-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Yields Climb on Heavy Corporate Debt Issuance

- MNI Gov Waller: Don't Have To Hike Imminently

- MNI BRIEF Fed's Mester: Rates Might Have To Go A Bit Higher

- MNI Factory Orders Fare Better Than Expected In July

US TSYS Yields Higher on Heavy Corporate Issuance, Mixed Fed Speaker Tones

- Treasury futures are a little off late session lows at the moment, likely tied to rate lock/hedge unwinds tied to nearly $37B high grade corporate issuance on the day. Partly seasonal, a return from summer market malaise, coupled with expectation the Federal Reserve is at or at least near the end of it's tightening cycle has reignited expectation of heavy supply.

- Early dovish headlines from Fed Gov Waller, that last week's data "allows the Fed to proceed carefully .. no need to do anything imminently", saw Dec'23 10Y futures jump to 110-17 session high (yield 4.0284% low).

- Support evaporated after Cleveland Fed Mester said the Fed might need to lift interest rates "a bit higher" on the back of stronger-than-expected economic data and upside inflation risks in an interview with German newspaper Boersen-Zeitung Tuesday.

- "The latest indicators suggest that demand is somewhat stronger than expected, that the momentum in the economy is greater than thought," she said. "I can well imagine, from what I see so far, that we might have to go a bit higher, that we might have to raise the policy rate a bit more."

- After a brief delay, FI futures are extended session lows after July Factory orders comes out better (less negative) than expected at -2.1% vs. -2.5% est (+2.3% prior), ex-trans +0.8% vs. +0.1% est (0.3% prior/revised).

- Dec'23 10Y futures held above initial support at 109-28+ (Low Aug 29). Next support at 109-18+/09+ Low Aug 25 / 22 and the bear trigger.

US

FED: Some highlights from the Gov Waller CNBC interview which certainly didn't drive home the need for a September hike, or indeed another hike in this cycle more broadly.

- Given that he's toward the end of the hawkish spectrum on the FOMC, one has to doubt there will be many participants arguing strongly for a hike later this month.

- On further hiking: Latest data allows us to proceed carefully. nothing indicates that we have to do anything imminently. We can sit and watch the data.

- On whether they can achieve a soft landing: "The way the data's coming in right now is looking pretty good."

- Need to hike more? That depends on the data. We've been burned twice before (in 2021 and 2022). On the balance of risks: I'd say the risks are more balanced toward doing too much/too little. Wouldn't say one more hike would throw the economy into a recession. But not obvious we're in serious danger of doing damage to the jobs market if we raise rates one more time.

- On policy lags: A tricky problem - not exact timeline as to when hikes will hit. Don't have to wait 2 years to see it impact the economy. We're already seeing the impact now as far as I'm concerned.

FED: The Federal Reserve might need to lift interest rates "a bit higher" on the back of stronger-than-expected economic data and upside inflation risks, Cleveland Fed President Loretta Mester said in an interview with German newspaper Boersen-Zeitung published Tuesday.

- "The latest indicators suggest that demand is somewhat stronger than expected, that the momentum in the economy is greater than thought," she said. "I can well imagine, from what I see so far, that we might have to go a bit higher, that we might have to raise the policy rate a bit more." (See: MNI INTERVIEW: US Manufacturing Set To Sustain Rebound - ISM)

- Mester doesn't expect the FOMC to cut interest rates early next year. "We need to keep a sufficiently restrictive stance for quite some time to feel assured that inflation will come back down to 2%," she said. "There are upside risks to our inflation forecasts, in my view. So yes, inflation could go up again. So we have to make sure that our policy is sufficiently restrictive."

OVERNIGHT DATA

- US JUL FACTORY ORDERS -2.1%; EX-TRANSPORT NEW ORDERS +0.8%

- US JUL DURABLE ORDERS -5.2%

- US JUL NONDEFENSE CAP GOODS ORDERS EX AIRCRAFT +0.1%

US: Factory orders came in stronger than expected in July although still fell a heavy -2.1% M/M (cons -2.5) after +2.3% M/M in June.

- Transport weighed heavily, with factor orders +0.8% M/M (cons 0.1) after a slightly upward revised 0.3% (initial 0.2).

- The 3M/3M run rate for overall factory orders remains strong at 6.6% annualized, although that is boosted by a heavy -1.7% M/M from back in February.

- Indeed, less volatile measures such as core durable goods orders saw minimal revisions in the final July estimate, running at 1.7% annualized on a 3M/3M basis – tepid but holding up well relative to the ISM manufacturing survey still firmly in contraction territory despite a strong increase to 47.6 in August.

