-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Pondering Policy Pivots

EXECUTIVE SUMMARY

US

FED: U.S. inflation is seen only very gradually falling back to 2% and is projected to still be nearly 2.7% by the end of 2025, far above the Fed's December SEP median projection of 2.1%, Cleveland Fed economists wrote in a paper published Tuesday.

- "Inflation is going to remain higher for longer: rather than core PCE inflation reaching 2.1% by the end of 2025, our model projects that it will be at 2.8%, with the 70% confidence interval spanning 2.4 to 3.2%," according to the paper by economists Randal Verbrugge and Saeed Zaman.

- Core goods prices are seen turning negative through 2025 and core services ex-housing are seen falling to only 3.8% by the end of 2023 and 3.4% by 2024. Housing prices are projected to fall steadily but then stall at a 4.5% pace in 2025. For more see MNI Policy main wire at 1231ET.

- ESH3 falls 10 points but remains within the sessions generally tight range at 4009.50. Resistance 4043.00 (Dec 15 high), support 3891.50 (Jan 10 low).

- "A bank's failure to resolve longstanding deficiencies despite reprimands from its regulators and onerous restrictions such as caps on its growth are evidence that a firm is unmanageable and needs to be broken up, acting Comptroller of the Currency Michael Hsu said."

- "Mr. Hsu's remarks don't target any specific bank to be broken up but appear to highlight concerns about firms like Wells Fargo & Co., which has struggled to resolve longstanding problems despite repeated enforcement actions and billions paid in penalties."

- According to a statement issued by the USTR: "The new TRQ allocations are based on the historic pattern of agricultural exports to the 27 EU Member States. The Agreement will restore favorable market access for multiple US agricultural products, including for U.S. rice, almonds, wheat, and corn."

- According to the office of the USTR, "In the first eleven months of 2022, the United States exported $11.1 billion worth of agricultural goods to the EU."

- Bloomberg: "Tariff-rate quotas allows countries to export specified quantities of a product to other nations at lower duty rates, but subjects shipments above a pre-determined threshold to higher tariffs."

- The agreement is undersigned by US Trade Representative Katherine Tai, Swedish Permanent Representative to the European Union Mikael Lindvall, and European Commission Deputy Director General for Agriculture and Rural Development Michael Scannell.

UK

BOE: The Bank of England will examine whether to increase its estimate of the level of unemployment compatible with stable inflation in its February Monetary Policy Report, a move which could mean it was less likely to slow the pace of interest rate hikes as joblessness rises.

- At the start of 2021 Bank staff estimated the so-called non-accelerating inflation rate of unemployment at around 4.25%, and it will only be in next month’s MPR that it delivers a fresh stock take of the labour market, prompted by a recent decline in participation rates. Falling participation seems to be partly linked to an increase in long-term sickness, which work by MPC member Jonathan Haskel and Bank economist Josh Martin has indicated has moved markedly higher since the Covid pandemic than indicated by some official data.

- Other factors include Brexit, which cut off a supply of European workers but opened new less flexible avenues for working visas tied to jobs in specific sectors, and an increase in early retirement, which may be explained by savings accumulated during lockdowns and rule changes allowing more flexible access to pensions. For more see MNI Policy main wire at 0432ET.

