-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI ASIA OPEN: Tsy Yields Higher Ahead Retail Sales Data

- MNI INTERVIEW: Fed Review Should Revive Pre-Emptive Rate Moves

- MNI BRIEF: U.S. Consumer Inflation Expectations Fall - NY Fed

- MNI INTERVIEW: BOE Likely To Revise Up View Of Wage Growth

MNI 1Y Inflation Expectations Lowest Since Apr’21 – NY Fed

US

US: The Federal Reserve should reintroduce in its next framework review slated for 2025 its strategy of pre-emptively lifting interest rates to head off higher inflation, a practice it followed for more than three decades before abandoning it in 2020, a former New York Fed staffer told MNI.

- Fed officials adjusted their framework in 2020 to take a more relaxed view by allowing for periods in which inflation would run slightly above the central bank’s 2% target, to make up for past episodes in which inflation ran below the target.

- "The bottom line is this asymmetry in the loss function coupled with the lags in policy runs the risk of generating some inflationary bias in policymaking," said Gauti Eggertsson, who worked in the New York Fed's research department from 2004 to 2012. For more see MNI Policy main wire at 0849ET.

FED: U.S. consumer inflation expectations declined across the board in July while year-ahead price growth expectations for food, medical care and rent declined to their lowest levels in nearly three years, according to the Federal Reserve Bank of New York's monthly Survey of Consumer Expectations released Monday.

- Median inflation expectations fell to 3.5% from 3.8% at the one-year-ahead horizon, its lowest since April 2021, and both the three-year and five-year-ahead inflation expectations edged down to 2.9% from 3.0%, the New York Fed said. Median year-ahead expected price changes also fell for all commodities, with readings for food, medical care and rent at their lowest since September 2020, November 2020 and January 2021, respectively, the bank said.

UK

BOE: The Bank of England will come under pressure to revise its prediction for wages growth to ease rapidly as it adjusts higher its view of the level of unemployment compatible with its inflation target, National Institute of Economic and Social Research Deputy Director Stephen Millard told MNI.

- In its August Monetary Policy Report, the BOE foresaw earnings growth dropping from 6% in 2023 to 3.5% in 2024 and 2.5% in 2025, but Monetary Policy Committee minutes noted that pay has risen more strongly than the Bank's standard models would have predicted. This in turn suggests that U*, the estimated unemployment rate at which inflation is stable, is higher than the Bank has assumed and will be revised up, Millard said in an interview.

- "I think they're trying to ... prepare people for that by saying, 'Well ..we have these models. And they're all under-predicting wage growth. So we need to rethink what's driving wage growth,” he said. For more see MNI Policy main wire at 0636ET.

US TSYS Markets Roundup: Exogenous Risk, Deal Tied Hedging Weigh on Tsys

- Treasury futures are trading mildly weaker again, back near the middle of the session range. Treasury futures quickly reversed early session gains, rising yields partially tied to Hong Kong real estate developer/services company Country Garden's sell-off post MS downgrade overnight.

- Rate lock hedges vs. Bank of America $5B debt issued in 2s and 3s added to curve flattening (2Y10Y -3.262 at -77.717) pressure in the front end (total of $9B high grade corporate debt to price Monday).

- No data or Fed speakers Monday, data resumes Tuesday with Retail Sales, import/export index and TIC flows. Minutes for July FOMC this Wednesday.

- Meanwhile, according to Punchbowl, “House Republicans have a conference call tonight at [18:00 ET 23:00 BST] to discuss FY2024 government funding, the thorniest issue they’ll face this fall [and] Speaker Kevin McCarthy [R-CA] is hosting his annual retreat in Jackson Hole, Wyo., this week.”

OVERNIGHT DATA

Nothing to report Monday, data resumes Tuesday with Retail Sales, import/export index and TIC flows. Minutes for July FOMC this Wednesday.

MARKETS SNAPSHOT

Key late session market levels:- DJIA down 40.54 points (-0.11%) at 35241.13

- S&P E-Mini Future up 15.5 points (0.35%) at 4496.5

- Nasdaq up 108.2 points (0.8%) at 13753.27

- US 10-Yr yield is up 3.7 bps at 4.1894%

- US Sep 10-Yr futures are down 7.5/32 at 109-30.5

- EURUSD down 0.004 (-0.37%) at 1.0909

- USDJPY up 0.51 (0.35%) at 145.47

- WTI Crude Oil (front-month) down $0.73 (-0.88%) at $82.46

- Gold is down $5.88 (-0.31%) at $1907.87

- EuroStoxx 50 up 8.9 points (0.21%) at 4330.23

- FTSE 100 down 17.01 points (-0.23%) at 7507.15

- German DAX up 72.08 points (0.46%) at 15904.25

- French CAC 40 up 8.65 points (0.12%) at 7348.84

US TREASURY FUTURES CLOSE

- 3M10Y +3.338, -124.655 (L: -132.02 / H: -123.411)

