-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Staff: Recession Plausible in 2023

EXECUTIVE SUMMARY

US

FED: Almost all Federal Reserve officials agreed it was time to step down the pace of rate hikes to a quarter point at their Jan 31-Feb.1 meeting but "a few" wanted to hike by 50 basis points to get sufficiently restrictive more quickly, minutes from the gathering published Wednesday showed.

- There was no discussion of a pause in rate hikes despite hopes in financial markets that such deliberations had been in an integral part of the Fed's most recent meeting.

- "Almost all participants agreed that it was appropriate to raise the target range for the federal funds rate 25 basis points at this meeting,” the report said. “A few participants stated that they favored raising the target range for the federal funds rate 50 basis points at this meeting or that they could have supported raising the target by that amount.” For more see MNI Policy main wire at 1300ET.

FED: The Federal Reserve will need to tighten more than investors or policymakers believe, raising interest rates to at least 5.6% and possibly above 6% to subdue inflation, Fed academic consultant Ricardo Reis told MNI.

- The chance the Fed hikes beyond 6% ranges between 25% and 50%, Reis said. That's a stronger view than officials who in December signaled two more 25bp hikes in March and May before peaking just above 5%. Some officials have since said there's a risk rates could edge somewhat higher.

- Reis' baseline is for the U.S. central bank to raise the current 4.5%-4.75% fed funds target range to between 5.5% and 5.7% in 25bp steps, adding he sees a 50bp move as an option. "I don't think that would be a dreadful mistake to do a 50 basis point," he said in an interview. "I can see the argument for why to do it and I would certainly not put it off the table." For more see MNI Policy main wire at 1127ET.

FED: U.S. labor demand could be less sensitive to higher interest rates than in previous decades, possibly requiring the Fed to tighten policy even more to slow the economy and tame inflation, Federal Reserve Bank of Atlanta economist Jonathan Willis told MNI.

- Despite lifting the fed funds rate 450bps in less than a year, the Fed's hiking campaign isn't getting much traction in the labor market. Employers added an average of 356,000 jobs a month over the past three months, triple what's needed to keep up with workforce growth, and job openings remain much high than pre-pandemic levels.

- Economists say it could take up to 24 months for monetary policy to take full effect, and Willis argues declining interest-rate sensitivity could be to blame. Structural changes in industries and financial markets since the 1970s and early '80s have led to a diminished response by employment to monetary policy shocks outside of the most interest-rate-sensitive sectors. For more see MNI Policy main wire at 0829ET.

- "Just by allowing the securities to mature, it would take the Fed two to three years to reach a normalized size of its balance sheet," coauthors Huberto Ennis and Tre' McMillan wrote, estimating normalization will be done by late 2025 or early 2026.

- The projections suggest the Fed can continue QT for longer and lower the amount of reserves in the system a touch lower than investors expect. The median expectation in the December 2022 Survey of Market Participants conducted by the New York Fed saw QT ending in the fourth quarter of 2024, with the central bank's balance sheet at USD6.25 trillion and reserves dipping to USD2.375 trillion.

US TSYS: Not Much of a Pause in Feb FOMC Minutes

Tsys firmer after the bell, but off session highs to near middle session range after Feb FOMC minutes revealed "a few" members wanted to hike 50bp. Yield curves off steeper levels w/ short end under pressure (2s10s -.188 at -77.623 vs. -73.312 high).- Not much of a pause gleaned from Feb minutes: "pause" came up just once in the minutes, in the context of other central banks indicating they were at or near a point where it could be appropriate to do so.

- Fed funds implied hike for Mar'23 at 29.6bp, May'23 cumulative 55.6bp (+1.8) to 5.143%, Jun'23 72.2bp (+3.3) to 5.309%, terminal climbs to 5.38% high in Aug'23.

- Tsys had bounced earlier after StL Fed Bullard interview on CNBC siphoned some hawkish positioning out of markets. StL Fed Bullard sees "tough road ahead" on inflation, rates reaching 5.375%, he states "we have a good shot at beating inflation in 2023", while mkt may be overpricing chances of recession.

- Heavy two-way trade (TYH3>3.8M) driven by quarterly futures rolls from Mar'23 to Jun'23 ahead next Tue First Notice (Jun'23 takes lead).

