-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Yields Recede, GDP Beats Ests

- MNI BRIEF: Ex-Fed's Clarida - 2% Inflation Needs Softer Growth

- MNI ECB WATCH: ECB Holds Rates As Inflation, Growth Slow

- MNI BRIEF: No Balance Sheet, Rate Cut Talk In Athens -Lagarde

- MNI Continuing Claims Jump With Less Favorable Seasonal Adjustment

- MNI US DATA: Real GDP Beats But Helped By Inventories

US

FED: Former Fed Vice Chair Richard Clarida said Thursday both price and wage inflation measures indicate that further macro adjustment is required for the Federal Reserve to hit its 2% inflation goal, as the central bank takes on a mantra of higher for as long as it takes.

- "I am in the camp that thinks for the Fed to confidently get inflation on a trajectory and ultimately back to 2% is going to require a downshift in demand growth below potential output growth," he said in a virtual National Economists Club event. The Commerce Department reported earlier in the day the U.S. economy grew 4.9% in the third quarter, the fastest pace in nearly two years, and well above estimates of trend growth at around 2%. "I do think a downshift in demand growth is going to be required and certainly from this level a pretty significant downshift in demand growth."

- "Whether or not that requires an NBER recession or not remains to be seen. But I do think obviously continued growth at this pace would be inconsistent with achieving that objective," he said, also citing some recent good news on the supply side. "If the Fed wants to keep inflation expectations anchored at 2, then at some point inflation has to fall to two." (See: MNI INTERVIEW: Fed Likely Done With Hikes Despite Hawkish Tone)

EUROPE

ECB: The European Central Bank kept its key interest rate on hold at 4% on Thursday after 10 consecutive rate rises, citing a marked drop in inflation in September, a weakening economy and tougher financial conditions, but adding that fresh tightening remained possible.

- September’s drop in price pressures was broad-based, president Christine Lagarde said, with most measures of underlying inflation continuing to ease and risks to growth tilted to the downside. PMI numbers are "indicative of weakened growth" and "growth continues to be weak,” she said, though she declined to comment on whether September’s staff macroeconomic growth had already proved optimistic, ahead of December’s projections. (See MNI INTERVIEW: ECB Growth Assumptions Over-Optimistic).

- Past rate increases continue to be transmitted forcefully into financing conditions, Lagarde said, with policy lags meaning demand is expected to fall further. Spikes in bond yields have also made financing conditions tighter, she added.

ECB: The European Central Bank's Governing Council did not discuss its balance sheet at its Athens meeting, or when or whether to cut interest rates, President Christine Lagarde said Thursday. Lagarde also noted that after 10 consecutive interest rate hikes, now was not the time to think about forward guidance. Policy decisions remain data-driven, she said.

- She again expressed concern over the spill-over impact of events in the Middle East, and the risk that oil and gas prices could rise further. "We are monitoring the situation and we are attentive to consequences on energy prices and the level of confidence," Lagarde said. (MNI POLICY: ECB Saves Look At Balance Sheet Cuts For Late '23)

US TSYS FI Consolidation, Tsys Near Midrange for the Week

- US Treasury futures continued to extend gains in late trade, near session highs to midrange for the week. Shorts consolidated following this morning's higher than expected Q3 GDP (4.9% vs. 4.5% est, 2.1% prior) - largely driven by inventories and softer than expected core PCE prices (2.4% vs. 2.5% est) and jobless claims (210k vs 207k est, 198k prior) at their highest in five months, suggesting that labor market tightness may start to wane.

- Additional FI support after the $38B 7Y note auction (91282CJG7) stops through: 4.908% high yield vs. 4.910% WI; 2.70x bid-to-cover vs. 2.47x last month.

- Current Dec'23 10Y futures are at 106-10 +20.5) vs. 106-13 high, still well below initial technical resistance of 106-31 (20-day EMA), 10Y yield at 4.8487% (-.1062) vs. 4.9873% high overnight. Curves reverse course - mostly flatter: 3M10Y at -61.524 (-8.971), 2Y 10Y -3.332 at -20.112.

