-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Focus on FOMC, Steady Rates and Dot Projections

- MNI INTERVIEW: More FOMC Members Set To Raise R-Star-Rosengren

- MNI BOE WATCH: 25bp Hike Expected, Eyes On "Table-Top" Policy

- MNI INTERVIEW: September Rate Rise Probably ECB's Last- Simkus

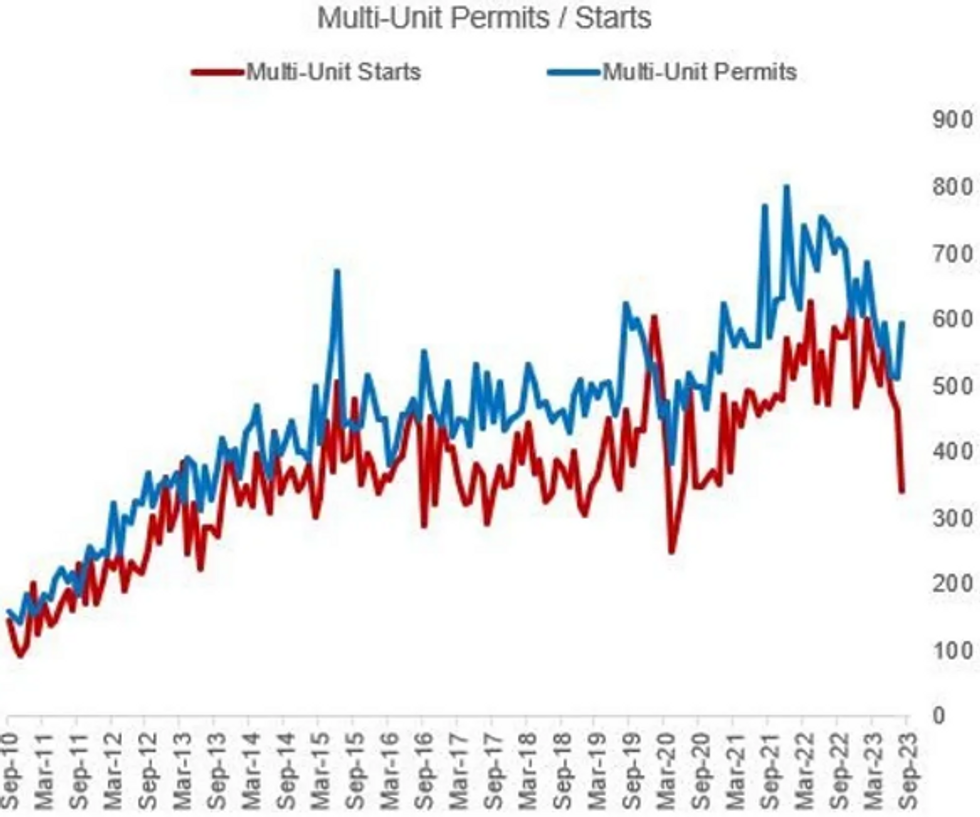

- MNI Multi-Unit Starts A Big Drag On August Housing Activity

US

FED: More Federal Reserve policymakers are likely to raise their view of the longer-run neutral interest rate in updated forecasts this week to around 2.75%, meaning the central bank would have a slower path of cuts in coming years to a higher level, former Boston Fed President Eric Rosengren told MNI.

- "The fact that we're keeping a pretty constant unemployment rate at a time when interest rates are well above that 2.5% has to start making people think about whether the real interest rate has increased more than people have expected," he said. Rosengren said he would pencil in a number a little higher than the FOMC's current 2.5% for the longer-run neutral rate.

- "If you believe in AI that's going to increase productivity, that would imply R-star being higher. If you thought the deficit was going to continue to be an issue, less fiscal restraint means R-star is going to be higher," he said. "There are reasons and recent evidence to believe that R-star would be higher." For more see MNI Policy main wire at 1028ET.

UK

BOE: The Bank of England is widely expected to hike by 25 basis points to 5.5% at its September meeting, but the Monetary Policy Committee will struggle to reach agreement over any signal that the policy rate is around its peak level and that it is likely to stay little changed for a significant period.

