-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Virus Spd Underscores Risk-off Bid For Rates

EXECUTIVE SUMMARY:

- MNI PREVIEW: ECB Likely To Wait Before PEPP Boost

- MCENANY SAYS CHANCES ARE SLIM FOR STIMULUS BILL BEFORE ELECTION, Bbg

- Fr PM Macron: TO ADDRESS NATION WED. ON NEW COVID-19 MEASURES: Bbg

- Fr PM Macron: "CONSIDERING NATIONWIDE LOCKDOWN BECAUSE CURFEWS HAVE FAILED TO STOP VIRUS SPREAD", LE FIGARO

- SENIOR EUROPEAN COMMISSION OFFICIAL JOHN BERRIGAN SAYS FINANCIAL SECTOR SHOULD NOT EXPECT TOO MUCH FROM ANY UK-EU FREE TRADE DEAL, Reuters

- EU WARNS THERE WILL NOT BE ENOUGH COVID-19 VACCINES FOR WHOLE EU POPULATION BEFORE THE END OF 2021 - SOURCES, Reuters

US

US: Civiqs Poll Puts Biden Up By 5% In Georgia

A new opinion poll from Civiqs shows Democratic candidate Joe Biden leading Republican Donald Trump by 5% in the southern, historically red state of Georgia. Democrats also leading in races for both of Georgia's US Senate seats.

- Biden 51%, Trump 46%

- Georgia Senate: Ossoff (D) 51%, Perdue (R-inc) 45%, Hazel (L) 2%

- Georgia special Senate: Warnock (D): 48.0%, Collins (R): 23.0%, Loeffler (R-Inc): 22.0%, Lieberman (DEM): 2.0%

- Special Senate Hypothetical Runoffs: Warnock (D) 51%, Loeffler (R-inc) 37%; Warnock (D) 51%, Collins (R) 42%

- All polls Civiqs/@dailykos, Likely Voters, 23-26 Oct. https://t.co/VVMXGR7Fke

- While these are just one set of polls from a single outlet, if accurate they point towards a full 'blue wave' win for the Democrats. Should the Dems take the David Perdue's Senate seat in November, a Democratic majority in the chamber would be all but assured. Winning the special election run-off in January could solidify major gains for the Democrats in the next Congress.

- Democrats haven't held both Georgia US Senate seats since the defeat of Max Cleland in the 2002 mid-terms.

EUROPE

ECB: The European Central Bank should adopt a 'wait-and-see' approach at its meeting on Thursday as it assesses the impact of the second wave of Covid-19 before adding to the EUR1.35 trillion envelope of its pandemic emergency purchase program, although it could point to a faster pace of bond buys or authorize a fresh EUR120 billion for its pre-pandemic quantitative easing, sources told MNI. For more see 10/27 main wire at 0951ET.

OVERNIGHT DATA

US DATA: September Durable Goods New Orders +1.9%; Ex-Transport +0.8%

- Orders of U.S. durable goods surged in September, growing by 1.9% following a downward revised 0.4% increase in August (prev +0.5%), according to figures released Tuesday by the Census Bureau. Financial markets had expected a m/m gain of 0.5%.

- Orders of transportation equipment were up 4.1% in September after falling 0.9% in August. Motor vehicle and parts orders rose 1.5% after a sharp 4.1% decline in August.

- Meanwhile, defense aircraft orders were down 46.1% in September following August's smaller 13.8% drop.

- Excluding transportation, new orders were up 0.8% when markets had expected an increase of 0.4%,.

- Capital goods new orders rose 4.7% in September following August's stronger 5.3% gain. Nondefense capital goods new orders were up 10.4% , while defense capital goods orders were down 22.3%.

- Excluding aircraft, nondefense capital goods new orders were up 1.0%.

- U.S. OCT. CONSUMER CONFIDENCE INDEX FALLS TO 100.9 FROM 101.3 (102.0 expected)

- U.S. OCT. RICHMOND FED FACTORY INDEX AT 29 (18 expected)