- 2Y10Y -3.915, -78.37 (L: -79.097 / H: -72.889)

- 2Y30Y -5.07, -68.611 (L: -70.05 / H: -62.326)

- 5Y30Y -3.507, -7.843 (L: -8.923 / H: -3.493)

- Current futures levels:

- Sep 2-Yr futures down 4.625/32 at 101-10.625 (L: 101-10.5 / H: 101-15.625)

- Sep 5-Yr futures down 8/32 at 106-1.25 (L: 105-31.25 / H: 106-11.5)

- Sep 10-Yr futures down 8/32 at 109-30 (L: 109-24.5 / H: 110-10)

- Sep 30-Yr futures down 5/32 at 120-19 (L: 120-06 / H: 121-09)

- Sep Ultra futures down 8/32 at 126-14 (L: 126-00 / H: 127-12)

US 10Y FUTURE TECHS: (U3) Trend Signals Remain Bearish

- RES 4: 113-08 High Jul 18 and a bull trigger

- RES 3: 112-31 High Jul 20

- RES 2: 112-11 50-day EMA

- RES 1: 111-29/112-07 High Aug 10 / Jul 27

- PRICE: 110-04 @ 16:20 BST Aug 14

- SUP 1: 109-24+/109-24 Low Aug 14 / 4 and the bear trigger

- SUP 2: 109-14 Low Nov 8 2022 (cont)

- SUP 3: 109-10+ Low Nov 4 2022 (cont)

- SUP 4: 108-26+ Low Oct 21 2022 (cont) and a major support

Treasuries reversed sharply off the Thursday high and printed a new pullback low at 109-24+. Weakness extended into the Monday session and prices are yet to recover materially. This reinforces a bearish theme and suggests that recent gains have been a correction. A continuation lower would pave the way for weakness towards key support and the bear trigger at 109-24, the Aug 4 low. A break would resume the downtrend. Key short-term resistance has been defined at 111-29, Thursday’s high.

SOFR FUTURES CLOSE

- Sep 23 -0.008 at 94.588

- Dec 23 -0.025 at 94.590

- Mar 24 -0.065 at 94.775

- Jun 24 -0.095 at 95.080

- Red Pack (Sep 24-Jun 25) -0.10 to -0.08

- Green Pack (Sep 25-Jun 26) -0.075 to -0.05

- Blue Pack (Sep 26-Jun 27) -0.045 to -0.02

- Gold Pack (Sep 27-Jun 28) -0.01 to steady

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00213 to 5.31261 (-.00976 total last wk)

- 3M +0.00726 to 5.37183 (-0.00601 total last wk)

- 6M +0.01688 to 5.43196 (-0.01911 total last wk)

- 12M +0.04862 to 5.35444 (-0.05653 total last wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $105B

- Daily Overnight Bank Funding Rate: 5.31% volume: $271B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.347T

- Broad General Collateral Rate (BGCR): 5.28%, $561B

- Tri-Party General Collateral Rate (TGCR): 5.28%, $547B

- (rate, volume levels reflect prior session)

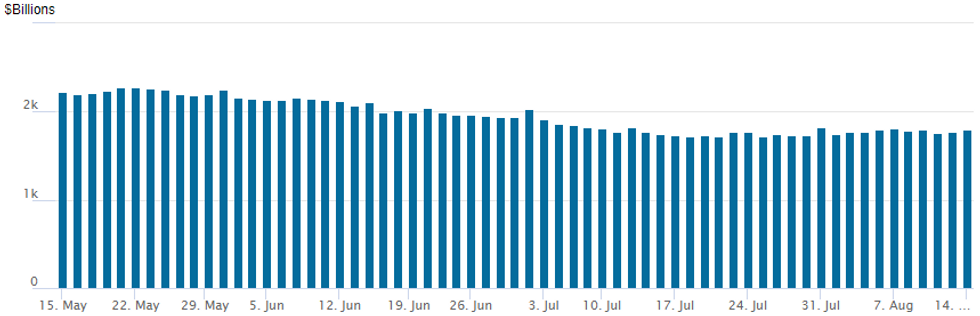

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The latest operation climbs to $1,799.311B, w/103 counterparties, compared to $1,773.236B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $5B Bank of America 4Pt Issuance Launched

Rate lock hedges vs. Bank of America $5B debt issued in 2s and 3s certainly large enough to weigh on front end today. Total of $9B high grade corporate debt to price Monday.

