-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Inflation Expectations Climb Ahead Next FOMC

- MNI Fed Preview - Nov 2023: Determining A High Yield Strategy

- MNI INTERVIEW: Fed Caution Warranted As Price Views Soar-UMich

- MNI INTERVIEW: Blinder Sees Fed Rates At Peak For About A Year

- MNI: Forks In Road Ahead For Fed's QT Plan -Ex-Staff

- MNI Core PCE Trends Stall 0.5-1pp Above Target

- MNI U.Mich 1Y Inflation Expectations Surprisingly Surge Beyond Flash Estimate

US

FED: The FOMC will leave rates unchanged for the 2nd consecutive meeting on Nov 1.

- While economic activity data has been strong and inflation progress has arguably stalled since the September meeting, the Committee will maintain a cautious approach as it assesses the impact of tighter financial conditions and the lagged effects of past tightening.

- Powell’s press conference and the Statement will attempt to underpin market hike pricing which is broadly aligned with the Fed’s previously signaled path.

- This will include maintaining a bias toward further tightening, though Powell has set a fairly high bar to further hikes.

FED: The Federal Reserve should take a cautious stance regarding its progress in tamping down price pressures as one-year-ahead inflation expectations surged to the highest level since May, helping to fuel a significant decline in sentiment, the head of the University of Michigan's Survey of Consumers told MNI.

- "Although inflation is slowing, people's concerns about inflation continued to rise," said survey director Joanne Hsu in an interview Friday.

- "The fact that long term inflation expectations have been between 2.9 and 3.1 for over two years now should tell the Fed that the inflation battle has not necessarily been wrapped up but nobody needs to panic from this jump in one year expectations." (See MNI INTERVIEW: Disinflation Stall Could Force Fed To 6% Or More) For more see MNI Policy main wire at 1236ET.

FED: The Fed is set to keep interest rates at the cycle peak for about a year after deciding whether resilient data merits a final hike or whether the recent spike in yields has sufficiently tightened financial conditions, former Vice Chair Alan Blinder told MNI.

- "My guess is either they’re finished now or maybe, depending on incoming data, they go up another 25 basis points and then hang around that rate for a substantial period of time. I wouldn’t be shocked if it was for a year," Blinder said in an interview. "That’s stabilizing the rate."

- Booming GDP growth in the third quarter also strengthens FOMC hawks but the U.S. economy is expected to slow dramatically in the fourth quarter and the surge in inventory build-up through September could be a bearish signal, he said.

- His view of a long pause after rates peak is in line with the FOMC's September dot plots showing perhaps one more hike this year to about 5.6% and a decline next year to 5.1%. Those projections don't reflect the recent surge in bond yields. For more see MNI Policy main wire at 1139ET.

FED: Treasury market dysfunction or a recession next year will likely end the Federal Reserve's plan to unload trillions of dollars of government assets from its balance sheet, but a soft landing could see QT running another two years as planned, former Fed economists told MNI.

- Having trimmed USD1.1 trillion from their nearly USD9 trillion assets held at peak last year, Fed officials are keen to continue normalizing the balance sheet as long as they're also holding interest rates high enough to restrain economic activity.

- But market participants worry that banks' desire to hold more cash after sudden deposit outflows wiped out several regional lenders this year means reserve scarcity is closer at hand than the Fed believes and, when reached, will trigger sharp and unpredictable moves in markets akin to the repo crisis of 2019 that halted QT and prompted a Fed intervention.

US TSYS Unwinding Risk Ahead Weekend Tsys Extending Highs

- Geopol risk over the weekend saw curves twisted steeper during the second half, short end started outperforming around the time Israeli military spokesman headlines made the rounds: "ISRAELI ARMY SAYS GROUND FORCES EXPANDING ACTIVITY IN GAZA: AP".

- Current Dec'23 2Y futures trade 101-11 (+1.88) while 10Y trades 106-15.5 (+4.5) with initial technical resistance at 106-29 (20-day EMA); 10Y yield -.0099 at 4.8346%, 2Y10Y +2.120 at -17.584.

- Early support in equities evaporated on the headlines as well, longs squaring ahead the weekend (SPX Eminis currently -29.5 at 4125.50).

