-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Prior Revisions Tempers NFP Job Gains

- MNI INTERVIEW: ISM Chief Sees Bumpy Start To 2024 For Services

- MNI BRIEF: Next Several Months Inflation Data Critical -Barkin

- MNI US DATA: Worst ISM Services Employment Since Jul 2020 Consistent With Recession

- MNI US DATA: Relationship Between ISM Employment and Payrolls Called Further Into Question

- MNI US WHITE HOUSE: OMB Director 'Not Optimistic' On Deal To Avert Partial Shutdown

- MNI US DATA: December NFP Beat Again Offset By Downward Revisions

Markets Roundup: Tsys Weaker After Noisy Dec NFP, Weak ISM Discounted

- Treasury futures holding weaker after the bell, near the middle of a wide session range following this mornings headline NFP data. Mar'24 10Y futures -11 at 111-20.5 vs. 111-06.5 low; curves steeper: 3M10Y +6.503 at -133.760, 2Y10Y +4.017 at -34.770.

- Deemed "noisy", the higher than expected jobs gain was tempered by down revisions for the two prior releases (Dec jobs gain of 216k vs. 175k est, prior down-revised to 173k from 199k).

- Coupled with lower than expected ISM services data (50.6 vs. 52.5 est), ISM Services Employment (43.3 vs. 51.0 est) and Services New Orders (52.8 vs. 56.1 est) underlying rates gapped higher (10Y yield fell to 3.9513% low from 4.0971% high). Support gradually evaporated through midday with underlying futures holding weaker into the close with 10Y yield at 4.0476% (+.0489%).

- The vast U.S. services sector is set to sustain modest growth in coming months despite a surprisingly poor end to last year, with possible Federal Reserve rate cuts helping to stimulate demand later in the year, Institute for Supply Management chair Anthony Nieves told MNI Friday.

- Traders tentative as they await next week's CPI and PPI inflation measures on Thursday and Friday respectively.

NEWS

INTERVIEW (MNI): ISM Chief Sees Bumpy Start To 2024 For Services

The vast U.S. services sector is set to sustain modest growth in coming months despite a surprisingly poor end to last year, with possible Federal Reserve rate cuts helping to stimulate demand later in the year, Institute for Supply Management chair Anthony Nieves told MNI Friday.

US FED (MNI): Next Several Months Inflation Data Critical -Barkin

Federal Reserve Bank of Richmond President Thomas Barkin said Friday inflation data over the next several months will be key for determining the path of interest rates, while the latest labor market data point to a "normalizing but not weakening" job market. He did not reveal his preferred interest rate path, saying only there is a range of projections on the FOMC from no rate cuts to six cuts this year.

US DATA (MNI): Worst ISM Services Employment Since Jul 2020 Consistent With Recession

There may only be a small sample size (survey started in 1997), and it's seemingly at odds with broader labor market data, but an ISM Services employment reading as weak as December's has always coincided with a recession.

US DATA (MNI): Relationship Between ISM Employment and Payrolls Called Further Into Question

Looking at the size of the surprise decline in ISM services, it’s worth noting a seeming structural break in the historical relationship with payrolls growth ahead of and especially since the pandemic.

US WHITE HOUSE (MNI): OMB Director 'Not Optimistic' On Deal To Avert Partial Shutdown

Speaking to reporters at a Christian Science Monitor event, Director of the Office of Management and Budget Shalanda Young, says that on the topic of avoiding a partial gov't shutdown "I wouldn't say pessimistic but I'm not optimistic," that a deal can be reached by the 19 Jan deadline. For the latest updates on Congressional wrangling over the looming shutdown please see our latest US Daily Brief here.

OVERNIGHT DATA

US DATA: December NFP Beat Again Offset By Downward Revisions

- Nonfarm payrolls increased 216k in Dec for a 41k beat to consensus but was offset by -71k of downward revisions, landing more heavily in October.

- Looking back since March, seven months now have beaten consensus estimates for the latest month, yet net of two-month revisions only two months have surprised higher.

- There was a similar story in private payrolls as well, the 164k increase in Dec marked a 34k beat but with a -55k downward revision.

- The NFP 3mma of 165k is the lowest since Jan’21, the private payrolls 3mma of 115k is joint low with August for the lowest since Jun’20.

- BLS: NET PAYROLLS REVISIONS FOR NOV, OCT -71K

- US PRIOR MONTHS PAYROLLS REVISED: NOV +173K; OCT +105K

- US DEC UNEMPLOYMENT RATE 3.7%

- US DEC AVERAGE HOURLY EARNINGS +0.4% Vs NOV +0.4%; +4.1% YOY

- US DEC AVERAGE WEEKLY HOURS 34.3 HRS

- Total AHE:

- M/M (SA): 0.44% in Dec from 0.353% in Nov (initial 0.353%)

- Y/Y (SA): 4.101% in Dec from 4.024% in Nov

- AHE Non-Supervisory:

- M/M (SA): 0.341% in Dec from 0.445% in Nov (initial 0.411%)

