-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Persistent Inflation

EXECUTIVE SUMMARY

US

FED: The Federal Reserve will need to raise interest rates beyond current expectations because inflation tends to fall only gradually from high levels – and its decline will require at least a modest recession, according to the flagship paper from the Chicago Booth Monetary Policy Forum.

- “Policy will need to tighten further, with rates going higher than their current expected level, and ... the cost of lower inflation to the Fed’s 2% target by 2025 will likely be associated with at least a mild recession,” the paper, written by former New York Fed staffers Stephen Cecchetti and Michael Feroli, in addition to three co-authors.

- The Fed earlier this month raised its official interest rate target range by a quarter percentage point to 4.50%-4.75%, reducing the size of the one-meeting rate increase from 2022's torrid pace. For more see MNI Policy main wire at 1017ET.

- "The ongoing imbalance between the supply and demand for labor, combined with the large share of labor costs in the services sector, suggests that high inflation may come down only slowly," Fed Governor Philip Jefferson said in prepared remarks at the U.S. Monetary Policy Forum that focused on a keynote paper. Cleveland Fed President Loretta Mester also touched on the economic outlook.

- "Inflationary forces impinging on the U.S. economy at present represent a complex mixture of temporary and more long-lasting elements that defy simple, parsimonious explanation," Jefferson added. Some economists have told MNI they see a risk the Fed raises rates above 6%. For more see MNI Policy main wire at 1017ET.

- "Inflation remains too high. I anticipate further rate increases to reach a sufficiently restrictive level, then holding there for some, perhaps extended, time," she said according to prepared remarks. "I remain optimistic there is a path to restoring price stability without a significant downturn."

- The process of realigning demand with supply is underway now that policy is in restrictive territory, she said. "These actions, along with the ones I expect will be taken going forward, should bring inflation back down to target in a reasonable amount of time," she added.

- "The Fed has considerable institutional credibility compared with its 1970s counterpart, suggesting that a soft landing is feasible in the U.S. if the post-pandemic regime shift is executed well," he said, according to prepared materials, without specifying how much further he would like to see rates rise.

- The path to the soft landing requires a credible switch of monetary-fiscal policy to the policy regime that existed before the pandemic, he added.

US TSYS: Hot PCE Green Light For More Fed Hikes

Tsys near lows after the bell. Hot PCE read points to "more to do" by the Fed to reel in inflation, yield curves flatter but off lows as 30s races 2s to new contract lows: TUH3 new contract low of 101-17.88, 2YY hits 4.8364% - highest level since July 2007; USH3 133-20 low, 30YY tapped 3.9597% high.

- Tsys gapped lower as nominal personal spending was stronger than expected in Jan (1.8% vs 1.4) and incomes weaker (0.6% vs 1.0), with the savings rate rising further to 4.7% in Jan from 4% in Q4 and a low of 2.7% in June (albeit prone to sizeable revs). Stronger inflation meant that real spending came in as expected, bouncing strongly after yesterday's surprise downward revision with the 1.1% M/M the strongest since Mar'21.

- Jump in new home sales added to the FI sell-off, 7.2% M/M in Jan (cons 0.7) after an upward revised 7.2% M/M (initial 2.3), leaving sales at 670k (cons 620k) for the highest since March.

- Fed funds implied hike for Mar'23 at 31.0bp, May'23 cumulative 58.1bp (+1.9) to 5.164%, Jun'23 75.5bp (+3.0) to 5.338%, terminal at 5.40% in Aug'23/Sep'23, off first half high of 5.445%.

- Early Fed speak from Cleveland Fed Mester in line with previous, favoring getting rates somewhat above 5%, won't pre-judge next meeting size.

- Boston Fed President Susan Collins said Friday she sees the need for more rate increases amid high inflation and then likely holding there for an extended period of time.

OVERNIGHT DATA

- US JAN. PERSONAL SPENDING RISES 1.8% M/M; EST. 1.4%

- US JAN. PCE PRICE INDEX RISES 0.6% M/M; EST. 0.5%

- US JAN. CORE PCE PRICE INDEX RISES 0.6% M/M; EST. 0.4%

- Core PCE Un-rounded:

- Headline PCE 0.619% M/M after 0.201% M/M (revised from 0.052 prior)

- Core PCE 0.571% M/M after 0.374% (revised from 0.296 prior)

- YoY using same SA adjusted data:

- Headline PCE 5.382% Y/Y from 5.287%

- Core PCE 4.707% Y/Y from 4.604%

US DATA: Core PCE Just Fractionally Off Strongest Months Of Cycle

- Core PCE inflation of 0.571% M/M (cons 0.4) is the hottest since the 0.63 prints of Jun’22 and Apr’21.

