-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: PBOC Increases Gold Reserves

MNI BRIEF: Japan Q3 GDP Revised Up On Net Exports, Capex

MNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI ASIA OPEN: Tsy Ylds Rise, Fed Williams No Hurry to Cut

- MNI INTERVIEW: Fed Only Likely To Cut Once This Year- Giannoni

- MNI FED BRIEF: Fed's Williams Says There's No Urgency To Cut Rates

- MNI US DATA: Jobless Claims Slightly Better Than Expected Across The Board:

US

INTERVIEW (MNI): Fed Only Likely To Cut Once This Year- Giannoni: The Federal Reserve will only cut interest rates once this year, in either September or December, given stubborn inflation pressures, former Dallas Fed research director Marc Giannoni told MNI, noting that the current policy stance was only somewhat restrictive.

- "They might be looking at the earliest opportunity that they can cut, and September is very much in play, but if the data does not allow that -- in particular if PCE inflation is a little firmer -- then they could easily push that out to December," he said in an interview. "It would be one cut for the year, so it would be either September or December."

- A third month of hotter-than-expected inflation, continued labor market, tightness and a resilient economy is not going to allow the Fed to cut by the 75 basis points starting in June that the FOMC had indicated in its March economic projections, Giannoni said. But he stressed that the central bank still leans in the direction of easing policy this year.

FED BRIEF (MNI): Fed's Williams Says There's No Urgency To Cut Rates: New York Federal Reserve President John Williams on Thursday said the central bank can take its time and let well-positioned monetary policy work and let the economy continue to rebalance.

- "I definitely don't feel urgency to to cut interest rates. I think monetary policy is doing exactly what we'd like to see," he said in Q&A at a Semafor event. "My expectation is inflation gets all the way to 2% on a sustained basis as the economy's in good balance. Interest rates will need to be lower at some point, but the timing is driven by the economy."

- Williams, vice chair of the FOMC, said his base case does not include raising the fed funds rate further.

NEWS

EUROPEAN COUNCIL (MNI): Pushback On Defence Eurobonds At EUCO Summit: The prospect of agreement being reached on joint EU debt issuance, including so-called 'defence eurobonds' to pay for enhanced investment in the Union's defence and security, remains a distant one with several national leaders pushing back against the prospect at the ongoing special European Council summit in Brussels.

EU-RUSSIA (MNI): EU Com VP-Should Be Decision On Russian Assets For Ukraine In H124: Wires carrying comments from European Commission Exec VP Valdis Dombrovskis regarding the prospect of using the profits from frozen Russian assets to fund Ukraine's war effort.

ISRAEL (MNI): Netanyahu Sets Date For Rafah Operation-Spox: Wires reporting comments from a gov't spox claiming that Prime Minister Benjamin Netanyahu has sat a date for the planned military operation in the southern Gaza city of Rafah.

MIDEAST (MNI): FT-Qatar Reconsiders Israel-Hamas Mediator Role: The FT is reporting that Qatar is reconsidering its months-long role as a key mediator between Israel and Hamas in the ongoing war in Gaza.

IRAN (MNI): IRGC Commander-If Israel Hits Nuclear Sites We Will Respond In Kind: Tasnim News, an Iranian outlet with links to the Islamic Revolutionary Guard Corps (IRGC) is reporting comments from senior IRGC commander Major General Ahmad Haghtalab, claiming that 'It is possible and conceivable to revise Iran's nuclear doctrine and policies, and deviate from past considerations.'

PHILIPPINES (MNI): Manila Upgrades Ties w/NZ Amid Regional Diplomatic Drive: (MNI) London - The upgrading of ties between New Zealand and the Philippines to a 'comprehensive partnership' has been announced as part of NZ PM Christopher Luxon's official visit to the country.

US TSYS Near Lows, Possibly Overreacting to NY Fed Williams

- Treasury futures are moderately weaker after the bell, near session lows as markets gradually price out dovish policy projections for the year. Treasuries reacted negatively to comments from NY Fed Williams on the potential for a data driven rate hike in the future. Markets may have overreacted while Williams simply stated the Fed can take its time and let well-positioned monetary policy work and let the economy continue to rebalance.

- On earlier data, moderate action followed slightly lower than expected weekly claims (212k vs. 215k est, prior up-revised to 212k from 211k) and continuing claims (1.812M vs. 1.818M est, prior down-revised to 1.810M from 1.817M), while Philadelphia Fed Business Outlook came out much higher than estimated (15.5 vs. 2.0 est).

