-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: May FOMC Minutes, Officials Split on Hikes

- MNI: Fed Minutes Show Split FOMC On Continued Rate Hikes

- MNI: Fed Gov Waller Says Too Soon To Call For June Pause

- MNI: Fed Gov Waller Probably Leaning Toward June Hike

- MNI: Canada Warned Ending Mortgage Bonds Could Be Costly

- MNI US: Dem Leader Jeffries: House Republicans Are Intent On Crashing The Economy

US

FED: Federal Reserve officials were split at their early May meeting in whether it would soon be appropriate to pause its interest rate increases, while almost all participants commented that downside risks to growth and upside risks to unemployment had increased, according to minutes from the meeting released Wednesday.

- "Many participants focused on the need to retain optionality after this meeting," the FOMC meeting minutes said. "Some participants commented that, based on their expectations that progress in returning inflation to 2% could continue to be unacceptably slow, additional policy firming would likely be warranted at future meetings," the minutes said.

- "Several participants noted that if the economy evolved along the lines of their current outlooks, then further policy firming after this meeting may not be necessary." Against that backdrop, "all" FOMC members reaffirmed their strong commitment to return inflation to 2%, the minutes said. For more see MNI Policy main wire at 1400ET.

FED: A lack of progress bringing down inflation means it’s too soon for Federal Reserve officials to stop raising interest rates, Governor Christopher Waller said Wednesday, although tighter credit conditions could alter that calculus.

- “I do not expect the data coming in over the next couple of months will make it clear that we have reached the terminal rate. And I do not support stopping rate hikes unless we get clear evidence that inflation is moving down towards our 2% objective,” Waller said in prepared remarks titled "Hike, Skip, or Pause?"

- The latest CPI figures showed “almost no progress,” because the decline in headline inflation to 4.9% was “only due to rounding,” Waller said. “Whether we should hike or skip at the June meeting will depend on how the data come in over the next three weeks. Based solely on the data we have in hand as of today, we are not making much progress on inflation,” he said. For more see MNI Policy main wire at 1215ET.

- Hike: "Based solely on the data we have in hand as of today, we are not making much progress on inflation. If one doesn't believe the incoming data will be much better, one could advocate for another 25-basis-point hike as the appropriate action in June."

- Skip: "If one is sufficiently worried about [the downside risk on the economy of credit conditions tightening], then prudent risk management would suggest skipping a hike at the June meeting but leaning toward hiking in July based on the incoming inflation data. "

- Pause: "Between policy lags and possible tightening credit conditions, the current stance of monetary policy may be seen... as sufficiently restrictive to move us toward the dual mandate. "

- His comments and hawkish-leaning track record would suggest he's leaning toward a June hike, but could be persuaded otherwise by data / banking developments - either way he's definitely not a "pauser":

- "I do not expect the data coming in over the next couple of months will make it clear that we have reached the terminal rate. And I do not support stopping rate hikes unless we get clear evidence that inflation is moving down towards our 2 percent objective. But whether we should hike or skip at the June meeting will depend on how the data come in over the next three weeks."

US: Max Cohen at Punchbowl News reports comments from House Minority Leader Hakeem Jeffries (D-NY) providing a pessimistic assessment of debt limit talks.

- Jeffries: “It’s increasingly clear to me that House Republicans are intent on crashing the economy and defaulting on our debt. That’s wrong. It will hurt everyday Americans in the brinksmanship.”

- With the Senate in recess and the White House negotiators declining to talk substantively to the press, much of the Democrat messaging on the debt ceiling has fallen on Jeffries.

- Jeffries' comments reflect a more pessimistic tone on the Hill as negotiators continue discussions at the White House.

- Jeffries told reporters yesterday that Democrats are willing to accept a spending freeze as part of a deal but unwilling to consider the spending cuts restated as a condition by House Speaker Kevin McCarthy (R-CA) today.

- Jefferies: “As part of the effort to find common ground, we’re willing to consider freezing spending. That is not an extreme proposal. That is a reasonable proposal.”

CANADA

CANADA: Canada's finance department was cautioned before a government proposal to eliminate a mortgage-backed bond program that such a move could threaten financial stability and raise costs across the nation's CAD4 trillion debt market, according to a document obtained by MNI.