- Y/Y (SA): 4.289% in Dec from 4.379% in Nov

US ISM DEC SERVICES COMPOSITE INDEX 50.6

US ISM DEC SERVICES BUSINESS INDEX 56.6

US ISM DEC SERVICES PRICES 57.4

US ISM DEC SERVICES EMPLOYMENT INDEX 43.3

US ISM DEC SERVICES NEW ORDERS 52.8

- US NOV FACTORY ORDERS +2.6%; EX-TRANSPORT NEW ORDERS +0.1%

- US NOV DURABLE ORDERS +5.4%

- US NOV NONDEFENSE CAP GOODS ORDERS EX AIRCRAFT +0.8%

- Dec unemployment rate holds steady from Nov at +5.8% after increasing in five of the previous seven months. Employment +0.1K vs +12K expected as part time jobs +23.6K, offsetting the -23.5K drop in full time employment. Average hourly wages for permanent employees rose most YOY since Jan 2021 at +5.7%. Average hourly wages for all workers +5.4%.

CANADA DEC IVEY PURCHASING MANAGERS INDEX 56.3 SA

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 45.83 points (-0.12%) at 37396.33

- S&P E-Mini Future down 7 points (-0.15%) at 4722.75

- Nasdaq down 27.7 points (-0.2%) at 14484.04

- US 10-Yr yield is up 5.1 bps at 4.0495%

- US Mar 10-Yr futures are down 11/32 at 111-20.5

- EURUSD down 0.0006 (-0.05%) at 1.0939

- USDJPY up 0.05 (0.03%) at 144.68

- WTI Crude Oil (front-month) up $1.61 (2.23%) at $73.80

- Gold is up $0.56 (0.03%) at $2044.33

- European bourses closing levels:

- EuroStoxx 50 down 10.5 points (-0.23%) at 4463.51

- FTSE 100 down 33.46 points (-0.43%) at 7689.61

- German DAX down 23.08 points (-0.14%) at 16594.21

- French CAC 40 down 29.94 points (-0.4%) at 7420.69

US TREASURY FUTURES CLOSE

- 3M10Y +6.503, -133.76 (L: -143.917 / H: -130.378)

- 2Y10Y +3.808, -34.979 (L: -40.104 / H: -34.484)

- 2Y30Y +4.171, -19.271 (L: -27.766 / H: -17.477)

- 5Y30Y +1.881, 18.931 (L: 12.594 / H: 21.387)

- Current futures levels:

- Mar 2-Yr futures down 1.25/32 at 102-20.375 (L: 102-14.625 / H: 102-26)

- Mar 5-Yr futures down 5.75/32 at 107-29.75 (L: 107-18 / H: 108-11.5)

- Mar 10-Yr futures down 10/32 at 111-21.5 (L: 111-06.5 / H: 112-10)

- Mar 30-Yr futures down 30/32 at 121-29 (L: 121-09 / H: 123-07)

- Mar Ultra futures down 1-15/32 at 129-12 (L: 128-22 / H: 131-08)

US 10Y FUTURE TECHS: (H4) Corrective Pullback Slips Through First Support

- RES 4: 115-00+ 2.236 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 114-06+ 2.00 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 2: 114-00 Round number resistance

- RES 1: 113-12+ 1.764 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- PRICE: 111-21+ @ 1515 ET Jan 05

- SUP 1: 111-09+ High Dec 7

- SUP 2: 111-06+ Low Jan 05

- SUP 3: 110-25+ 50-day EMA

- SUP 4: 109-31+ Low Dec 11 and key short-term support

The corrective pullback in Treasuries slipped through first support at the 20-day EMA of 111-31+ into NY hours on Friday. Having held yesterday, the fall below is a bearish development, and opens levels last seen in early December, with the next notable support undercutting at the 111-09+ Dec 7 high. For any recovery to take hold, a rejection of the break below the 20-day EMA is required, before any progress toward 113-12+, a Fibonacci projection point.

SOFR FUTURES CLOSE

- Current White pack (Mar 24-Dec 24):

- Mar 24 +0.010 at 94.930

- Jun 24 +0.005 at 95.335

- Sep 24 -0.010 at 95.720

- Dec 24 -0.020 at 96.060

- Red Pack (Mar 25-Dec 25) -0.045 to -0.03

- Green Pack (Mar 26-Dec 26) -0.055 to -0.045

- Blue Pack (Mar 27-Dec 27) -0.06 to -0.055

- Gold Pack (Mar 28-Dec 28) -0.06 to -0.06

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00447 to 5.33924 (-0.01448/wk)

- 3M -0.00005 to 5.32926 (-0.00214/wk)

- 6M +0.01476 to 5.19284 (+0.02036/wk)

- 12M +0.03521 to 4.85450 (+0.08352/wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (-0.07), volume: $1.930T

- Broad General Collateral Rate (BGCR): 5.31% (-0.02), volume: $681B

- Tri-Party General Collateral Rate (TGCR): 5.31% (-0.02), volume: $672B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $86B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $245B

