-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - Trump Softens Tone Ahead of Zelenskyy Visit

MNI: EU Seeks To Avoid Stigma From Fiscal Opt Outs For Defence

MNI ASIA OPEN:Tsy Ylds Recede, Stocks Up, More Fed Speak Ahead

- MNI FED: Fed’s Mester-Larger Banks Can Handle Higher Capital

- MNI FED: Bostic Says Fed Likely To Begin Easing In Summer

- MNI FED: Chicago Fed Goolsbee Asks How Long Tight Fed Policy Is Needed

- MNI POLICY: G20 CenBanks Worried By Optimistic Rates Markets

- MNI Chicago Business Barometer™ - Softened to 44.0 in February

- MNI US DATA: Core PCE Broadly In Line In Jan But With Particularly Strong Supercore

US

FED (MNI): Fed’s Mester-Larger Banks Can Handle Higher Capital: The largest U.S. banks are still in a position to handle tighter capital standards without compromising their lending capacity, Cleveland Fed President Loretta Mester said Thursday.

- In a wide ranging speech offering an array of incremental suggestions to make the financial system more resilient, Mester said the banking turmoil of last March, which culminated in the collapse of Silicon Valley Bank, is a reminder that policymakers should not be complacent.

- “In my view, at the larger banks, current minimum capital standards are still below the level where an increase would be counterproductive in terms of thwarting productive risk-taking, beneficial innovation, or economic growth,” Mester said in prepared remarks to a conference at Columbia University that did not touch on monetary policy.

FED (MNI): Bostic Says Fed Likely To Begin Easing In Summer: Federal Reserve Bank of Atlanta President Raphael Bostic reiterated Thursday the central bank is likely going to be in a position to begin easing interest rates sometime in the summer, but he added that economic data will be the guide and easing can be pulled forward or pushed back.

- "It'll probably be appropriate if things go the way I expect to see us to start to reduce rates in the summertime," he said in Q&A at an Atlanta Fed banking conference.

FED (MNI): Chicago Fed Goolsbee Asks How Long Tight Fed Policy Is Needed: Chicago Federal Reserve President Austan Goolsbee said Thursday that the need for tight monetary policy may diminish even with strong GDP growth if the U.S. economy continues to see improvements in supply that would help further curb inflation.

- The Fed's policy rate is already restrictive compared with inflation and the FOMC's long-term estimate of borrowing costs, he said during an online discussion hosted by the Princeton University Bendheim Center for Finance. “The question is how long do we want to remain in this restrictive of a territory?” he asked. The idea that the economy may be overheating with economic growth around 3% could be misleading, he said, suggesting there's still room for improvements in the supply chain and increases in labor supply to bring down inflation further.

NEWS

POLICY (MNI): G20 CenBanks Worried By Optimistic Rates Markets: Central bankers gathered at the G20 meeting in Sao Paulo discussed the disconnect between their own expectations for inflation and interest rates and investor expectations, which they fear could loosen monetary conditions prematurely, MNI understands.

US: HOUSE HAS VOTES TO PASS STOPGAP GOVERNMENT FUNDING BILL, Bbg

US (MNI): Congress Expected To Pass Government Funding Continuing Resolution Today. The House of Representatives is expected to vote today on a short-term Continuing Resolution to extend government funding deadlines and avert a partial government shutdown on Saturday. Assuming the bill passes the House, the Senate is expected to pass the bill via unanimous consent this evening.

US-EU (MNI): BBG: Biden Wants Plan On Tapping Frozen Russian Assets By G7 Summit. Bloomberg reporting that US President Joe Biden wants G7 countries to make progress on a plan to tap frozen Russian sovereign assets to aid Ukraine by the G7 Leaders Summit in Italy in June.

SECURITY (MNI): PM Mikati: Israel-Hamas Ceasefire Would Halt Fighting In Lebanon. Lebanon's caretaker prime minister, Najib Mikati, has told Reutershe's "confident" a ceasefire agreement between Israel and Hamas would end hostilities between Israel and Iran-backed Hezbollah along Lebanon's southern border with Israel.

SECURITY (MNI): Putin's Comments On Nukes Most Explicit To Date: As part of his annual address to the Federal Assembly, the two chambers of the Russian parliament, President Vladimir Putin made some of the most explicit threats to the West regarding the potential use of nuclear weapons to date. In the aftermath of French President Emmanuel Macron raising the prospect of NATO/European troops being on the ground in Ukraine, Putin warned of "the fate of those who once sent their contingents to our country. Now the consequences for possible interveners will be much more tragic."

