-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsys Off Highs on Weak 10Y Sale

EXECUTIVE SUMMARY

US

FED: U.S. interest rates "may well” peak higher than the Fed has anticipated until now if inflation doesn't slow and the labor market remains tight, even as officials shift to smaller hikes to minimize the risk of overtightening, Federal Reserve Bank of Richmond President Thomas Barkin said in an interview Wednesday.

- Now that real rates are credibly positive across the curve, the time is ripe for a different reaction function -- one that is more deliberate, less about speed and more about direction, he told MNI.

- "Precision is an impossible standard here. Our tools work with long and variable lags, and the data are influenced by many things in addition to our tools," he said. "That’s why I like the idea of going slower for longer to a potentially higher place, because it will give you time to read the data and what you're learning from contacts and react appropriately." For more see MNI Policy main wire at 1210ET.

US: The boost to CPI inflation from housing is likely to accelerate further before reversing course even though the rental market from which such measures are computed has started to soften, Cleveland Fed economist Randal Verbrugge told MNI.

- "I expect CPI rent to have a bit of momentum because it's just much more slow moving. I sort of expect CPI rent to grow a little bit more and then start to slowly decelerate," he said in an interview. "New tenant rents are probably going to decelerate back to kind of a normal level and slowly average rents will fall back to that."

- The CPI's measure of rents was up 0.8% in September, the largest monthly increase in over three decades, and 7.2% over the year. Verbugge, along with the Cleveland Fed's Lara Loewenstein and BLS coauthors Brian Adams and Hugh Montag, show in a recent paper rent inflation for new tenants leads the official BLS rent inflation by roughly 12 months. For more see MNI Policy main wire at 1437ET.

- The bulk of the expected moderation in October core is seen coming from used cars declining at a faster pace and a health insurance reset. So it’ll likely be changes outside of these components that are of note, especially service components with rents expected to continue to increase extremely strongly.

- A similar 0.1-0.2pt beat to last month could see a delay in the Fed’s anticipated downshift to 50bp hikes into 2023 or augur a longer string of hikes, either way pushing the terminal rate higher still and driving a sharp flattening in the Treasury curve. For more see MNI Policy main wire at 0855ET.

US TSYS: Bonds Weaker at the Bell, 10Y Auction Tailed

After a moderately volatile first half Tsy futures sell-off, curves steepened after $35B 10Y note auction (91282CFD8) tails yet again w/ 4.140% high yield vs. 4.107% WI; 2.23x bid-to-cover vs. 2.34x prior.

- Tsys followed EGBs higher in the first half, Bonds leading as following Russia/Ukraine headline the former planning on withdrawal from city of Kherson. Debatable as a trigger, as stocks bounced off lows as well are trading weaker again: (ESZ2 -35.00 at 3800.25).

- Unrelated Bbg headline around same time: PUTIN TO SKIP GROUP OF 20 SUMMIT IN INDONESIA NEXT WEEK, unlikely to have contributed to FI/EQ bounce.

- Markets remain skittish for a number of reasons including lack of definitive results from US midterm elections, no clear leader for control of Congress as yet.

- Many remain sidelined ahead Thursday's CPI data (prior, est): MoM (0.4%, 0.6%); YoY (8.2%, 7.9%); CPI ex-food and energy MoM (0.6%, 0.5%); YoY (6.6%, 6.5%).

- Pick-up in corporate issuance: GE Healthcare 6-part jumbo rumored appr $8B total, in addition to today's $35B 10Y note sale.

