-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUSD/JPY Firms Further With Wider Yield Differential

- The front-end of the US yield curve extended higher in Monday trade, putting the US 2y yield within range of 5.00% (at one point touching 4.97%), a level last crossed at the beginning of July. This dictated play across currency markets, with the greenback firmer against all other G10 peers although off highs as fixed income markets pared some of those losses.

- Dollar strength played out via new highs in USD/JPY with an earlier 145.58, clearing levels seen earlier in 2023 to trade at Nov'22 levels and prices at which the Japanese authorities last intervened in the currency.

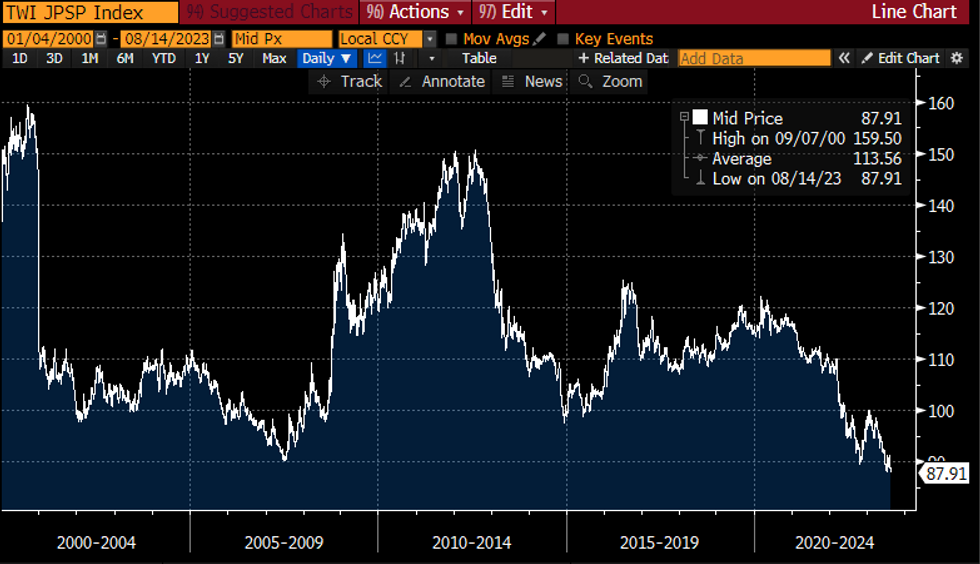

- Concurrently, the JPY trade-weighted index has continued to hit new pullback lows and is through the early July lowest levels - now clearing at levels not seen since the 1980s. Kanda, Japan's currency official, last stated the MoF would consider all options on "excessive" currency moves on July 21st. Trade-weighted JPY has fallen more than 2.5% since.

- Scandi currencies were the poorest performers as markets took a risk-off footing in response to reports out of China suggesting economic fragility is not contained to just the property sector, as a notable wealth manager missed payments to investors. The Hang Seng and Shanghai Composite both posted losses into the close.

- Focus Tuesday turns to RBA minutes, Chinese industrial production and retail sales for July as well as UK jobs, German ZEW, Canadian CPI and US retail sales releases. Fed's Kashkari is the sole CB speaker.

Deutsche Bank JPY Trade-Weighted SpotSource: Bloomberg

Deutsche Bank JPY Trade-Weighted SpotSource: Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.