- Rates see-sawed around session lows after drop in Existing Home Sales to 4.19M from 4.38M prior comes out more or less in line with expectations (4.2m) MoM -4.3% from 9.5% prior (-4.1% est), Leading index -0.3% vs -0.1% est (prior up-revised to 0.2% from 0.1%).

- Jun'24 10Y trading 107-24.5 last (-12.5) vs. 107-20.5 low, still inside initial technicals with support at 107-13.5 (Apr 16 low) vs r 108-25.5 resistance (Apr 12 high). 10Y yield 4.5977% +.0104, curves off lows: 2s10s +.491 -34.206.

- Look ahead: no economic data to report Friday while Chicago Fed Goolsbee will participate in a moderated Q&A at a SABEW conference (1030ET) ahead of the Fed blackout late Friday.

OVERNIGHT DATA

US DATA (MNI): Jobless Claims Slightly Better Than Expected Across The Board: Initial jobless claims were a little lower than expected at a seasonally adjusted 212k (cons 215k) in the week to Apr 13 after an upward revised 212k (initial 211k).

- The latest week for initial claims covers a payrolls reference period

- The four-week average of 215k was unchanged for the third week running, still low historically and below the 218k averaged through 2019.

- Continuing claims were also better than expected at a seasonally adjusted 1812k (cons 1818k) in the week to Apr 6 after a downward revised 1810k (initial 1817k).

- It sees continuing claims keep within the particularly narrow range of recent months.

- Changes in non-seasonally adjusted terms look in keeping with other years for both initial and continuing claims

US DATA (MNI): Philly Fed Prices Paid Jump But Limited Passthrough, Per Beige Book: The Philly Fed manufacturing index was clearly stronger than expected in April at 15.5 (cons 2.0) after 3.2 in Mar, for its highest since Apr’22.

- Supporting this strength was the six-month ahead version only dipping from 38.6 to 34.3 after jumping 31pts in March.

- Activity: New orders increased strongly from 5.4 to 12.2 (highest since May’22) and shipments increased from 11.4 to 19.1 (strongest since Aug’22).

- Prices: Prices paid jumped from a particularly low 3.7 to 23.0 (highest since Dec’23) although prices received were more contained as they only increased from 4.6 to 5.5.

- More striking was the 6-mths ahead measures of prices paid increasing from 38.0 to 54.5 (highest since Jun’22), although again, prices received fell from 37.1 to 34.4.

- Recall yesterday’s Beige Book noted a considerable weakening in recent months in ability to pass cost increases on to consumers. It also added that the perceived upside risks to near-term input and output prices were mostly confined to manufacturers.

- On an ISM-equivalent basis, it firms from 48.0 to 49.8 (highest since Aug'22) after the Empire survey firmed from 45.5 to 46.0 on Monday.

US DATA (MNI): Existing Home Sales As Expected, Relative Supply Slowly Building: Existing home sales were very close to consensus in March at 4.19m (cons 4.20m) after falling -4.3% M/M (cons -4.1). The decline comes after a particularly strong 9.5% increase in Feb, with that increase still looking surprisingly strong considering a much smaller uplift in pending home sales.

US DATA (MNI): Leading Index Points To Fragile But Not Recessionary Growth Outlook: The Conference Board’s leading index fell more than expected in Mar (-0.3% M/M vs cons -0.1%) but after an upward revision (+0.2% M/M vs initial +0.1%). The February uptick remains the first increase since Feb 2022. From the press release: “Negative contributions from the yield spread, new building permits, consumers’ outlook on business conditions, new orders, and initial unemployment insurance claims drove March’s decline.”