MARKETS SNAPSHOT

Key late session market levels:- DJIA down 135.36 points (-0.39%) at 34700.86

- S&P E-Mini Future down 11.75 points (-0.26%) at 4509.5

- Nasdaq up 5.9 points (0%) at 14037.22

- US 10-Yr yield is up 8.3 bps at 4.2617%

- US Dec 10-Yr futures are down 19/32 at 109-31.5

- EURUSD down 0.0075 (-0.69%) at 1.0721

- USDJPY up 1.28 (0.87%) at 147.75

- WTI Crude Oil (front-month) up $1.06 (1.24%) at $86.60

- Gold is down $16.32 (-0.84%) at $1926.37

- EuroStoxx 50 down 10.71 points (-0.25%) at 4269.16

- FTSE 100 down 14.83 points (-0.2%) at 7437.93

- German DAX down 53.14 points (-0.34%) at 15771.71

- French CAC 40 down 24.79 points (-0.34%) at 7254.72

US TREASURY FUTURES CLOSE

- 3M10Y +8.114, -117.738 (L: -127.069 / H: -116.945)

- 2Y10Y +0.379, -70.009 (L: -70.856 / H: -67.181)

- 2Y30Y +0.25, -58.66 (L: -59.996 / H: -54.837)

- 5Y30Y -0.094, -0.49 (L: -2.35 / H: 1.556)

- Current futures levels:

- Dec 2-Yr futures down 6.5/32 at 101-21.625 (L: 101-20.875 / H: 101-27.5)

- Dec 5-Yr futures down 12.25/32 at 106-11 (L: 106-09.75 / H: 106-22.75)

- Dec 10-Yr futures down 19/32 at 109-31.5 (L: 109-29.5 / H: 110-17)

- Dec 30-Yr futures down 1-9/32 at 119-2 (L: 118-31 / H: 120-08)

- Dec Ultra futures down 1-30/32 at 125-27 (L: 125-24 / H: 127-19)

US 10Y FUTURE TECHS: (Z3) Trend Outlook Remains Bearish

- RES 4: 112-24+ High Jul 27

- RES 3: 112-14 High Aug 10 and a key short-term resistance

- RES 2: 112-00 Round number resistance

- RES 1: 111-12+ High Sep 1

- PRICE: 110-08 @ 11:25 BST Sep 5

- SUP 1: 109-28+ Low Aug 29

- SUP 2: 109-18+/09+ Low Aug 25 / 22 and the bear trigger

- SUP 3: 108-20 1.000 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 4: 107.23 1.236 proj of the Jul 18 - Aug 4 - Aug 10 price swing

Treasury prices have pulled back from Friday’s high of 111-12+. The move lower highlights a potential short-term reversal and 111-12+ represents a key short-term resistance. The medium-term trend direction is down and moving average studies reinforce this theme. An extension lower would signal scope for 109-09+, the Aug 22 low and the bear trigger. Clearance of this level would strengthen a bearish theme.

SOFR FUTURES CLOSE

- Sep 23 -0.013 at 94.583

- Dec 23 -0.040 at 94.565

- Mar 24 -0.085 at 94.710

- Jun 24 -0.125 at 94.980

- Red Pack (Sep 24-Jun 25) -0.135 to -0.11

- Green Pack (Sep 25-Jun 26) -0.10 to -0.07

- Blue Pack (Sep 26-Jun 27) -0.07 to -0.065

- Gold Pack (Sep 27-Jun 28) -0.07 to -0.07

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00125 to 5.32762 (+.00004 total last wk)

- 3M -0.01122 to 5.39108 (+0.02072 total last wk)

- 6M -0.02112 to 5.43212 (+0.01407 total last wk)

- 12M -0.04295 to 5.32571 (+0.04300 total last wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $104B

- Daily Overnight Bank Funding Rate: 5.32% volume: $266B

- Secured Overnight Financing Rate (SOFR): 5.31%, $1.458T

- Broad General Collateral Rate (BGCR): 5.30%, $559B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $554B

- (rate, volume levels reflect prior session)

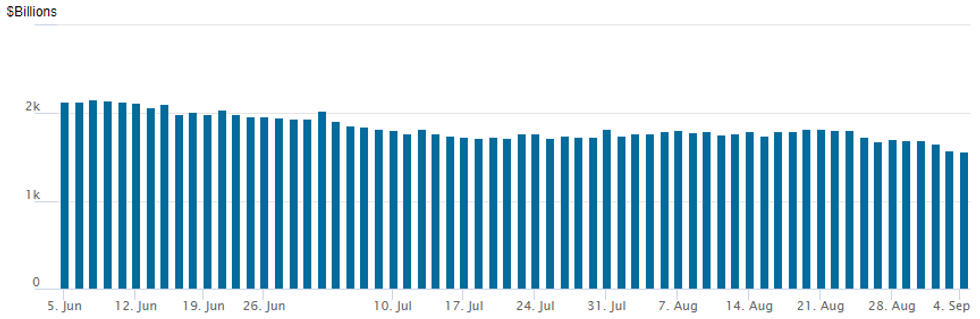

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation falls to $1,568.490B (lowest since early March 2022) w/94 counterparties, compared to $1,574.065B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $4.75B BHP Billiton Launched

Top four issuers led by BHP Billiton with $4.75B 5pt debt, appr two dozen names pushed total corporate bond issuance to $36.95B.