- Brief two-way reported after Personal Income came in a little lower than expected (0.3% vs. 0.4% est, 0.4% prior), Personal Spending firmer (0.7% vs 0.5% exp, 0.4% prior). PCE deflator's in line: MoM (0.4% vs. 0.3% est, 0.4% prior); YoY (3.4% vs. 3.4% est, 3.4% prior/rev).

- Fast two-way noted Tsys pared gains then rebound after higher than expected UofMich 1Y inflation figure at 4.2% vs. 3.8% est (3.8% prior), 5Y in-line with exp at 3.0%.

- Quiet start to the week ahead, main focus on Wednesday afternoon's FOMC policy annc, ADP private employment data early Wednesday and Non-Farm payrolls next Friday. US Treasury's quarterly borrowing estimates on Monday.

OVERNIGHT DATA

- US SEPT. PCE PRICE INDEX RISES 0.4% M/M; EST. 0.3%

- US SEPT. PCE PRICE INDEX RISES 3.4% Y/Y; EST. 3.4%

- US SEPT. CORE PCE PRICE INDEX RISES 0.3% M/M; EST. 0.3%

- US SEPT. CORE PCE PRICE INDEX RISES 3.7% Y/Y; EST. +3.7%

US DATA: Core PCE ultimately came in as expected at 0.299% M/M (cons 0.3 median, 0.27 av) courtesy of mainly a downward revision to August, meaning it followed an average of 0.168% M/M over the prior three-months instead of 0.178% (we knew there would be a modest net downward revision after yesterday's Q3 advance).

- It saw the 3-month average accelerate to 2.55% annualized after a rare return to target of 2.0% in August for the first time since Dec’20.

- The 6-month average meanwhile eased marginally to 2.8% annualized from 2.9%, its lowest since Feb’21 but with the pace of moderation slowing.

- Combined, the two measures show some slowing in disinflationary progress, a reminder that the process won’t be smooth.

- More of note will be the stalling in the core services ex-housing component, at 4.0% and 3.5% 3-month and 6-month annualized rates respectively as noted earlier.

US DATA: U.Mich consumer inflation expectations jumped further for the 1Y, registering 4.2% vs preliminary 3.8% for a sharp rise from the 3.2% in September, marking its highest reading since May.

- The 5-10Y measure was confirmed to have increased 0.2pps back to 3.0%, back in its narrow 2.9-3.1% range seen in 25 of the last 27 months.

- From the press release: “Consumer sentiment confirmed its early-month reading, falling back about 6% this October following two consecutive months of very little change. This decline was driven in large part by higher-income consumers and those with sizable stock holdings, consistent with recent weakness in equity markets.”

- “While consumers recognize that inflation has slowed down from its peak last summer, they cannot ignore that their budgets remain stretched and their purchasing power reduced,’’ Joanne Hsu, director of the survey, said in a statement.

MARKETS SNAPSHOT

- Key late session market levels

- DJIA down 436.31 points (-1.33%) at 32339.05

- S&P E-Mini Future down 29.5 points (-0.71%) at 4125.5

- Nasdaq up 27.2 points (0.2%) at 12618.96

- US 10-Yr yield is down 0.4 bps at 4.8409%

- US Dec 10-Yr futures are up 3.5/32 at 106-14.5

- EURUSD up 0.0003 (0.03%) at 1.0565

- USDJPY down 0.86 (-0.57%) at 149.54

- WTI Crude Oil (front-month) up $1.73 (2.08%) at $84.95

- Gold is up $23.9 (1.2%) at $2008.93

- European bourses closing levels:

- EuroStoxx 50 down 35.04 points (-0.87%) at 4014.36

- FTSE 100 down 63.29 points (-0.86%) at 7291.28

- German DAX down 43.64 points (-0.3%) at 14687.41

- French CAC 40 down 93.58 points (-1.36%) at 6795.38

US TREASURY FUTURES CLOSE

- 3M10Y +0.408, -61.8 (L: -62.972 / H: -57.18)

- 2Y10Y +2.551, -17.153 (L: -20.32 / H: -14.988)

- 2Y30Y +6.526, 0.985 (L: -6.401 / H: 2.201)

- 5Y30Y +6.627, 25.379 (L: 18.262 / H: 25.542)

- Current futures levels:

- Dec 2-Yr futures up 1.375/32 at 101-10.5 (L: 101-07.875 / H: 101-10.75)