- Date $MM Issuer (Priced *, Launch #)

- 08/14 $5B #Bank of America $2B 2Y +70, $400M 2Y SOFR+78, $2B 3Y +90, $600M 3Y SOFR+102

- 08/14 $2B #Fiserv Inc $700M 5Y +108, $1.3B 10Y +155

- 08/14 $1.25B #Huntington Bancshares 6NC5 +185

- 08/14 $750M #Otis Worldwide 5Y +98

- 08/14 $500M PBF Energy 7NC3

EGBs-GILTS CASH CLOSE: 30Y Yields Stand Out Despite Bear Flattening

The German and UK curves bear flattened to start the week amid limited trading volumes, with US Treasuries leading the selloff rather than any Europe-specific catalysts.

- UK yields hit the highest levels since July across the curve, with the exception of 30Y yields which hit the highest since Oct 2022.

- German yields remained within recent ranges but 30Y yields briefly hit the highest since Jan 2014 (2.727%).

- BoE hike pricing picked up sharply (ECB peak rates edged higher to lesser extent) ahead of Tuesday's main highlights of UK jobs data (we put out a short preview of this today) and German ZEW, with UK CPI Wednesday the main event of the week.

- Periphery spreads were mixed, befitting a mixed day for risk assets - Greece outperformed, with Italy underperforming.

- Reminder that while markets remain open across Europe Tuesday, trading may be thinned by Assumption Day holidays observed in several countries.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.9bps at 3.078%, 5-Yr is up 2.2bps at 2.652%, 10-Yr is up 1.4bps at 2.637%, and 30-Yr is up 0.3bps at 2.709%.

- UK: The 2-Yr yield is up 4.9bps at 5.081%, 5-Yr is up 4.1bps at 4.571%, 10-Yr is up 3.9bps at 4.566%, and 30-Yr is up 2.5bps at 4.753%.

- Italian BTP spread up 1.2bps at 164.2bps / Greek down 2.1bps at 126bps

FOREX USD/JPY Firms Further With Wider Yield Differential

- The front-end of the US yield curve extended higher in Monday trade, putting the US 2y yield within range of 5.00% (at one point touching 4.97%), a level last crossed at the beginning of July. This dictated play across currency markets, with the greenback firmer against all other G10 peers although off highs as fixed income markets pared some of those losses.

- Dollar strength played out via new highs in USD/JPY with an earlier 145.58, clearing levels seen earlier in 2023 to trade at Nov'22 levels and prices at which the Japanese authorities last intervened in the currency.

- Concurrently, the JPY trade-weighted index has continued to hit new pullback lows and is through the early July lowest levels - now clearing at levels not seen since the 1980s. Kanda, Japan's currency official, last stated the MoF would consider all options on "excessive" currency moves on July 21st. Trade-weighted JPY has fallen more than 2.5% since.

- Scandi currencies were the poorest performers as markets took a risk-off footing in response to reports out of China suggesting economic fragility is not contained to just the property sector, as a notable wealth manager missed payments to investors. The Hang Seng and Shanghai Composite both posted losses into the close.

- Focus Tuesday turns to RBA minutes, Chinese industrial production and retail sales for July as well as UK jobs, German ZEW, Canadian CPI and US retail sales releases. Fed's Kashkari is the sole CB speaker.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/08/2023 | 0130/1130 | *** |  | AU | Quarterly wage price index |

| 15/08/2023 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 15/08/2023 | 0200/1000 | *** |  | CN | Retail Sales |

| 15/08/2023 | 0200/1000 | *** |  | CN | Industrial Output |

| 15/08/2023 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate M/M |

| 15/08/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 15/08/2023 | 0600/0800 | *** |  | SE | Inflation Report |

| 15/08/2023 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 15/08/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 15/08/2023 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 15/08/2023 | 1230/0830 | *** |  | CA | CPI |

| 15/08/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/08/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 15/08/2023 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 15/08/2023 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/08/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 15/08/2023 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 15/08/2023 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 15/08/2023 | 1400/1000 | * |  | US | Business Inventories |

| 15/08/2023 | 1500/1100 |  | US | Minneapolis Fed's Neel Kashkari | |

| 15/08/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 15/08/2023 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.