- Further, the upward revisions in yesterday’s Q4 data were increasingly distributed towards latest months, with Dec revised up 0.078pps to 0.374%.

- The upward revision to Nov also means that Jul’22 is the only month to have been below the rate consistent with the 2% inflation target since Feb’21.

- MICHIGAN FINAL FEB. CONSUMER SENTIMENT AT 67; EST. 66.4

- MICHIGAN FEB. EXPECTATIONS INDEX AT 64.7 FROM 62.7

- MICHIGAN FEB. 5-YR EXPECTED INFLATION UNCHANGED AT 2.9%

- MICHIGAN FEB. 1-YR EXPECTED INFLATION AT 4.1% FROM 3.9%

- US JAN. NEW-HOME SALES AT 670,000 ANN. RATE; EST. 620,000

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 284.75 points (-0.86%) at 32871.29

- S&P E-Mini Future down 40.75 points (-1.01%) at 3978.5

- Nasdaq down 196.2 points (-1.7%) at 11395.1

- US 10-Yr yield is up 6.8 bps at 3.9452%

- US Mar 10-Yr futures are down 15.5/32 at 110-30.5

- EURUSD down 0.0042 (-0.4%) at 1.0554

- USDJPY up 1.7 (1.26%) at 136.4

- Gold is down $9.93 (-0.54%) at $1812.38

- EuroStoxx 50 down 79.34 points (-1.86%) at 4178.82

- FTSE 100 down 29.06 points (-0.37%) at 7878.66

- German DAX down 265.95 points (-1.72%) at 15209.74

- French CAC 40 down 130.16 points (-1.78%) at 7187.27

US TREASURY FUTURES CLOSE

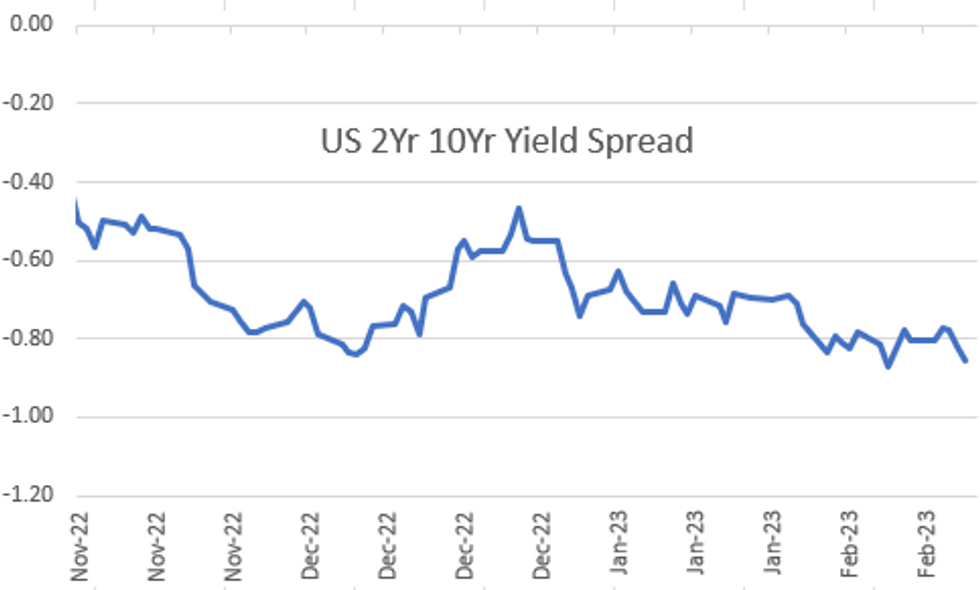

- 3M10Y +5.536, -89.493 (L: -100.972 / H: -87.402)

- 2Y10Y -3.727, -86.2 (L: -87.251 / H: -81.142)

- 2Y30Y -5.669, -87.435 (L: -92.186 / H: -81.216)

- 5Y30Y -5.038, -27.547 (L: -33.607 / H: -22.063)

- Current futures levels:

- Mar 2-Yr futures down 5.25/32 at 101-20.625 (L: 101-17.875 / H: 101-26.75)

- Mar 5-Yr futures down 13.75/32 at 106-16.5 (L: 106-10.25 / H: 107-00.5)

- Mar 10-Yr futures down 15.5/32 at 110-30.5 (L: 110-21 / H: 111-19)