Tsys Hold Range Into Month-End, ISMs, UofM and More Fed Speak Friday

- Treasury futures hold firmer levels for the most part, short end under pressure heading into month end, curves flatter (2s10s -1.965 at -39.526).

- The new lead quarterly Jun'24 10Y futures currently at 110-14.5 (+3.5) vs. 110-00 low, trading inside technicals: initial technical resistance 110-26+ (20-day EMA) vs. technical support 109-25+ (Low Feb 23).

- Futures bounced off lows following this morning's higher than expected Personal Income (1.0% vs. 0.4% est), Personal Spending came out in line at 0.2% vs est. Supercore PCE, however, at 4.2% over three-months (from 2.2% in Dec), 3.4% over six-months (from 2.8%).

- Initial Jobless Claims higher than expected (215k vs. 210k est) while Continuing Claims climbs to 1.905M vs. 1.874M est.

- Balance of data looked in-line: Real Personal Spending (-0.1% vs. -0.1% est); PCE Deflator MoM (0.3% vs. 0.3% est), YoY (2.4% vs. 2.4% est), PCE Core Deflator MoM (0.4% vs. 0.4% est), YoY (2.8% vs. 2.8% est).

- Fed speak remains balanced while leaning toward cut(s) in 2H'24. Federal Reserve Bank of Atlanta President Raphael Bostic reiterated Thursday the central bank is likely going to be in a position to begin easing interest rates sometime in the summer, but he added that economic data will be the guide and easing can be pulled forward or pushed back.

- Look ahead: Wrapping up the week with another busy data day: ISMs, UofM Sentiment, and more Fed Speakers.

OVERNIGHT DATA

US DATA (MNI): Core PCE Broadly In Line In Jan But With Particularly Strong Supercore. Core PCE increased 0.416% M/M in January, fractionally stronger than the 0.4 median consensus which had tilted fractionally lower.

- The previously known Q4 upward revision was mildly dovish from a momentum perspective, in that Dec was revised down from 0.17% to 0.145% (triggering the rounded downward revision), followed an upward revised 0.089% (from 0.065) in Nov and 0.154 (from 0.140) in Oct.

- Core services ex-housing inflation was indeed very strong, at 0.596% M/M (two analysts had looked for 0.55 prior) for its strongest monthly print since Dec’21.

- Within housing, PCE imputed rental of owner-occupied housing mirrors the acceleration in CPI’s OER, jumping to 0.56% M/M from a downward revised 0.42 (initial 0.47).

- Recent annualized trend rates: core PCE at 2.6% over three-months (from 1.6% in Dec), 2.5% over six-months (from 1.9%).

- Supercore PCE at 4.2% over three-months (from 2.2% in Dec), 3.4% over six-months (from 2.8%).

US DATA (MNI): Chicago Business Barometer™ - Softened to 44.0 in February: The Chicago Business BarometerTM, produced with MNI softened -2.0 points to 44.0 in February. This is the third consecutive monthly decline, pushing the index deeper into contractionary territory, and marking the lowest print since July 2023. We also note that this print is -1.4 points below the 2023 average.

US DATA (MNI): Pending Home Sales See Surprise Slide In January: Pending home sales were much weaker than expected in January at a seasonally adjusted -4.9% M/M (cons +1.5) after a downward revised 5.7% (initial 8.3%) increase in Dec.

US DATA (MNI) Continuing Claims Push Higher In Payrolls Reference Week. Initial jobless claims surprised slightly higher in the week to Feb 24 at a seasonally adjusted 215k (cons 210k) after a marginally upward revised 202k (initial 201k).

- They continue to run a relatively low four-week average of 213k, down from 216k the week prior but holding a drift off particularly low 203/204k readings in mid-January.

- Continuing claims, covering the reference week for next week’s payrolls report, saw a larger surprise higher in the week to Feb 17, at a seasonally adjusted 1905k (cons 1875k) after little revised 1860k (initial 1862k). The SA 1905k compares with 1828k from last month’s reference week.