- Dec 5-Yr futures up 4/32 at 104-22.25 (L: 104-14.25 / H: 104-22.5)

- Dec 10-Yr futures up 3/32 at 106-14 (L: 106-03 / H: 106-14.5)

- Dec 30-Yr futures down 11/32 at 109-17 (L: 108-30 / H: 109-27)

- Dec Ultra futures down 19/32 at 112-17 (L: 111-29 / H: 113-05)

US 10Y FUTURE TECHS: (Z3) Recovers Off Lows, But Still Weak

- RES 4: 109-20 High Sep 19

- RES 3: 108-11/16 50-day EMA / High Oct 12 and key resistance

- RES 2: 107-22+ High Oct 16

- RES 1: 106-29 20-day EMA

- PRICE: 106-10 @ 11:11 BST Oct 27

- SUP 1: 105-10+ Low Oct 19 and the bear trigger

- SUP 2: 104-26 2.00 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 3: 104-09+ 2.0% 10-dma envelope

- SUP 4: 103-20+ Low Jun’07

The trend condition in Treasuries is unchanged and short-term gains appear to be part of a correction. Recent weakness resulted in a break of 106-03+, the Oct 4 low, that confirmed a resumption of the downtrend. The move down has exposed 104-26, a Fibonacci projection. Key short-term trend resistance is at 108-16, the Oct 12 high. Initial firm resistance is at 106-29, the 20-day EMA.

SOFR FUTURES CLOSE

- Dec 23 +0.010 at 94.585

- Mar 24 +0.015 at 94.680

- Jun 24 +0.025 at 94.905

- Sep 24 +0.025 at 95.170

- Red Pack (Dec 24-Sep 25) +0.030 to +0.060

- Green Pack (Dec 25-Sep 26) +0.045 to +0.060

- Blue Pack (Dec 26-Sep 27) +0.030 to +0.035

- Gold Pack (Dec 27-Sep 28) +0.010 to +0.025

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00274 to 5.32412 (-0.00750/wk)

- 3M -0.00677 to 5.38321 (-0.01520/wk)

- 6M -0.01628 to 5.44063 (-0.02885/wk)

- 12M -0.03054 to 5.37295 (-0.06540/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $100B

- Daily Overnight Bank Funding Rate: 5.32% volume: $247B

- Secured Overnight Financing Rate (SOFR): 5.31%, $1.506T

- Broad General Collateral Rate (BGCR): 5.30%, $566B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $557B

- (rate, volume levels reflect prior session)

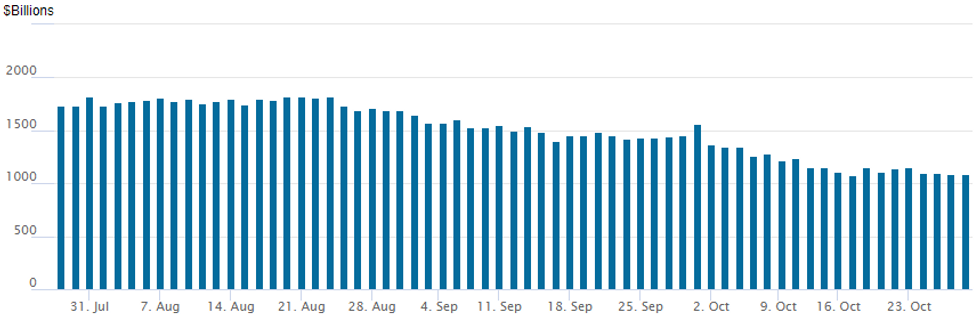

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The NY Fed Reverse Repo operation usage inches up to $1,091.858B w/100 counterparties vs. $1,089.850B in the prior session -- just above last week Tuesday's $1,082.399B - the lowest level since mid-September 2021. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

$2.5B Capital One 2Pt Launched

Capital One dropped the SOFR leg, issuance launched:

- Date $MM Issuer (Priced *, Launch #)

- 10/27 $2.5B #Capital One $750M 4NC3 +230, $1.75B 8NC7 +277

EGBs-GILTS CASH CLOSE: Bellies Outperform As BoE/ECB Implied Hikes Fade

European yields fell Friday, with Gilts outperforming Bunds, and periphery spreads tightening.

- Curve bellies outperformed as central bank tightening was further priced out following Thursday's in-line ECB meeting, and ahead of Eurozone October inflation data and the BoE decision next week.

