-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Rate Cut Projections Gain Momentum Ahead NFP

EXECUTIVE SUMMARY

- MNI INTERVIEW: Hard To Rule Out More Fed Rate Hikes-Acharya

- MNI INTERVIEW: No Fed Cuts Until H2, Ex-KC Fed's Hoenig Says

- MNI FED BRIEF: Powell: Know Risk Of Waiting Too Long To Cut Rates

- MNI US: Biden To Propose New Housing Initiatives At SOTU

- MNI US Payrolls Preview: A Return To Greater Normality After January Distortions

- MNI ECB WATCH: Rates On Hold, Pointer To Possible June Cut

- MNI US DATA: Initial Claims Inline Although Continuing Pushing Higher

US

FED INTERVIEW (MNI): Hard To Rule Out More Fed Rate Hikes-Acharya: Stubborn inflation pressures are still plaguing the U.S. economy and making it harder for the Federal Reserve to cut interest rates, with uncertainty so high that even the possibility of additional rate increases cannot be ruled out, a former resident scholar at the New York Fed, told MNI.

- “The volatility of interest rates in the markets and the uncertainty people have on inflation are both signs to me that anything must be considered on the table,” said Viral Acharya, also a former deputy governor of the Reserve Bank of India, in an interview.

FED INTERVIEW (MNI): No Fed Cuts Until H2, Ex-KC Fed's Hoenig Says: The Federal Reserve's monetary policy stance might not be all that restrictive given persistent economic strength, suggesting the central bank will stay cautious about cutting interest rates for longer, likely into the second half of the year, former Kansas City Fed president Thomas Hoenig told MNI.

- "They're restrictive but only moderately so and inflation is coming down but it's coming down much more slowly now," he said in an interview. "We've come off a year in 2023 that was stronger than anyone anticipated and even coming into this year the first quarter looks to be good."

FED BRIEF (MNI): Powell: Know Risk Of Waiting Too Long To Cut Rates: Federal Reserve officials will try to avoid waiting so long to cut interest rates that they cause unnecessary employment losses, Fed Chair Jerome Powell said in testimony Thursday.

- “We’re well aware of that risk, and very conscious of avoiding it," Powell told lawmakers when asked about the risk of waiting too long to cut interest rates and causing undue job losses.

- “What we’re seeing is continued strong growth and strong labor market, and progress in bringing inflation down. If that happens, if the economy follows that path then we do think the process of carefully removing the restrictive stance of policy can and will begin over the course of this year.”

US Payrolls Preview (MNI): A Return To Greater Normality After January Distortions: Bloomberg consensus sees nonfarm payrolls growth of 200k in February but two-month revisions will likely be watched particularly closely.

NEWS

US (MNI): Biden To Propose New Housing Initiatives At SOTU: The White House has released a fact sheet of new initiatives, "to lower housing costs for working families," that President Biden will propose during this evening's State of the Union Address.

ECB WATCH (MNI): Rates On Hold, Pointer To Possible June Cut: The European Central Bank kept its key interest rate on hold at 4% on Thursday for a fourth consecutive time, and President Christine Lagarde said that while Governing Council did not discuss rate cuts this time, policy makers are “just beginning to discuss the dialing back of our restrictive stance”.

UK (MNI): Snap Polls Show Little Public Enthusiasm For Budget Measures: Chancellor of the Exchequer Jeremy Hunt's Budget statement on 6 March delivered, as MNI's Issuance Deep Dive outlined, little in the way of 'rabbits from the hat' in terms of unexpected giveaways.

INTERVIEW (MNI): UK Tax Cuts No Boost To Inflation- OBR's Miles: Tax cuts in this week’s UK budget will boost demand but also labour supply, with a minimal and possibly not even positive overall effect on inflation and scant implications for Bank of England monetary policy, the Office for Budget Responsibility’s David Miles, a two-time Monetary Policy Committee member, told MNI.