- Looking in non-seasonally adjusted terms, initial claims are low for this time of year, whilst there is no change for continuing claims compared to last week – they remain higher than levels seen in both 2022 and 2023 but at the lower end of pre-pandemic levels.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 23.25 points (0.06%) at 38969.02

- S&P E-Mini Future up 19 points (0.37%) at 5099.25

- Nasdaq up 106.9 points (0.7%) at 16053.39

- US 10-Yr yield is down 1.4 bps at 4.2502%

- US Mar 10-Yr futures are up 4/32 at 109-30

- EURUSD down 0.0034 (-0.31%) at 1.0804

- USDJPY down 0.74 (-0.49%) at 149.95

- WTI Crude Oil (front-month) down $0.53 (-0.67%) at $78.00

- Gold is up $10.66 (0.52%) at $2045.22

- European bourses closing levels:

- EuroStoxx 50 down 6 points (-0.12%) at 4877.77

- FTSE 100 up 5.04 points (0.07%) at 7630.02

- German DAX up 76.97 points (0.44%) at 17678.19

- French CAC 40 down 26.96 points (-0.34%) at 7927.43

US TREASURY FUTURES CLOSE

- 3M10Y +0.014, -114.006 (L: -117.143 / H: -108.809)

- 2Y10Y -1.986, -39.547 (L: -40.211 / H: -37.081)

- 2Y30Y -3.491, -26.964 (L: -27.474 / H: -23.53)

- 5Y30Y -2.778, 11.55 (L: 11.045 / H: 14.16)

- Current futures levels:

- Mar 2-Yr futures up 1.5/32 at 101-29.75 (L: 101-26.25 / H: 101-31.75)

- Mar 5-Yr futures up 1.75/32 at 106-17 (L: 106-08.5 / H: 106-22)

- Mar 10-Yr futures up 4/32 at 109-30 (L: 109-16 / H: 110-04)

- Mar 30-Yr futures up 15/32 at 119-7 (L: 118-07 / H: 119-16)

- Mar Ultra futures up 25/32 at 126-0 (L: 124-17 / H: 126-10)

US 10Y FUTURE TECHS: (M4) Trend Needle Points South

- RES 4: 112-04 High Feb 7

- RES 3: 111-24+ High Feb 13

- RES 2: 110-08 50-day EMA

- RES 1: 110-26+ 20-day EMA

- PRICE: 110-19 @ 1300 ET Feb 29

- SUP 1: 109-25+ Low Feb 23

- SUP 2: 109-14+ Low Nov 28

- SUP 3: 108-19+ 61.8% of the Oct 19 - Dec 27 bull phase

- SUP 4: 109-12+ 1.764 proj of Dec 27 - Jan 19 - Feb 1 price swing

The trend direction in Treasuries is unchanged and remains down with the contract continuing to trade closer to its recent lows. Price has recently pierced the 110-00 handle. A clear break of this level would strengthen the bearish condition and signal scope for an extension towards 109-14+, the Nov 28 low. On the upside, initial firm resistance is seen at 111-08, the 50-day EMA.

SOFR FUTURES CLOSE

- Mar 24 +0.003 at 94.685

- Jun 24 steady at 94.890

- Sep 24 -0.010 at 95.185

- Dec 24 -0.015 at 95.50

- Red Pack (Mar 25-Dec 25) -0.01 to -0.005

- Green Pack (Mar 26-Dec 26) steadysteady0 to +0.005

- Blue Pack (Mar 27-Dec 27) +0.005 to +0.010

- Gold Pack (Mar 28-Dec 28) +0.010

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00315 to 5.32244 (-0.00169/wk)

- 3M -0.00773 to 5.33352 (+0.00295/wk)

- 6M -0.01194 to 5.27493 (+0.00142/wk)

- 12M -0.02147 to 5.07185 (-0.00058/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.620T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $670B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $661B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $96B