- Tsy futures dip briefly, still firm after $43B 5Y note auction (91282CGH8) tails: 4.109% high yield vs. 4.105% WI; 2.48x bid-to-cover vs. 2.64x the prior month.

OVERNIGHT DATA

US MBA: REFIS -2% SA; PURCH INDEX -18% SA THRU FEB 17 WK

US MBA: UNADJ PURCHASE INDEX -41% VS YEAR-EARLIER LEVEL

US MBA: 30-YR CONFORMING MORTGAGE RATE 6.62% VS 6.39% PRE

US MBA: MARKET COMPOSITE -13.3% SA THRU FEB 17 WK

US REDBOOK: FEB STORE SALES +4.8% V YR AGO MO

US REDBOOK: STORE SALES +5.3% WK ENDED FEB 18 V YR AGO WK

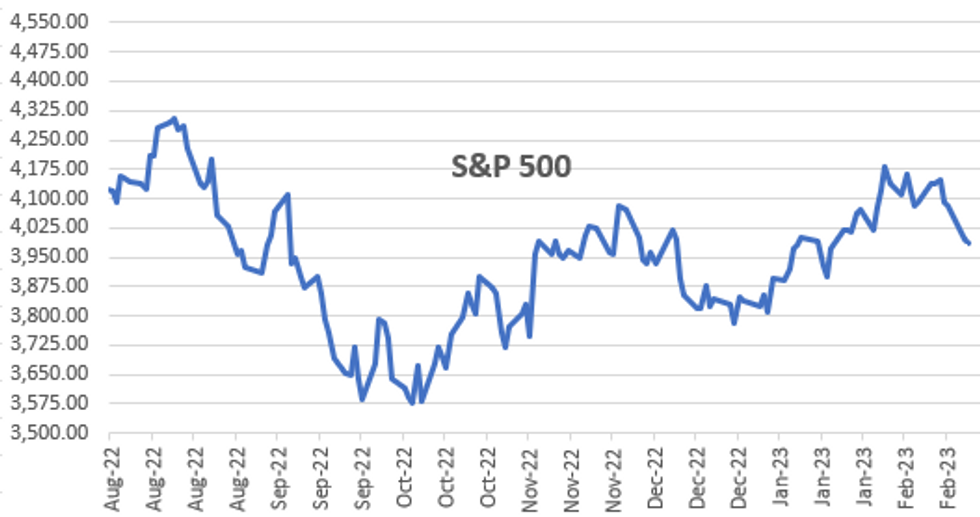

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 143.64 points (-0.43%) at 32985.78

- S&P E-Mini Future down 16.25 points (-0.41%) at 3989

- Nasdaq down 17.4 points (-0.2%) at 11474.03

- US 10-Yr yield is down 3.3 bps at 3.9195%

- US Mar 10-Yr futures are up 4.5/32 at 111-6.5

- EURUSD down 0.0047 (-0.44%) at 1.0601

- USDJPY down 0.07 (-0.05%) at 134.93

- Gold is down $9.96 (-0.54%) at $1824.83

- EuroStoxx 50 down 7.52 points (-0.18%) at 4242.88

- FTSE 100 down 47.12 points (-0.59%) at 7930.63

- German DAX up 2.27 points (0.01%) at 15399.89

- French CAC 40 down 9.39 points (-0.13%) at 7299.26

US TREASURY FUTURES CLOSE

- 3M10Y -5.573, -94.008 (L: -97.38 / H: -85.562)

- 2Y10Y -0.163, -77.598 (L: -80.226 / H: -73.312)

- 2Y30Y -1.611, -77.119 (L: -78.954 / H: -71.042)

- 5Y30Y -2.074, -22.521 (L: -23.017 / H: -17.867)

- Current futures levels:

- Mar 2-Yr futures up 0.375/32 at 101-26 (L: 101-25.125 / H: 101-28.75)

- Mar 5-Yr futures up 2.75/32 at 106-27 (L: 106-22.25 / H: 107-00.75)

- Mar 10-Yr futures up 4/32 at 111-6 (L: 110-30.5 / H: 111-14.5)

- Mar 30-Yr futures up 14/32 at 124-17 (L: 123-30 / H: 124-30)

- Mar Ultra futures up 1-4/32 at 134-26 (L: 133-16 / H: 135-11)