- Mar 30-Yr futures down 1-05/32 at 123-30 (L: 123-18 / H: 125-12)

- Mar Ultra futures down 1-17/32 at 134-11 (L: 133-20 / H: 136-11)

US 10YR FUTURE TECHS: (H3) Near-Term Weakness Persists Post-PCE

- RES 4: 115-22+ High Feb 3

- RES 3: 115-00 Round number resistance

- RES 2: 113-09 50-day EMA

- RES 1: 112-19 20-day EMA

- PRICE: 110-30+ @ 1515ET Feb 24

- SUP 1: 110-21 Low Feb 24

- SUP 2: 110-07 Lower 2.0% Bollinger Band

- SUP 3: 109-24+ 2.0% 10-dma envelope

- SUP 4: 109-22 Low Nov 3

Near-term weakness extended across Treasury futures this week, putting prices at new pullback lows of 110-21. The price action opens medium-term losses toward levels not seen since November. The strengthening bearish theme exposes 109-22, the Nov 3 low. Key short-term resistance is seen at the 50-day EMA which intersects at 113-09. A break of this EMA would ease bearish pressure.

EURODOLLAR FUTURES CLOSE

- Mar 23 +0.033 at 94.925

- Jun 23 -0.025 at 94.485

- Sep 23 -0.065 at 94.340

- Dec 23 -0.115 at 94.490

- Red Pack (Mar 24-Dec 24) -0.21 to -0.17

- Green Pack (Mar 25-Dec 25) -0.18 to -0.115

- Blue Pack (Mar 26-Dec 26) -0.10 to -0.07

- Gold Pack (Mar 27-Dec 27) -0.06 to -0.05

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00286 to 4.56171% (+0.00485/wk)

- 1M +0.01786 to 4.63486% (+0.04357/wk)

- 3M -0.00443 to 4.95343% (+0.03814/wk)*/**

- 6M -0.04186 to 5.23514% (-0.00786/wk)

- 12M -0.00315 to 5.63871% (-0.00415/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 4.95786% on 2/23/23

- Daily Effective Fed Funds Rate: 4.58% volume: $106B

- Daily Overnight Bank Funding Rate: 4.57% volume: $299B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.137T

- Broad General Collateral Rate (BGCR): 4.51%, $457B

- Tri-Party General Collateral Rate (TGCR): 4.51%, $444B

- (rate, volume levels reflect prior session)

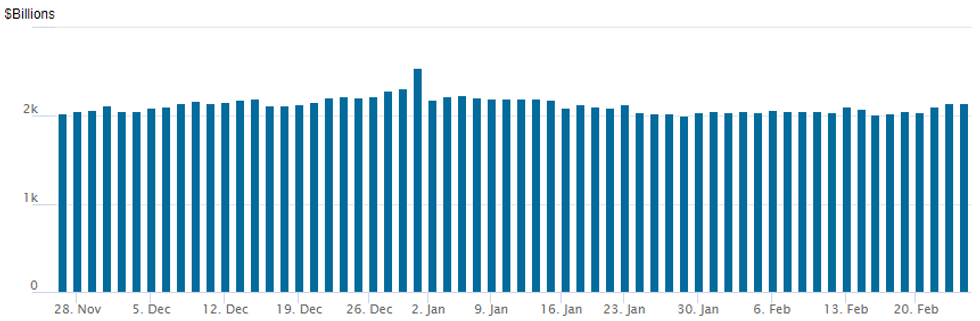

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $2,142.141B w/ 104 counterparties vs. prior session's $2,147.417B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/02/2023 | 0030/1130 |  | AU | Business Indicators | |

| 27/02/2023 | 0700/0800 | ** |  | SE | Retail Sales |

| 27/02/2023 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 27/02/2023 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 27/02/2023 | 0900/1000 | ** |  | EU | M3 |

| 27/02/2023 | 0900/0900 |  | UK | BOE Broadbent Opens BEAR Research Conference | |

| 27/02/2023 | 1000/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 27/02/2023 | 1330/0830 | * |  | CA | Current account |

| 27/02/2023 | 1330/0830 | ** |  | US | Durable Goods New Orders |

| 27/02/2023 | 1500/1000 | ** |  | US | NAR Pending Home Sales |

| 27/02/2023 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 27/02/2023 | 1530/1030 |  | US | Fed Governor Philip Jefferson | |

| 27/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 27/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 27/02/2023 | 1700/1800 |  | EU | ECB Lane Lecture at Goethe University Frankfurt |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.