-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Philly-Fed Surprises, Beats Estimates

- MNI INTERVIEW: Fed Might Not Be Done With Rate Hikes–Kohn

- MNI Weekly Jobless Claims Data Mostly As Expected

- MNI Philly Fed Mfg Sees Notable Bounce, New Orders Positive After 14 Negative Months

US

FED: The Federal Reserve could raise interest rates further, especially if economic growth reaccelerates, in order to ensure inflation is convincingly on its way back down to the 2% target, former Fed Vice Chair Donald Kohn told MNI.

- While a couple of benign recent inflation readings probably give policymakers the luxury of standing pat at their September meeting, additional increases might still be required later this year from the current fed funds level of 5.25%-5.5%, Kohn said in an interview.

- “I don’t think we can prejudge November, December, but I think it’s very much on the table,” Kohn said. “The issue here is what people are calling the last mile: Inflation is down, even underlying inflation is down quite a bit, but the labor market is looking pretty tight, at least by the latest measure wages are going up pretty quickly.”

- Getting inflation to target will require below-trend growth in the economy, which seems to be going in the opposite direction as consumers show resilience and even sectors that bore the brunt of rate hikes, like housing, appear to be stabilizing. For more see MNI Policy main wire at 1152ET.

US TSYS Markets Roundup: Late Risk Off Bouys' Rates

- Still weaker but well off midday lows now, Treasury futures are have rebounded over the last hour (TYU3 109-11.5 -6.5), partially a risk-off move as stocks continue to weaken, SPX Eminis back to late June levels (4387.0 -33.0)

- Curves maintaining steeper profiles with short end rates outperforming: 3m10Y +6.865 -113.724, 2Y10Y +4.652 at -67.252. Robust volumes for late summer trade: TYU3 over 1.5M. Of note, 30Y yield had climbed past late Dec 2022 high to 4.4219% in the first half, a level last seen in late June 2011, is currently at 4.4043%.

- Earlier, Treasury futures traded lower after Philadelphia Fed Business Outlook comes out higher than expected at 12.0 vs. -10.0 est, prices paid 20.8 vs. 9.5 prior. Weekly claims largely in-line with expectations: -11k to 239k vs. 240k est while continuing claims climbs to 1.716M vs. 1.700M est.

- With data out of the way early (and no data Friday) Treasury futures managed to recover by midmorning, front month 10Y futures marking 109-20.5 high amid a combination of two-way position, option hedging and early cycle Sep/Dec quarterly futures rolling. Nascent support evaporated going into the European close with rates marking session lows on similar moves in Gilts and Bunds.

OVERNIGHT DATA

- US JOBLESS CLAIMS -11K TO 239K IN AUG 12 WK

- US PREV JOBLESS CLAIMS REVISED TO 250K IN AUG 05 WK

- US CONTINUING CLAIMS +0.032M to 1.716M IN AUG 05 WK

- Initial claims as expected, dipping to 239k (cons 240k) in the week to Aug 12, a payrolls reference period, after a marginally upward revised 250k (initial 248k).

- We focus on the four-week average to smooth some of the noise, which increased 2k to 234k, up from a recent low of 228k two weeks prior but still below a recent high of 257k from Jun 23.

- The 213k for NSA initial claims looks fair when eyeballing the seasonality chart vs the level of SA claims.

- Continuing claims a little higher than expected at 1716k (cons 1700k) after an unrevised 1684k). It’s technically the highest since Jul 7 but is only just above the 2019 average. There still appears to be a favorable seasonal adjustment process in level terms considering the levels of NSA claims remains above that of pre-pandemic years.

- US AUG PHILADELPHIA FED MFG INDEX 12

- US AUG. PHILADELPHIA FED PRICES-PAID INDEX 20.8 VS 9.5

- US AUG. PHILADELPHIA FED PRICES-RECEIVED AT 14.1 VS 23.0

- US AUG. PHILADELPHIA FED EMPLOYMENT INDEX AT -6.0 VS -1.0

- US AUG. PHILADELPHIA FED NEW ORDERS INDEX AT 16.0 VS -15.9

- US AUG. PHILADELPHIA FED FUTURE INDEX AT 3.9 VS 29.1

- The Philly Fed manufacturing survey saw a large beat in August, rising to +12.0 (cons -10.2) from -13.5 in stark contrast to renewed softness for the typically more volatile Empire Fed survey earlier in the week.

- It’s the first positive reading since Aug’22 and its highest since Apr’22, whilst the 25.5pt increase on the month was the largest since at least 2000 when looking outside of initial pandemic re-opening.