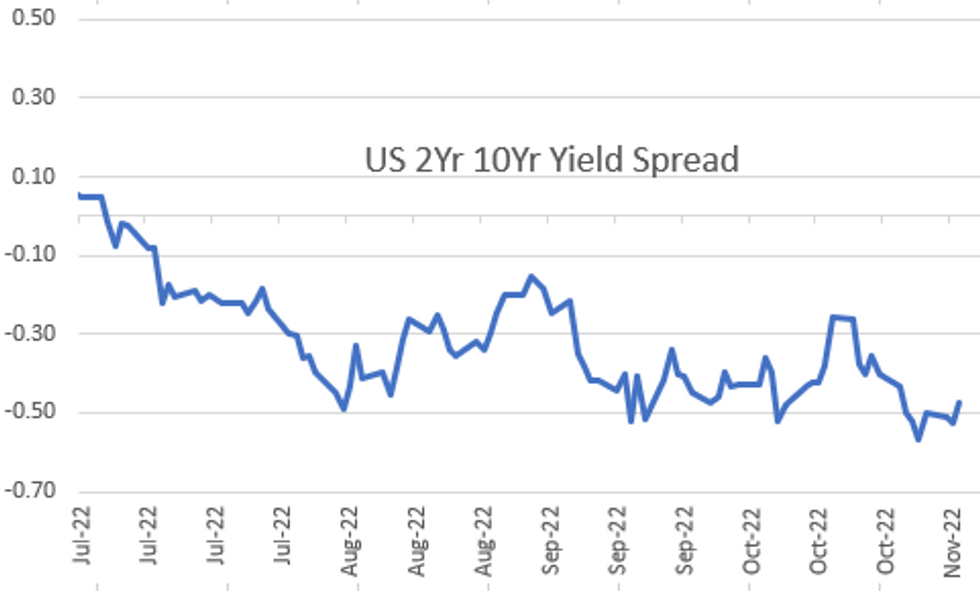

- The 2-Yr yield is down 3.3bps at 4.6173%, 5-Yr is down 1.4bps at 4.2797%, 10-Yr is up 2.1bps at 4.1447%, and 30-Yr is up 3bps at 4.3047%.

OVERNIGHT DATA

- US SEP WHOLESALE INV 0.6%; SALES 0.4%\

- US MBA: MARKET COMPOSITE -0.1% SA THRU NOV 04 WK

- US MBA: REFIS -4% SA; PURCH INDEX +1% SA THRU NOV 4 WK

- US MBA: UNADJ PURCHASE INDEX -41% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 7.14% VS 7.06% PREV

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 524.17 points (-1.58%) at 32639.67

- S&P E-Mini Future down 66 points (-1.72%) at 3769.25

- Nasdaq down 220.8 points (-2.1%) at 10396.25

- US 10-Yr yield is up 2.1 bps at 4.1447%

- US Dec 10Y are up 2/32 at 110-11

- EURUSD down 0.0063 (-0.63%) at 1.0011

- USDJPY up 0.87 (0.6%) at 146.55

- WTI Crude Oil (front-month) down $3.15 (-3.54%) at $85.75

- Gold is down $5.28 (-0.31%) at $1707.12

- EuroStoxx 50 down 11.25 points (-0.3%) at 3728.03

- FTSE 100 down 9.89 points (-0.14%) at 7296.25

- German DAX down 22.43 points (-0.16%) at 13666.32

- French CAC 40 down 10.93 points (-0.17%) at 6430.57

US TSY FUTURES CLOSE

- 3M10Y +2.179, -5.837 (L: -13.294 / H: -2.537)

- 2Y10Y +5.463, -47.68 (L: -55.031 / H: -47.468)

- 2Y30Y +6.204, -31.789 (L: -41.462 / H: -30.855)

- 5Y30Y +4.105, 2.037 (L: -4.883 / H: 3.412)

- Current futures levels:

- Dec 2Y up 3/32 at 101-29.875 (L: 101-25.5 / H: 101-30)

- Dec 5Y up 5/32 at 106-13.75 (L: 106-04.5 / H: 106-15.5)

- Dec 10Y up 2/32 at 110-11 (L: 110-00 / H: 110-17.5)

- Dec 30Y down 8/32 at 119-22 (L: 119-05 / H: 120-15)

- Dec Ultra 30Y down 21/32 at 125-28 (L: 125-09 / H: 127-02)

US 10YR FUTURE TECH: (Z2) Sights Are On The Bear Trigger

- RES 4: 113-27+ High Sep 21

- RES 3: 113-30 High Oct 4 and a key resistance

- RES 2: 112-15+ 50-day EMA

- RES 1: 110-23+/111-31 20-day EMA / High Oct 27

- PRICE: 110-08+ @ 1445ET Nov 9

- SUP 1: 109-10+ Low Nov 04

- SUP 2: 108-26+ Low Oct 21 and the bear trigger

- SUP 3: 108-06+ Low Oct 2007 (cont)

- SUP 4: 107.09 3.0% 10-dma envelope

Treasuries are in consolidation mode but remain bearish and the contract continues to trade below 111-31, the Oct 27 high and a key short-term resistance. Clearance of this hurdle is required to signal scope for a stronger short-term rally. This would open the 50-day EMA at 112-15+. The primary trend direction is down and attention is on the bear trigger at 108-26+, the Oct 21 low. A break of this support would confirm a resumption of the trend.

