-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Rates Reverse, Lose Support On Eq Bid

EXECUTIVE SUMMARY:

- - MNI INTERVIEW: Millions More US Jobs Lost if Govt Aid Falters

- - SENATE WON'T PASS BILL WITHOUT LIABILITY PROTECTIONS: MCCONNELL - BBG

US: Millions more U.S. jobs will be lost in coming months if a federal relief package fails to support struggling households and businesses, labor market experts told MNI.

"Senate GOP unveils coronavirus relief plan with 70% wage replacement in unemployment insurance" CNN

"Republicans unveil major parts of their coronavirus relief plan."

"Congress faces pressure to pass new aid after states stopped paying out enhanced unemployment insurance and a federal eviction moratorium expired."

"Democratic congressional leaders Nancy Pelosi and Chuck Schumer plan to meet with Trump administration officials later Monday"

California virus data:

- "REPORTS 6,891 NEW VIRUS CASES; TOTAL OF 460,550" Bbg

- "HAS 29 NEW VIRUS DEATHS, LESS THAN 14-DAY AVG OF 98" Bbg That said...

- "VIRUS CASES RISE 1.5%, LESS THAN 7-DAY AVG OF 2.4%" Bbg

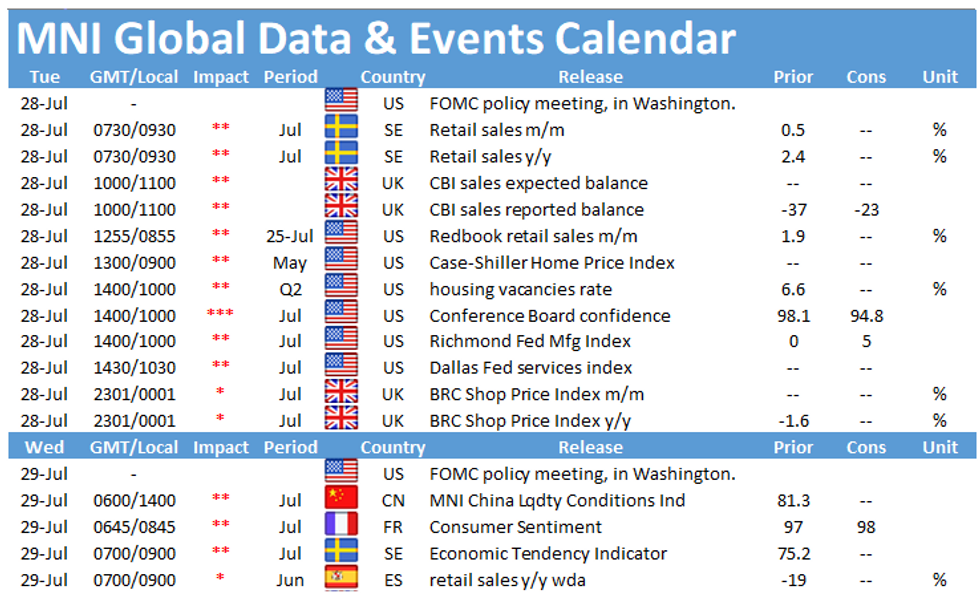

OVERNIGHT DATA

MNI: US Jun DURABLE NEW ORDERS 7.3%; EX-TRANSPORTATION 3.3%

MARKETS SNAPSHOT

Key market levels in late NY trade:

- DJIA up 114.88 points (0.43%) at 26584.77

- Nasdaq up 173.1 points (1.7%) at 10536.27

- US 10-Yr yield is up 2.6 bps at 0.6151%

- US Sep 10Y are down 3.5/32 at 139-15

- EURUSD down 0.0002 (-0.02%) at 1.175

- USDJPY up 0.01 (0.01%) at 105.38

- Gold is up $0.05 (0%) at $1942.29

- European bourses closing levels:

- EuroStoxx 50 down 8.05 points (-0.24%) at 3302.84

- FTSE 100 down 18.94 points (-0.31%) at 6104.88

- French CAC 40 down 16.81 points (-0.34%) at 4939.62

US TSY SUMMARY: Second Half Sag Combination of stronger equities, two tailed note auctions and larger than exp'd corporate issuance hedging tied to ATT 5pt jumbo borrowing another $11B after securing $12.5B in May, reversed first half support, futures extending session lows after the close. Yld curves see-sawed on session, finish steeper. The 2-Yr yield is up 0.4bps at 0.1514%, 5-Yr is up 1bps at 0.2852%, 10-Yr is up 2.6bps at 0.6151%, and 30-Yr is up 3.3bps at 1.2626%

TSY FUTURES CLOSE: Combination of stronger equities, two note auctions that tailed and larger than expected corporate issuance related hedging (ATT 5pt jumbo borrowed another $11B after securing $12.5B in May). Yld curves see-sawed on session, finish steeper. Update