- While the BOE’s minutes are likely to reflect some support for the so-called “Table Mountain” or “Table Top” approach, the policy statement is unlikely to do more than signal the concept in a loose form. While Chief Economist Huw Pill has expressed support for a Table Mountain approach and independent MPC member Swati Dhingra told the Treasury Select Committee that the “trade-off between how high we go and the duration of staying high is fundamental,” Catherine Mann, another independent, has warned against signalling flat policy. (See MNI INTERVIEW:Flat Rates Fit With Data Dependence-ExBoe's Bean)

- Holding rates constant at current levels risks extending excessive price rises, Mann said in a Sept 11 speech, pointing to what she was said was an increasing inflation risk premium priced into the UK’s macroeconomic prospects. For more see MNI Policy main wire at 0812ET.

EUROPE

ECB: The European Central Bank has probably raised key interest rates for the final time in the cycle, the governor of the Bank of Lithuania told MNI, adding that cuts would be on the table if growth declines more quickly than expected.

- “Barring any surprises, I don’t expect for us to need to think about another hike,” Gediminas Simkus, regarded as a monetary policy hawk, said in an interview. “I would say that we are in sufficiently restrictive monetary policy territory. But of course, it will eventually depend on the data.”

- With attention shifting to how long rates will remain at their peak, Simkus said that while it is “way too early” to talk about cuts, Governing Council members will also pay close attention to the health of the eurozone economy.

- “Our baseline is a soft landing rather than a sharp decline in GDP. But it's quite clear that if the economy proves to be much weaker than projected, and we have to revise the GDP forecast, then we will see,” he said. “We can't ignore the euro area growth output in general, because it very much plays into price pressures in the medium term. I am already trying to think about what’s important for 2026.” For more see MNI Policy main wire at 1147ET.

US TSYS Yields Mark 16 Year Highs Ahead Wed's FOMC Rate Announcement

- Treasury futures have quietly extended session lows after the bell, yields climbing to the highest levels since November 2007 (10YY 4.367%, 5Y 4.5205%). Generally subdued in the lead-up to Wednesday's FOMC policy annc with SEP/dot projections at 1400ET.

- Traders expect the Fed to keep rates on hold with a tightener bias ahead while the median of analysts’ expectations for the Fed’s September Dot Plot rates suggest that the central expectation is for no changes from June’s projections: 5.6% for 2023, 4.6% for 2024, 3.4% for 2025, with the new entry for 2026 at 2.6%, and the Longer-Run rate at 2.5%.

- Little react to this morning's data with a brief flurry of two way trade after higher than expected Building Permits (1.543M vs. 1.440M est, 1.443M prior/rev), MoM (6.9% vs -0.2% est) while Housing Starts comes out softer (1.283M vs. 1.439M), MoM (-11.3 vs. -0.9% est, 2.0% rev/prior).

- Rates recovered some ground in the first half as early Greenback weakness reversed, only to reverse course in the second half with TYZ3 trading just above technical support of 109-03 (bear trigger).

- Little change -- Tsy futures still hold weaker levels after $13B 20Y bond auction reopen (912810TU2) draws 4.592% high yield vs. 4.592% WI; 2.74x bid-to-cover vs. prior month's 2.56x.

OVERNIGHT DATA

- US AUG HOUSING STARTS 1.283M; PERMITS 1.543M

- US JUL STARTS REVISED TO 1.447M; PERMITS 1.443M

- US AUG HOUSING COMPLETIONS 1.406M; JUL 1.335M (REV)

US DATA: August's residential construction data came in very mixed versus expectations.

- Housing starts dropped to 1.283mln on a seasonally-adjusted annual rate from 1.447mln prior (rev July), missing expectations by over 150k. But building permits beat expectations by over 100k at 1.543mln (had been expected to stay relatively flat from July's rev. 1.443mln).

- The driver behind the weak starts figure was a 122k drop in multi-unit starts to 342k, the lowest since May 2020 at the start of the pandemic. Single family starts dipped to 941k, down 42k from July but still well above the sub-900k readings seen going into the summer.

