-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Corporate Supply Pipeline

US Treasury Auction Calendar

MNI ASIA OPEN - Markets Steady, Awaiting ECB, BoC Judgement

EXECUTIVE SUMMARY:

- JACKSON HOLE TOO EARLY FOR POWELL TO SIGNAL TAPER - MNI

- BOC TAPER SEEN ON COURSE AS GROWTH WOBBLES - MNI

- TREASURIES MAINTAIN POST-NFP RALLY

Figure 1: Can EUR/USD Momentum Continue Without Chinese Help?

US & Canada

US (MNI): Jackson Hole Too Early For Powell To Signal Taper

Federal Reserve Chairman Jerome Powell might not have enough evidence of a truly robust labor market by this summer's Jackson Hole symposium to deliver the kind of major policy signal of an imminent QE taper Wall Street has come to expect, former Fed economists told MNI.

Canada (MNI): Canada's April trade deficit is expected to slightly narrow to CAD1 billion from March's CAD1.1 billion, according to an economist consensus, reflecting imports falling faster than exports. Widespread lockdowns disrupted auto production, while exports were hit by lower energy prices. Industry sources have told MNI there are signs of a rebound in exports in the summer, as more restrictions will be eased and there is strong demand for Canadian grain, lumber and autos.

Canada (MNI): BOC Taper Seen On Course As Growth Wobbles

The Bank of Canada on Wednesday may signal it remains on a path to the further tapering that some investors expect in the third quarter, holding its rate and asset purchase settings for now as it juggles a short-term growth slowdown and faster inflation.

EUROPE

UK (MNI): BOE Sees Digital Currency Risk To Bank Lending

The Bank of England has published a detailed discussion paper on central bank digital currencies, floating the idea of pressing ahead with a CBDC but implementing a transition period during which it could slow the shift to the new currency to ensure financial stability.

ASIA

JAPAN (MNI): BOJ Consumption Index Lower After March Bounce

The Bank of Japan's Consumption Activity Index fell 0.7% m/m in April, falling after the revised 1.7% rise in March (up from +1.2%), data released Monday showed. The April index rose 0.4% q/q from Q1.

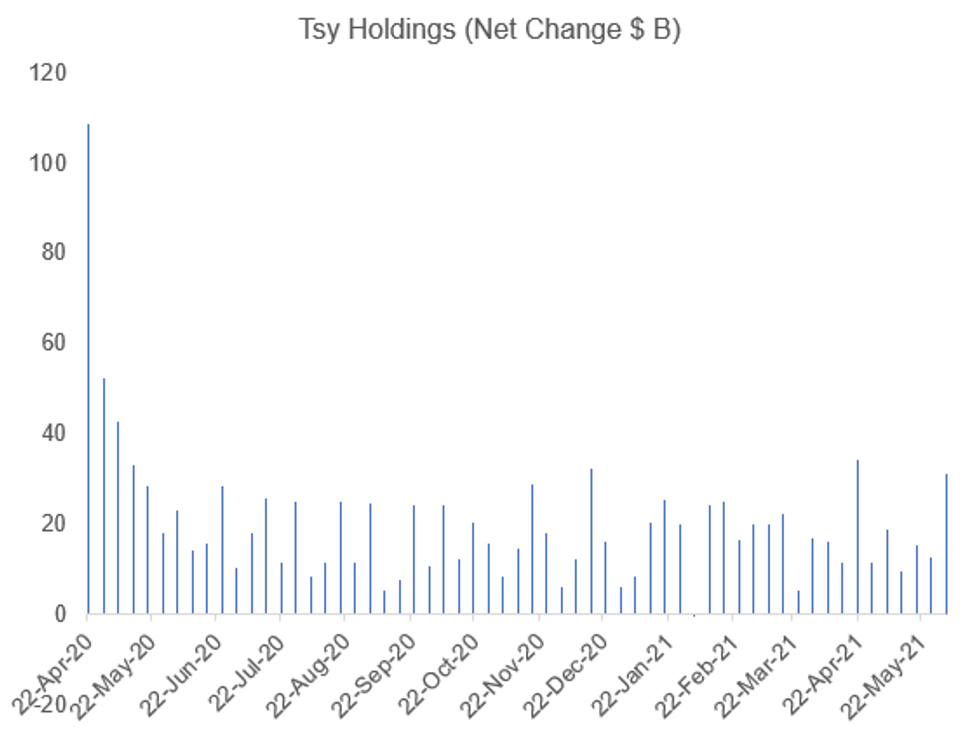

Net Tsy Buys Jump In Holiday-Shortened Week

Fed assets rose by $32.2B in the week ending Jun 2. This amount was comprised almost entirely of Treasury coupon purchases, with no net additions to the MBS or TIPS portfolios.

- That was the 2nd largest weekly increase in Tsy holdings since the Fed began ramping up asset purchases in March 2020 (the week ending Apr 21 saw $34B in purchases). Notably it occurred in a holiday-shortened week (Memorial Day).