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 19.68 points (0.05%) at 37777.25

- S&P E-Mini Future down 14.75 points (-0.29%) at 5048.25

- Nasdaq down 87.3 points (-0.6%) at 15597.82

- US 10-Yr yield is up 4.7 bps at 4.6347%

- US Jun 10-Yr futures are down 13/32 at 107-24

- EURUSD down 0.0029 (-0.27%) at 1.0644

- USDJPY up 0.23 (0.15%) at 154.63

- WTI Crude Oil (front-month) up $0.06 (0.07%) at $82.76

- Gold is up $18.8 (0.8%) at $2379.76

- European bourses closing levels:

- EuroStoxx 50 up 22.44 points (0.46%) at 4936.57

- FTSE 100 up 29.06 points (0.37%) at 7877.05

- German DAX up 67.38 points (0.38%) at 17837.4

- French CAC 40 up 41.75 points (0.52%) at 8023.26

US TREASURY FUTURES CLOSE

- 3M10Y +4.556, -77.902 (L: -86.578 / H: -76.404)

- 2Y10Y -0.876, -35.573 (L: -36.455 / H: -33.646)

- 2Y30Y -2.502, -25.913 (L: -26.615 / H: -22.246)

- 5Y30Y -3.063, 5.102 (L: 4.716 / H: 9.738)

- Current futures levels:

- Jun 2-Yr futures down 3.5/32 at 101-15.5 (L: 101-15 / H: 101-20.25)

- Jun 5-Yr futures down 8.75/32 at 104-31 (L: 104-29.25 / H: 105-11.25)

- Jun 10-Yr futures down 13/32 at 107-24 (L: 107-20.5 / H: 108-10.5)

- Jun 30-Yr futures down 17/32 at 114-10 (L: 114-02 / H: 115-06)

- Jun Ultra futures down 23/32 at 120-17 (L: 120-09 / H: 121-22)

US 10Y FUTURE TECHS (M4) Trend Needle Points South

- RES 4: 110-03+ 50-day EMA

- RES 3: 109-26+ High Apr 10

- RES 2: 109-02/08 Low Apr 8 / 20-day EMA

- RES 1: 108-25+ High Apr 12

- PRICE: 107-24 @ 1240 ET Apr 18

- SUP 1: 107-13+ Low Apr 16

- SUP 2: 107-07+ 76.4% of the Oct - Dec ‘23 bull leg (cont)

- SUP 3: 106-27 2.764 proj of Dec 27 - Jan 19 - Feb 1 price swing

- SUP 4: 106-08 3.00 proj of Dec 27 - Jan 19 - Feb 1 price swing

A bear cycle in Treasuries remains in play and short-term gains are considered corrective. This week’s move lower reinforces the current bear theme and the move down has resumed this year’s downtrend and in the process, cleared a number of short-term support points. Scope is seen for a move to 107.07+ next, a Fibonacci retracement. Initial firm resistance is seen at 109-08, the 20-day EMA.

SOFR FUTURES CLOSE

- Jun 24 -0.005 at 94.735

- Sep 24 -0.030 at 94.875

- Dec 24 -0.060 at 95.045

- Mar 25 -0.080 at 95.220

- Red Pack (Jun 25-Mar 26) -0.085 to -0.08

- Green Pack (Jun 26-Mar 27) -0.08 to -0.07

- Blue Pack (Jun 27-Mar 28) -0.07 to -0.06

- Gold Pack (Jun 28-Mar 29) -0.06 to -0.05

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00338 to 5.31544 (-0.00385/wk)

- 3M -0.00200 to 5.32456 (-0.00300/wk)

- 6M -0.00176 to 5.29978 (-0.00359/wk)

- 12M -0.00642 to 5.20367 (+0.01739/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.731T

- Broad General Collateral Rate (BGCR): 5.30% (-0.01), volume: $701B

- Tri-Party General Collateral Rate (TGCR): 5.30% (-0.01), volume: $685B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $80B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $243B

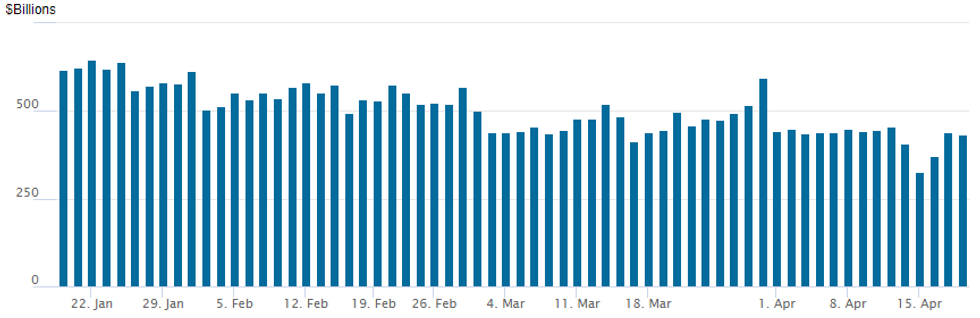

FED Reverse Repo Operation

- RRP usage recedes to $433.006B vs. $440.508B yesterday. Compares to $327.066B on Monday -- the lowest level since mid-May 2021 as desks cited Federal tax deadline for the drop.

