-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Potential for 50Bp Hikes Remains

EXECUTIVE SUMMARY

US

FED: The Federal Reserve should keep raising interest rates to ensure the recent disinflationary trend continues and inflation expectations remain well anchored, St. Louis Fed President James Bullard said Thursday.

- “Continued policy rate increases can help lock in a disinflationary trend during 2023, even with ongoing growth and strong labor markets, by keeping inflation expectations low,” he said, without specifying how much further he would like to see rates rise. He said inflation remains too high despite recent declines.

- Market expectations for Fed tightening have ratcheted some 40 basis points higher in the last two weeks after strong jobs and inflation data boosted the perception that more rate hikes will be needed.

- Bullard said the economy’s prospects are robust despite Fed tightening, arguing that real GDP growth could be in “a neighborhood of the potential growth rate of about 2% on a year-on-year basis after stellar growth in 2021.”

FED: St. Louis Fed President James Bullard said Thursday he does not yet have a view on how big a rate hike will be warranted at the Fed’s next meeting in March, but would not rule out a half percentage point increase in a briefing with reporters.

- “What will happen now, I don’t know, I wouldn’t rule anything out for that meeting or any meeting in the future,” he said, adding that he sees fed funds peaking at 5.375%. “I do have a preference for the frontloading policy.” (See: MNI: Fed’s Peak Rate Looking Perkier As Jobs Boom-Ex-Officials)

- “At the last FOMC meeting I was an advocate for a 50 basis point hike and I argued that we should get to the level of rates that the committee viewed as sufficiently restrictive as soon as we could. The committee made a different judgment,” Bullard added.

FED: U.S. interest rates need to rise above 5% and stay there for some time, Federal Reserve Bank of Cleveland President Loretta Mester said Thursday, warning inflation risks are still tilted to the upside and the cost of prematurely loosening policy outweighs the cost of doing too much.

- The stronger-than-expected January CPI report offers "a cautionary tale against concluding too soon that inflation is on a timely and sustained path back to 2%," she noted, while the Ukraine war and China's emergence from its zero-Covid policies mean food and commodities prices could move up again.

- "The incoming data have not changed my view that we will need to bring the fed funds rate above 5% and hold it there for some time to be sufficiently restrictive to ensure that inflation is on a sustainable path back to 2%," she said in remarks prepared for a Global Interdependence Center event. "Indeed, at our meeting two weeks ago, setting aside what financial market participants expected us to do, I saw a compelling economic case for a 50-basis-point increase, which would have brought the top of the target range to 5%." For more see MNI Policy main wire at 0845ET.

US TSYS: Potential Pivot From Feb 1 FOMC Pivot?

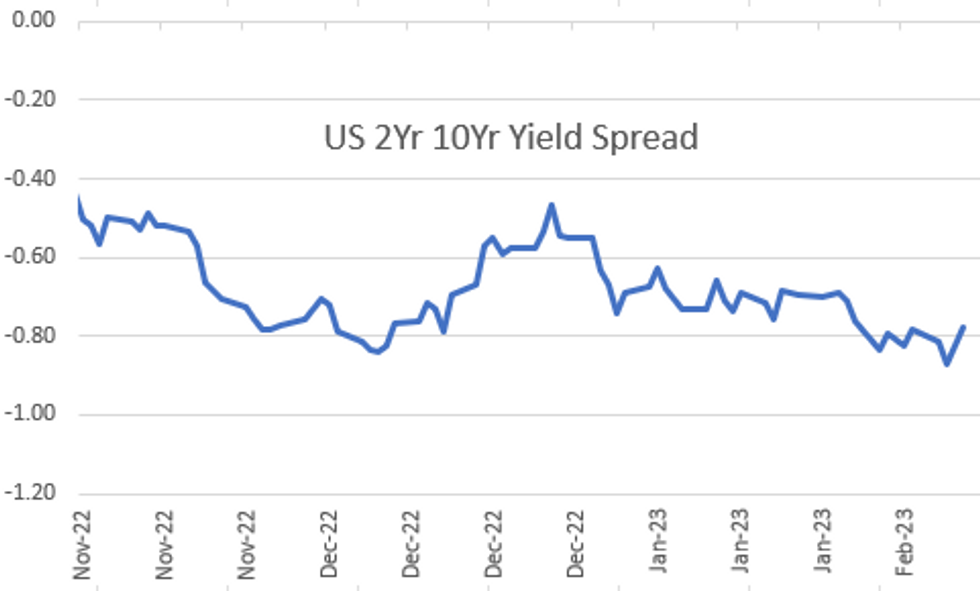

Heavy session volumes (TYH3>1.8M) as rates extend past midmorning lows (30YY 3.9262% high) as StL Fed Bullard puts his thumb on the scale stating he wouldn't rule out a move back to 50bps hike at the March 22 FOMC. Yield curves hold onto steeper levels, however, 2s10s +5.338 at -78.306. Reminder, Cleveland Fed Mester speaks about her economic outlook later this evening (1815ET).