- The memo from Canada Mortgage and Housing Corp. vice presidents Nadine Leblanc and Michel Tremblay was sent Nov. 1 to finance department assistant deputy minister Isabelle Jacques. MNI obtained the four-page document via a freedom of information request and a few parts were redacted.

- Canada Mortgage Bonds “support CMHC’s financial stability mandate” that “ensures continuity of mortgage funding for Canadians in all business cycles,” the letter said. The program turning pools of approved mortgages into government-backed bonds was created in 2001 and this year's annual report showed CAD255 billion of guarantees. For more see MNI Policy main wire at 1158ET.

US TSYS: Post-FOMC Minutes Rebound Gaining Momentum

Still mildly weaker, Treasury futures continue to climb off midday lows as markets digest the May FOMC minutes.- "Many participants focused on the need to retain optionality after this meeting," the FOMC meeting minutes said. "Some participants commented that, based on their expectations that progress in returning inflation to 2% could continue to be unacceptably slow, additional policy firming would likely be warranted at future meetings," the minutes said.

- At the moment, 10Y futures are trading -3.5 at 113-16, well off early session high of 113-25 before debt ceiling headlines buffeted rates. From a technical perspective, TYM3 break of 113-30+ last week, the Apr 19 low and a key support, has reinforced a bearish theme. Tuesday’s move lower opens 112-30 next, a Fibonacci retracement. On the upside, initial resistance is seen at 113-30+ ahead of the 50-day EMA, at 114-23+. A break of the average is required to signal a potential reversal.

- Markets still have Fed Gov Waller comments to digest as well after remarking the lack of progress bringing down inflation means it’s too soon for Federal Reserve officials to stop raising interest rates, although tighter credit conditions could alter that calculus.

OVERNIGHT DATA

- US MBA: REFIS -5% SA; PURCH INDEX -4% SA THRU MAY 19 WK

- US MBA: UNADJ PURCHASE INDEX -30% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 6.69% VS 6.57% PREV

- US MBA: MARKET COMPOSITE -4.6% SA THRU MAY 19 WK

US DATA: MBA Applications Slide Further As Mortgage Rates Continue Bounce: MBA composite mortgage applications fell a further -4.6% last week after the prior -5.7%, with broadly even drags from purchases -4% and refis -5%.

- It came with a 12bp increase in the 30y conforming rate to 6.69% after the prior week’s 9bp for the highest since Mar 10 as Tsy yields began to slump on regional bank woes. The spread to 10Y Tsy yields is at an elevated 300bps appr.

- Levels of purchase applications are within 10% of Feb lows when they reached levels not touched since the late 1990s.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 196.58 points (-0.59%) at 32855.24

- S&P E-Mini Future down 28 points (-0.67%) at 4130.5

- Nasdaq down 77.6 points (-0.6%) at 12482.15

- US 10-Yr yield is up 3.3 bps at 3.7246%

- US Jun 10-Yr futures are down 8.5/32 at 113-11

- EURUSD down 0.0015 (-0.14%) at 1.0754

- USDJPY up 0.61 (0.44%) at 139.21

- Gold is down $15.67 (-0.79%) at $1959.50

- EuroStoxx 50 down 78.64 points (-1.81%) at 4263.74

- FTSE 100 down 135.85 points (-1.75%) at 7627.1

- German DAX down 310.73 points (-1.92%) at 15842.13

- French CAC 40 down 125.25 points (-1.7%) at 7253.46

TREASURY FUTURES CLOSE

- 3M10Y -1.859, -163.089 (L: -171.765 / H: -159.977)

- 2Y10Y +0.219, -63.258 (L: -65.421 / H: -56.558)

- 2Y30Y -1.279, -39.186 (L: -42.041 / H: -31.058)

- 5Y30Y -3.174, 17.143 (L: 14.961 / H: 21.129)

- Current futures levels:

- Jun 2-Yr futures down 4.375/32 at 102-11.5 (L: 102-09.125 / H: 102-17.875)

- Jun 5-Yr futures down 7/32 at 108-14.75 (L: 108-10.75 / H: 108-25)

- Jun 10-Yr futures down 8.5/32 at 113-11 (L: 113-06.5 / H: 113-25)