- Meanwhile, the latest number of counterparties recedes to 75 vs. 89 prior.

PIPELINE $5B Goldman Sachs 2Pt Debt Issuance Launched

- Date $MM Issuer (Priced *, Launch #)

- 4/18 $5B #Goldman Sachs $2.5B 6NC5 +105, $2.5B 11NC10 +122

- 4/18 $800M *LG $500M 3Y +95, $300M 5Y +110

- 4/18 $750M #Citizens Financial 11NC10 +200

EGBs-GILTS CASH CLOSE: Pullback On Multiple Factors

Core FI largely reversed the prior session's gains Thursday, with multiple factors weighing increasingly on Bunds and Gilts as the session went on.

- After largely constructive trade in the European morning session, helped by softer oil/gas prices, stronger-than-expected US manufacturing survey data (Philly Fed) helped kick off global core FI weakness in the afternoon, aided by a bounce in energy prices and hawkish-leaning Fedspeak.

- While ECB speakers maintained broad consensus on a June rate cut, Austria's Holzmann broke from the Governing Council's recent rhetoric by noting that the ECB's rate cut cycle would be restrained if Federal Reserve easing proved limited.

- The German and UK curves leaned bear flatter, with Gilts outperforming Bunds.

- Periphery EGB spreads widened in mid-afternoon before later re-tightening, mirroring moves in equities.

- Early Friday sees UK retail sales data.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 4.2bps at 2.986%, 5-Yr is up 4.2bps at 2.517%, 10-Yr is up 3.7bps at 2.502%, and 30-Yr is up 3.3bps at 2.632%.

- UK: The 2-Yr yield is up 2.5bps at 4.488%, 5-Yr is up 0.7bps at 4.192%, 10-Yr is up 1.4bps at 4.275%, and 30-Yr is up 3bps at 4.724%.

- Italian BTP spread down 1.5bps at 143bps / Spanish down 2bps at 81.8bps

FOREX Yield Bounce Saves USD From Further Declines

- Currency markets traded rangebound Thursday, with the USD Index respecting the recent range and largely consolidating just below this week's cycle high at 106.517. The session started slowly, with the USD lower, before a bottoming-out of the US yield followed comments from Fed's Williams, who stressed that he sees no urgency in pressing the Fed toward cutting interest rates, and that policy is in a "good place".

- Fed rate cut pricing across 2024 approached a new pullback low through the NY crossover, with just 38bps of easing priced across the calendar year - enough to drag the USD out of negative territory, but stop short of any formative rally.

- USD/JPY mimicked the recovery in yields, but failed to make any material test on next resistance. While the technical trend condition in USD/JPY remains positive, the next phase of strength could be harder to come by without another major shift in Fed policy pricing, as positioning looks stretched and diplomatic blockers to potential intervention appear to peel away.

- CAD outperformed at the margins, fading the overbought condition present earlier in the week. An uptick in oil through the London close aided the recovery, however for now weakness in USD/CAD is deemed corrective. Support is seen at 1.3682 (Apr 12 low) whilst is resistance at 1.3846 (Apr 16 high) before 1.3855 (Nov 10, 2023 high).

- Focus for the Friday session turns to the National CPI release for March, UK retail sales, German PPI and speeches from BoE's Ramsden & Mann, ECB's Nagel and Fed's Goolsbee.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/04/2024 | 2330/0830 | *** |  | JP | CPI |

| 19/04/2024 | 0600/0700 | *** |  | UK | Retail Sales |

| 19/04/2024 | 0600/0800 | ** |  | DE | PPI |

| 19/04/2024 | 1415/1515 |  | UK | BoE's Ramsden at Peterson Institute Conference | |

| 19/04/2024 | 1430/1030 |  | US | Chicago Fed's Austan Goolsbee | |

| 19/04/2024 | 1530/1130 |  | US | New York Fed's Roberto Perli | |

| 19/04/2024 | 1630/1730 |  | UK | BOE's Mann Panelist at Capital Flows Seminar | |

| 19/04/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.