- FI short end support translates to softer projected rate hikes into early 2024: November holding at 1.6%, w/ implied rate change of +.4bp to 5.333%, December cumulative of 5.5bp at 5.383%, January 2024 cumulative 7.9bp at 5.408%, while March 2024 slips to 3.5bp at 5.364%. Fed terminal at 5.438% in Jan'24. Fed terminal at 5.410% in Feb'24.

- Look Ahead: corporate earnings after the close that includes: L3Harris, Ford, Juniper Networks, Olin, Capital One, Intel, US Steel and Amazon. Friday data calendar includes Personal Income/Spending, UofM Inflation Exp

OVERNIGHT DATA

US DATA: Real GDP came in stronger than expected in the Q3 advance release at 4.88% annualized, somewhere between consensus at 4.5 and the Atlanta Fed GDPNow at 5.4, after the 2.06% annualized in Q2.

- Personal consumption as expected though at 4.0% after 0.8% in Q2.

- Broader contributions suggest the beat is driven by inventories: Final domestic sales +3.6pp after +2.0pp, change in inventories 1.3 after 0.00pp and net exports -0.08pp after +0.04pp. See charts.

- Being the advance release, it doesn’t have an estimate for GDI.

US DATA: Initial jobless claims were close to expected in the week to Oct 21 at a seasonally adjusted 210k (cons 207k) after a marginally upward revised 200k after an initial 198k had marked the first sub-200k week since January.

- The four-week average ticks up just 2k to 208k, itself holding between 205-210k for a month now at levels last seen in early February.

- Continuing claims provided the main dovish point though, surprisingly jumping to a seasonally adjusted 1790k in the week to Oct 14 (cons 1740k) after a decent increase to 1727k (initial 1734k) the week prior.

- It sees continuing claims further above the 2019 average of 1699k and back at May levels.

At first glance, it’s possible that we’re no longer seeing what appeared a particularly favorable seasonal adjustment in recent weeks/months. The 37k increase in the NSA data is on the higher side compared to increases at this time of year in 'normal' pre-pandemic periods but doesn’t look to warrant the 63k increase in the SA data.

- US SEP DURABLE NEW ORDERS +4.7%; EX-TRANSPORTATION +0.5%

- US AUG DURABLE GDS NEW ORDERS REV TO -0.1%

- US SEP NONDEF CAP GDS ORDERS EX-AIR +0.6% V AUG +1.1%

US DATA: Pending home sales surprisingly increased 1.1% M/M in September (cons -2%) but it does little to improve from the -7% drop in August.

- Combined with yesterday’s far stronger than expected new home sales (+12.3% vs cons 0.7%), the relative gap between new and (the larger) existing home sales segment has widened further when compared to pre-pandemic levels, and is unlikely to change in the next one-to-two months judging by the pending data.

- Prices have played a large role here: the median sale price can be noisy but new home sale prices were down -12% Y/Y in September vs +2.8% Y/Y for existing homes.

US DATA: A Small Miss For Core PCE In Q3 Advance

- Core PCE meanwhile was softer than expected at 2.43% annualized (cons 2.5) in the Q3 advance, and that rounding should help limit some of the attention on the 0.1pt miss on the screens.

- It can be a large assumption, but no change in the monthly profile would mean this is equivalent to just under a 0.23% M/M print in September (revealed tomorrow, cons currently at 0.3 rounded). Again, with no revisions, it would follow three months averaging 0.178% M/M.

MARKETS SNAPSHOT

- Key late session market levels

- DJIA down 48.48 points (-0.15%) at 32987.18

- S&P E-Mini Future down 24.25 points (-0.58%) at 4185.5

- Nasdaq down 130.9 points (-1%) at 12689.9

- US 10-Yr yield is down 11.3 bps at 4.8424%

- US Dec 10-Yr futures are up 22/32 at 106-11.5

- EURUSD down 0.0005 (-0.05%) at 1.0562

- USDJPY up 0.15 (0.1%) at 150.38

- WTI Crude Oil (front-month) down $2.14 (-2.51%) at $83.23

- Gold is up $7.32 (0.37%) at $1986.96

- European bourses closing levels:

- EuroStoxx 50 down 23.95 points (-0.59%) at 4049.4

- FTSE 100 down 59.77 points (-0.81%) at 7354.57

- German DAX down 161.13 points (-1.08%) at 14731.05

- French CAC 40 down 26.11 points (-0.38%) at 6888.96

US TREASURY FUTURES CLOSE

- 3M10Y -9.606, -62.159 (L: -62.631 / H: -49.233)