EU COMMISSION (MNI): EPP Confirms VdL As Lead Candidate Ahead Of Elections: As was widely expected, the centre-right European People's Party (EPP) political grouping has approved incumbent European Commission President Ursula von der Leyen as the group's lead candidate (spitzenkandidat) ahead of the June European Parliament elections.

US TSYS Yields Recede on Late Positioning Ahead Friday's Feb Employ Data

- Tsy futures are climbing off a lower, narrow range over the last hour - TYM4 near middle of the range at 111-20 (+4.5) vs. 111-27 high.

- Late support not headline driven - more flow driven as accts square up ahead tomorrow's Feb employ report, with trading desks reporting some renewed real$ buying in 30s. Note, however, curves remain steeper (2s10s +3.023 at -42.136).

- Tsys rallied through technical resistance this morning after lower than expected Unit Labor Costs (0.4% vs. 0.7% est). Weekly jobless claims largely in line: (216k vs. 217k est) while Continuing Claims rise (1.906M vs. 1.880M est; prior down-revised to 1.898M from 1.905M)). Additional data: Nonfarm Productivity (3.2% vs. 3.1% est); Trade Balance (-$67.4B vs. -$63.5B est).

- No new insight from Fed Chairman Powell today as he repeated yesterday's policy testimony to Congress.

- Later this evening: President Biden's State of the Union Address at 2100ET.

- Friday Data Calendar: February Employment Report.

OVERNIGHT DATA

US DATA (MNI): Initial Claims Inline Although Continuing Pushing Higher: Initial jobless claims were almost fully in line for no change on the week, at a seasonally adjusted 217k (cons 216k) after a slightly upward revised 217k (initial 215k).

- The four-week average ticked 1k lower to 212k, off the 203-204k seen in mid-Jan but still historically low and below the 218k averaged in 2019.

- Continuing claims meanwhile increased more than expected to a seasonally adjusted 1906k (1880k) from a downward revised 1898k (initial 1905k) in the week prior. It’s another step back to the recent high of 1925k from mid-Nov.

- The non-seasonally adjusted data appear to reflect these trends. Initial claims are at the lower end of the historical range and picking up in the latest week to less of an extent than in 2023. However, continuing claims are opening up a wider gap with 2023 and especially 2022 figures for this time of year.

US Q4 UNIT LABOR COSTS +0.4%; Y/Y +2.5%

US JAN TRADE GAP -$67.4B VS DEC -$64.2B

CANADIAN JAN TRADE BALANCE CAD +0.5 BILLION

CANADA JAN EXPORTS CAD 62.3 BLN, IMPORTS CAD 61.8 BLN

CANADA REVISED DEC MERCHANDISE TRADE BALANCE CAD -0.9 BLN

CANADIAN JAN BUILDING PERMITS +13.5% MOM

CANADA RESIDENTIAL BUILDING PERMITS +12.6%; NON-RESIDENTIAL +14.8%

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 117.73 points (0.3%) at 38779.5

- S&P E-Mini Future up 46.25 points (0.9%) at 5158

- Nasdaq up 229.2 points (1.4%) at 16260.03

- US 10-Yr yield is down 1.6 bps at 4.0865%

- US Jun 10-Yr futures are up 6/32 at 111-21.5

- EURUSD up 0.0047 (0.43%) at 1.0946

- USDJPY down 1.34 (-0.9%) at 148.04

- WTI Crude Oil (front-month) down $0.26 (-0.33%) at $78.87

- Gold is up $11.75 (0.55%) at $2160.00

- European bourses closing levels:

- EuroStoxx 50 up 58.73 points (1.19%) at 4974.22

- FTSE 100 up 13.15 points (0.17%) at 7692.46

- German DAX up 126.14 points (0.71%) at 17842.85

- French CAC 40 up 61.48 points (0.77%) at 8016.22

US TREASURY FUTURES CLOSE

- 3M10Y -1.47, -130.892 (L: -135.086 / H: -127.661)

- 2Y10Y +3.26, -42.109 (L: -46.902 / H: -40.644)

