-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Higher PPI Less Inflationary at Core

- MNI: Most Of FOMC Saw One More Hike This Year -- Fed Minutes

- MNI: Fed's Bowman Sees Risk of Impaired Treasury Market

- MNI BRIEF: Waller-Tighter Markets Doing Some Of Fed’s Work

- MNI: PPI Higher Than Expected, But Less Worrisome In The Core Details

US

FED: Most Federal Reserve officials agreed at their September meeting that they would need to raise interest rates one more time this year, according to minutes from the central bank’s September meeting, although the recent spike in bond yields since the meeting appears to have dampened that inclination to some degree.

- “A majority of participants judged that one more increase in the target federal funds rate at a future meeting would likely be appropriate, while some judged it likely that no further increases would be warranted. All participants agreed that the Committee was in a position to proceed carefully,” the Fed minutes said.

- The minutes highlighted the Fed’s higher for longer message. “All participants agreed that policy should remain restrictive for some time until the Committee is confident that inflation is moving down sustainably toward its objective,” the report said. For more see MNI Policy main wire at 1401ET.

FED: Federal Reserve Governor Michelle Bowman warned Wednesday Treasury market functioning is at risk of again becoming impaired, especially as Fed QT continues and Treasury auction volumes expand to meet issuance needs, and that can disrupt central bank plans.

- "U.S. Treasury market stress events -- including the repo-market stress in September 2019 and the March 2020 dash for cash -- have raised concerns about the resiliency of U.S. Treasury markets," she said in remarks prepared for The Reinventing Bretton Woods Committee and Policy Center for the New South Marrakech Economic Festival in Marrakesh, Morocco. "It will be important to watch for signs of impaired Treasury market functioning."

- Dealer balance sheet capacity may become strained, especially in times of volatile financial markets, limiting market funding, she added. Regulators should contemplate lowering the leverage ratio and global systemically important bank (G-SIB) surcharge for large U.S. banks as these are set much higher than the international standard, she said.

FED: The rise in long-term yields is tightening financial conditions in much the same way as Federal Reserve interest rate increases do, Fed Governor Christopher Waller said Wednesday. “Financial markets are tightening up and they’re going to do some of the work for us,” he said during a Q&A, adding that policymakers would need to watch those movements to see how they would interact with monetary policy.

- Waller, one of the more hawkish voices on the FOMC, sounded sanguine on the inflation outlook. “We’re finally getting very good inflation data. If this continues we’re pretty much back to our target. We’re seeing wages softening. That portends well for service sector firms." (See MNI POLICY: Softer Trend Inflation Boosts Case For Fed Pause) At the same time, the economy is still growing very quickly in a way that should keep officials on watch, said Waller, adding that Q3 GDP growth could exceed 4%.

US TSYS No Surprises From September FOMC Minutes

- Treasury futures climbed off second half lows as the September FOMC Minutes showed a majority expect one more hike, while some deemed further increases not warranted.

- Fed officials continued to pencil in one additional rate increase this year in their Summary of Economic Projections. That was before a deepening selloff in longer-run Treasuries pushed 10-year yields to 16-year highs, a move some policymakers have since argued could be a substitute for additional rate hikes.

- Projected rate hikes into early 2024 are largely treading water after the minutes release: November at 9.8% (compared to 30.5% late Fri), w/ implied rate change of +1.9bp to 5.348%, December cumulative of 7.6bp at 5.405%, January 2024 5.9bp at 5.387%. Fed terminal at 5.40% in Jan'24.

- Still off early session highs where Dec'23 10Y futures (TYZ3) traded up to 108-11 earlier are currently trading 108-00.5, well inside technicals: resistance at 108-11, support at 106-12 (2.0% Lower Bollinger Band).

- Treasury futures had pared gains after the $35B 10Y note auction reopen (91282CHT1) tailed: 4.610% high yield vs. 4.594% WI; 2.50x bid-to-cover vs. 2.52x prior.

- Nomination of Scalise to replace McCarthy as House speaker appeared to improve risk sentiment somewhat as stocks traded modestly higher: S&P E-Mini futures are up 6.75 points (0.15%) at 4398,DJIA up 2.5 points (0.01%) at 33741.96, Nasdaq up 58.9 points (0.4%) at 13622.06.