- Tsy had gapped lower earlier as PPI (+0.7%, ex-food/energy +0.5%) and Jobless (194K) both indicated strength and inflation, while Philly Fed at -24.3 has only been lower in covid spike and the global financial crisis.

- The sell-off accelerated on comments from Fed Mester that rates need to rise above 5% and stay there for some time, warning inflation risks are still tilted to the upside and the cost of prematurely loosening policy outweighs the cost of doing too much. Mester "SAW A 'COMPELLING' CASE FOR 50 BPS HIKE AT LAST FOMC MEETING .. adding the "FED CAN ACCELERATE PACE OF HIKES IF CONDITIONS WARRANT" Bbg.

- Fed funds implied hike for Mar'23 +2.1 at 28.2bp, May'23 cumulative +3.2 at 49.2bp to 5.073%, Jun'23 +3.4 at 63.4bp to 5.215%, terminal at 5.26% in Aug'23.

- Heavy session volumes before noon included several steepener (flattener unwind) blocks (5s/ultra-30s, 2s5s, 10s/ultra-30s) while the roll from Mar'23 to Jun'23 Tsy futures has begun.

OVERNIGHT DATA

- US JOBLESS CLAIMS -1K TO 194K IN FEB 11 WK

- US PREV JOBLESS CLAIMS REVISED TO 195K IN FEB 04 WK

- US CONTINUING CLAIMS +0.016M to 1.696M IN FEB 04 WK

- US JAN FINAL DEMAND PPI +0.7%, EX FOOD, ENERGY +0.5%

- US JAN FINAL DEMAND PPI EX FOOD, ENERGY, TRADE SERVICES +0.6%

- US JAN FINAL DEMAND PPI Y/Y +6.0%, EX FOOD, ENERGY Y/Y +5.4%

- US JAN PPI: FOOD -1.0%; ENERGY +5.0%

- US JAN PPI: GOODS +1.2%; SERVICES +0.4%; TRADE SERVICES +0.2%

- US JAN HOUSING STARTS 1.309M; PERMITS 1.339M

- US DEC STARTS REVISED TO 1.371M; PERMITS 1.337M

- US JAN HOUSING COMPLETIONS 1.406M; DEC 1.392M (REV)

- US FEB PHILADELPHIA FED MFG INDEX -24.3

- The Philly mfg survey surprisingly slid in February at -24.3 (cons -7.5) after -8.9, which outside of the pandemic is the lowest since the months after Lehman. The survey continues its recent trend of moving in the opposite direction of the Empire survey which bounced back from -32.9 to -5.8 yesterday, highlighting volatility in any given regional Fed series albeit with Philly typically less noisy than Empire.

- Both current activity and new orders remained negative whilst "price indexes continued to suggest overall increases but were in line with long-run averages".

- The overall 6-month ahead index meanwhile was relatively stronger, holding just about positive at 1.7, still relatively depressed historically but the

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 287.62 points (-0.84%) at 33920

- S&P E-Mini Future down 43 points (-1.03%) at 4127.75

- Nasdaq down 152.8 points (-1.3%) at 11967.95

- US 10-Yr yield is up 4.6 bps at 3.8512%

- US Mar 10-Yr futures are down 7.5/32 at 111-26

- EURUSD down 0.0013 (-0.12%) at 1.0682

- USDJPY down 0.22 (-0.16%) at 133.84

- WTI Crude Oil (front-month) down $0.29 (-0.37%) at $78.38

- Gold is up $3.63 (0.2%) at $1842.24

- EuroStoxx 50 up 17.2 points (0.4%) at 4297.24

- FTSE 100 up 14.7 points (0.18%) at 8012.53

- German DAX up 27.3 points (0.18%) at 15533.64

- French CAC 40 up 65.3 points (0.89%) at 7366.16

US TREASURY FUTURES CLOSE

- 3M10Y +2.031, -96.817 (L: -103.351 / H: -93.974)

- 2Y10Y +4.971, -78.46 (L: -85.112 / H: -77.491)

- 2Y30Y +6.908, -72.713 (L: -80.637 / H: -71.109)

- 5Y30Y +4.509, -15.242 (L: -20.443 / H: -13.753)

- Current futures levels:

