-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Chile Central Bank Preview - July 2021: Lift-Off

MNI Chile CB Preview - July 2021

Executive Summary

- The Chilean Central Bank are likely to hike the key interest rate by 25bps to 0.75%.

- Following previous signals within the minutes and creeping inflationary pressures, the BCCh are expected to commence a gradual tightening cycle at their July meeting.

- The growth outlook and Covid situation continue to provide optimism relating to activity.

- These factors, combined with lingering political uncertainty and pressure on the currency, support the BCCh reducing the current level of monetary policy stimulus.

Click to view full preview: MNI BCCH Preview - July 2021.pdf

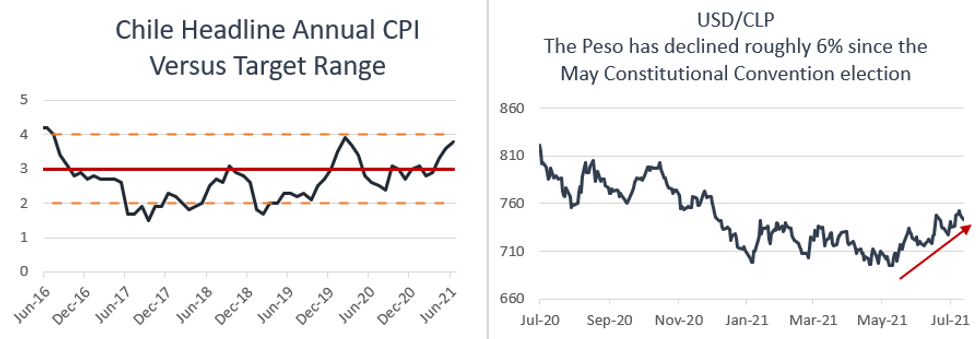

Inflation Edges Higher But Within Target Range

Headline annual inflation continued to climb, reaching 3.8% in June, from 3.65% in May. While the reading inches closer to the upper tolerance band of 4%, it was notably below the 4.1% estimate. Additionally, the central bank's preferred core inflation measure (core excluding volatile items) was 3.25% y/y, down from 3.37% in March. Nevertheless, the central bank raised its year-end headline inflation forecasts to 4.4% in 2021 from 3.0% in the previous monetary policy report, above the ceiling of the 3.0% +/- 1 percentage point target.

Following the data, analysts have debated whether a hike at the July meeting will manifest, however, several other factors may have strengthened the case for the start of policy rate lift-off.

Minutes From June Meeting Suggest High Likelihood Of Hike

By preparing the market for MPR adjustments that "would occur shortly", combined with the explicit discussion of a 25bps hike and continued favourable adjustments to the growth outlook, we believe the BCCh are comfortable with commencing hikes at Wednesday's meeting.

Growth and Covid Reasons For Optimism

May economic activity rebounded above expectations to 2.6% m/m, offsetting negative prints in both March and April, following tighter mobility restrictions amid the second wave of the pandemic. Most recently, the government adjusted their economic growth calculation to 7.5% for 2021, from 6% previously. Recovering activity points to a narrowing output gap and supports expectations for the central bank to reduce accommodation.

Source: MNI/Bloomberg

Source: MNI/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.