OVERNIGHT DATA

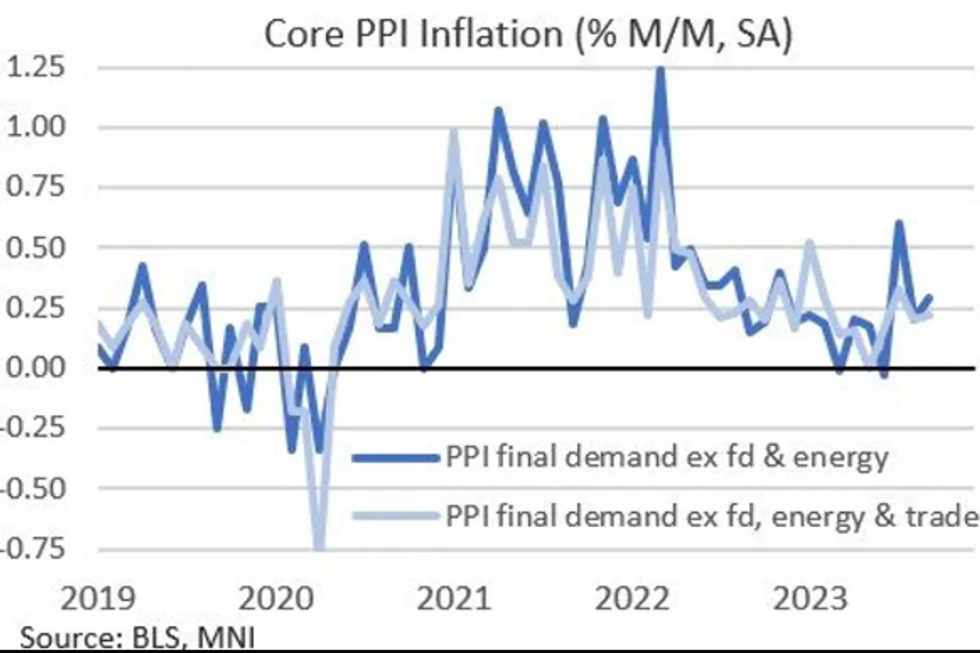

- US SEP FINAL DEMAND PPI +0.5%, EX FOOD, ENERGY +0.3%

- US SEP FINAL DEMAND PPI EX FOOD, ENERGY, TRADE SERVICES +0.2%

- US SEP FINAL DEMAND PPI Y/Y +2.2%, EX FOOD, ENERGY Y/Y +2.7%

- US SEP PPI: FOOD +0.9%; ENERGY +3.3%

- US SEP PPI: GOODS +0.9%; SERVICES +0.3%; TRADE SERVICES +0.5%

A higher-than-expected September PPI contained details that look less inflationary from a core perspective as we head to Thursday's CPI:

- The 0.5% M/M rise was higher than the 0.3% estimate (+0.7% prior), with ex-food and energy +0.3% vs 0.2% expected (+0.2% prior). Ex-food, energy, and trade services printed 0.2% M/M for the 2nd consecutive month (upon revision from 0.3% for August).

- Most of the increase in goods can largely be discounted from a core PCE / CPI perspective - 3/4 of the increase is due to the rise in energy prices (which pulled back sharply from 10.3% in Aug) as expected to be mirrored in the CPI release tomorrow. The jump in goods to a 10-month high +0.9% M/M was more concerning in this regard.

- Final demand services were up 0.3%, but the BLS notes that a major factor was a 13.9% jump in the index for "deposit services" (which had been negative the prior 2 months) - there's no explanation of this in the release but it's imputed from interest rate spreads.

- Looking at the PCE categories. Airline passenger services (which are used in PCE as airfares, and not the CPI reading out tomorrow) fell by the most since April, -2.1% M/M.

- Health care services ticked a little higher unrounded but were steady rounded at 0.1% M/M; health and medical insurance prices pulled back sharply to 0.2% from 0.5% prior.

- Insurance costs overall though pulled back to 0.2% M/M from 0.3% prior; auto insurance costs notably ticked higher.

- US MBA: MARKET COMPOSITE +0.6% SA THRU OCT 06 WK

- US MBA: REFIS +0.3% SA; PURCH INDEX +1% SA THRU OCT 6 WK

- US MBA: UNADJ PURCHASE INDEX -19% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 7.67% VS 7.53% PREV

- CANADIAN AUG BUILDING PERMITS +3.4% MOM

- CANADA RESIDENTIAL BUILDING PERMITS -3.7%; NON-RESIDENTIAL +14.8%

MARKETS SNAPSHOT

- Key late session market levels:

- DJIA down 4.47 points (-0.01%) at 33736.7

- S&P E-Mini Future up 6 points (0.14%) at 4398

- Nasdaq up 55.1 points (0.4%) at 13618.58

- US 10-Yr yield is down 7 bps at 4.5829%

- US Dec 10-Yr futures are up 9/32 at 108-0

- EURUSD up 0.0006 (0.06%) at 1.0611

- USDJPY up 0.52 (0.35%) at 149.23

- WTI Crude Oil (front-month) down $2.11 (-2.45%) at $83.83

- Gold is up $13.17 (0.71%) at $1873.56

- European bourses closing levels:

- EuroStoxx 50 down 4.43 points (-0.11%) at 4200.8

- FTSE 100 down 8.18 points (-0.11%) at 7620.03

- German DAX up 36.49 points (0.24%) at 15460.01

- French CAC 40 down 31.22 points (-0.44%) at 7131.21

US TREASURY FUTURES CLOSE

- 3M10Y -6.72, -92.299 (L: -96.165 / H: -84.908)

- 2Y10Y -9.524, -41.607 (L: -43.068 / H: -31.866)

- 2Y30Y -13.203, -27.224 (L: -28.278 / H: -13.702)

- 5Y30Y -8.727, 13.054 (L: 11.48 / H: 22.344)

- Current futures levels:

- Dec 2-Yr futures down 1/32 at 101-14 (L: 101-12.375 / H: 101-17)

- Dec 5-Yr futures up 1.5/32 at 105-12.25 (L: 105-07.25 / H: 105-19.75)

- Dec 10-Yr futures up 9.5/32 at 108-0.5 (L: 107-21 / H: 108-11)

- Dec 30-Yr futures up 1-14/32 at 113-16 (L: 111-31 / H: 113-25)

- Dec Ultra futures up 1-29/32 at 118-10 (L: 116-07 / H: 118-22)

US 10Y FUTURE TECHS: (Z3) Bounce Tops 20-day EMA

- RES 4: 109-24+ 50-day EMA

- RES 3: 108-26+ High Sep 22

- RES 2: 108-14+ High Sep 29

- RES 1: 108-11 High Oct 11

- PRICE: 108-00+ @ 1530 ET Oct 11

- SUP 1: 106-12 2.0% Lower Bollinger Band

- SUP 2: 106-03+/00 Low Sep 4 / Round number support

- SUP 3: 105-11 2.0% 10-dma envelope

- SUP 4: 104-26 2.00 proj of the Jul 18 - Aug 4 - Aug 10 price swing

Markets trade firmer through the 20-day EMA early Wednesday, further building momentum and signalling a possible base at the early October lows. The near-term upside opens for further gains toward late September levels at 108-14+, the Sep29 high. With last week’s lows yet to be re-tested, a further stabilisation in prices could signal a near-term reversal higher. For bears to regain control, weakness through 106-12 would signal a fade in the short-term momentum, and open further losses.

SOFR FUTURES CLOSE

- Dec 23 -0.005 at 94.575

- Mar 24 -0.015 at 94.70

- Jun 24 -0.020 at 94.920

- Sep 24 -0.030 at 95.185

- Red Pack (Dec 24-Sep 25) -0.035 to steadysteady0

- Green Pack (Dec 25-Sep 26) +0.015 to +0.045

- Blue Pack (Dec 26-Sep 27) +0.050 to +0.075

- Gold Pack (Dec 27-Sep 28) +0.075 to +0.095

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.01639 to 5.33238 (-0.00869/wk)

- 3M -0.03200 to 5.39377 (-0.01297/wk)

- 6M -0.04975 to 5.43464 (-0.01982/wk)

- 12M -0.08973 to 5.35601 (-0.04055/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $95B

- Daily Overnight Bank Funding Rate: 5.32% volume: $255B

- Secured Overnight Financing Rate (SOFR): 5.31%, $1.522T

- Broad General Collateral Rate (BGCR): 5.30%, $561B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $552B

- (rate, volume levels reflect prior session)

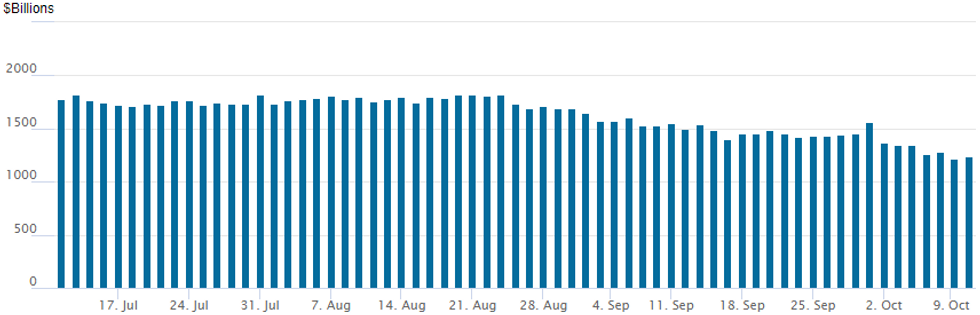

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation usage climbs to $1,239.382B w/100 counterparties vs. $1,222.440B (lowest since mid-September 2021) in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE $3.5B Smucker 4Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 10/11 $6B *KFW 2Y SOFR+21, 7Y SOFR+49

- 10/11 $3.5B #Smucker $750M 5Y +130, $1B 10Y +160, $750M 20Y +162.5, $1B 30Y +180

- 10/11 $1.25B #Nationwide BS 4NC3 +180

- 10/11 $500M *JBIC WNG 5Y SOFR+59

EGBs-GILTS CASH CLOSE: Flatter On Geopolitical Concerns

The German and UK curves flattened Wednesday, with Gilts outperforming.