- US AUG CASE-SHILLER SEAS ADJ HOME PRICE INDEX +0.5% M/M

- US AUG CASE-SHILLER UNADJ HOME INDEX +1.1% M/M; +5.2% Y/Y

- US AUG CASE-SHILLER NATIONAL IDX +1.0% SA, +1.1% NSA, +5.7% Y/Y

- US REDBOOK: OCT STORE SALES +0.8% V SEP THROUGH OCT 24 WK

- US REDBOOK: OCT STORE SALES +1.6% V YR AGO MO

- US REDBOOK: STORE SALES +1.2% WK ENDED OCT 24 V YR AGO WK

- MNI:US AUG FHFA HPI SA +1.5% V +1.1% JUL; +8.0% Y/Y

MARKETS SNAPHOT

- DJIA down 168.72 points (-0.61%) at 27506.68

- S&P E-Mini Future down 6.25 points (-0.18%) at 3385.5

- Nasdaq up 57.6 points (0.5%) at 11413.51

- US 10-Yr yield is down 2.5 bps at 0.776%

- US Dec 10Y are up 7/32 at 138-27.5

- EURUSD up 0.0002 (0.02%) at 1.1815

- USDJPY down 0.36 (-0.34%) at 104.47

- WTI Crude Oil (front-month) up $0.93 (2.41%) at $39.50

- Gold is up $6.13 (0.32%) at $1908.08

- European bourses closing levels:

- EuroStoxx 50 down 34.65 points (-1.12%) at 3091.25

- FTSE 100 down 63.02 points (-1.09%) at 5795.77

- German DAX down 113.61 points (-0.93%) at 12128.66

- French CAC 40 down 85.46 points (-1.77%) at 4768.5

US TSY SUMMARY: Virus Spd Underscores Risk-off Bid For Rates

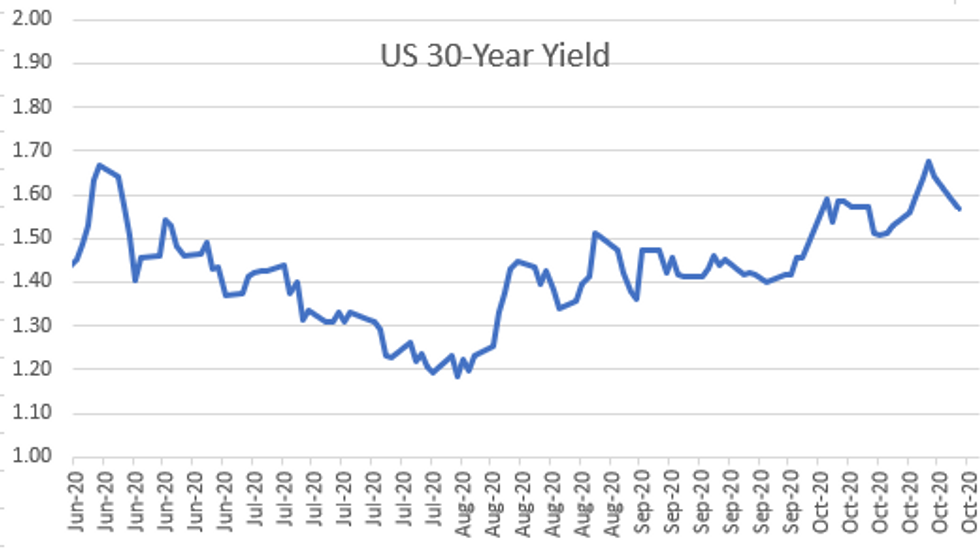

Tsys held near early session highs post data but continued to extend, finishing near the top end of session range, Yld curves adding to Mon's bull flattening.

- Sources reported early two-way flow in intermediates with carry-over bank portfolio selling in 10s, derivative selling out the curve vs. real$ buying 30s. Better buying in intermediates to the long end reported in the second half, albeit on lighter volume (TYZ around 825k by the closing bell) as the spread of COVID-19 spurred lockdown concerns.

- Underscoring, if not adding to the risk-off tone, French PM Macron is said to be "considering a national lockdown" as curfews set last wk have failed to stop the spd of the virus. Macron to address nation Wednesday evening.

- Other salient headlines: WH Press Sec MCenany: CHANCES ARE SLIM FOR STIMULUS BILL BEFORE ELECTION, Bbg; EU official warned there won't BE ENOUGH COVID-19 VACCINES FOR WHOLE EU POPULATION" until late 2021.

- Second half trade included decent deal-tied hedging, light steepener unwinds in 2s and 5s vs. 10s. So-so auction, US Tsy $54B 2Y Note (91282CAR2) drew 0.151% (0.136% last month) vs. 0.149% WI, bid/cover 2.41 vs. 2.42 previous. The 2-Yr yield is down 0.2bps at 0.1474%, 5-Yr is down 1.9bps at 0.3317%, 10-Yr is down 2.5bps at 0.776%, and 30-Yr is down 2.6bps at 1.5652%.

