-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Inflation Metrics Cool, Still Won't Stall Hike

- MNI INTERVIEW: CPI Drop Won't Stall Hikes-Ex-NY Fed Economist

- MNI BRIEF: Fed's Daly-Too Soon To Declare Victory On Inflation

- MNI INTERVIEW: Canada Seen Hiking At Least 50BP More-WLU Prof

- US DATA: PPI Inflation On Balance Softer Than Expected

US

FED: Federal Reserve officials will likely insist on raising raise interest rates a couple of more times to clamp down on persistent core inflation even with headline price gains fading, former New York Fed economist Gianluca Benigno told MNI.

- Investors have pared bets for additional rate increases after data this week showing a drop in headline CPI to 3%, the lowest since March 2021. Core prices slowed to a still-hefty 4.8% annual pace. Fed hawks dominating the FOMC will be unsatisfied with those kinds of figures, Benigno said in an interview.

- “I’m not sure they will be happy, especially considering core inflation is still relatively high,” said Benigno, former head of international research at the New York Fed and now a professor at the University of Lausanne.

- Fed officials held interest rates steady at 5-5.25% in June while boosting their Summary of Economic Projection forecasts for the peak fed funds rate to 5.6%, implying at least two more hikes this year. They are widely expected to raise borrowing costs again at the end of July and markets are now focused on what might happen in September. For more see MNI Policy main wire at 1308ET.

FED: It's too soon for the Federal Reserve to declare victory over inflation despite a better-than-expected June CPI reading this week, San Francisco Fed President Mary Daly told CNBC Thursday.

- "It's too early to say that we can declare victory on inflation," she said. "This month of data is very positive, I hope it's part of a downward trend in inflation. But I remain in a wait-and-see mode on that because I remain resolute to bring inflation back down to 2%."

- She repeated that two more rate hikes this year is still a "reasonable projection." (See: MNI INTERVIEW: Fed Will Likely Hike Rates Above 6%-Plosser)

CANADA

BOC: The academic who beat the market by predicting steep Bank of Canada rate hikes now says his model suggests policymakers will move at least another half point to make sure inflation returns to target.

- “Inflation isn’t coming down to 2% fast enough, so if it’s not coming fast enough to 2%, that is a signal we need to do more,” said Christos Shiamptanis of Wilfrid Laurier University. “They are going to have to do more into coming meetings. And yes, there could be a case that they go beyond the 0.5%. Our model says 0.5 is the bare minimum.”

- Last September he and co-author and Ke Pang said their research indicated the Bank would hike to 4.75%, something done last month before they went further on Wednesday to 5%, the highest since 2001. Around last September the Bank's key rate was raised from 2.5% to 3.25%. (See: MNI INTERVIEW: Canada Could Hike To 4.75%-WLU Researchers)

- Their paper, based on internal projections by the central bank recently made available with a multiple-year lag, shows the BOC tends to respond more to lasting deviations from the inflation target. The Bank's new quarterly forecast is notable in projecting inflation above the 2% target over the entire forecast horizon, even showing a 2.1% pace in the fourth quarter of 2025, he said.

US TSYS: Risk-On Post-Data, Rate Hike Projections Cool

- Treasury futures drift near late session highs, well above this morning's knee-jerk bid after PPI +0.1% vs. -0.1% est quickly reversed on weekly claims decline of 12k to 237k vs . 250k est.

- Curves running mixed: 3M10Y -9.840 at -163.468 (still above late June lows), while 2s10s remains steeper, but off highs (2s10s +3.889 at -85.206 vs. -82.676 high).

- Despite post-CPI, carry-over support in 10s, medium-term trend remains down and the latest recovery is likely part of a short-term corrective cycle. The contract has cleared the 20-day EMA and attention turns to a key resistance area at the 50-day EMA, at 113-12. A clear break of this average would strengthen a bullish theme. Key support and the bear trigger has been defined at 110-05, the Jul 6 low.

- In-line with short-end support, rate-hike projections have cooled in later dates: July 26 FOMC is 89% w/ implied rate of +22.2bp to 5.298%. September cumulative of +25.2bp at 5.33%, November cumulative of 29.3bp at 5.364%, December cumulative slips to 21.5bp vs. 31.7bp late Tuesday. Fed terminal has slipped to at 5.365% in Nov'23.

- Little react to San Fran Fed Pres Mary Daly on CNBC earlier: "It's too early to say that we can declare victory on inflation," she said. "This month of data is very positive, I hope it's part of a downward trend in inflation. But I remain in a wait-and-see mode on that because I remain resolute to bring inflation back down to 2%." Reminder, Fed enters policy blackout tomorrow at midnight.

