-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI CHINA LIQUIDITY INDEX: Dec Conditions, Policy Seen Steady

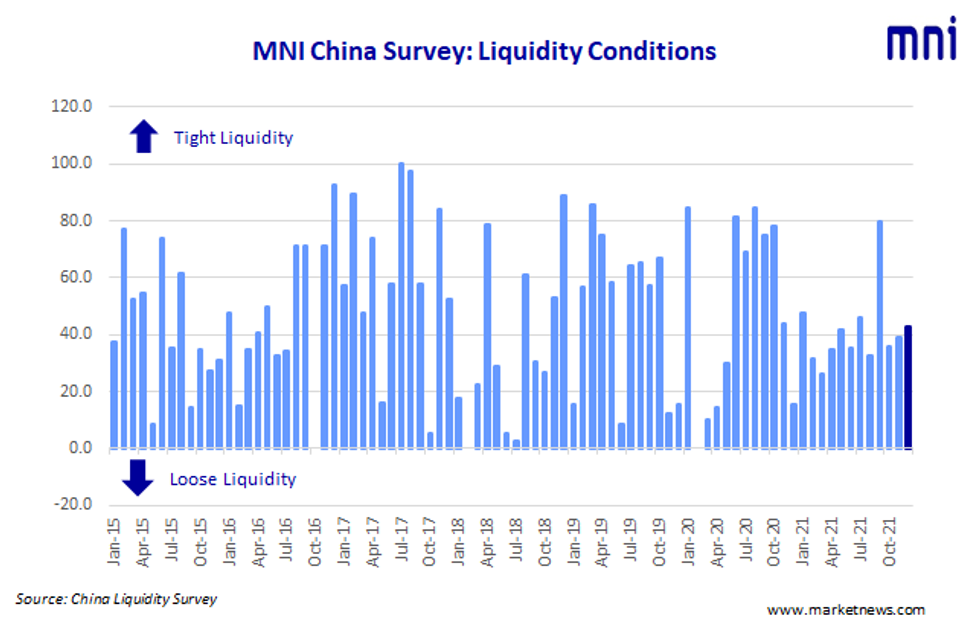

MNI Nov China Liquidity Conditions Index 38.9 Vs 35.7 Oct

Liquidity conditions across China’s interbank market were little changed into the end of the calendar year, with markets seeing stable policy in coming weeks, the latest MNI Liquidity Conditions Index shows.

The Liquidity Condition Index picked up to 42.9 in December from the previous 38.9, with 64.3% of the traders reporting conditions little changed from November.

The higher the index reading, the tighter liquidity appears to survey participants.

One trader with a state-owned bank based in Nanjing told MNI the People’s Bank of China would keep liquidity ample through month-end, meeting all the normal cash demands.

The PBOC conducted CNY500 billion MLF in December, draining CNY450 billion from the market after offsetting the CNY950 billion of maturities, draining another net CNY350 billion via its open market operation as of Dec 20, MNI calculated.

Against that, the reserve requirement ratio (RRR) cut effective on Dec 15 released around CNY1.2 trillion into the market.

DOWNWARD PRESSURE

The Economy Condition Index slid to 8.9 in December from last 14.8, with 82.1% traders expressing concern over the economy, with one Beijing-based trader expressing surprise that retail sales missed expectations in November.

But there was some optimism, with one trader at a commercial bank looking for a boost from government support measures.

Retail sales, slowed to 3.9% y/y in November from 4.9% y/y in October, the second lowest reading this year.

STEADY POLICY

The PBOC Policy Bias Index was 41.1 in December, slightly up from the 40.7 in November, with 82.1% of participants saying current policy will be well implemented.

One senior trader with top bank in Beijing told MNI the central bank would likely look to ease the transition between phases of the economy, keeping policy direction clear.

The Guidance Clarity Index was 53.6 in December, barely changed from 53.7 in December, with 92.9% of the traders seeing clear signals or messaging from the central bank’s move.

The 7-Day Repo Rate Index edged up to 78.6 from 74.1, with 64.3% of the participants predicting a higher rate before year-end. The 7-day weighted average interbank repo rate for depository institutions (DR007) closed at 2.0449% Tuesday.

The 10-year CGB Yield Index was 76.8 in December, up slightly from the previous 75.9, with 64.3% seeing yields climbing.

RATE CUT?

Following Monday’s surprise LPR cut, MNI asked survey respondents whether another rate cut was possible. A total 53.6% participants saw it as likely to see another policy or market rate-cut while 25.0% didn’t.

“Current rates are appropriate, more cuts are not necessary as the critical problem is there’s not sufficient capital demands rather than high rates,” one trader said.

The MNI survey collected the opinions of 28 traders with financial institutions operating in China's interbank market, the country's main platform for trading fixed income and currency instruments, and the main funding source for financial institutions. Interviews were conducted Dec 6 – Dec 17.

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.