Source: Fed, MNI

Source: Fed, MNI

- Operational purchases in the week were largely toward the short end: May 26 (settling May 27) saw $8.4B of 2.25-4Y buys; May 27: $6.7B of 22.5Y-30Y; May 28 saw $12.4B in 0-2.25Y purchases, Jun 1 $8.4B of (again) 2.25-4.5Y.

| Assets | Total Assets | MBS | TIPS | Treasury Bonds/Notes | Other |

| Last Week's Net Change (USDbn) | 32.2 | 0.0 | 0.0 | 31.9 | 0.3 |

| 4-Week Net Change (USD bn) | 125.2 | 52.9 | 6.8 | 78.6 | -13.1 |

| Total Holdings (USD bn) | 7935.7 | 2244.3 | 342.9 | 5119.0 | 570.1 |

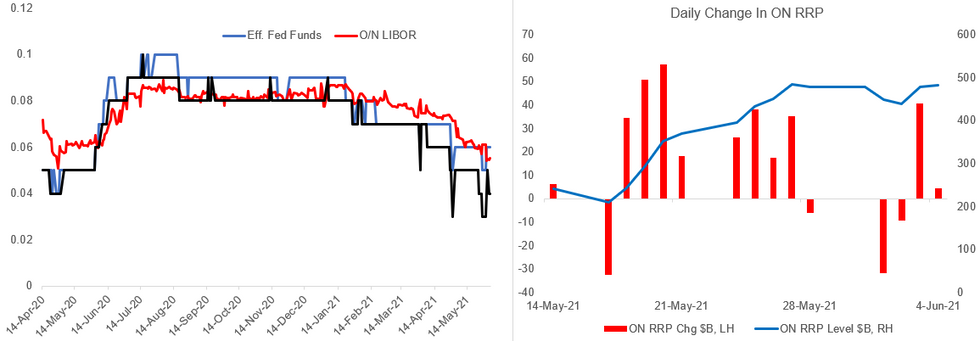

ON Reverse Repo Takeup Cools Off

Overnight Reverse Repo takeup was only slightly higher in the week to Jun 2, with some 'cooling off' in usage of the facility following the Memorial Day holiday. Even so, the level of reserves fell slightly (-$3.4B), with the Treasury's account at the fed contracting by $29.2B for a 4-week net drop of $170.5B.

- But daily data shows ON RRP usage rising $40B on Thursday alone, the biggest jump since May 20, so the theme of continued growth amid burgeoning system reserves appears to remain intact.

- In a note Friday, Goldman wrote they expect RRP usage peaking around $1T (w reserves to $4.2T by year-end), but this amount is more conservative than the ~$1.2-1.3T one would assume if the almost one-to-one relationship between TGA drawdown/Fed assets and RRP growth continues. If net Tsy bill supply fails to ramp up, for instance, ON RRP may be end up more heavily used than Goldman has pencilled in.

Source: Federal Reserve, MNI

Source: Federal Reserve, MNI

- Despite continued evidence of reserves putting downward pressure on overnight rates, most analysts see a Fed adjustment of administered rates as a close call. Prevailing opinion on whether the Fed will act at next week's meeting appears to be shifting toward an expectation of inaction, as the funds rate remains at 0.06% (despite a brief dip to 0.05%). MNI will have more out in our Fed Preview next Monday.

| Liabilities | Reserves | US Treasury General Account | Reverse Repo | Currency In Circulation | Other |

| Last Week's Net Change (USDbn) | -3.4 | -29.2 | 2.5 | 6.8 | 55.5 |

| 4-Week Net Change (USD bn) | -52.5 | -170.5 | 284.6 | 12.0 | 51.6 |

| Total Holdings (USD bn) | 3848.3 | 783.2 | 672.9 | 2176.9 | 454.4 |

US TSYS SUMMARY: Yields Maintain Post-NFP Drift

- Treasury futures held inside a 5 tick range Monday, maintaining the post-payrolls pattern that'd initially driven 10y yields sharply lower.

- The longer-end of the curve underperformed, with 30y, 20y yields rising near 2bps apiece, prompting some minor steepening, but recent ranges were wholly respected.

- Markets await the next macro cues, which may emerge at Wednesday and Thursday's Bank of Canada & ECB decisions, with FOMC within the pre-rate decision media blackout period.

- Headlines on Biden's flagship infrastructure package garnered some market focus, with the POTUS due to meet Capito later Monday or Tuesday as well as remaining open to negotiations with other GOP Senators including Mitt Romney. Fiscal stimulus headlines are expected to die down later in the week, as global leaders head to Cornwall, UK for the G7 meeting.

- Tuesday sees the release of April trade balance, JOLTs job openings and the 3yr auction.

FOREX: Dollar Edges Lower In Subdued Monday Trading

- After consolidating Non-Farm Payroll losses for much of the Asia and European sessions, the greenback gradually retreated during US hours on Monday.

- With very little in the form of market moving headlines, steady supply led the dollar index through Friday's worst levels and back below 90.00 to post 0.2% losses on the day.

- Most G10 counterparts were beneficiaries with Aussie and Kiwi relative outperformers gaining around 0.35%. EUR, GBP, JPY and CAD all strengthened around 0.2% mirroring broader dollar sentiment.

- Despite the slightly softer oil prices, the Norwegian Krona led gains, firming 0.65% against the dollar. NOK strength may have been supported by Health Ministry headlines shortening the interval between vaccine doses, providing optimism for the herd immunity timeline.

- CNH slightly underperformed on the day overall, following the slight miss in trade data released overnight.

- German ZEW headlines the docket on Tuesday, however, markets will eagerly anticipate the release of US CPI on Thursday. Also on the week's agenda are monetary policy decisions/statements from the Bank of Canada and the ECB.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.