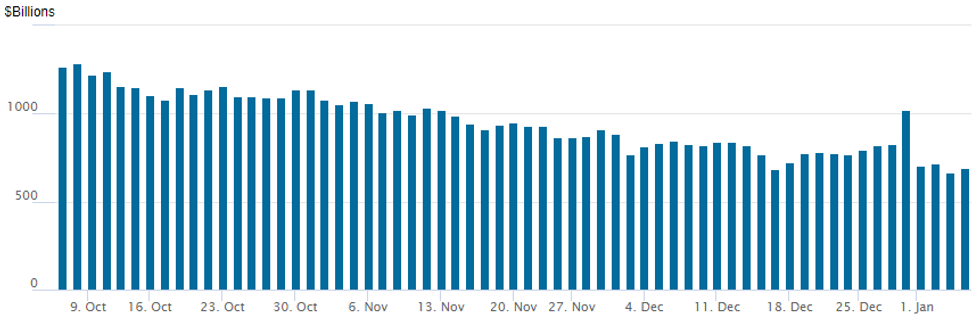

REVERSE REPO OPERATION: Rebound

NY Federal Reserve/MNI

- RRP usage rebounds to $694.478B vs. $664.899B yesterday -- the lowest level since mid-June 2021, compares to last Friday's move over $1T: $1,018.483B.

- The number of counterparties rebounds to 83 vs. 78 yesterday, the lowest since April 2022.

PIPELINE

No new high grade corporate issuance Friday, this after $20.5B high grade corporate debt priced Thursday, total for the week at $80.6B -- healthy, but well off the $94.775B priced in the first week of 2023.

EGBs-GILTS CASH CLOSE: Weaker, But Off Worst Levels

European core FI closed Friday weaker but well off the session's worst levels, as US data dictated price action.

- At the outset of Friday's session, Gilts and Bunds resumed their recent negative price action.

- Eurozone Dec flash inflation came in line with expectations, both coming into the week and after Thursday's French and German data (our Eurozone Inflation Insight is here). That translated into a muted market reaction, setting the stage for US data to drive price action for the rest of the day.

- A surprisingly high payrolls gain in December's US employment report initially spurred a global rates sell-off in early afternoon.

- But that would prove the low point for the day: the move fully reversed and then some as the underlying details appeared softer. A very weak ISM Services report in mid-afternoon accelerated the rally.

- Gilts underperformed Bunds, with the belly proving the weakest point on both curves for yet another session. Periphery EGB spreads widened slightly though were briefly tighter in the immediate aftermath of the US ISM data.

- Next week starts with EU (and potential EFSF) supply on Monday, along with German factory orders. and eurozone retail sales/confidence surveys.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.5bps at 2.568%, 5-Yr is up 3.8bps at 2.102%, 10-Yr is up 3.2bps at 2.156%, and 30-Yr is up 2.6bps at 2.376%.

- UK: The 2-Yr yield is up 4.6bps at 4.242%, 5-Yr is up 6.9bps at 3.756%, 10-Yr is up 6bps at 3.787%, and 30-Yr is up 3.4bps at 4.396%.

- Italian BTP spread up 0.4bps at 169.5bps / Greek up 3.5bps at 116.8bps

FOREX Significant Greenback Swings Amid Nuanced US Data

- Expectations for heightened volatility surrounding the releases of both US employment and ISM Services data were fully justified, with some significant two-way flows for the greenback on Friday. Despite the USD index remaining close to unchanged on the session, the DXY exhibited an impressive 1.2% intra-day range.

- Broad greenback strength was seen as the with AHE and headline NFP dynamics biased markets in that direction. However, delving deeper into the figures significantly took the shine off the report, prompting a sharp reversal. This ensuing turnaround was then exacerbated by a lower-than-expected ISM Services Index and a particularly weak employment component.

- The price action is perhaps best emphasised by movements in USDJPY, whose sensitivity to major US data was amplified once more. The pair continued to take advantage of a change in sentiment in 2024 during the morning session, rising back above 145.00 where it consolidated before the data.

- Following the payrolls release, USDJPY traded as high as 145.97, an impressive 3.66% above the week’s lows. In the aftermath, however, the Japanese Yen recovered well and traded in lockstep with the reversal lower for US yields. Eventually, USDJPY hit a session low of 143.81 as short-term positioning was squeezed in the aftermath of the ISM Services figure. The pair rose around one big figure into the weekend close.

- In G10, GBP was a marginal relative outperformer on the session and EUR sentiment remained a touch bearish. The developments were well received by emerging market currencies, with the likes of MXN and BRL rising around 0.5% on Friday.

- German factory orders and Swiss inflation data kick things off next Monday, however, the focus on the docket will be Thursday’s release of US CPI.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/01/2024 | 0700/0800 | ** |  | DE | Trade Balance |

| 08/01/2024 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 08/01/2024 | 0730/0830 | *** |  | CH | CPI |

| 08/01/2024 | 0730/0830 | ** |  | CH | Retail Sales |

| 08/01/2024 | 1000/1100 | ** |  | EU | Retail Sales |

| 08/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 08/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 08/01/2024 | 1730/1230 |  | US | Atlanta Fed's Raphael Bostic | |

| 08/01/2024 | 2000/1500 | * |  | US | Consumer Credit |

| 09/01/2024 | 2330/0830 | ** |  | JP | Tokyo CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.