- 2Y30Y +5.549, -26.053 (L: -34.328 / H: -25.073)

- 5Y30Y +4.934, 17.051 (L: 10.673 / H: 17.155)

- Current futures levels:

- Jun 2-Yr futures up 3.125/32 at 102-19.75 (L: 102-15.625 / H: 102-19.875)

- Jun 5-Yr futures up 6/32 at 107-21.75 (L: 107-13 / H: 107-23.25)

- Jun 10-Yr futures up 6/32 at 111-21.5 (L: 111-11 / H: 111-27)

- Jun 30-Yr futures up 5/32 at 121-24 (L: 121-08 / H: 122-13)

- Jun Ultra futures down 8/32 at 130-22 (L: 130-03 / H: 132-01)

US 10Y FUTURE TECHS: (M4) Bull Cycle Remains In Play

- RES 4: 112-10+ 61.8% retracement of the Feb 1 - 23 bear leg

- RES 3: 112-04 High Feb 7

- RES 2: 111-27 50% retracement of the Feb 1 - 23 bear leg

- RES 1: 111-23 High Mar 6

- PRICE: 111-16+ @ 16:52 GMT Mar 6

- SUP 1: 110-21 Low Mar 4

- SUP 2: 110-05+/109-25+ Low Mar 1 / Low Feb 23 and bear trigger

- SUP 3: 109-14+ Low Nov 28

- SUP 4: 109-12+ 1.764 proj of Dec 27 - Jan 19 - Feb 1 price swing

Treasuries are holding on to their recent gains. The contract has topped resistance at the 50-day EMA and the clear break highlights a bullish reversal. This opens 111-27 initially, 50% of the downleg off the Feb 1 high. For bears, a failure to maintain price at or above current levels would return focus back to support at the 109-25+ bear trigger, the Feb 23 low. Initial support to watch lies at 110-21, the Mar 4 low.

SOFR FUTURES CLOSE

- Mar 24 +0.008 at 94.703

- Jun 24 +0.025 at 94.955

- Sep 24 +0.040 at 95.280

- Dec 24 +0.045 at 95.610

- Red Pack (Mar 25-Dec 25) +0.050 to +0.055

- Green Pack (Mar 26-Dec 26) +0.030 to +0.045

- Blue Pack (Mar 27-Dec 27) +0.015 to +0.030

- Gold Pack (Mar 28-Dec 28) +0.005 to +0.015

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00212 to 5.31771 (-0.00491/wk)

- 3M -0.00332 to 5.32122 (-0.00980/wk)

- 6M -0.01017 to 5.23565 (-0.03166/wk)

- 12M -0.01664 to 4.99749 (-0.05905/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.707T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $681B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $671B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $99B

- Daily Overnight Bank Funding Rate: 5.31% (-0.01), volume: $273B

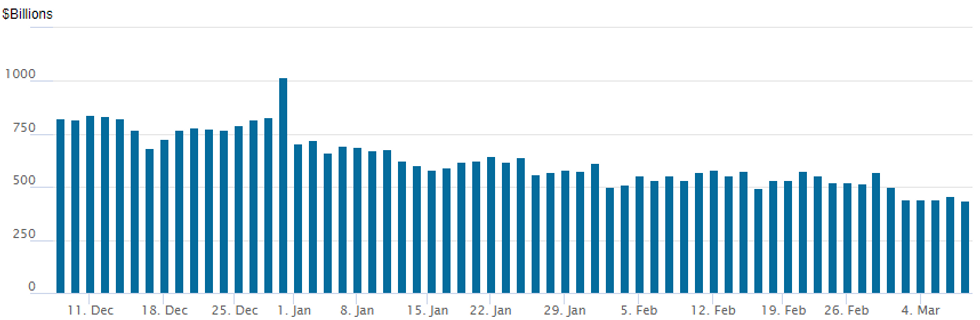

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage falls to new lowest level since May 2021 today: $436,754B from $456.847B Wednesday. Today's usage compares to Monday's low of $439.793B.