- Bunds traded mostly within Thursday's ranges, rebounding from early morning losses with some pointing to disinflationary dynamics in Berlin/Brandenburg state inflation released this morning (ahead of the national German print on Monday).

- As anticipation built over next week's Oct flash inflation round (MNI's preview here), and perhaps with an eye on those German state data, ECB hike pricing diminished, with <1bp of tightening seen in the rest of the cycle, and 78bp of cuts in 2024 (5bp more than seen Thurs).

- Gilts gained more or less steadily throughout the session, though like ECB pricing, BoE rates were seen 8bp lower in the year past the peak, vs what was seen Thurs.

- Periphery spreads tightened, with BTP/Bunds heading below the tightest levels seen during Thursday's ECB press conference when Lagarde noted that PEPP policy wasn't discussed by the Governing Council.

- As noted, next week's Euro inflation data (Mon-Tue) and next Thursday's BoE decision will be the focus next week.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.8bps at 3.037%, 5-Yr is down 4.2bps at 2.683%, 10-Yr is down 2.9bps at 2.832%, and 30-Yr is down 0.2bps at 3.124%.

- UK: The 2-Yr yield is down 4.3bps at 4.777%, 5-Yr is down 6.7bps at 4.475%, 10-Yr is down 5.3bps at 4.544%, and 30-Yr is down 4.3bps at 5.025%.

- Italian BTP spread down 3.7bps at 197.2bps / Spanish down 1.3bps at 109.5bps

FOREX USD Index Set to Post 0.35% Weekly Advance Amid Waning Equities

- Pressure on the greenback in early US trade on Friday was largely soaked up, with late equity weakness amid further geopolitical concerns providing support to the dollar as we approach the close. Despite the USD index residing in moderate negative territory on the session, it looks set to post a 0.35% advance on the week overall. Large two-way swings for US yields and weakness for equity benchmarks have been the dominant drivers for G10 pairs, however, most are in close proximity to the prior week’s closes.

- Initial headlines on Friday suggesting that ceasefire talks may be progressing well lifted the mood in currency markets, most notably by EURUSD rising from session lows of 1.0535 to within a whisker of the 1.0600 mark.

- However, the weakness for the equities approaching the weekend close as sentiment dampened on reports of increased ground incursions into Gaza from Israel produced a renewed greenback bid. This saw the likes of EURUSD and GBPUSD roughly 40 pips off the earlier highs before stablising.

- Some notable divergence between notorious safe havens on Friday sees CHFJPY extend declines on the session to roughly 1%, which eats into a healthy portion of the October rally.

- The Japanese yen is the best G10 performer on Friday ahead of next Tuesday’s BOJ decision. We anticipate that the BOJ will uphold its existing policies in the forthcoming announcement. This includes keeping the short-term interest rate at -0.1%. In a Reuters survey of economists conducted between October 17-25, 25 out of 28 economists expected no change in policy at the upcoming meeting, while the remaining three—Barclays, JP Morgan, and UBS—predicted that the BOJ would begin unwinding its accommodative stance.

- A busy week next week kicks off with Eurozone inflation readings. The Fed and the BOE then take centre stage before the US employment report on Friday.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/10/2023 | 0030/1130 | ** |  | AU | Retail Trade |

| 30/10/2023 | 0630/0730 | *** |  | DE | North Rhine Westphalia CPI |

| 30/10/2023 | 0800/0900 | *** |  | ES | HICP (p) |

| 30/10/2023 | 0800/0900 | * |  | CH | KOF Economic Barometer |

| 30/10/2023 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 30/10/2023 | 0930/0930 | ** |  | UK | BOE M4 |

| 30/10/2023 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 30/10/2023 | 0930/1030 | *** |  | DE | Baden Wuerttemberg CPI |

| 30/10/2023 | 1000/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 30/10/2023 | 1000/1100 | *** |  | DE | Saxony CPI |

| 30/10/2023 | 1300/1400 | *** |  | DE | HICP (p) |

| 30/10/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 30/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 30/10/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 30/10/2023 | 1930/1530 |  | CA | BOC's Macklem testifies at House committee. | |

| 31/10/2023 | 2330/0830 | * |  | JP | labor forcer survey |

| 31/10/2023 | 2350/0850 | ** |  | JP | Industrial production |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.