricing ending the session around 76bp (around 6bp less than Friday's close).

- With ECB end-2024 rate pricing also pared (around 3bp less, to 89bp), the German and UK curves bear flattened on the day amid short-end weakness.

- Periphery spreads erased earlier modest widening to finish flat/tighter to Bunds.

- Data was decidedly second-tier, with Finnish and Spanish PPI showing further disinflationary impulses ahead of flash March Eurozone CPI readings later in the week (Spain Wednesday).

- That data will be the holiday-shortened week's focus: MNI's preview will be published Tuesday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 5.8bps at 2.885%, 5-Yr is up 5.6bps at 2.389%, 10-Yr is up 4.9bps at 2.372%, and 30-Yr is up 3.2bps at 2.526%.

- UK: The 2-Yr yield is up 6.2bps at 4.184%, 5-Yr is up 5.7bps at 3.872%, 10-Yr is up 6bps at 3.988%, and 30-Yr is up 3.8bps at 4.484%.

- Italian BTP spread up 0.3bps at 132.2bps / Portuguese PGB spread down 0.7bps at 66.6bps

FOREX USD Index Loses Moderate Ground, AUD Outperforms

- Currency markets overall have been generally rangebound and trading on light volumes Monday, with CHF marginally the poorest performer and AUD & GBP the strongest. Equities have consolidated a very minor pop off the lows, and the USD index has been consolidating losses of around 0.2% on the session. While the index is softer (against the grain of higher US yields), it remains well within range of the recovery high, and while above 103.99, the short-term outlook remains bullish.

- EURUSD trades a quarter of a percent firmer despite retaining the S/T bearish outlook for the pair. A reversal lower from here would concentrate markets back on 1.0796 first, the Feb29 low and open the bear trigger further out at 1.0695.

- AUDUSD is firmer off last week's pullback low, and tech traders will be watching for the imminent formation of a death cross in the pair (50-dma < 200-dma) - the first since April last year, which should indicate short-term momentum in the pair is pointed lower. Notably, the AUD net short position continues to swell - putting AUD net positioning at a % of open interest at the largest short on CFTC records stretching back to the early 90s.

- However, AUD outperforms to start the week and alongside the Swiss Franc weakness, we highlight the bullish potential for AUDCHF here: https://roar-assets-auto.rbl.ms/files/60505/FX%20Market%20Analysis%20-%20AUDCHF.pdf

- Fed's Bostic, Goolsbee and Cook made appearances but did little to move the needle at the beginning of a shortened holiday week, largely echoing sentiment from Chair Powell’s post-meeting press conference last week.

- Second-tier data from the US on Tuesday, with durable goods and consumer confidence scheduled. Perhaps more market attention will be on emerging markets with a rate decision in Hungary tomorrow, before South Africa on Wednesday.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/03/2024 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 26/03/2024 | 0700/0800 | ** |  | SE | PPI |

| 26/03/2024 | 0800/0900 | *** |  | ES | GDP (f) |

| 26/03/2024 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 26/03/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 26/03/2024 | 1200/0800 |  | CA | BOC Sr Deputy Rogers speaks in Halifax NS | |

| 26/03/2024 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 26/03/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 26/03/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 26/03/2024 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 26/03/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/03/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/03/2024 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 26/03/2024 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 26/03/2024 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 26/03/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 26/03/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 26/03/2024 | 1900/2000 |  | EU | ECB Lane Lecture At Trinity College Dublin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.