- Most notable were gains in new orders after being negative for fourteen consecutive months (from -15.9 to +16.0, highest since Mar’22) and shipments (from -12.5 to +5.7, albeit only highest since Jun’23). However, employment softened to -6.0 (-5pts)

- Mixed price components on the month but both are near their long-run averages: prices paid at 20.8 (+11pts) but prices received 14.1 (-9pts).

- However, the six-month ahead overall index offered a conflicting message, failing to hold its July jump to 29.1 and instead fell back to just 3.9.

- US July Leading Indicator Falls 0.4% M/M; Est. -0.4%

MARKETS SNAPSHOT

Key late session market levels at:- DJIA down 285.44 points (-0.82%) at 34481.45

- S&P E-Mini Future down 35.75 points (-0.81%) at 4384

- Nasdaq down 153 points (-1.1%) at 13321.37

- US 10-Yr yield is up 4.4 bps at 4.2939%

- US Sep 10-Yr futures are down 7/32 at 109-11

- EURUSD down 0.0016 (-0.15%) at 1.0863

- USDJPY down 0.44 (-0.3%) at 145.91

- WTI Crude Oil (front-month) up $0.77 (0.97%) at $80.15

- Gold is down $3.64 (-0.19%) at $1888.10

- EuroStoxx 50 down 56.44 points (-1.32%) at 4227.83

- FTSE 100 down 46.67 points (-0.63%) at 7310.21

- German DAX down 112.55 points (-0.71%) at 15676.9

- French CAC 40 down 68.51 points (-0.94%) at 7191.74

US TREASURY FUTURES CLOSE

- 3M10Y +5.874, -114.715 (L: -123.786 / H: -111.939)

- 2Y10Y +6.004, -65.9 (L: -72.195 / H: -64.79)

- 2Y30Y +6.298, -55.452 (L: -62.507 / H: -52.968)

- 5Y30Y +2.446, -3.004 (L: -6.802 / H: 0.54)

- Current futures levels:

- Sep 2-Yr futures up 1.5/32 at 101-11.375 (L: 101-08.5 / H: 101-13.25)

- Sep 5-Yr futures down 2.25/32 at 105-25 (L: 105-20.25 / H: 105-30)

- Sep 10-Yr futures down 7/32 at 109-11 (L: 109-03.5 / H: 109-20.5)

- Sep 30-Yr futures down 21/32 at 118-23 (L: 118-14 / H: 119-19)

- Sep Ultra futures down 29/32 at 123-31 (L: 123-18 / H: 125-05)

US 10Y FUTURE TECHS: (U3) Fresh Cycle Low

- RES 4: 112-07 High Jul 27

- RES 3: 111-31 50-day EMA

- RES 2: 111-29 High Aug 10

- RES 1: 110-07/110-30 High Aug 15 / 20-day EMA

- PRICE: 109-12 @ 1520 ET Aug 17

- SUP 1: 109-03+ Low Aug 17

- SUP 2: 109-00 Round number support

- SUP 3: 108-26+ Low Oct 21 2022 (cont) and a major support

- SUP 4: 108-08+ 2.0% 10-dma envelope

The trend direction in Treasuries remains down and the contract traded lower Thursday. This week’s activity has resulted in a break of 109.24, the Aug 4 low, that confirmed a resumption of the bear cycle. The move lower signals scope for 108-26 next, the Oct 21 2022 low (cont). Moving average studies are in a bear mode condition, highlighting a downtrend. Firm resistance is at 110-30, the 20-day EMA.

SOFR FUTURES CLOSE

- Sep 23 +0.003 at 94.588

- Dec 23 +0.020 at 94.605

- Mar 24 +0.030 at 94.80

- Jun 24 +0.035 at 95.10

- Red Pack (Sep 24-Jun 25) -0.02 to +0.030

- Green Pack (Sep 25-Jun 26) -0.06 to -0.035

- Blue Pack (Sep 26-Jun 27) -0.075 to -0.07

- Gold Pack (Sep 27-Jun 28) -0.08 to -0.075

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00203 to 5.31398 (+.00350/k)

- 3M +0.00053 to 5.37976 (+0.01519/wk)

- 6M -0.00074 to 5.44112 (+0.02604/wk)

- 12M -0.00909 to 5.37645 (+0.07063/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $96B

- Daily Overnight Bank Funding Rate: 5.32% volume: $251B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.391T

- Broad General Collateral Rate (BGCR): 5.28%, $550B

- Tri-Party General Collateral Rate (TGCR): 5.28%, $538B

- (rate, volume levels reflect prior session)