- 3M10Y +2.895, 50.877 (L: 45.254 / H: 51.041)

- 2Y10Y +1.52, 45.467 (L: 42.552 / H: 45.631)

- 2Y30Y +1.836, 109.825 (L: 106.304 / H: 109.951)

- 5Y30Y +1.488, 96.699 (L: 94.006 / H: 96.859)

- Current futures levels:

- Sep 2Y down 0.5/32 at 110-12.875 (L: 110-12.875 / H: 110-13.8)

- Sep 5Y down 2/32 at 125-23.75 (L: 125-23.5 / H: 125-28)

- Sep 10Y down 4.5/32 at 139-14 (L: 139-14 / H: 139-24)

- Sep 30Y down 18/32 at 180-17 (L: 180-17 / H: 181-21)

- Sep Ultra 30Y down 21/32 at 225-3 (L: 225-01 / H: 227-05)

DATE TIME AMOUNT SECURITY (CUSIP)/ANNC AWARDED

- 27 Jul 1130ET $51B 26W Bill (912796UC1) 0.130%

- 27 Jul 1130ET $48B 2Y Note (91782CAC5) 0.155%

- 27 Jul 1300ET $54B 13W Bill (9127962T5) 0.105%

- 27 Jul 1300ET $49B 5Y Note (91282CAB7) 0.288%

- 28 Jul 1130ET $30B 42D Bill CMB (912796TJ8)

- 28 Jul 1130ET $30B 120D Bill CMB (9127963B3)

- 28 Jul 1300ET $24B 2Y Note FRN (91282CAA9)

- 28 Jul 1300ET $44B 7Y Note (91282CAD3)

- 30 Jul 1130ET TBA 4W Bill 28 Jul Annc

- 30 Jul 1130ET TBA 8W Bill 28 Jul Annc

- Sep 20 steady at 99.760

- Dec 20 -0.005 at 99.705

- Mar 21 -0.010 at 99.790

- Jun 21 -0.010 at 99.810

- Red Pack (Sep 21-Jun 22) -0.015 to -0.01

- Green Pack (Sep 22-Jun 23) -0.02 to -0.015

- Blue Pack (Sep 23-Jun 24) -0.02 to -0.015

- Gold Pack (Sep 24-Jun 25) -0.025 to -0.02

- O/N +0.0002 at 0.0851% (+0.0002/wk)

- 1 Month -0.0064 to 0.1662% (-0.0064/wk)

- 3 Month +0.0229 to 0.2696% (+0.0229/wk)

- 6 Month -0.0018 to 0.3166% (-0.0018/wk)

- 1 Year -0.0026 to 0.4569% (-0.0026/wk)

STIR: Federal Reserve Bank of New York EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $45B

- Daily Overnight Bank Funding Rate: 0.09%, volume: $138B

US TSYS: REPO REFERENCE RATES:

- Secured Overnight Financing Rate (SOFR): 0.10%, $950B

- Broad General Collateral Rate (BGCR): 0.07%, $403B

- Tri-Party General Collateral Rate (TGCR): 0.07%, $381B

- Tue 07/28 1010-1030ET: Tsy 0-2.25Y, appr $12.825B

- Thu 07/30 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 07/31 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Tue 08/04 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 08/05 1100-1120ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 08/06 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Mon 08/10 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Tue 08/11 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Wed 08/12 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- 07/27 $11B #ATT $2.25B 7.5Y +120, $2.5B 11.5Y +165,

- $2.5B 22.5Y +185, $2.25B 31.5Y +205, $1.5B 40.5Y +225

- 07/27 $2.6B #UBS $1.3B Each 4NC3 +83, 6.5NC5.5 +108

- 07/27 $1.25B *Kinder Morgan $750M 10Y +150. $500M 30Y +210

- 07/27 $1B *Prosus 30Y+280

- The USD index sank to a new multi-year low last seen in mid-2018, with the greenback's losses extending to 9% from the 2020 high. The catalysts for the USD selling are piling up, with worsening Sino-US tensions, an extended build in the EUR net long position, month-end greenback sales and the Fed rate decision Wednesday all adding to the negative dollar bias.

- The dollar's drop worked in favour of precious metals, prompting a new intraday high in spot gold at $1,945.72 alongside strength in haven FX as USD/JPY dropped well below Y106. Despite this, CHF failed to benefit, with the EUR's persistent rally largely responsible - EUR/CHF rallied through crowded resistance at 1.0795-97 and looks set to close above 1.08 for the first time since early June.

- The data calendar Tuesday is lighter, with just US consumer confidence on the docket. Earnings from Pfizer, Visa, 3M and McDonald's are due. No central bank speakers are currently scheduled, with the Fed in media blackout ahead of Wednesday's policy decision.

UP TODAY:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.