-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weekly Claims Weigh on Treasurys

- MNI INTERVIEW: ECB Pause Likely In Sept-ExBank Of Cyprus Chief

- MNI Lack Of Supply Continues To Provide House Price Support

- MNI: Initial Jobless Claims Better Than Expected In Payrolls Reference Week

US TSYS: Rates Off Late Session Lows as Stocks Head South

- Treasury futures are weaker across the board after the bell, drifting off second half lows after the first block buy at 1324:02ET: +5,000 FVU3 107-06.25, buy through 107-06 post-time offer. As was the case in EGBs, session moves were largely flow driven, not headline related on the day.

- Futures opened and continued to extend lows after weekly claims came out lower than expected at 228k vs. 240k est., Philly Fed -13.5 vs. -10 est. Sporadic knee-jerk selling saw front month 10Y futures initially mark 112-09.5 low (-22.5) before bouncing to 112-14 amid moderate two-way trade.

- Trading desks reported heavy round of selling in 10s into midday: over 15,000 TYU3 extended session low to 112-00 (-1-00). Unexpected consequence, 2s10s curve bounced off the session inverted low of -105.083 (compares to appr 40-year lows tapped in early March and July of -110.89) to -98.802, up +3.185 on the day.

- Despite the late drift off lows, rate hike projections gain slightly: July running at 96% w/ implied rate of +24bp to 5.318%. September cumulative of +28.2bp at 5.360%, November cumulative of 34.2bp at 5.42%, and December cumulative of 28.8bp at 5.366%. Fed terminal holding at 5.42% in Nov'23.

- Dearth of economic data over the next two sessions, awaiting the latest FOMC policy announcement next Wednesday. July 26.

EUROPE

ECB: The European Central bank is likely to pause interest rate hikes in September, a former Governing Council member told MNI, with inflation trending downwards and risks to the growth outlook becoming increasingly pronounced.

- “We don't know what will happen between now and September, but if we assume there are no unpleasant inflation surprises between now and then, I think they would pause,” said Panicos Demetriades, governor of the Central Bank of Cyprus from 2012-14 and now Emeritus Professor of Financial Economics at the University of Leicester School of Business. (See MNI SOURCES: Data Deluge Clouds Early ECB September Rate Call)

- “The fact that the Fed paused would certainly have a bearing on it. Having peaked in October 2022, inflation is heading downwards. The ECB doesn’t follow the Fed, but what the Fed does certainly creates a comfort zone for central bankers," he said in an interview. For more see MNI Policy main wire at 0613ET.

OVERNIGHT DATA

- US JOBLESS CLAIMS -9K TO 228K IN JUL 15 WK

- US PREV JOBLESS CLAIMS REVISED TO 237K IN JUL 08 WK

- US CONTINUING CLAIMS +0.033M to 1.754M IN JUL 08 WK

- Initial jobless claims were lower than expected in the week to Jul 15, covering a payrolls reference week, at a seasonally adjusted 228k (cons 240k) after an unrevised 237k.

- It sees the 4-week average fall further from 247k to 238k, notably down from a recent high of 257k in the four weeks to Jun 23 for its lowest since Jun 2.

- The NSA data don’t suggest any particularly beneficial or penal seasonal adjustment this week when eyeballing the seasonality chart although California, the largest state, is starting to drift higher above its seasonal norm and Ohio remains notably higher than pre-pandemic norms but nothing more untoward than last week.

- Continuing claims take some of the gloss off though, surprisingly rising to 1754k (cons 1722k) after a downward revised 1721k (initial 1729k). It still remains depressed though, close to the 2019 average of 1699k. The NSA data saw an outsized increase from 1725k to 1893k, supporting the seasonally adjusted climb.

- US JUL PHILADELPHIA FED MFG INDEX -13.5

- US JUNE EXISTING HOME SALES FALL 3.3% TO 4.16 MILLION RATE

- US JUNE LEADING INDICATOR FALLS 0.7% M/M; EST. -0.6%

- Average existing home sale prices fell -0.9% Y/Y in June, in an improvement from the -3.0% Y/Y of May that for now at least looks to be a low for the rate of decline with very little payback after prices surged post-pandemic.

- It’s helped by the continued low level of housing inventory, which remained unchanged at 1.08m units and saw the months of supply only tick up a tenth to 3.1.

- NAR’s Yun noted "There are simply not enough homes for sale […] The market can easily absorb a doubling of inventory" and indeed the chart below shows that whilst months of supply are slowing creeping higher, they remain at least 1 month below levels for this time of year in the pre-pandemic era and considerably below the low double digits of late 2007-early 2009.