- Permits were a different story: multi-unit (ie apartment building) permits rose to the joint-highest since March (594k, up 81k from Jul), with single family permits ticking up 19k to 949k.

- Overall it looks as though single family housing activity has stabilized from the late 2022 post-pandemic lows, albeit below the boom times of 2020-21. And despite the tickup in permits, weaker multi-family activity is looking like a big concern for the economy.

- It's only one month and there may have been some one-off effects at play: multi-family starts dropped 82k in the South seasonally adjusted, representing the bulk of the drop, so this could partly reflect a Hurricane Idalia impact.

- But permit activity - which is a leading indicator - has suggested that a pronounced slowdown was coming at some point, and we got another soft homebuilder sentiment reading in Monday's NAHB report.

- The multi-unit sector is seen as being sensitive to higher interest rates and as we've said before, apartment construction in the pipeline is a headwind for rent inflation (and when it slows sharply, a headwind for growth). The stronger permits suggest that we may see a decent end-of-year in multifamily construction, but for now the sector continues to look disinflationary.

- US REDBOOK: SEP STORE SALES +4.1% V YR AGO MO

- US REDBOOK: STORE SALES +3.6% WK ENDED SEP 16 V YR AGO WK

- CANADA AUG CPI +4% YOY VS FORECAST +3.8%, PRIOR +3.3%

- CANADA AUG CPI +0.4% MOM VS FORECAST +0.2%, PRIOR +0.6%

- CANADA CPI EX FOOD & ENERGY +0.2% MOM; +3.6% YOY

- CANADA CORE MEDIAN CPI +4.1% YOY, PRIOR +3.9%

- CANADA CORE TRIM CPI +3.9% YOY, PRIOR +3.%

- CANADA INFLATION RATE QUICKENS AS GASOLINE +4.6% MOM, +0.8% YOY

CANADA DATA: August CPI Rises Faster Than Expected: Headline inflation +4% YOY, prior +3.3%, as favorable base effects fade and gasoline prices increase. The consensus was +3.8%.

- CPI +0.4% month-on-month in August, +0.6% seasonally adjusted. Closely watched core measures increase as trim +3.9%, prior +3.6%, and median +4.1%, prior 3.9%. Excluding gasoline, inflation was +4.1% YOY, the same as in July.

- Rent increased +6% YOY, with mortgage interest costs reaching a new record of +31%. Food prices showed some deceleration as they increased +6.9% YOY from +8.5% in July

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 164.66 points (-0.48%) at 34460.1

- S&P E-Mini Future down 18.75 points (-0.42%) at 4482.5

- Nasdaq down 58.5 points (-0.4%) at 13651.95

- US 10-Yr yield is up 5.8 bps at 4.3607%

- US Dec 10-Yr futures are down 11.5/32 at 109-5

- EURUSD down 0.0014 (-0.13%) at 1.0678

- USDJPY up 0.25 (0.17%) at 147.86

- WTI Crude Oil (front-month) down $0.16 (-0.17%) at $91.32

- Gold is down $2.24 (-0.12%) at $1931.68

European bourses closing levels:

- EuroStoxx 50 down 3.18 points (-0.07%) at 4242.7

- FTSE 100 up 7.26 points (0.09%) at 7660.2

- German DAX down 62.64 points (-0.4%) at 15664.48

- French CAC 40 up 5.98 points (0.08%) at 7282.12

US TREASURY FUTURES CLOSE

- 3M10Y +4.275, -111.995 (L: -119.748 / H: -111.594)

- 2Y10Y +0.897, -74.443 (L: -75.952 / H: -72.507)

- 2Y30Y -0.808, -67.999 (L: -69.536 / H: -64.892)

- 5Y30Y -2.415, -9.002 (L: -9.619 / H: -5.511)

- Current futures levels:

- Dec 2-Yr futures down 3/32 at 101-11.25 (L: 101-10.875 / H: 101-15.25)

- Dec 5-Yr futures down 7.75/32 at 105-21.25 (L: 105-20.25 / H: 105-31.75)