- Mar 2-Yr futures down 0.125/32 at 101-31.125 (L: 101-28.625 / H: 102-02.125)

- Mar 5-Yr futures down 2.75/32 at 107-7.5 (L: 107-02.75 / H: 107-17.75)

- Mar 10-Yr futures down 7/32 at 111-26.5 (L: 111-20.5 / H: 112-11.5)

- Mar 30-Yr futures down 24/32 at 125-15 (L: 125-10 / H: 126-20)

- Mar Ultra futures down 1-23/32 at 135-16 (L: 135-12 / H: 137-27)

US 10YR FUTURE TECHS: (H3) Near-Term Weakness Extends

- RES 4: 115-22+ High Feb 3

- RES 3: 115-00 Round number resistance

- RES 2: 114-06+ 20-day EMA

- RES 1: 114-00+ 50-day EMA

- PRICE: 111-29+ @ 1215 ET Feb 16

- SUP 1: 111-20+ Low Feb 16

- SUP 2: 111-19+ Lower 2.0% Bollinger Band

- SUP 3: 110-21+ 2.0% 10-dma envelope

- SUP 4: 109-22 Low Nov 3

Near-term weakness extends across Treasury futures, putting prices at new pullback lows. The weekly low at 111-20+ marks the weakest for the contract since early January, opening medium-term losses toward levels not seen since November. This strengthens the current bearish theme and exposes 109-22 over the medium-term, the Nov 3 low. Key short-term resistance is seen at the 50-day EMA which intersects at 113-25+. A break of this EMA would ease bearish pressure.

EURODOLLAR FUTURES CLOSE

- Mar 23 -0.015 at 94.933

- Jun 23 -0.005 at 94.595

- Sep 23 steady00 at 94.520

- Dec 23 +0.015 at 94.740

- Red Pack (Mar 24-Dec 24) -0.01 to +0.040

- Green Pack (Mar 25-Dec 25) -0.04 to -0.02

- Blue Pack (Mar 26-Dec 26) -0.045 to -0.035

- Gold Pack (Mar 27-Dec 27) -0.045 to -0.04

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00372 to 4.55814% (-0.00115/wk)

- 1M -0.00357 to 4.59786% (+0.01986/wk)

- 3M +0.02429 to 4.90086% (+0.03143/wk)*/**

- 6M +0.00014 to 5.18043% (+0.05329/wk)

- 12M -0.01129 to 5.57314% (+0.08857/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.90086% on 2/16/23

- Daily Effective Fed Funds Rate: 4.58% volume: $111B

- Daily Overnight Bank Funding Rate: 4.57% volume: $319B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.239T

- Broad General Collateral Rate (BGCR): 4.53%, $470B

- Tri-Party General Collateral Rate (TGCR): 4.53%, $458B

- (rate, volume levels reflect prior session)

FED Reverse Repo Operation

NY Federal Reserve/MNI

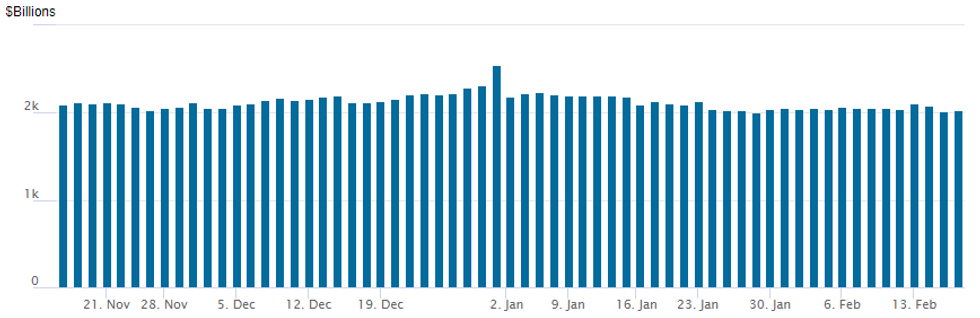

NY Fed reverse repo usage rebounds to $2,032.457B w/ 98 counterparties vs. prior session's $2,011.998B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

$1.75B AT&T 3NC1 Launched

$8.5B to price Thursday

- Date $MM Issuer (Priced *, Launch #)

- 02/16 $2.5B #Exelon $1B 5Y +112.5, $850M 10Y +145, $650M 30Y +170

- 02/16 $1.75B #AT&T 3NC1 +120

- 02/16 $1.5B *NWB 2Y SOFR+19

- 02/16 $1.3B #KHFC $1B 5Y +70, $300M 10Y +88

- 02/16 $750M #Leidos 10Y +205

- 02/16 $700M #Trane Technologies 10Y +142

$30B total priced Wednesday, thanks to Amgen's $24B 8pt "mega" issuance to help finance it's $28B acquisition of Horizon Pharmaceuticals. Amgen issuance the seventh largest bond issuance on record, topping $22B Cigna offering in 2018.