- Jun 30-Yr futures down 14/32 at 126-16 (L: 126-11 / H: 127-14)

- Jun Ultra futures down 14/32 at 134-2 (L: 133-27 / H: 135-07)

US 10YR FUTURE TECHS: (M3) Remains Vulnerable

- RES 4: 117-00 High May 4

- RES 3: 115-18+/116-16 High May 16 / 11

- RES 2: 114-05/114-23+ High May 19 / 50-day EMA

- RES 1: 113-30+ Low Apr 19 and a recent breakout level

- PRICE: 113-16+ @ 16:33 BST May 24

- SUP 1: 113-04/112-30 Low May 23 / 61.8% of the Mar 2 - 24 rally

- SUP 2: 112-21 Low Mar 13

- SUP 3: 111-31 76.4% retracement of the Mar 2 - 24 rally

- SUP 4: 111-20+ Low Mar 10

Treasury futures remain soft and the contract traded lower Tuesday, but has managed to recover from its worst levels. The break of 113-30+ last week, the Apr 19 low and a key support, has reinforced a bearish theme. Tuesday’s move lower opens 112-30 next, a Fibonacci retracement. On the upside, initial resistance is seen at 113-30+ ahead of the 50-day EMA, at 114-23+. A break of the average is required to signal a potential reversal.

SOFR FUTURES CLOSE

- Jun 23 -0.055 at 94.730

- Sep 23 -0.085 at 94.875

- Dec 23 -0.095 at 95.220

- Mar 24 -0.090 at 95.695

- Red Pack (Jun 24-Mar 25) -0.075 to -0.01

- Green Pack (Jun 25-Mar 26) -0.03 to -0.005

- Blue Pack (Jun 26-Mar 27) -0.035 to -0.015

- Gold Pack (Jun 27-Mar 28) -0.005 to steady

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.01084 to 5.11080 (+.01707/wk)

- 3M +0.02538 to 5.19155 (+.02808/wk)

- 6M +0.03681 to 5.20017 (+.05364/wk)

- 12M +0.05742 to 4.97115 (+.09349/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00428 to 5.06186%

- 1M +0.00286 to 5.14086%

- 3M +0.02857 to 5.42443% */**

- 6M +0.02785 to 5.53214%

- 12M +0.01157 to 5.53371%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.42443% on 5/24/23

- Daily Effective Fed Funds Rate: 5.08% volume: $126B

- Daily Overnight Bank Funding Rate: 5.07% volume: $298B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.383T

- Broad General Collateral Rate (BGCR): 5.02%, $585B

- Tri-Party General Collateral Rate (TGCR): 5.02%, $580B

- (rate, volume levels reflect prior session)

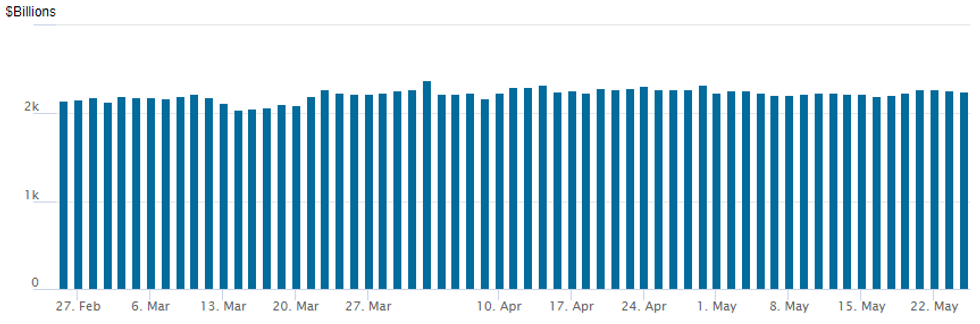

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $2,250.709B w/ 105 counterparties, compares to prior $2,256.689B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $2.5B JPM 10Y Launched

- Date $MM Issuer (Priced *, Launch #)

- 05/24 $4B #KFW 5Y SOFR+34

- 05/24 $2.5B #JP Morgan 11NC10 +162.5

- 05/24 $Benchmark MFB (Hungarian Dev Bank) 5Y +320a

- 05/24 $900M *Banque Saudi Fransi 5Y Sukuk +105

EGBs-GILTS CASH CLOSE: Inflation Shock Sinks UK Short End

The UK short-end sold off the most since September 2022 in a strong bear flattening curve move Wednesday, with Gilts easily underperforming Bunds.