OVERNIGHT DATA

- US JOBLESS CLAIMS -12K TO 237K IN JUL 08 WK

- US PREV JOBLESS CLAIMS REVISED TO 249K IN JUL 01 WK

- US CONTINUING CLAIMS +0.011M to 1.729M IN JUL 01 WK

- US JUN FINAL DEMAND PPI +0.1%, EX FOOD, ENERGY +0.1%

- US JUN FINAL DEMAND PPI EX FOOD, ENERGY, TRADE SERVICES +0.1%

- US JUN FINAL DEMAND PPI Y/Y +0.1%, EX FOOD, ENERGY Y/Y +2.4%

- US JUN PPI: FOOD -0.1%; ENERGY +0.7%

- US JUN PPI: GOODS +0.0%; SERVICES +0.2%; TRADE SERVICES +0.2%

US DATA: Final demand ex food & energy disappoints both on the month and with sizeable downward revisions. The 0.12% M/M in June (cons 0.2) followed 0.14% in May (initially 0.20) and 0.06% in April (initially 0.21).

- It leaves a Q2 average of 0.11% M/M after 0.13% in Q1.

- Final demand ex food, energy & services was more in line, however. It printed 0.10% M/M (cons 0.1) after limited net revisions. That is though following a weaker -0.01% M/M in May. It leaves a Q2 average of 0.0% M/M after 0.32% M/M in Q1.

- The low growth rates chime with yesterday’s CPI core goods ex autos printing 0.00% M/M in June for an average of 0.02% in Q2 from 0.39% in Q1, following the considerable improvement in supply chain pressures.

MARKET SNAPSHOT

Key late session market levels:- DJIA up 53.93 points (0.16%) at 34401.27

- S&P E-Mini Future up 32.25 points (0.72%) at 4540

- Nasdaq up 199.4 points (1.4%) at 14119.45

- US 10-Yr yield is down 9.6 bps at 3.7614%

- US Sep 10-Yr futures are up 24.5/32 at 113-1

- EURUSD up 0.0092 (0.83%) at 1.1221

- USDJPY down 0.43 (-0.31%) at 138.06

- WTI Crude Oil (front-month) up $1.23 (1.62%) at $76.97

- Gold is up $2.5 (0.13%) at $1959.87

- EuroStoxx 50 up 31.3 points (0.72%) at 4391.76

- FTSE 100 up 24.1 points (0.33%) at 7440.21

- German DAX up 118.03 points (0.74%) at 16141.03

- French CAC 40 up 36.79 points (0.5%) at 7369.8

US TREASURY FUTURES CLOSE

- 3M10Y -9.905, -163.533 (L: -165.757 / H: -155.698)

- 2Y10Y +3.227, -85.868 (L: -88.645 / H: -82.676)

- 2Y30Y +7.426, -72.583 (L: -79.539 / H: -70.188)

- 5Y30Y +7.963, -4.73 (L: -12.446 / H: -3.047)

- Current futures levels:

- Sep 2-Yr futures up 7.625/32 at 102-4.75 (L: 101-28.5 / H: 102-05.75)

- Sep 5-Yr futures up 18/32 at 107-31.25 (L: 107-11.75 / H: 108-01.25)

- Sep 10-Yr futures up 24/32 at 113-0.5 (L: 112-07 / H: 113-03)

- Sep 30-Yr futures up 1-04/32 at 126-29 (L: 125-16 / H: 126-31)

- Sep Ultra futures up 1-06/32 at 135-5 (L: 133-17 / H: 135-10)

US 10Y FUTURE TECHS: (U3) Approaching The 50-Day EMA

- RES 4: 114-06+ High Jun 6

- RES 3: 114-00 High Jun 13

- RES 2: 113-12 50-day EMA and a key resistance point

- RES 1: 112-29 High Jul 13

- PRICE: 112-28+ @ 17:05 BST Jul 13

- SUP 1: 111-03+110-05 Low Jul 11 / 6 and the bear trigger

- SUP 2: 110-00 Low Nov 9 2022 (cont)

- SUP 3: 109-14 Low Nov 8 2022 (cont)

- SUP 4: 109-10+ Low Nov 4 2022 (cont)

Treasury futures rallied Wednesday and added to the gains into the Thursday close. The medium-term trend remains down and the latest recovery is likely part of a short-term corrective cycle. The contract has cleared the 20-day EMA and attention turns to a key resistance area at the 50-day EMA, at 113-12. A clear break of this average would strengthen a bullish theme. Key support and the bear trigger has been defined at 110-05, the Jul 6 low.

SOFR FUTURES CLOSE

- Sep 23 +0.020 at 94.630

- Dec 23 +0.060 at 94.740

- Mar 24 +0.120 at 95.110

- Jun 24 +0.160 at 95.575

- Red Pack (Sep 24-Jun 25) +0.185 to +0.205

- Green Pack (Sep 25-Jun 26) +0.130 to +0.195

- Blue Pack (Sep 26-Jun 27) +0.085 to +0.120

- Gold Pack (Sep 27-Jun 28) +0.060 to +0.080

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.01942 to 5.22164 (+.04463/wk)

- 3M -0.00309 to 5.31105 (+.01258/wk)

- 6M -0.01826 to 5.39280 (-.02220/wk)

- 12M -0.05675 to 5.32653 (-.12789/wk)

- Daily Effective Fed Funds Rate: 5.08% volume: $116B

- Daily Overnight Bank Funding Rate: 5.07% volume: $263B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.361T

- Broad General Collateral Rate (BGCR): 5.04%, $585B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $574B