- Dec 10-Yr futures down 12/32 at 109-4.5 (L: 109-03.5 / H: 109-20)

- Dec 30-Yr futures down 17/32 at 118-8 (L: 118-03 / H: 119-00)

- Dec Ultra futures down 22/32 at 124-22 (L: 124-15 / H: 125-20)

US 10Y FUTURE TECHS: (Z3) Support Remains Intact, For Now

- RES 4: 111-12+ High Sep 1 key resistance

- RES 3: 111-02 50-day EMA

- RES 2: 110-10+ High Sep 8

- RES 1: 110-03+ 20-day EMA

- PRICE: 109-18 @ 11:36 BST Sep 19

- SUP 1: 109-03 Low Sep 13 and the bear trigger

- SUP 2: 109-00 Round number support

- SUP 3: 108-20 1.000 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 4: 107.23 1.236 proj of the Jul 18 - Aug 4 - Aug 10 price swing

The trend in Treasuries remains bearish and last week’s low of 109-03 (Sep 13) reinforces the bearish theme. However, the recovery from Wednesday’s low was a bullish development and a hammer candle - a reversal signal - was confirmed at the close. The pattern remains valid and If correct, suggests scope for a correction near-term. First resistance to watch is 110-03+, 20-day EMA. On the downside, a break of 109-03 would resume the downtrend.

SOFR FUTURES CLOSE

- Sep 23 +0.005 at 94.610

- Dec 23 -0.005 at 94.530

- Mar 24 -0.015 at 94.620

- Jun 24 -0.045 at 94.805

- Red Pack (Sep 24-Jun 25) -0.085 to -0.06

- Green Pack (Sep 25-Jun 26) -0.085 to -0.075

- Blue Pack (Sep 26-Jun 27) -0.07 to -0.055

- Gold Pack (Sep 27-Jun 28) -0.05 to -0.04

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00075 to 5.32409 (-0.00295/wk)

- 3M -0.00083 to 5.39702 (-0.00466/wk)

- 6M +0.00251 to 5.46857 (+0.00273/wk)

- 12M +0.01140 to 5.45434 (+0.03290/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $94B

- Daily Overnight Bank Funding Rate: 5.32% volume: $259B

- Secured Overnight Financing Rate (SOFR): 5.31%, $1.565T

- Broad General Collateral Rate (BGCR): 5.30%, $574B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $561B

- (rate, volume levels reflect prior session)

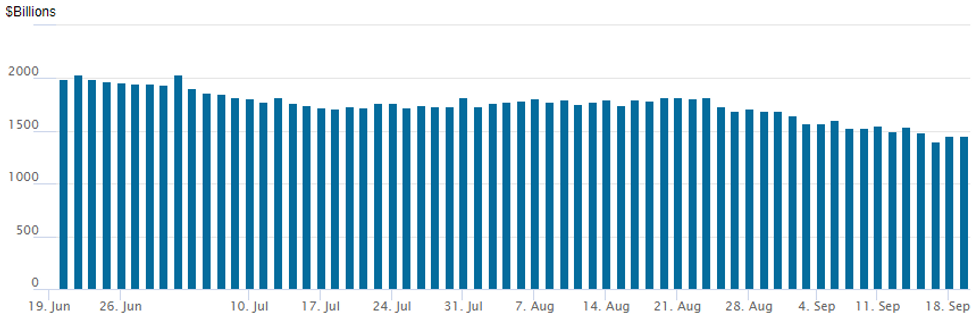

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation inches up to: 1,453.324B w/96 counterparties, compared to $1,452.942B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE $3.5B World Bank (IBRD) 5Y SOFR Priced

- Date $MM Issuer (Priced *, Launch #)

- 09/19 $3.5B *World Bank (IBRD) 5Y SOFR+34

- 09/19 $1.25B #Danske Bank 3NC2 +118

- 09/19 $Benchmark Five Holdings Ltd 5NC2 investor calls

EGBs-GILTS CASH CLOSE: German Yields Hit Fresh Multi-Month/Year Highs

Gilts outperformed Bunds Tuesday ahead of Wednesday's UK CPI data and the BoE decision Thursday.