US EURODOLLAR FUTURES CLOSE

- Dec 22 +0.025 at 94.910

- Mar 23 +0.015 at 94.665

- Jun 23 +0.025 at 94.650

- Sep 23 +0.050 at 94.845

- Red Pack (Dec 23-Sep 24) +0.075 to +0.095

- Green Pack (Dec 24-Sep 25) +0.055 to +0.085

- Blue Pack (Dec 25-Sep 26) +0.010 to +0.045

- Gold Pack (Dec 26-Sep 27) -0.02 to steady

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00343 to 3.81214% (-0.00415/wk)

- 1M +0.01986 to 3.87857% (+0.02043/wk)

- 3M +0.03800 to 4.63000% (+0.07971/wk) * / **

- 6M +0.02186 to 5.15629% (+0.14500/wk)

- 12M -0.00743 to 5.63286% (-0.03357/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.59200% on 11/8/22

- Daily Effective Fed Funds Rate: 3.83% volume: $101B

- Daily Overnight Bank Funding Rate: 3.82% volume: $288B

- Secured Overnight Financing Rate (SOFR): 3.78%, $978B

- Broad General Collateral Rate (BGCR): 3.75%, $401B

- Tri-Party General Collateral Rate (TGCR): 3.75%, $388B

- (rate, volume levels reflect prior session)

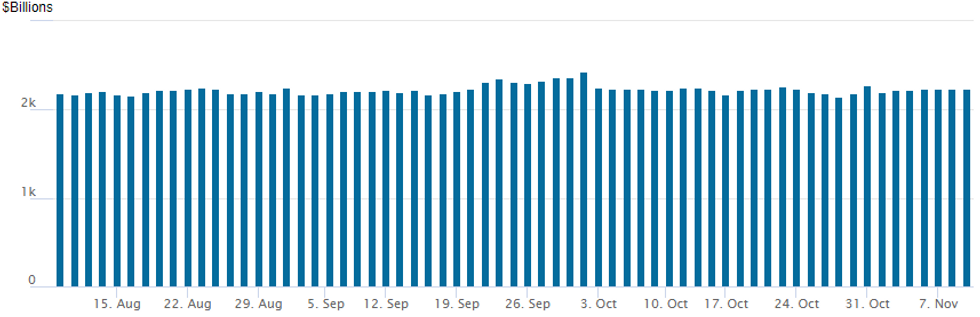

FED Reverse repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,237.812B w/ 101 counterparties vs. $2,232.555B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

PIPELINE: $8.25B GE Healthcare 6Pt Jumbo Launched

GE Healthcare 6Pt jumbo leads Wed's $18.2B total high-grade issuance:- Date $MM Issuer (Priced *, Launch #)

- 11/09 $8.25B GE Healthcare: $1B 2Y +105, $1.5B 3Y +120, $1.75B 5Y +150, $1.25B 7.25Y +170, $1.75B 10Y +185, $1B 30Y +210

- 11/09 $2.75B #Citigroup 11NC10 +210

- 11/09 $2.5B #Westpac $1.25B 2Y +82, $1.25B 5Y +122

- 11/09 $2B #Credit Suisse WNG 11NC10 +485

- 11/09 $1B #KeyBank 5Y +160

- 11/09 $700M #Consolidated Edison WNG 30Y +185

- 11/09 $1B #BNP Paribas perpNC5 9.25%

EGBs-GILTS CASH CLOSE: UK Long End Leads

UK long-end yields fell sharply Wednesday, with the belly outperforming on the German curve.

- Multiple factors spurred the European FI rally amid a generally risk-off session, with equities falling sharply alongside losses in the cryptocurrency space.