- Most gains were posted in the morning, with a safe-haven bid centred around geopolitical concerns (rockets fired between Israel and Lebanon), helped by more dovish-leaning Federal Reserve participant commentary (Gov Bowman).

- Gains stalled in early afternoon, as US producer prices came in higher than expected ahead of Thursday's US CPI report; the rally resumed later in the day as oil prices dropped sharply on reports casting doubt on Iran's role in the Hamas attacks on Israel. Notably European gas prices also dropped sharply on the day.

- Yields closed near the lows, with the short end relatively stubborn: the German curve twist flattened with Schatz yields higher; 2Y UK yields were relatively flat in a bull flattening move.

- Periphery spreads mostly tightened, appearing to track oil prices in the latter half of the session, after having benefited earlier from higher equities.

- UK GDP represents the European data highlight first thing Thursday; we get several central bank speakers as well including BOE's Pill, with the ECB's September meeting accounts published - all before the US inflation report in the afternoon.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.8bps at 3.108%, 5-Yr is down 0.6bps at 2.659%, 10-Yr is down 5.7bps at 2.718%, and 30-Yr is down 10.8bps at 2.899%.

- UK: The 2-Yr yield is down 0.2bps at 4.797%, 5-Yr is down 3.8bps at 4.388%, 10-Yr is down 9.8bps at 4.328%, and 30-Yr is down 15.1bps at 4.768%.

- Italian BTP spread up 0.1bps at 195.1bps / Spanish down 0.6bps at 109.9bps

FOREX Antipodean FX Slips Amid Turn Lower For Crude

- The USD index stands in modest positive territory on Wednesday as we approach the APAC crossover amid a turn lower for crude futures and a downtick for equity indices. Price action has weighed the most on Antipodean currencies with both AUD and NZD sliding around 0.65% on the session. Higher front-end yields in the US have supported the dollar, also placing some renewed pressure on the Japanese Yen, with USDJPY grinding back above the 149.00 handle to settle around 149.30. The FOMC minutes prompted some very marginal greenback selling off the highs.

- AUDUSD remains bearish following last week’s breach of support at 0.6331, despite the broad strength posted across the past three sessions. Last week’s break of support confirmed a range breakout and a resumption of the downtrend that started early February. This signals scope for 0.6215 next, a Fibonacci projection.

- As noted, the USDJPY uptrend remains intact. A clear break of the 150.00 handle would reinforce bullish conditions. The bull trigger is 150.16, the Oct 3 high.

- In emerging markets, both the South African rand and the Mexican peso extended their strong recoveries this week, remaining largely unfazed by the ongoing developments in the middle east.

- Focus turns to US inflation data on Thursday, where ex-food and energy (core) CPI is expected to print 0.3% M/M in September for the 2nd month in a row, still firmly higher than the unrounded 0.16% M/M readings in both June and July. Even in the case of an upside shock, this CPI report is unlikely to spur the FOMC to hike at the November meeting, and a December hike would probably require the October and November inflation prints to also show insufficient progress on inflation.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/10/2023 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 12/10/2023 | 0600/0700 | ** |  | UK | Index of Services |

| 12/10/2023 | 0600/0700 | *** |  | UK | Index of Production |

| 12/10/2023 | 0600/0700 | ** |  | UK | Trade Balance |

| 12/10/2023 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 12/10/2023 | 0740/0940 |  | EU | ECB's Elderson attends EC Summit | |

| 12/10/2023 | 0900/1000 |  | UK | BoE's Pill speaks in Marrakesh | |

| 12/10/2023 | 1100/1300 |  | EU | ECB's Panetta participates in IMF panel | |

| 12/10/2023 | 1230/0830 | *** |  | US | Jobless Claims |

| 12/10/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 12/10/2023 | 1230/0830 | *** |  | US | CPI |

| 12/10/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 12/10/2023 | 1500/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 12/10/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 12/10/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 12/10/2023 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/10/2023 | 1700/1300 |  | US | Atlanta Fed's Raphael Bostic | |

| 12/10/2023 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 12/10/2023 | 1800/1400 | ** |  | US | Treasury Budget |

| 12/10/2023 | 2000/1600 |  | US | Boston Fed's Susan Collins |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.