- Meanwhile, the latest number of counterparties climbs to 72 from 68 Wednesday (compares to 65 on January 16, the lowest since July 7, 2021).

PIPELINE $2.5B Bank of NY Mellon 3Pt, $750M Swedbank 5Y Debt Launched

- Date $MM Issuer (Priced *, Launch #)

- 3/7 $2.5B #Bank of NY Mellon $500M 2NC1 SOFR+45, $1B 6NC5 +90, $1B 11NC10 +110

- 3/7 $2B #CaixaBank 1B 6NC5 +160, $1B 11.25NC10.25 +195

- 3/7 $1.1B United Rentals 10NC5 6.125%a

- 3/7 $1.05B #Vici Properties $550M 10Y +175, $500M 30Y +200

- 3/7 $750M Alcoa 7NC3 7.5%a

- 3/7 $750M #Swedbank 5Y +133

- 3/7 $750M Station Casinos 8NC3 6.75%a

- 3/7 $650M #Indianapolis Power & Light WNG 30Y +147

FOREX Greenback Weakness Extends Ahead of February Employment Data

- Another more volatile session across G10 FX on Thursday culminates in the USD index extending its short-term weakening trend, down a further 0.4% on the day and breaching the February lows. Price action may have been spurred on by a partially dovish read of Powell's comment that the Fed is “not far from confidence needed to cut rates" and partially on the poorer-than-expected weekly jobless claims. Moreover, the short-term path of least resistance appears lower for the USD, with some pre-positioning ahead of tomorrow's NFP potentially in play.

- Alongside the ECB rate decision, a minor downtick for inflation forecasts prompted a very brief selloff for EURUSD, however, a more cautious Lagarde spurred a solid turnaround. EURUSD swiftly recovered back above 1.09 and the greenback weakness assisted the pair higher to 1.0940 as we approach the APAC crossover.

- Notably, EUR crosses remain lower on the session, with the outperformance of AUD and NZD this week extending amid the solid recovery for major equity benchmarks. EURAUD in particular traded as low as 1.6441, briefly expanding the pullback from the week’s highs to 1.8% in the direct aftermath of the ECB decision.

- In similar vein, EURJPY remains half a percent lower, mainly due to the developments in Japan overnight which keep the Japanese Yen as the strongest performer on Thursday. As a reminder, stronger Jan wages data, and a large union announcing larger pay increases this year appears to be supporting calls for a potential exit of negative interest rate policy as early as this month.

- USDJPY tracks closely to 148.00, however, the pair did trade as low as 147.59. The pair has breached the 20-day EMA and is through support at the 50-day EMA - at 148.54. The clear break of this average strengthens the current bearish cycle, potentially signalling scope for a move towards 146.83, a Fibonacci retracement.

- Focus turns immediately to the US employment report, where Bloomberg consensus sees nonfarm payrolls growth of 200k in February but two-month revisions will likely be watched particularly closely. Canadian employment data will also cross.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/03/2024 | 0500/1400 |  | JP | Economy Watchers Survey | |

| 08/03/2024 | 0700/0800 | ** |  | DE | Industrial Production |

| 08/03/2024 | 0700/0800 | ** |  | DE | PPI |

| 08/03/2024 | 0700/0800 | ** |  | SE | Private Sector Production m/m |

| 08/03/2024 | 0745/0845 | * |  | FR | Foreign Trade |

| 08/03/2024 | 0800/0900 | ** |  | ES | Industrial Production |

| 08/03/2024 | 0900/1000 | ** |  | IT | PPI |

| 08/03/2024 | 1000/1100 | *** |  | EU | GDP (final) |

| 08/03/2024 | 1000/1100 | * |  | EU | Employment |

| 08/03/2024 | 1200/0700 |  | US | New York Fed's John Williams | |

| 08/03/2024 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 08/03/2024 | 1330/0830 | *** |  | US | Employment Report |

| 08/03/2024 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 08/03/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.