- (rate, volume levels reflect prior session)

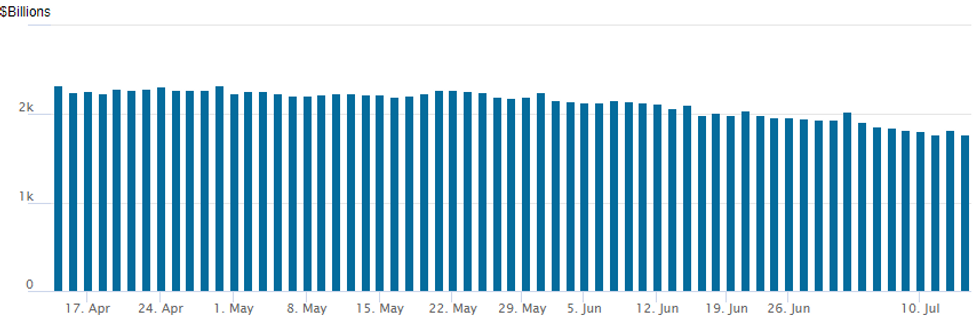

FED Reverse Repo Operation

NY Federal Reserve/MNI

Back to making new lows, the latest operation falls to $1,767.432B (lowest since early May'22), w/ 98 counterparties, compared to $1,820.146B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $2.35B RBC 3Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 07/13 $2.35B #Royal Bank of Canada $1B 3Y +98, $350M 3Y SOFR+108, $1B 5Y +128

- 07/13 $1.5B #CPPIB (Canada Pension Plan Inv Board) 5Y SOFR+57

- 07/13 $650M #Aircastle 5Y +260

- 07/13 $1B #FHLB 5Y +8.5

EGBs-GILTS CASH CLOSE: Rally Continues On US Disinflation Narrative

European yields fell sharply for a 2nd consecutive session Thursday as the dovish implications of Wednesday's soft US inflation data continued to reverberate.

- Most of the day's German yield drop was in place by midday European trade, with a modest retracement thereafter, even as another round of weak US price data (this time PPI) appeared to reinforce the disinflationary narrative.

- UK yields continued to head lower by late afternoon as BoE hike prospects dimmed further, (-7bp on the day) in a cross-asset move that saw the US dollar sink further and equities push higher.

- 5Y UK yields fell the most across European instruments on the day as the short-end/belly rallied despite less soft-than-expected UK GDP data.

- Periphery spreads were mixed.

- Otherwise, data had little impact (final French CPI, weak Eurozone IP), while the ECB's accounts of the June meeting brought no surprises.

- Friday's schedule is light, with no major European data or central bank speakers expected.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 7.7bps at 3.152%, 5-Yr is down 8.8bps at 2.565%, 10-Yr is down 9.3bps at 2.485%, and 30-Yr is down 6.2bps at 2.529%.

- UK: The 2-Yr yield is down 9.2bps at 5.137%, 5-Yr is down 12.6bps at 4.566%, 10-Yr is down 9.2bps at 4.422%, and 30-Yr is down 6.6bps at 4.539%.

- Italian BTP spread down 2.8bps at 165.4bps / Greek up 4.1bps at 142.1bps

FOREX: Greenback Weakens Further, USDNOK Extends Weekly Drop To 6.25%

- Further optimism for risk assets on Thursday saw an extension of the building momentum across the currency space this week. The moves have been underpinned by a weaker greenback, with today’s price action leading the USD index (-0.71%) below the 100 mark for the first time since April 2022.

- In similar price action to Wednesday, Antipodean FX have been the biggest beneficiaries, with both AUD & NZD rising over 1.5% against the greenback. In similar vein, Scandinavian FX has continued to surge. A perfect storm of higher domestic inflation, a softer greenback, elevated oil prices and firmer risk have led USDNOK to fall an impressive 6.25% just this week, declining below 10.00 for the first time since February this year.

- The short-term outlook for USDCAD has deteriorated Thursday, with spot falling through the horizontal bear trigger drawn off the late June low of 1.3117. Next downside levels in USD/CAD undercut at 1.3084 the 1.618 projection of the Apr 28 - May 8 - May 26 price swing ahead of 50% retracement for the 2021 - 2022 upleg at 1.2992.

- Hot on the heels of their higher beta counterparts, EURUSD and GBPUSD continue to trade in a bullish manner, grinding above 1.12 and 1.31 respectively. For EURUSD, this represents the highest point since March 2022 and immediate focus is on 1.1211, before a retracement level at 1.1274 and the February 24 2022 high at 1.1313.

- Given the moves for SEK this week, emphasis is on the June inflation data due on Friday. Elsewhere the docket remains fairly quiet until the latest sentiment and inflation expectations data from the University of Michigan round off the week.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/07/2023 | 0600/0800 | *** |  | SE | Inflation Report |

| 14/07/2023 | 0900/1100 | * |  | EU | Trade Balance |

| 14/07/2023 | - |  | EU | ECB de Guindos in Ecofin Meeting | |

| 14/07/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 14/07/2023 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 14/07/2023 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 14/07/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.