-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Brazil Central Bank Preview - May 2021

Brazil Central Bank

MNI POV: Arguments for Greater Than "Partial" Normalisation May Be Building

The full preview with analyst views can be found here:

MNI Brazil Central Bank Preview May 2021.pdf

Prior Communication – In the March statement the BCB outlined their intentions for the May meeting clearly:

"For the next meeting, unless there is a significant change in inflation projections or in the balance of risks, the Committee foresees the continuation of the partial normalization process with another adjustment, of the same magnitude, in the degree of monetary stimulus."

While the board stress their decisions depend upon the evolution on a multitude of economic factors, there have been no data or events that might prompt any surprises at this meeting regarding the previous decision.

Markets – Participants will be focused on whether the central bank sticks to similar language used at the March meeting relating to a partial normalisation. Given the unanimous consensus for the decision on rates, clues on further tightening and the magnitude of those moves will be eagerly eyed for any potential marginal implications for markets.

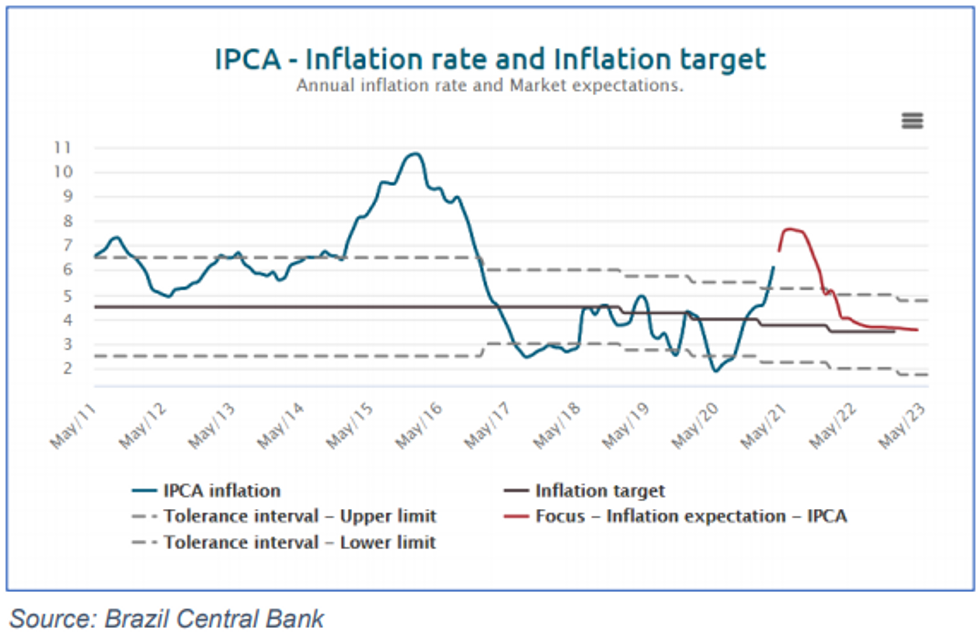

State-Of-Play - Inflation expectations have been revised higher since the March meeting. The latest focus survey sees 2021 expectations at 5.04% up from 4.60% and 2022 year-end inflation at 3.61%, up from 3.50%. Considering the BCB believe the 2022 year-end figure to be the most relevant for the policy horizon, this increase, albeit small, is significant as it confirms a potential de-anchoring of medium-term expectations.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.