- Daily Overnight Bank Funding Rate: 5.31% (+0.00), volume: $282B

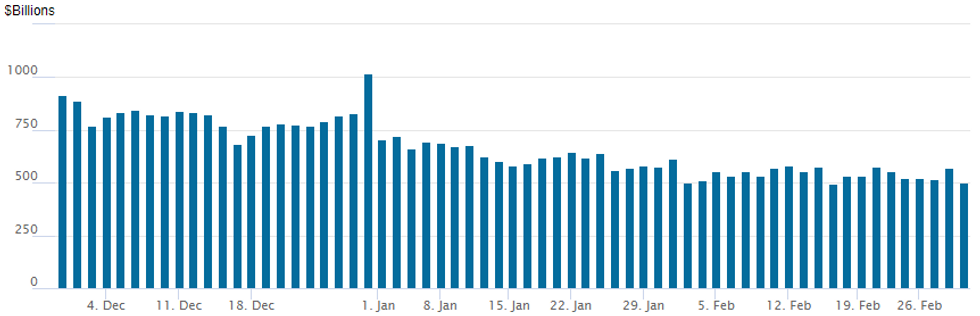

FED Reverse Repo Operation: Usage Falls to Two Week Lows

NY Federal Reserve/MNI

- RRP usage falls to the lowest level in two weeks at $502.074B vs. $569.855B Wednesday; compares to $493.065B on Thursday, Feb 15 -- the lowest since early June 2021 .

- Meanwhile, the latest number of counterparties slips to 83 from 87 Wednesday (compares to 65 on January 16, the lowest since July 7, 2021).

$2.6B High Grade Corporate Debt to Price Thursday

Today's modest corporate issuance pushed the month total for February 2024 to $254.2B

- Date $MM Issuer (Priced *, Launch #)

- 2/29 $1B #Prologis Targeted Fund $500M 5Y +110, $500M 10Y +135

- 2/29 $1B #Bank of Montreal 60NC5 7.7%

- 2/29 $600M #TPG Operating Group 10Y +165

- 2/29 $Benchmark Doha Bank 5Y Investor calls

FOREX Initial Greenback Weakness Reverses Course, JPY Remains Outperformer

- US PCE inflation came in close to estimates on Thursday, leaving the greenback victim to weaker-than-expected US jobless claims figures, as well as a below-estimate MNI Chicago PMI. The USD index was quick to erase moderate gains and trade to a fresh session low of 103.66 right ahead of the month-end WMR fix.

- However, with month-end positioning potentially well telegraphed, the greenback had a sharp squeeze into 1600 GMT and continued its reversal higher in the immediate aftermath. The USD index briefly extended its intra-day bounce to 0.5%, before trading a tenth lower into the APAC crossover.

- Despite the late recovery for the greenback and USDJPY, the Japanese yen remains the standout performer on Thursday, largely on the back of the overnight hawkish commentary from BOJ’s Takata, who pointed to the Bank's inflation target being within sight.

- USDJPY traded as low as 149.21 from the overnight 150.70 highs, although the pair trades mid-range in recent trade, supporting the viewpoint that dips remain corrective at this juncture. Initial support lies at 149.63, the 20-day EMA - a level pierced, but not convincingly broken on Thursday.

- Elsewhere, the likes of EUR and GBP have fallen around a quarter of a percent, and the Swiss Franc scans as the weakest in G10, with USDCHF rising to a two-week high above 0.8840.

- Overnight, RBNZ Governor Orr may speak again about the Monetary Policy Statement in Christchurch, however, focus will be on Chinese manufacturing and non-manufacturing PMI’s. Eurozone CPI then takes centre stage before US ISM Manufacturing PMI rounds off the week’s tier-one data.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/03/2024 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 29/02/2024 | 0110/2010 |  | US | New York Fed's John Williams | |

| 01/03/2024 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 01/03/2024 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 01/03/2024 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/03/2024 | 0730/0830 | ** |  | CH | Retail Sales |

| 01/03/2024 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/03/2024 | 0845/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 01/03/2024 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/03/2024 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/03/2024 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/03/2024 | 0930/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/03/2024 | 1000/1100 | *** |  | EU | HICP (p) |

| 01/03/2024 | 1000/1100 | ** |  | EU | Unemployment |

| 01/03/2024 | 1000/1100 | *** |  | IT | HICP (p) |

| 01/03/2024 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/03/2024 | 1400/1400 |  | UK | BOE's Pill Speech at Cardiff University | |

| 01/03/2024 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/03/2024 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/03/2024 | 1500/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 01/03/2024 | 1500/1000 | * |  | US | Construction Spending |

| 01/03/2024 | 1515/1015 |  | US | Fed Governor Chris Waller | |

| 01/03/2024 | 1515/1015 |  | US | Dallas Fed's Lorie Logan | |

| 01/03/2024 | 1715/1215 |  | US | Atlanta Fed's Raphael Bostic | |

| 01/03/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 01/03/2024 | 1830/1330 |  | US | San Francisco Fed's Mary Daly | |

| 01/03/2024 | 2030/1530 |  | US | Fed Governor Adriana Kugler |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.