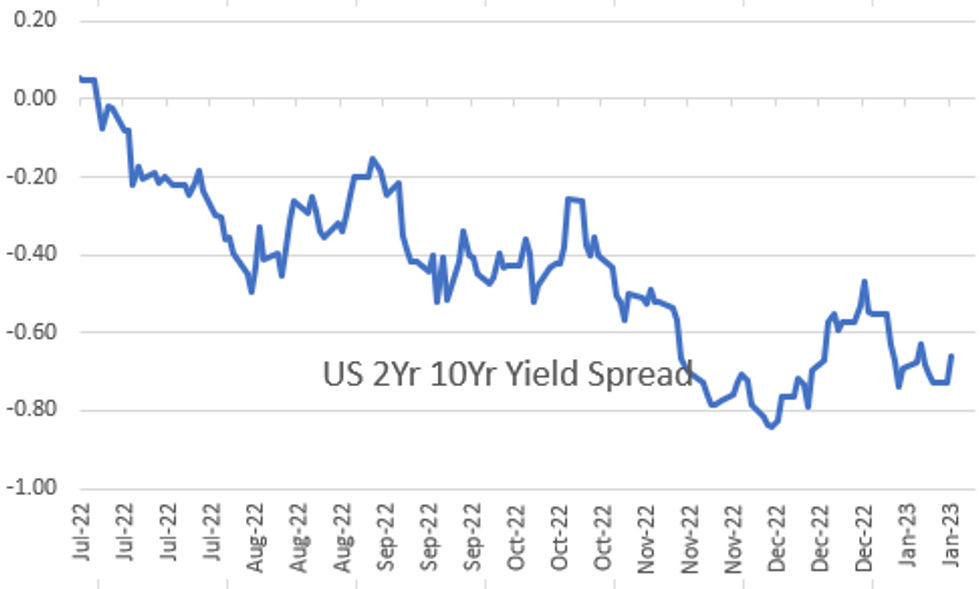

US TSYS: Yld Curves Bear Steepen Ahead Heavy Data Docket Wednesday

Tsys holding modestly mixed levels after the bell, near top end narrow range since midmorning, yield curves bouncing off deeper inverted levels (2s10s +7.413 at -66.082). Tsys mirrored similar moves in German Bunds in early trade, gapped higher after Bbg story hit wires: "ECB Starts to Ponder Slower Hikes After Half Point in February".

- Tsys extended past early overnight highs (30YY slips to 3.6135% low vs. 3.6948% high) following the headlines while equities bounced to new session highs briefly before moving back to early session range.

- Muted react to limited data (NY FED EMPIRE STATE MFG INDEX -32.9 JAN) participants plied the sidelines ahead Wednesday's heavy data docket that includes Retail Sales, PPI, IP/Cap-U, Business Inventories, Net TIC flows.

- Fed Funds implied hikes have shifted lower, continuing through the session after a sizeable miss for the admittedly volatile Empire mfg index.* 27bp for Feb 1 (unch from Fri close), cumulative 46bp for Mar (-1bp), 57bp to 4.90% terminal in Jun (-2.5bp) before 48bp of cuts to 4.42% for Dec (-5.5bp).

- Comes ahead of the BoJ overnight and tomorrow's stacked docket including multiple important data releases, four Fed speakers (incl Bullard at 0930ET not showing on BBG calendar) and the Fed Beige Book.

- Equity earnings resume, Goldman Sachs just annc ($10.59B 4Q rev vs. $10.7B est, $3.32 EPS), Morgan Stanley (sales & trade rev's $1.42B vs. $1.68B est);, UAL and Interactive Brokers after the close. Earnings on tap early Wednesday: Charles Schwab, Prologis Inc, JB Hunt Transport, PNC Financial Services.

OVERNIGHT DATA

- US NY FED EMPIRE STATE MFG INDEX -32.9 JAN

- US NY FED EMPIRE MFG NEW ORDERS -31.1 JAN

- US NY FED EMPIRE MFG EMPLOYMENT INDEX 2.8 JAN

- US NY FED EMPIRE MFG PRICES PAID INDEX 33.0 JAN

- CANADA DEC CPI INFLATION -0.6% M/M, +6.3% YY

- CANADA DEC CPI +6.3% YOY VS FORECAST +6.4%, NOV +6.8%

- CANADA DEC CPI -0.6% MOM VS FORECAST -0.5%, NOV +0.1%

- CANADA INFLATION RATE SLOWS AS GASOLINE PRICES FALL

- CANADA DEC CPI EX FOOD & ENERGY -0.1% MOM; +5.3% YOY

- CANADA CORE TRIM CPI +5.3% YOY, MEDIAN +5.0%

- "The Consumer Price Index (CPI) rose 6.8% on an annual average basis in 2022, following gains of 3.4% in 2021 and of 0.7% in 2020. The increase in 2022 was a 40-year high, the largest increase since 1982 (+10.9%)."

- "Excluding energy, the annual average CPI rose 5.7% in 2022 compared with 2.4% in 2021."

- Additionally, "prices for food purchased from stores rose 9.8% in 2022, the fastest pace since 1981 (+12.0%), after increasing 2.2% in 2021."

- FOREIGN HOLDINGS OF CANADA SECURITIES +12.8B CAD IN NOV

- CANADIAN HOLDINGS OF FOREIGN SECURITIES +14.1B CAD IN NOV

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 326.32 points (-0.95%) at 33951.76

- S&P E-Mini Future down 1.5 points (-0.04%) at 4013.75

- Nasdaq up 26.4 points (0.2%) at 11095.16

- US 10-Yr yield is up 2.8 bps at 3.531%

- US Mar 10-Yr futures are down 2/32 at 114-22.5

- EURUSD down 0.0028 (-0.26%) at 1.0793

- USDJPY down 0.28 (-0.22%) at 128.35

- WTI Crude Oil (front-month) up $0.94 (1.18%) at $80.66

- Gold is down $7.08 (-0.37%) at $1907.99

- EuroStoxx 50 up 17.33 points (0.42%) at 4174.33

- FTSE 100 down 9.04 points (-0.12%) at 7851.03

- German DAX up 53.03 points (0.35%) at 15187.07

- French CAC 40 up 33.85 points (0.48%) at 7077.16

US TSY FUTURES CLOSE

- 3M10Y +2.362, -109.532 (L: -116.696 / H: -105.394)