- April UK CPI came in above all expectations, with core accelerating to a 31-year high 6.8% Y/Y vs 6.2% expected and the survey high 6.6%.

- Gilts dropped sharply in the aftermath, though pared some of those losses later in the session, in part because BoE's Bailey didn't compound the hawkish sentiment in an afternoon appearance.

- 2Y yields rose the most in 8 months (over 23bp) as 34bp of hikes were added to the BoE's hiking path, with longer-dated instruments faring relatively better.

- The German curve also bear flattened in sympathy with UK move, but yields pulled back over the course of the session, with Buxl closing stronger.

- Periphery spreads widened slightly amid risk-off trade.

- A fairly quiet data session awaits Thursday, but there will be plenty of central bank speakers including ECB's Nagel, Villeroy and Centeno, and BoE's Haskel.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.2bps at 2.854%, 5-Yr is up 1.8bps at 2.469%, 10-Yr is up 0.3bps at 2.472%, and 30-Yr is down 1.5bps at 2.627%.

- UK: The 2-Yr yield is up 23.7bps at 4.372%, 5-Yr is up 14.5bps at 4.136%, 10-Yr is up 5.6bps at 4.214%, and 30-Yr is up 1.1bps at 4.544%.

- Italian BTP spread up 1.4bps at 186.6bps / Spanish up 1.5bps at 106.4bps

FOREX: NZD Plummets Following RBNZ, Greenback Remains On Front Foot

- NZD (-2.32%) remains the poorest performer in G10 on Wednesday following the RBNZ rate decision. The bank raised rates by 25bps - as expected - but unexpectedly signalled that their tightening cycle has now concluded, resulting in NZDUSD dropping below 0.6150 for the first time since April. Ongoing greenback strength throughout US hours prompted a further grind lower for NZDUSD, eventually printing a 0.6094 low, narrowing the gap substantially with the year’s lows at 0.6085.

- Kiwi weakness dragged its antipodean counterpart lower, with AUD registering 1% losses, helped by the weakness for major global equity benchmarks.

- UK markets drew focus across the European morning following the higher-than-expected CPI print for April. While headline CPI dipped to 8.7% from 10.1% prior - it was a far slower step-down for inflation pressure, and core also accelerated to 6.8% from 6.2%.

- GBP's initial inflation-inspired rally faltered following the Gilt open, with markets returning to the previously observed pattern of selling the currency alongside notable increases in short-end rates. GBP/USD corrected off the high of 1.2470 down to an eventual session low of 1.2358 where spot closely resides as we approach the APAC crossover.

- Japanese yen weakness has been consistent over the course of the US session as we approached the release of the FOMC minutes which showed a split FOMC over the need for continued rate hikes.

- USDJPY extended gains above yesterday’s highs around 138.90 and then the 139 handle. Price action opens the next targets for the move which are 139.59, a Fibonacci retracement and eventually 140.62, the bull channel top drawn from the Jan 16 low.

- Thursday’s data highlight will be the second read of US Q1 GDP, as well as jobless claims and pending home sales data. US Core PCE Price index data is scheduled for Friday.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/05/2023 | 0600/0800 | *** |  | DE | GDP (f) |

| 25/05/2023 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 25/05/2023 | 0600/0800 | ** |  | SE | Unemployment |

| 25/05/2023 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 25/05/2023 | 0700/0900 | ** |  | ES | PPI |

| 25/05/2023 | 0900/1100 |  | EU | ECB de Guindos Presents ECB Annual Report 2022 | |

| 25/05/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 25/05/2023 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 25/05/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 25/05/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 25/05/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 25/05/2023 | 1230/0830 | *** |  | US | GDP |

| 25/05/2023 | 1350/0950 |  | US | Richmond Fed's Tom Barkin | |

| 25/05/2023 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 25/05/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 25/05/2023 | 1430/1030 |  | US | Boston Fed's Susan Collins | |

| 25/05/2023 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 25/05/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 25/05/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 25/05/2023 | 1630/1730 |  | UK | BOE Haskel Speech at Peterson Institute | |

| 25/05/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.