MARKETS SNAPSHOT

Key late session market levels:- DJIA up 203.99 points (0.58%) at 35261.68

- S&P E-Mini Future down 29 points (-0.63%) at 4567.5

- Nasdaq down 278.5 points (-1.9%) at 14076.51

- US 10-Yr yield is up 10.4 bps at 3.8523%

- US Sep 10-Yr futures are down 27.5/32 at 112-4.5

- EURUSD down 0.0074 (-0.66%) at 1.1127

- USDJPY up 0.55 (0.39%) at 140.21

- WTI Crude Oil (front-month) up $0.28 (0.37%) at $75.63

- Gold is down $7.29 (-0.37%) at $1969.67

- EuroStoxx 50 up 11.45 points (0.26%) at 4373.73

- FTSE 100 up 57.85 points (0.76%) at 7646.05

- German DAX up 95.29 points (0.59%) at 16204.22

- French CAC 40 up 57.97 points (0.79%) at 7384.91

US TREASURY FUTURES CLOSE

- 3M10Y +9.961, -156.923 (L: -171.125 / H: -154.365)

- 2Y10Y +3.136, -98.851 (L: -105.083 / H: -97.57)

- 2Y30Y -0.489, -93.333 (L: -99.391 / H: -91.735)

- 5Y30Y -4.493, -19.25 (L: -21.771 / H: -14.049)

- Current futures levels:

- Sep 2-Yr futures down 5.25/32 at 101-23.125 (L: 101-20.5 / H: 101-28.125)

- Sep 5-Yr futures down 18/32 at 107-7.5 (L: 107-03.5 / H: 107-24.5)

- Sep 10-Yr futures down 27.5/32 at 112-4.5 (L: 112-00 / H: 112-31)

- Sep 30-Yr futures down 48/32 at 126-6 (L: 125-29 / H: 127-20)

- Sep Ultra futures down 56/32 at 134-22 (L: 134-08 / H: 136-14)

US10Y FUTURE TECHS: (U3) Softer Start to Thursday Trade

- RES 4: 114-06+ High Jun 6

- RES 3: 114-00 High Jun 13

- RES 2: 113-09+ 50-day EMA and a key resistance point

- RES 1: 113-08 High Jul 18

- PRICE: 112-20 @ 11:24 BST Jul 20

- SUP 1: 112-07+ Low Jul 13

- SUP 2: 111-03+/110-05 Low Jul 11 / 6 and the bear trigger

- SUP 3: 110-00 Low Nov 9 2022 (cont)

- SUP 4: 109-14 Low Nov 8 2022 (cont)

Support provided for Treasuries from the soft UK inflation release proved short-lived, with prices fading through to the Thursday NY open. Nonetheless, prices remain within reach of recent highs of 113-08 - the best level since June 29. The contract has cleared the 20-day EMA and attention turns to a key resistance area at the 50-day EMA, at 113-09+. A clear break of this average would strengthen a bullish theme. Key support and the bear trigger has been defined at 110-05, the Jul 6 low.

SOFR FUTURES CLOSE

- Sep 23 -0.015 at 94.590

- Dec 23 -0.045 at 94.635

- Mar 24 -0.070 at 94.925

- Jun 24 -0.095 at 95.295

- Red Pack (Sep 24-Jun 25) -0.15 to -0.115

- Green Pack (Sep 25-Jun 26) -0.17 to -0.16

- Blue Pack (Sep 26-Jun 27) -0.17 to -0.15

- Gold Pack (Sep 27-Jun 28) -0.15 to -0.135

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.02777 to 5.29134 (+.06140/wk)

- 3M +0.01205 to 5.34557 (+.03568/wk)

- 6M +0.01346 to 5.41260 (+.03706/wk)

- 12M +0.02340 to 5.30920 (+.05519/wk)

- Daily Effective Fed Funds Rate: 5.08% volume: $106B

- Daily Overnight Bank Funding Rate: 5.07% volume: $262B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.456T

- Broad General Collateral Rate (BGCR): 5.03%, $589B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $581B

- (rate, volume levels reflect prior session)