- Date $MM Issuer (Priced *, Launch #)

- 09/05 $4.75B #BHP Billiton $850M 3Y +65, $700M 5Y +85, $900M 7Y +100, $1.5B 10Y +110, $800M 30Y +125

- 09/05 $3.4B #Volkswagen $800M 2Y +85, $50M 2Y SOFR+93, $900M 3Y +105, $700M 5Y +130, $500M 10Y +165

- 09/05 $3.25B #CBA (Comm. Bank of Australia) $900M 2Y +55, $600M 2Y SOFR+63, $1.75B 5Y SOFR+92

- 09/05 $3B #ING 4NC3 +142, 4NC3 SOFR+156, 11NC10 +185

- Click here for full corporate issuance summary

EGBs-GILTS CASH CLOSE: BTPs And Gilts Underperform

Gilts underperformed Bunds Tuesday, with European yields following Treasuries in reversing an early drop over the course of the day.

- Morning data was mixed: Spanish and Italian services PMI disappointed with contractionary readings, though the UK's was revised higher, and the ECB's consumer survey showed a tick higher in inflation expectations.

- ECB's Lane noted optimism on core inflation continuing to come down in the autumn, though Wunsch suggested that "we maybe need to do a little bit more" on rates.

- After drifting weaker most of the session, Gilts and Bunds ticked higher in early afternoon largely on more-dovish-than-expected comments by Fed Gov Waller - only for yields to later hit session highs on above-consensus US factory orders data and Fed's Mester eyeing potential for more hikes.

- The UK curve bear flattened, with Germany's bear steepening ahead of 10Y supply Wednesday.

- BTP spreads hit their widest since mid-July; Greece outperformed in a reversal of Monday's widening.

- German factory orders feature first thing Wednesday, with BoE's Bailey speaking later.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.2bps at 3.045%, 5-Yr is up 2.6bps at 2.596%, 10-Yr is up 3.3bps at 2.612%, and 30-Yr is up 5.5bps at 2.757%.

- UK: The 2-Yr yield is up 6.5bps at 5.271%, 5-Yr is up 6.4bps at 4.803%, 10-Yr is up 6.2bps at 4.525%, and 30-Yr is up 3.8bps at 4.793%.

- Italian BTP spread up 1.7bps at 172.8bps / Greek down 3.4bps at 131.6bps

FOREX Greenback Rally Extends, AUDUSD Prints Fresh 2023 Low

- The USD index has risen half a percent on Tuesday, with the greenback favoured as US participants return from their Labor Day bank holiday amid a climb higher in US yields, notably the 10-year yield stands back above 4.25%.

- The resulting USD strength is pressing major pairs lower, with the more risk sensitive currencies across the majors feeling the brunt of the moves.

- As such, the Australian dollar sits at the bottom of the G10 leaderboard, with AUD weaker against all others following the RBA rate decision overnight. The bank kept policy unchanged, with markets reading into the bank's view that the peak in inflation has now passed. Persistent weakness in Chinese markets also undermined the currency, briefly placing AUDUSD (-1.22%) below key support and the bear trigger of 0.6365, the lowest level for the pair this year. Similar weakness was seen in NZD, dropping 1.00%.

- Another notable move was in USDJPY, with the higher yields continuing to amplify the yield differentials between the US and Japan, weighing on the Yen all session. USDJPY has now risen 0.88% to 147.75 shortly before the APAC crossover. This keeps the trend outlook bullish, with spot rallying through resistance at 147.37, the Aug 29 high and the bull trigger. A clear break here confirms a resumption of the uptrend and opens 148.40, the Nov 4 2022 high.

- The greenback’s strength was even more noticeable in emerging markets, highlighting the cautious sentiment prevailing through global markets. The Hungarian Forint fell as much as 2% against the dollar, with both the Polish Zloty and the Mexican peso also sliding as much as 1.25%.

- Wednesday’s docket includes Aussie GDP, German Factory order and Eurozone retail sales. The focus will then turn to the Bank of Canada rate decision and US ISM Services PMI for August.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/09/2023 | 0130/1130 | *** |  | AU | Quarterly GDP |

| 06/09/2023 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 06/09/2023 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/09/2023 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/09/2023 | 0900/1100 | ** |  | EU | Retail Sales |

| 06/09/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 06/09/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 06/09/2023 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 06/09/2023 | 1230/0830 | ** |  | US | Trade Balance |

| 06/09/2023 | 1230/0830 |  | US | Boston Fed's Susan Collins | |

| 06/09/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 06/09/2023 | 1315/1415 |  | UK | BoE Reports Hearing (Financial Stability & MP) | |

| 06/09/2023 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 06/09/2023 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 06/09/2023 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 06/09/2023 | 1800/1400 |  | US | Fed Beige Book | |

| 06/09/2023 | 1900/1500 |  | US | Dallas Fed's Lorie Logan |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.