(H3) Near-Term Weakness Persists

- RES 4: 115-22+ High Feb 3

- RES 3: 115-00 Round number resistance

- RES 2: 113-15 50-day EMA

- RES 1: 112-30 20-day EMA

- PRICE: 111-13+ @ 1330ET Feb 22

- SUP 1: 110-30+ Low Feb 22

- SUP 2: 110-23 Lower 2.0% Bollinger Band

- SUP 3: 110-07 2.0% 10-dma envelope

- SUP 4: 109-22 Low Nov 3

Near-term weakness extends across Treasury futures, putting prices at new pullback lows of 110-30+. This puts the contract through the early January lows, opening medium-term losses toward levels not seen since November. The strengthening bearish theme exposes 109-22 over the medium-term, the Nov 3 low. Key short-term resistance is seen at the 50-day EMA which intersects at 113-15. A break of this EMA would ease bearish pressure.

EURODOLLAR FUTURES CLOSE

- Mar 23 -0.013 at 94.883

- Jun 23 -0.015 at 94.480

- Sep 23 -0.010 at 94.380

- Dec 23 -0.010 at 94.595

- Red Pack (Mar 24-Dec 24) -0.015 to +0.040

- Green Pack (Mar 25-Dec 25) +0.020 to +0.035

- Blue Pack (Mar 26-Dec 26) +0.010 to +0.020

- Gold Pack (Mar 27-Dec 27) +0.020 to +0.025

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00300 to 4.55686% (+0.00000/wk)

- 1M +0.01229 to 4.60429% (+0.01300/wk)

- 3M +0.00600 to 4.92814% (+0.01285/wk)*/**

- 6M +0.01357 to 5.27100% (+0.02800/wk)

- 12M -0.02000 to 5.61943% (-0.02343/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 4.92814% on 2/22/23

- Daily Effective Fed Funds Rate: 4.58% volume: $100B

- Daily Overnight Bank Funding Rate: 4.57% volume: $295B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.164T

- Broad General Collateral Rate (BGCR): 4.52%, $475B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $460B

- (rate, volume levels reflect prior session)

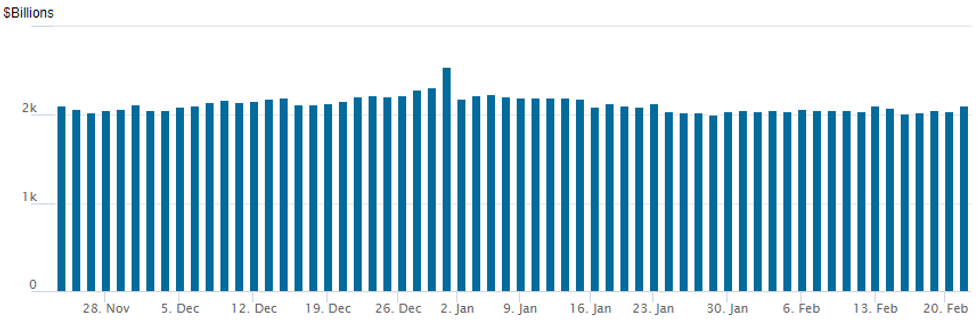

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,113.849B w/ 100 counterparties vs. prior session's $2,046.064B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: $500M Eastman Chemical 10Y Launched

- Date $MM Issuer (Priced *, Launch #)

- 02/22 $2.5B #NextEra WNG 2Y +120

- 02/22 $1B *OKB 5Y SOFR+36

- 02/22 $500M #Eastman Chemical 10Y +185

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/02/2023 | 0030/1130 | * |  | AU | Private New Capex and Expected Expenditure |

| 23/02/2023 | 0930/0930 |  | UK | BOE Mann Speech at Resolution Foundation | |

| 23/02/2023 | 1000/1100 | *** |  | EU | HICP (f) |

| 23/02/2023 | 1100/0600 | * |  | TR | Turkey Benchmark Rate |

| 23/02/2023 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 23/02/2023 | 1330/0830 | * |  | CA | Payroll employment |

| 23/02/2023 | 1330/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 23/02/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 23/02/2023 | 1330/0830 | *** |  | US | GDP (2nd) |

| 23/02/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 23/02/2023 | 1550/1050 |  | US | Atlanta Fed's Raphael Bostic | |

| 23/02/2023 | 1600/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 23/02/2023 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 23/02/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 23/02/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 23/02/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 23/02/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/02/2023 | 1900/1400 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.