- 2Y10Y -2.928, -19.708 (L: -20.127 / H: -13.769)

- 2Y30Y -1.453, -5.333 (L: -6.085 / H: 1.429)

- 5Y30Y +2.882, 19.106 (L: 16.033 / H: 22.572)

- Current futures levels:

- Dec 2-Yr futures up 4.625/32 at 101-9.125 (L: 101-02.75 / H: 101-10.25)

- Dec 5-Yr futures up 14.5/32 at 104-18.25 (L: 104-00.25 / H: 104-19.75)

- Dec 10-Yr futures up 22/32 at 106-11.5 (L: 105-15 / H: 106-13)

- Dec 30-Yr futures up 1-14/32 at 109-27 (L: 107-28 / H: 109-29)

- Dec Ultra futures up 1-29/32 at 113-4 (L: 110-17 / H: 113-07)

US 10Y FUTURE TECHS: (Z3) Recovers Off Lows, But Still Weak

- RES 4: 109-20 High Sep 19

- RES 3: 108-14/16 50-day EMA / High Oct 12 and key resistance

- RES 2: 107-22+ High Oct 16

- RES 1: 106-31 20-day EMA

- PRICE: 106-11 @ 1505 ET Oct 26

- SUP 1: 105-10+ Low Oct 19 and the bear trigger

- SUP 2: 104-26 2.00 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 3: 104-09+ 2.0% 10-dma envelope

- SUP 4: 103-20+ Low Jun’07

The trend condition in Treasuries remains bearish despite the rally through the London close. Recent gains are considered corrective. Last week’s move lower resulted in a break of 106-03+, the Oct 4 low, that confirmed a resumption of the downtrend. The move down has exposed 104-26, a Fibonacci projection. Key short-term trend resistance is at 108-16, the Oct 12 high. Initial firm resistance is at 106-31, the 20-day EMA.

SOFR FUTURES CLOSE

- Dec 23 +0.025 at 94.580

- Mar 24 +0.050 at 94.670

- Jun 24 +0.065 at 94.880

- Sep 24 +0.085 at 95.145

- Red Pack (Dec 24-Sep 25) +0.105 to +0.135

- Green Pack (Dec 25-Sep 26) +0.140 to +0.145

- Blue Pack (Dec 26-Sep 27) +0.130 to +0.140

- Gold Pack (Dec 27-Sep 28) +0.120 to +0.125

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00081 to 5.32686 (-0.00476/wk)

- 3M +0.00249 to 5.38998 (-0.00849/wk)

- 6M +0.00108 to 5.45691 (-0.01257/wk)

- 12M +0.00763 to 5.40349 (-0.03486/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $93B

- Daily Overnight Bank Funding Rate: 5.32% volume: $239B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.439T

- Broad General Collateral Rate (BGCR): 5.30%, $564B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $554B

- (rate, volume levels reflect prior session)

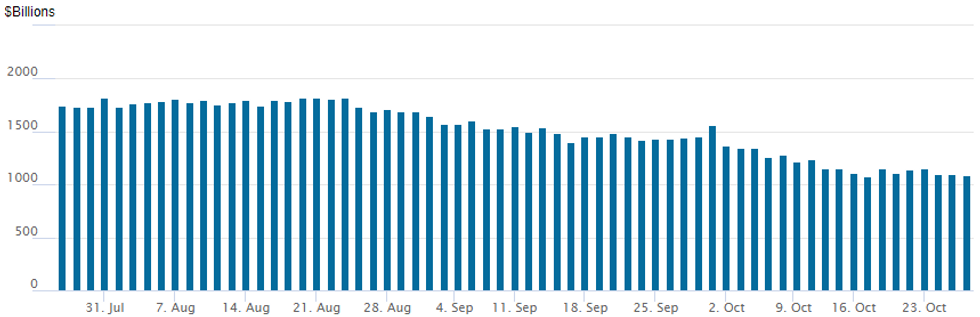

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The NY Fed Reverse Repo operation usage slips to $1,089.850B w/98 counterparties vs. $1,100.617B in the prior session -- just above last week Tuesday's $1,082.399B - the lowest level since mid-September 2021. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

M&T Bank 6NC5 Debt on Tap

- Date $MM Issuer (Priced *, Launch #)

- 10/26 $750M #M&T Bank 6NC5 +260

- $3.5B Priced Wednesday

- 10/25 $1.75B *Truist Financial 6NC5 +225

- 10/25 $1B *BGK (Bank Gospodarstwa Krajowego) 5Y +138

- 10/25 $750M *Mamoura 10.5Y +150a

EGBs-GILTS CASH CLOSE: Rally On Lack Of Hawkish ECB Surprises

Bunds outperformed Gilts Thursday, as the ECB meeting was in line with expectations.