US TSY FUTURES CLOSE Strong Close

Broadly higher on modest volumes (TYZ<825k), futures near top end relative narrow session range since the open, yld curves bull flatten, update:

- 3M10Y -3.12, 67.855 (L: 67.1 / H: 70.949)

- 2Y10Y -2.64, 62.32 (L: 61.818 / H: 65.464)

- 2Y30Y -2.579, 141.372 (L: 140.697 / H: 144.905)

- 5Y30Y -0.697, 123.148 (L: 122.473 / H: 124.868)

- Current futures levels:

- Dec 2Y up 0.12/32 at 110-13.5 (L: 110-13.12 / H: 110-13.75)

- Dec 5Y up 2.75/32 at 125-24.5 (L: 125-20.75 / H: 125-24.75)

- Dec 10Y up 7.5/32 at 138-28 (L: 138-18.5 / H: 138-28.5)

- Dec 30Y up 19/32 at 174-6 (L: 173-12 / H: 174-09.00)

- Dec Ultra 30Y up 44/32 at 217-28 (L: 216-02 / H: 218-04)

US EURODLR FUTURES CLOSE: At/Near Highs

Steady to mildly higher out the strip, at/near session highs; lead quarterly EDZ0 back to steady after trading firmer since 3M LIBOR set' +0.00575 to 0.22225% (-0.00188 last wk).

- Dec 20 steady at 99.755

- Mar 21 steady at 99.785

- Jun 21 +0.005 at 99.80

- Sep 21 +0.005 at 99.805

- Red Pack (Dec 21-Sep 22) steady to +0.005

- Green Pack (Dec 22-Sep 23) +0.010 to +0.015

- Blue Pack (Dec 23-Sep 24) +0.020 to +0.025

- Gold Pack (Dec 24-Sep 25) +0.030 to +0.035

US DOLLAR LIBOR: Latest settles

- O/N -0.00075 at 0.08063% (-0.00075/wk)

- 1 Month -0.00475 to 0.15150% (-0.00475/wk)

- 3 Month -0.00900 to 0.21325% (-0.00325/wk)

- 6 Month -0.00313 to 0.24625% (-0.00313/wk)

- 1 Year -0.00463 to 0.33200% (-0.00463/wk)

US TSY, Short Term Rates

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $58B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $179B

- Secured Overnight Financing Rate (SOFR): 0.09%, $921B

- Broad General Collateral Rate (BGCR): 0.06%, $338B

- Tri-Party General Collateral Rate (TGCR): 0.06%, $315B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.735B accepted vs. $4.064B submission

- --

- 28-Oct Next forward schedule release at 1500ET

PIPELINE: P&G, Berkshire Hathaway Energy Lead Day's Supply

- $7.15B to price Tuesday

- Date $MM Issuer (Priced *, Launch #)

- 10/27 $2.25B #P&G $1B 5Y +25, $1.25B 10Y +47 (issued $5B on March 23: 5pt: $750M 5Y +210, $500M 7Y +220, $1.5B 10Y +225, $1B 20Y +220, $1.25B 30Y +225)

- 10/27 $2B #Berkshire Hathaway Energy $500M 10Y +90, $1.5B 30Y +128 (issued $1.25B 5Y on March 20)

- 10/27 $1.25B #Kommuninvest 2Y +2

- 10/27 $500M #Genuine Parts Co 10Y +120

- 10/27 $650M #Tractor Supply 10Y +110

- 10/27 $500M #Acuity Brands Lighting 10Y +140

- Expected Wednesday

- 10/28 $500M Kommunalbanken 2Y +4a

- 10/28 $500M World Bank (IADB) +4Y SOFR+27a

FOREX: Greenback in Retreat, But Week's Lows Hold

Equities in Europe caught up with the stock sell-off Tuesday, with the EuroStoxx 50 shedding just over 1%, while US markets finished mixed. The greenback suffered Tuesday, but the USD index held above the Monday low, signaling little threat of a bearish breakout yet just yet. The 50-dma continues to cap prices at 93.281, but a break above would prove bullish for the greenback.

- A bounce-back for crude prices helped buoy commodity-tied FX Tuesday, resulting in CAD, NOK outperforming most others in G10, although CAD lagged slightly ahead of Wednesday's BoC decision.