- 2Y10Y +7.413, -66.082 (L: -72.155 / H: -65.555)

- 2Y30Y +7.978, -54.842 (L: -60.397 / H: -54.18)

- 5Y30Y +4.088, 3.699 (L: 1.207 / H: 4.902)

- Current futures levels:

- Mar 2-Yr futures up 3.125/32 at 102-31.375 (L: 102-26.625 / H: 103-00.25)

- Mar 5-Yr futures up 2.5/32 at 109-16.25 (L: 109-06.25 / H: 109-20.25)

- Mar 10-Yr futures down 2/32 at 114-22.5 (L: 114-09.5 / H: 114-29.5)

- Mar 30-Yr futures down 7/32 at 129-25 (L: 128-24 / H: 130-06)

- Mar Ultra futures down 12/32 at 141-23 (L: 140-08 / H: 142-13)

US 10Y FUTURE TECHS: (H3) Trend Signals Remain Bullish

- RES 4: 116-04 2.0% 10-dma env

- RES 3: 116-00 Round number resistance

- RES 2: 115-26 2.00 proj of the Oct 21 - 27 - Nov 3 low

- RES 1: 115-15+ High Jan 13

- PRICE: 114-27+ @ 15:59 GMT Jan 17

- SUP 1: 113-26+/17 20- and 50-day EMA values

- SUP 2: 112-18+/111-28 Low Jan 5 / Low Dec 30 and the bear trigger

- SUP 3: 111-27+ 61.8% retracement of the Nov 3 - Dec 13 rally

- SUP 4: 111-01 76.4% retracement of the Nov 3 - Dec 13 rally

Treasury futures maintain a bullish tone and the latest move lower is considered corrective. Price has recently attempted a break of resistance at 115-11+, high Dec 13. A clear breach of this level would strengthen bullish conditions and open 115-26, a Fibonacci projection. Price has also recently cleared the 100-dma and this reinforces the bullish theme. On the downside, initial support lies at 113-26+, the 20-day EMA.

US EURODOLLAR FUTURES CLOSE

- Mar 23 +0.010 at 94.970

- Jun 23 +0.035 at 94.910

- Sep 23 +0.060 at 95.040

- Dec 23 +0.060 at 95.40

- Red Pack (Mar 24-Dec 24) +0.050 to +0.075

- Green Pack (Mar 25-Dec 25) steady to +0.030

- Blue Pack (Mar 26-Dec 26) -0.02 to -0.01

- Gold Pack (Mar 27-Dec 27) -0.04 to -0.02

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00286 to 4.31657% (+0.00286/wk)

- 1M +0.00514 to 4.47000% (+0.01557/wk)

- 3M +0.00286 to 4.79757% (+0.00514/wk)*/**

- 6M +0.00528 to 5.12071% (+0.01957/wk)

- 12M +0.00229 to 5.39500% (+0.03800/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.82971% on 1/12/23

- Daily Effective Fed Funds Rate: 4.33% volume: $110B

- Daily Overnight Bank Funding Rate: 4.32% volume: $281B

- Secured Overnight Financing Rate (SOFR): 4.30%, $1.101T

- Broad General Collateral Rate (BGCR): 4.27%, $445B

- Tri-Party General Collateral Rate (TGCR): 4.27%, $418B

- (rate, volume levels reflect prior session)

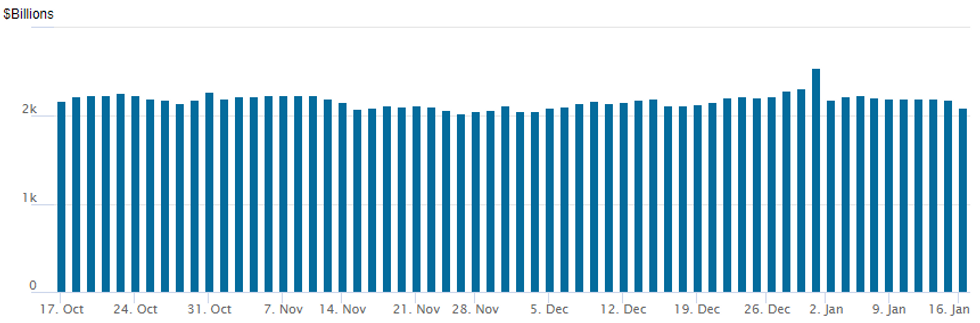

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,093.328B w/ 103 counterparties vs. prior session's $2.179.781B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: $1.65B Target 2Pt Launched, $3B BAC Priced

$12.25B to Price Tuesday- Date $MM Issuer (Priced *, Launch #)

- 01/17 $6B #Morgan Stanley $1.5B 4NC3 +120, $2.5B 6NC5 +153, $2B 15NC10 +243

- 01/17 $3B *Bank of America 4NC3 +120 (drops SOFR leg)