- The UK curve leaned bull flatter through the 10Y tenor with Germany's marginally bear flattening.

- Despite little in the way of headline or data catalysts, German yields hit multi-month highs (2Y / 5Y since July, 10Y since March, 30Y since 2011), with weakness accelerating briefly after higher-than-expected Canadian inflation data in the European afternoon.

- ECB's Villeroy said the ECB will keep rates at 4% for as long as needed to achieve its inflation goals; ECB's Simkus told MNI that "barring any surprises, I don’t expect for us to need to think about another hike".

- Gilt yields in contrast closed near their session lows ahead of key flashpoints the next two days.

- Our Bank of England preview (PDF here) was published today: we discuss the data leading up to the expected 25bp rate hike decision Thursday, and the potential for changes to forward guidance.

- The key data of course is tomorrow morning's CPI report, for which the Services component will be key - MNI's UK inflation preview PDF here.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3bps at 3.285%, 5-Yr is up 3.5bps at 2.77%, 10-Yr is up 3bps at 2.738%, and 30-Yr is up 2.3bps at 2.867%.

- UK: The 2-Yr yield is down 3.9bps at 4.994%, 5-Yr is down 4bps at 4.535%, 10-Yr is down 5.1bps at 4.34%, and 30-Yr is down 1.7bps at 4.714%.

- Italian BTP spread down 2.5bps at 177.9bps / Greek down 5.6bps at 139bps

FOREX Early Greenback Weakness Reverses, Narrow Pre-FOMC Ranges

- Initial greenback weakness on Tuesday saw the USD index fall around 0.25% ahead of NY trade. However, firmer-than expected August Building Permits data in the US sparked a reversal back to unchanged levels, keeping G10 ranges very contained ahead of Wednesday’s FOMC decision and press conference.

- The strong details of the Canadian August CPI report means that CAD is near the top of the G10 FX leaderboard, with USDCAD having briefly breached support below 1.3394 to trade as low as 1.3381. The pair has had a solid bounce along with the broad greenback reversal, however, USDCAD does remain 0.3% lower on the session. In similar vein, the Norwegian Krone is the best performing currency after yesterday’s struggles and ahead of Thursday’s Norges Bank rate decision. The overall crude oil complex continues to be supported by indications of tightening supply and more optimistic views of demand.

- Ahead of the Fed decision tomorrow, it is worth noting that USDJPY has been edging higher as we approach the APAC crossover, to trade within 5 pips of last week’s high at 147.95. Higher US yields have been unable to spark any topside momentum, however, trend conditions remain firmly in bullish territory, with sights on 148.40 next, the Nov 4 2022 high.

- UK CPI headlines the docket on Wednesday morning ahead of the Bank of England decision on Thursday. Despite a very muted session for GBPUSD, the trend needle continues to point south and the pair is trading near recent lows. The focus is on 1.2369, the Jun 5 low, and 1.2308, the May 25 low and a key support.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/09/2023 | 2301/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 20/09/2023 | 0115/0915 | *** |  | CN | Loan Prime Rate |

| 20/09/2023 | 0600/0800 | ** |  | DE | PPI |

| 20/09/2023 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 20/09/2023 | 0600/0700 | *** |  | UK | Producer Prices |

| 20/09/2023 | 0600/0800 | ** |  | SE | Unemployment |

| 20/09/2023 | 0700/0900 |  | EU | ECB's Panetta Speaks at Workshop | |

| 20/09/2023 | 0900/1100 | ** |  | EU | Construction Production |

| 20/09/2023 | 0900/1100 |  | EU | ECB's Schnabel Speaks at Event | |

| 20/09/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 20/09/2023 | 1230/1430 |  | EU | ECB's Elderson Speaks at Springtji Forum | |

| 20/09/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 20/09/2023 | 1730/1330 |  | CA | BOC minutes from last rate meeting | |

| 20/09/2023 | 1800/1400 | *** |  | US | FOMC Statement |

| 21/09/2023 | 2245/0045 |  | EU | ECB's Lane Speaks at NYU |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.