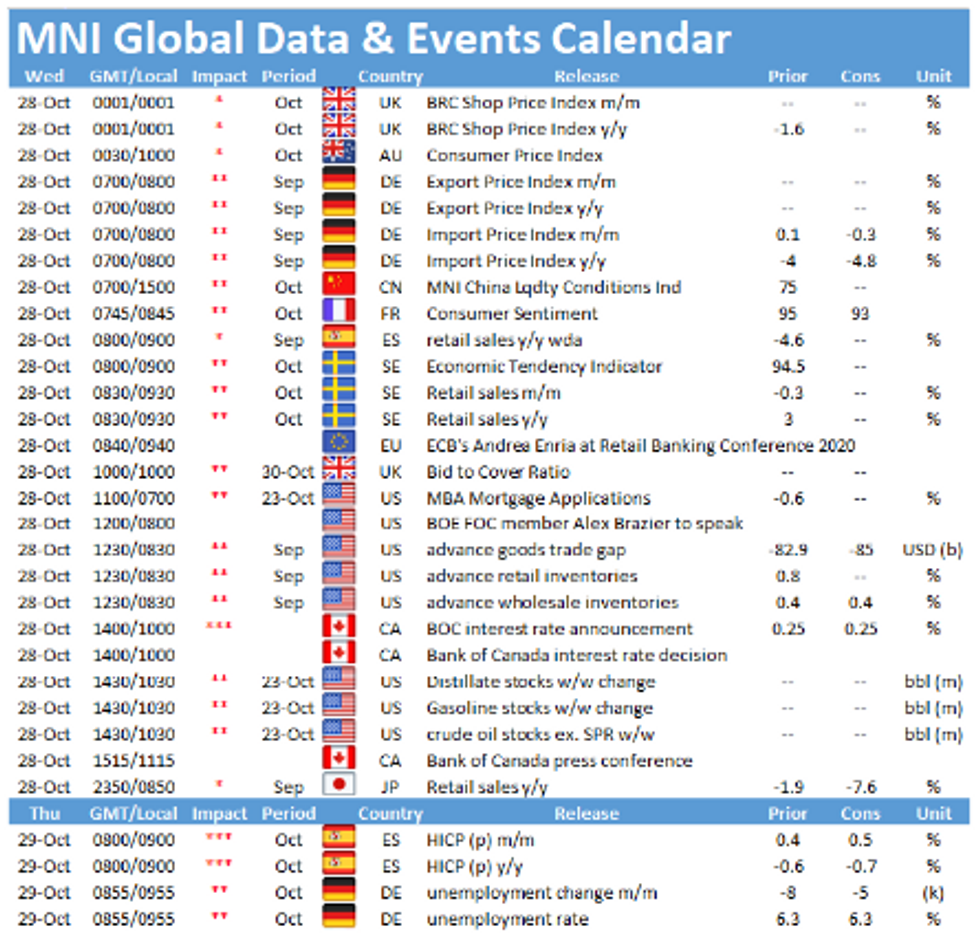

- Focus Wednesday turns to Australian CPI, which is expected to swing back into positive territory after indicating sharp downside price pressures throughout Q2. The Bank of Canada rate decision is also due, with the Bank seen keeping rates unchanged at 0.25%. Earnings season continues, with Boeing, Visa & Mastercard all due.

EGBs-GILTS CASH CLOSE: Relentless Bull Flattening

Relentless bull flattening was the prevalent theme in the UK and German curves Tuesday as equities continued to sell off into the cash bond close (30-Yr Gilt yields dropped 7+bps). The risk-off move was resisted by BTP spreads, which tightened very slightly (though 10-Yrs ended 3+bps off tightest levels).

- COVID lockdown concerns remained front-of-mind, with reports that France's Macron is considering a national lockdown, and cases across Europe mounting. Brexit talks simmering in the background too. Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 1.7bps at -0.774%, 5-Yr is down 2.9bps at -0.802%, 10-Yr is down 3.5bps at -0.615%, and 30-Yr is down 3.4bps at -0.196%.

- UK: The 2-Yr yield is down 1.5bps at -0.049%, 5-Yr is down 2.3bps at -0.054%, 10-Yr is down 4.3bps at 0.232%, and 30-Yr is down 7.1bps at 0.78%.

- Italian BTP spread down 0.4bps at 131.5bps

- Spanish bond spread up 0.7bps at 77.3bps

- Portuguese PGB spread up 0.6bps at 74.6bps

- Greek bond spread up 4.6bps at 154.7bps

UP TODAY

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.