- The decision to leave rates unchanged with communication virtually identical to the September meeting and no hawkish surprises (eg on balance sheet policy) saw a modest drop in EGB yields to session lows.

- Periphery spreads tightened after Pres Lagarde said early in the press conference that the Governing Council didn't discuss changes to PEPP policy at this meeting.

- However, Reuters reported just before the close that ECB policymakers agreed to debate PEPP policy early next year - pushing BTP/Bund spreads back up above 200bp.

- European instruments also benefited concurrently from US data that was seen as soft (including core Q3 inflation and weekly jobless claims).

- The German and UK curves finished steeper, with outperformance at the short end/belly.

- Friday's docket includes Italian and French sentiment data, the ECB's Survey of Professional Forecasters, and Spanish GDP., with attention likely to turn quickly to Eurozone flash October inflation data Mon and Tues.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 5bps at 3.075%, 5-Yr is down 4.4bps at 2.725%, 10-Yr is down 2.8bps at 2.861%, and 30-Yr is unchanged at 3.126%.

- UK: The 2-Yr yield is down 2.4bps at 4.82%, 5-Yr is down 2.7bps at 4.542%, 10-Yr is down 1.3bps at 4.597%, and 30-Yr is up 0.6bps at 5.068%.

- Italian BTP spread down 1.7bps at 200.9bps / Greek down 5.1bps at 134.1bps

FOREX USD Index Consolidates Strength Despite Yield Pullback

- Firmer US growth data and struggling equity indices have underpinned further greenback strength on Thursday. With currency volatility low throughout the US session, the USD index stands just 0.10% in the green ahead of the APAC crossover. The consolidation of USD strength is notable given the pullback for US yields that have shifted between 8-12bps lower across the curve.

- The morning session was highlighted by some significant moves for the Japanese yen, especially after the period of stagnant price action in recent weeks. With the post-5y auction weakness in Treasury futures persisting into Thursday morning and the resulting widening of the US/JN yield differential, USDJPY pushed to a new recovery high of 150.78. Shortly following the print, a sharp spike in volumes saw the rate correct lower, prompting a ~75 pip slide to new lows before stabilising. Price action raised focus on the October 31st BoJ reserves release, at which markets will gain official confirmation of any market intervention.

- Very little reaction for the single currency following the ECB hold, with EURUSD grinding to session lows around 1.0530 amid the additional stronger US GDP data.

- Price has risen 30 pips from those lows but overall, this week’s sell off reinforces a bearish theme for the pair. Note too that Tuesday’s price pattern is a bearish engulfing candle - a reversal signal. A continuation lower would signal scope for 1.0496, the Oct 13 low. The key support and bear trigger lies at 1.0448, Oct 3 low.

- The minor weakness in the Euro has been offset by a firmer AUD and NZD, both rising around 0.35% and eating into yesterday’s steep move lower.

- On Friday, US Core PCE deflator data will cross as well as personal income data. The week’s calendar will finish with the revisions to UMich sentiment data and inflation expectations.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/10/2023 | 2330/0830 | ** |  | JP | Tokyo CPI |

| 27/10/2023 | 0030/1130 | * |  | AU | Producer price index q/q |

| 27/10/2023 | 0600/0800 | ** |  | SE | Retail Sales |

| 27/10/2023 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 27/10/2023 | 0700/0900 | *** |  | ES | GDP (p) |

| 27/10/2023 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 27/10/2023 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 27/10/2023 | - |  | EU | ECB's Lagarde Participates in Euro Summit | |

| 27/10/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 27/10/2023 | 1300/0900 |  | US | Fed's Michael Barr | |

| 27/10/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 27/10/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.