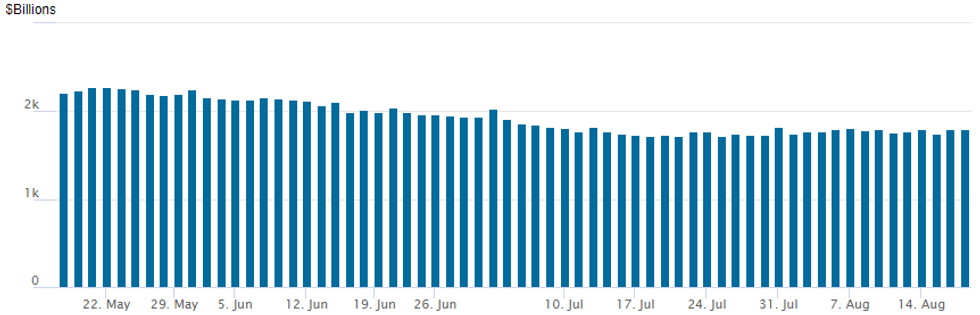

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operations continue to see-saw around 1.75-1.80T: the latest slips to to $1,794.120B, w/101 counterparties, compared to $1,796.725B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE Development Bank of Japan Investor Calls

- Date $MM Issuer (Priced *, Launch #)

- 08/17 $Benchmark DBJ (Development Bank of Japan) 3Y investor call

- 08/16 No new US$ corporate bond issuance Wednesday

EGBs-GILTS CASH CLOSE: Long End Closes On A Weak Note

Gilts sold off sharply again Thursday with UK 10Y yields hitting the highest levels in 15 years, cheapening further vs Bunds as BoE hike pricing picked up.

- Both the UK and German curves bear steepened in a session with very limited data and newsflow, with overnight events including the slightly hawkish-leaning FOMC minutes and a terrible long-end Japanese bond auction weighing into the open.

- Periphery spreads were little changed, with Spanish bonds showing little reaction to a key parliamentary vote win by PM Sanchez (more here).

- As global rates sold off, BoE terminal hike pricing eclipsed 6.10% for the first time since early August, and 10Y Gilts closed at their widest spread to Bunds since Oct 2022, and the highest outright yield level since 2008.

- The yield rise at the end of the session into the cash close suggests potential anxiety over Friday's pre-open retail sales release, given the first 2 of the week's 3 key UK data points (CPI, wages) were more inflationary than expected.

- Other than that, the only key item on Friday's schedule is final Eurozone CPI.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.2bps at 3.107%, 5-Yr is up 4.1bps at 2.704%, 10-Yr is up 5.9bps at 2.709%, and 30-Yr is up 6.3bps at 2.792%.

- UK: The 2-Yr yield is up 7.3bps at 5.276%, 5-Yr is up 9.1bps at 4.755%, 10-Yr is up 10bps at 4.746%, and 30-Yr is up 9.8bps at 4.932%.

- Italian BTP spread up 0.3bps at 170.5bps / Spanish up 0.1bps at 105.1bps

FOREX EURUSD Presses Fresh Session Lows, Bearish Extension For EURGBP

- Worth noting that EURUSD (-0.17) has made fresh session lows in recent trade below 1.0860 as the pair extends the intra-day pullback to around 60 pips and appears to have settled around this level approaching the APAC crossover. The July 6 low at 1.0834 remains the key level on the downside.

- EURGBP is also registering a 0.2% loss on the day, which would extend its losing streak to 5 consecutive trading days. Importantly, the cross has broken a key short-term support level of 0.8544, the Jul 27 low. A sustained break would strengthen current bearish conditions and signal scope for weakness towards 0.8504, the Jul 11 low and a bear trigger.

- Data remaining for the week could also have an impact here with UK July retail sales due on Friday, as well as the final reading of July Eurozone CPI.

- There was some notable CNH volatility earlier in the session following the news on state bank intervention to curb yuan depreciation. USDCNH trades as low as 7.2970 on the back of the headlines, briefly piercing 7.3043 support, the Aug 16 low.

- Despite this volatile move for CNH following the news, G10 currency adjustments have been limited on Thursday, with a dearth of tier-one economic data points and markets potentially shifting the focus to next week’s Jackson Hole Symposium.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/08/2023 | 0600/0700 | *** |  | UK | Retail Sales |

| 18/08/2023 | 0800/1000 |  | EU | ECB's Lane appears in ECB podcast | |

| 18/08/2023 | 0900/1100 | *** |  | EU | HICP (f) |

| 18/08/2023 | 0900/1100 | ** |  | EU | Construction Production |

| 18/08/2023 | 0900/0500 | * |  | US | Business Inventories |

| 18/08/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 18/08/2023 | 1400/1000 | * |  | US | Services Revenues |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.