- There was also some anticipation over Thursday's US CPI reading, with MNI's preview suggesting most are eyeing downside risks to the print.

- The risk-off tone had a brief respite in the afternoon on news of a Russian setback in Ukraine, but subsequent reports saw pessimism return. Bunds and Gilts rallied throughout.

- Periphery EGBs were mixed: GGBs underperformed.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 11.3bps at 2.211%, 5-Yr is down 10.6bps at 2.093%, 10-Yr is down 10.9bps at 2.172%, and 30-Yr is down 9.5bps at 2.09%.

- UK: The 2-Yr yield is down 2.4bps at 3.23%, 5-Yr is down 5.2bps at 3.452%, 10-Yr is down 9.5bps at 3.457%, and 30-Yr is down 17.2bps at 3.566%.

- Italian BTP spread up 0.3bps at 211.5bps / Greek up 5.5bps at 246.3bps

FOREX: Slump In Sentiment Bolsters Greenback Recovery

- Downward pressure for both equity and crypto markets weighed on sentiment Wednesday, prompting a flight to quality in currency markets and the US dollar to recover a portion of its declines on the week.

- The USD Index (+0.85%) looks set to halt a three-day slump as market participants await the latest set of US CPI data that could have significant short-term implications for December Fed-pricing and the immediate direction for the greenback.

- Equities continue to pare the week’s gains, largely shrugging off the earlier comments from Russian minister Shoigu, regarding a potential retreat the city of Kherson, that prompted a brief spike in risk. Global markets seemed to be more focused on the Ukrainian rebuttal with the deepening crypto rout an additional USD tailwind. Additional pressure on treasuries following the US 10yr auction is underpinning the dollar’s grind higher approaching the APAC crossover.

- With risk sentiment dented, the likes of AUD (-1.35%) and NZD(-1.31%) have shown significant weakness for the session, however, GBP is the clear underperformer, having fallen ~1.8%, back below 1.1350 and eyeing the week’s lows around the 1.1300 handle. EURGBP also extended gains above 0.8791 resistance, trading to a 4-week high of 0.8828. Next resistance comes in at 0.8867, high Oct 12.

- A very light data docket on Thursday ahead of the US CPI main event. Fed’s Waller, Mester and George are on the speaker slate as well as BoC’s Macklem.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/11/2022 | 0001/0001 | * |  | UK | RICS House Prices |

| 09/11/2022 | 0100/2000 |  | US | Minneapolis Fed's Neel Kashkari | |

| 10/11/2022 | 0101/0101 | ** |  | UK | IHS Markit/REC Jobs Report |

| 10/11/2022 | 0130/0130 |  | UK | BOE Ramsden Panels PIIE & LKY Conference | |

| 10/11/2022 | 0700/0200 |  | US | Fed Governor Christopher Waller | |

| 10/11/2022 | 0700/0800 | * |  | NO | CPI Norway |

| 10/11/2022 | 0900/1000 | * |  | IT | Industrial Production |

| 10/11/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 10/11/2022 | - |  | UK | House of Commons Recess Starts | |

| 10/11/2022 | 1300/1400 |  | EU | ECB Schnabel Discussion at at Bank of Slovenia | |

| 10/11/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 10/11/2022 | 1330/0830 | *** |  | US | CPI |

| 10/11/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 10/11/2022 | 1400/0900 |  | US | Philadelphia Fed's Patrick Harker | |

| 10/11/2022 | 1435/0935 |  | US | Dallas Fed's Lorie Logan | |

| 10/11/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 10/11/2022 | 1600/1100 |  | US | San Francisco Fed's Mary Daly | |

| 10/11/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 10/11/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 10/11/2022 | 1650/1150 |  | CA | BOC Gov Macklem speech, "The evolution of Canadian labour markets" | |

| 10/11/2022 | 1730/1230 |  | US | Fed Governor Loretta Mester | |

| 10/11/2022 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 10/11/2022 | 1830/1330 |  | US | Kansas City Fed's Esther George | |

| 10/11/2022 | 1900/1400 | ** |  | US | Treasury Budget |

| 10/11/2022 | 1900/1400 | *** |  | MX | Mexico Interest Rate |

| 10/11/2022 | 2335/1835 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.