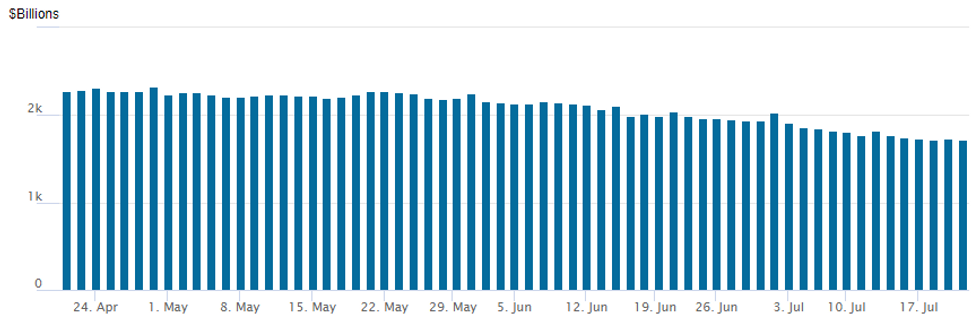

FED Revers Repo Operation: New Lows

NY Federal Reserve/MNI

The latest operation recedes to $1,721.001B (lowest since early April May'22), w/ 100 counterparties, compared to $1,732.804B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE $1B Province of Manitoba 10Y SOFR Priced

- Date $MM Issuer (Priced *, Launch #)

- 07/20 $1B *Province of Manitoba 10Y SOFR+74

- 07/20 $Benchmark Hanwa Q Cells AM 5Y +140a

EGBs-GILTS CASH CLOSE: Yields Continue To Claw Back UK CPI Drop

European yields continued to rebound from Wednesday morning's UK CPI-inspired drop, with curve short-end/bellies underperforming Thursday.

- While there were no obvious catalysts to the selloff, a combination of solid Australian and US labour market data rekindled a hawkish central bank narrative, and UK and Bund yields were dragged higher through to the cash close.

- Gilts underperformed, with the UK curve bear flattening as BoE hike expectations bounced (terminal pricing +7bp), tipping 2Y yields just shy of the 5% handle. MNI's review of Wednesday's UK CPI data is here.

- German yields rose 5-6bp across the curve, with 10Y yields ending higher than Monday's close.

- All in all, German 10Y yields are 17bp up from Wednesday's low, UK just 13bp.

- Periphery spreads tightened, led by Italy - 10Y BTP again tested the 160bp mark to Bunds.

- Attention first thing Friday morning will be on UK retail sales data.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 4.9bps at 3.123%, 5-Yr is up 5.6bps at 2.571%, 10-Yr is up 5.2bps at 2.49%, and 30-Yr is up 3.5bps at 2.504%.

- UK: The 2-Yr yield is up 8.4bps at 4.994%, 5-Yr is up 7.5bps at 4.385%, 10-Yr is up 6.2bps at 4.277%, and 30-Yr is up 3.5bps at 4.412%.

- Italian BTP spread down 2.4bps at 161.8bps / Spanish down 1.1bps at 99.7bps

FOREX: Greenback Extends Recovery Amid Higher US Yields, CHF Underperforms

- After a modest uptick on Wednesday, the USD index has extended its recovery during today’s session amid a substantial move higher for US yields. Lower than expected jobless claims appeared to rekindle a hawkish central bank narrative, enhanced by the earlier strong jobs data in Australia bolstering the theme across global markets.

- USDCHF is the best performing currency pair on Thursday, having advanced 0.93% as we approach the APAC crossover. Yield differentials the biggest factor underpinning the recovery with USDJPY also retaking the 140.00 handle in the process.

- EURUSD and GBPUSD were seen grinding lower over the course of US trade, mirroring the adjustment of the broad USD index. For GBPUSD, the price action marks an extension of the prior day’s move following the softer-than-expected UK inflation prints. Markets are on watch for a potential reversal pattern - which gathered strength on the show below 1.2866 - the 50% retracement of the late June upleg. This opens potential for losses toward 1.2801 initially, before 1.2751, the July 10 low.

- Despite pulling back, the Australian dollar remains an outperformer in G10 following the solid June jobs report. Australia added 32.6k jobs across the month, doubling market expectations.

- Offsetting the firmer greenback narrative somewhat was USD/CNH, which sits 0.80% lower on the session. The redback benefitted from a much stronger-than-expected lean in the USD/CNY mid-point fixing. The PBoC also tweaked limits to allow companies to borrow more overseas, opening the door to the potential for an uptick in capital inflows, providing further support to the yuan.

- Japan National Core CPI y/y is the data highlight overnight before next week’s Bank of Japan meeting/decision. On Friday we will also see retail sales data for both the UK and Canada.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/07/2023 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 21/07/2023 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 21/07/2023 | 0600/0700 | *** |  | UK | Retail Sales |

| 21/07/2023 | 0645/0845 | * |  | FR | Retail Sales |

| 21/07/2023 | 1230/0830 | ** |  | CA | Retail Trade |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.