- 01/17 $1.65B #Target $500M 10Y +90, $1.15B 30Y +115

- 01/17 $600M *Woori Bank 5Y +135

- 01/17 $Benchmark Israel Discount Bank 5Y investor calls

- Expected Wednesday:

- 01/17 $Benchmark JBIC 3Y SOFR+65a

- 01/17 $500M OPEC Fund 3Y SOFR+95a

- 01/18 $Benchmark CADES 3Y SOFR+42a

EGBs-GILTS CASH CLOSE: Rally On Another Dovish ECB Report

European bonds rallied Tuesday as Bloomberg published a sources piece pointing to a final 50bp ECB hike in Feb with smaller hikes starting in March.

- Similar to the price action following last week's MNI sources piece that pointed to potential for a dovish stepdown in the hiking pace, terminal ECB hike pricing fell sharply (by 17bp at one point).

- Bunds held their gains made in the aftermath, with the curve bull steepening.

- 10Y BTP/Bund spreads tested last week's 8-month low of 177bp, but closed the session a little wider of that. GGBs underperformed as Greece sold new 10Y via syndication.

- Gilts underperformed overall but moved to new session highs on the ECB report. Earlier, UK labour market data showed wage growth a little stronger than expected but the rest of the report was mixed.

- Bonds' strong close came in spite of overnight event risk ahead, with the Bank of Japan decision expected around 0300GMT, and UK CPI at 0700GMT.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 10.9bps at 2.457%, 5-Yr is down 8.2bps at 2.108%, 10-Yr is down 8.4bps at 2.091%, and 30-Yr is down 5.6bps at 2.091%.

- UK: The 2-Yr yield is down 5.4bps at 3.462%, 5-Yr is down 3.6bps at 3.276%, 10-Yr is down 6bps at 3.324%, and 30-Yr is down 6bps at 3.667%.

- Italian BTP spread down 4.2bps at 180.1bps / Greek up 5.3bps at 203.6bps

FOREX: Broad Euro Weakness Following ECB Report, USDCNH Extends Bounce

- Despite EURUSD rising to within close range of trend highs above 1.0850 in early trade on Tuesday, a Bloomberg report quickly dampened sentiment for the single currency.

- ECB policymakers are said to be starting to consider a slower pace of interest-rate hikes than President Christine Lagarde indicated in December, according to officials with knowledge of their discussions.

- Following the piece, ECB terminal rate pricing briefly dropped as much as 17bp and the Euro traded with a negative bias for the remainder of Tuesday’s session, currently residing 0.25% lower against the greenback around 1.0795. Initial firm support lies further away at 1.0680, the 20-day EMA.

- The relative Euro weakness was more pronounced in the crosses with the likes of EURGBP and EURNZD dropping ~1%.

- USDJPY lacked direction are largely respected the 128-129 range ahead of the much anticipated BOJ meeting & decision due overnight. Options markets are implying moves of approx 275 pip in either direction to cover the premium paid on an ATM straddle, a sure sign that markets are anticipating acute volatility in the wake of the decision.

- USDCNH has risen roughly half a percent, in very similar fashion to Monday’s price action, which may be a reflection of the stabilisation for the greenback but also pre-positioning ahead of lunar new year.

- Aside from the BOJ, UK December CPI, US PPI & retail sales highlight Wednesday’s data calendar.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/01/2023 | 0001/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 18/01/2023 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 18/01/2023 | 0930/0930 | * |  | UK | ONS House Price Index |

| 18/01/2023 | 1000/1100 | *** |  | EU | HICP (f) |

| 18/01/2023 | 1000/1100 | ** |  | EU | Construction Production |

| 18/01/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 18/01/2023 | - |  | JP | Bank of Japan policy decision | |

| 18/01/2023 | 1330/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 18/01/2023 | 1330/0830 | *** |  | US | PPI |

| 18/01/2023 | 1330/0830 | *** |  | US | Retail Sales |

| 18/01/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 18/01/2023 | 1400/0900 |  | US | Atlanta Fed's Raphael Bostic | |

| 18/01/2023 | 1415/0915 | *** |  | US | Industrial Production |

| 18/01/2023 | 1500/1000 | * |  | US | Business Inventories |

| 18/01/2023 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 18/01/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 18/01/2023 | 1800/1300 |  | US | Kansas City Fed's Esther George | |

| 18/01/2023 | 1900/1400 |  | US | Fed Beige Book | |

| 18/01/2023 | 2015/1515 |  | US | Philadelphia Fed's Pat Harker | |

| 18/01/2023 | 2100/1600 | ** |  | US | TICS |

| 18/01/2023 | 2200/1700 |  | US | Dallas Fed's Lorie Logan |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.