-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI CHINA LIQUIDITY INDEX: Conditions Tighter Into Quarter End

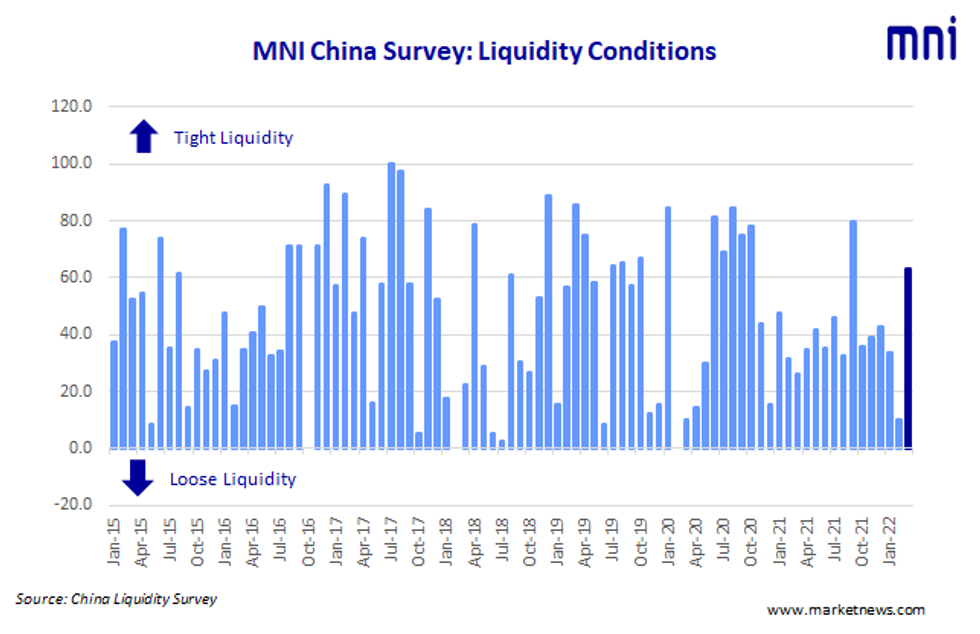

MNI March China Liquidity Conditions Index 63.3 Vs 10.0 Feb

Liquidity across China’s interbank markets tightened in March, with banks’ more cautious as they look to keep their books healthy ahead of the quarter-end Macro Prudential Assessment (MPA), the latest MNI Liquidity Conditions Index shows.

The Liquidity Condition Index jumped to 63.3 in March, up sharply from 10.0 in February, with a third of traders reporting condition as “tighter than last month”. The higher the index reading, the tighter liquidity appears to survey participants.

“Overnight funds are ample currently, but cross-quarter funding, particularly with renewed Covid-19 concerns, are seeing strong demand,” a trader with a state-owned bank in Shanghai told MNI.

“We noticed the recent liquidity squeeze, which is mainly caused by the MPA… capital will come back to the mean soon after the assessment,” a senior trader based in Zhejiang said.

The People’s Bank of China conducted CNY200 billion MLF in March, injecting CNY100 billion into the market after offsetting the CNY100 billion maturity. PBOC drained net CNY620 billion via its open market operation as of Mar 29, MNI calculated.

COVID IMPACTS

The Economy Condition Index fell to 21.7 in March from last 36.7, with more traders’ (63.3%) confidence hit by increasing covid cases in different cities all over China.

“Recent lockdowns are really beating market confidence…it’s definitely difficult for services,” a trader wrote in his questionnaire.

“Even Shanghai, the very financial center of China, is locked down half by half, we could read the strong determination of the government to ‘dynamic clear the covid cases’. But it’s really hard for business. Numbers of factories are shut down, people do not go out consuming, confidence are hit heavily,” the Shanghai trader said.

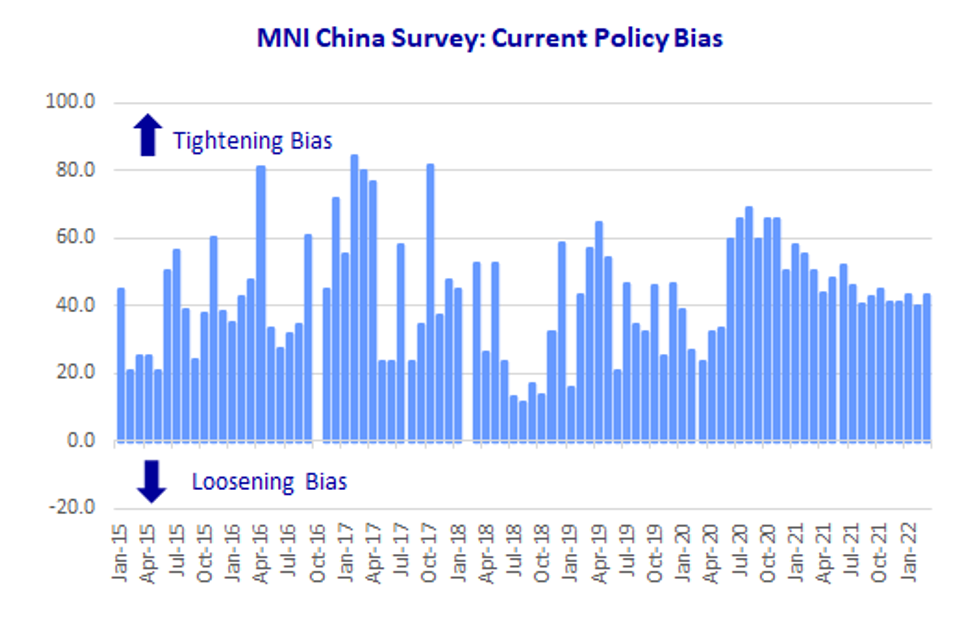

POLICY ON HOLD

The PBOC Policy Bias Index reads at 43.3 in March, up from 40.0 in February, with 86.7% of the participants seeing current policy implemented.

“Stability is still the top priority, especially on back of the new downward pressure caused by this round of epidemic,” the Beijing based trader told MNI.

The Guidance Clarity Index stood at 56.7 in March, slightly down from the previous 58.3, with traders saying they are receiving clear messages from the central bank. The PBOC is set to provide liquidity to offset any ‘black swan’ events, one trader saidopy.

RATES DIVERGE

The 7-Day Repo Rate Index edged up to 43.3 from 36.7 reading, with rates expected to dip after month-end.

The 7-day weighted average interbank repo rate for depository institutions (DR007) closed at 2.1816% Tuesday.

The 10-year CGB Yield Index was 66.7 in March, up from the previous 58.3 reading, with 53.3% seeing the yield will climb up.

The MNI survey collected the opinions of 30 traders with financial institutions operating in China's interbank market, the country's main platform for trading fixed income and currency instruments, and the main funding source for financial institutions. Interviews were conducted Mar 14 – Mar 25.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.