- Date $MM Issuer (Priced *, Launch #)

- 02/15 $24B *Amgen $2B 2Y +65, $1.5B 3NC1 +115, $3.75B 5Y +115, $2.75B 7Y +135, $4.25B 10Y +150, $2.75B 20Y +165, $4.25B 30Y +185, $2.75B 40Y +200

- 02/15 $5B *MUFG $1.65B 3NC2 +108, $600M 3NC2 SOFR+94, $1B 6NC5 +138, $500M 8NC7 +153, $1.25B 11NC10 +163

- 02/15 $1B *Gov of Sharjah +9Y +280

- Record Issuance Holders:

- 8/11/13 $49B Verizon

- 1/13/16 $46B AB InBev

- 9/04/18 $40B CVS over 9 tranches

- 11/12/19 $30B AbbVie jumbo 10-part

- 3/9/2022 $30B ATT/Discovery 11pt via Magallanes inc

- 4/30/20 $25B Boeing 7pt

EGBs-GILTS CASH CLOSE: Eyeing Overtightening Risks

UK and German yields saw little net change Thursday, coming off intraday highs set after stronger-than-expected US PPI data.

- Gilt and Bund yields hit the highest since early January before fading toward the close. Schatz yields set a fresh post-2008 high.

- Just after the close, BoE's Pill said there's a risk of overtightening rates, echoing comments by ECB's Panetta early in the session.

- However, ECB terminal rate expectations continued to climb (ECB nearing 3.70%), while BoE fell to a week low (Bank Rate seen peaking just below 4.50%).

- Periphery EGB spreads were steady.in a fairly heavy supply day including Italian 30Y syndication and a Spanish Obli auction.

- Attention first thing Friday will be on UK retail sales data.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.2bps at 2.881%, 5-Yr is up 0.8bps at 2.537%, 10-Yr is up 0.3bps at 2.478%, and 30-Yr is up 0.2bps at 2.436%.

- UK: The 2-Yr yield is up 0.5bps at 3.798%, 5-Yr is down 1.6bps at 3.41%, 10-Yr is up 1.2bps at 3.499%, and 30-Yr is up 2.6bps at 3.896%.

- Italian BTP spread down 0.1bps at 185.5bps / Spanish bond spread unchanged at 96.3bps

FOREX: Greenback Relinquishes Post Data Strength

- Despite the greenback receiving an initial boost following higher-than-expected US PPI data, the USD index has slowly been giving back these gains and looks set to post a moderate decline on the day as we approach the end of Thursday trade.

- The reversal could be pinned to the offsetting weaker US data, in the form of below expectation Philly Fed Business Outlook and weaker housing starts. Price action has remained lacklustre, with broad dollar indices grinding south throughout the session and major pairs sitting close to Wednesday's closing levels.

- USDJPY briefly topped Wednesday’s high to print at 133.46, however, now resides roughly 70 pips lower and is approaching the day’s lows approaching the APAC crossover.

- Earlier in the week, the pair broke above the key short-term resistance marking the 50-day EMA, suggesting scope for an extension higher that would expose 134.77, the Jan 6 high more broadly.

- However, the more medium-term trend direction remains down, and recent gains are considered technically corrective.

- For EURUSD, the pair made a new marginal low at 1.0655 and despite constantly testing the 50-day EMA throughout the week has firmed towards 1.0700 once again and looks unlikely to close below this touted support.

- On Friday, German PPI and UK retail sales highlight the European docket before US import price index figures for January will be of note. Worth noting that on Monday, the US will be out for President’s Day.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/02/2023 | 0700/0700 | *** |  | UK | Retail Sales |

| 17/02/2023 | 0700/0800 | ** |  | SE | Unemployment |

| 17/02/2023 | 0700/0800 | ** |  | DE | PPI |

| 17/02/2023 | 0745/0845 | *** |  | FR | HICP (f) |

| 17/02/2023 | 0900/1000 | ** |  | EU | EZ Current Account |

| 17/02/2023 | 1330/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 17/02/2023 | 1330/0830 | ** |  | US | Import/Export Price Index |

| 17/02/2023 | 1330/0830 |  | US | Richmond Fed's Tom Barkin | |

| 17/02/2023 | 1445/0945 |  | US | Fed Governor Michelle Bowman | |

| 17/02/2023 | 1500/1000 | * |  | US | Services Revenues |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.