-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Brussels Focused On 4-Year Defence Exemption

MNI: China Market Liquidity Tighter As Economy Looks To Bounce

China’s interbank market liquidity tightened in September as traders bet the economy will snap back from recent weakness, MNI's latest China Liquidity Survey shows.

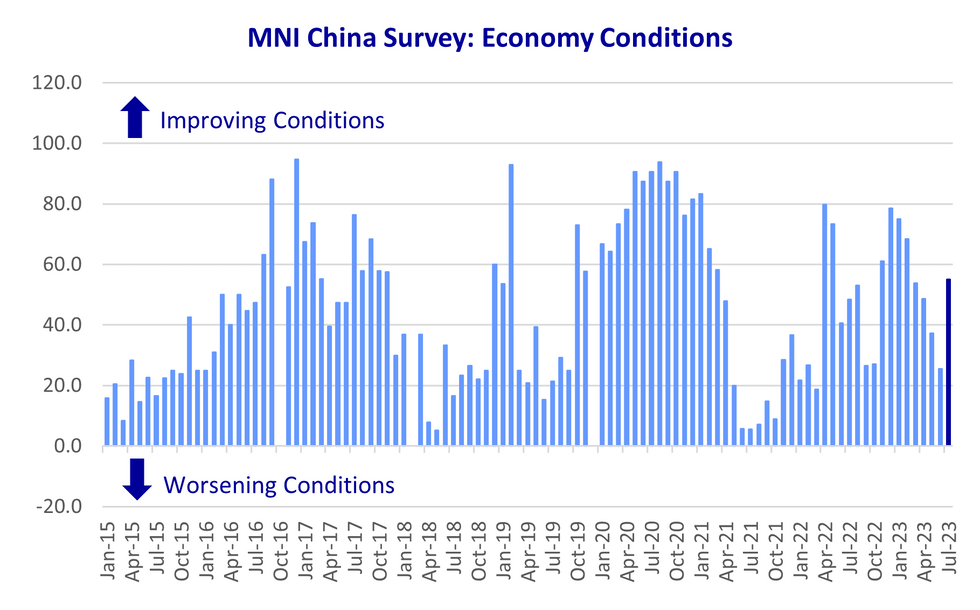

The September cut in banks' reserve requirements by the People's Bank of China and a better-than-expected month of output data have buoyed confidence, sending the the MNI China Economy Condition Index up almost 30 points to 55.1, a five-month high. Traders felt more confident about the economy, with almost 36% believing conditions had improved on last month.

With signs the economy is at least bottoming out, interbank liquidity was seen as tighter, despite the central bank's targetted move, although quarter-end regulatory cash-hoarding also weighed.

The benchmark MNI China Liquidity Condition Index climbed to 52.6 in September from August’s 44.9 as traders reported tighter conditions into quarter-end, even at the PBOC injected new cash into the system. The higher the index reading, the tighter liquidity.

The PBOC cut the RRR by 0.25% on Sept 15 releasing approximately CNY600 billion of funds into the banking system, with the central bank citing the need to consolidate economic recovery and maintain reasonable and ample liquidity. Additionally, the central bank conducted CNY591 billion of MLF in September, injecting CNY191 billion after offsetting maturities of CNY400 billion and had injected net CNY100 billion via open market operations as of Sept 23, MNI calculated.

The PBOC remains likely to cut its main policy rates to guide down the reference lending rate by 5-10bp later this year to bolster the economy. (See MNI PBOC WATCH: Banks’ Narrow Margins Restrain LPR Cut - Bonds & Currency News | Market News)

The central bank's next-day implementation of the cut following the announcement -- as opposed to the usual 10 day grace period -- showed the PBOC was focused on maintaining benign liquidity conditions in the interbank market, local economists told MNI. (See MNI PBOC WATCH: China To Keep LPR Steady, Q4 Rate Cut Eyed - Bonds & Currency News | Market News)

Looking longer term, the Chinese economy may need further accommodative policy to maintain a potential growth rate between 5.5-6% over the next 10 years, a policy advisor recently told MNI in an interview. (See: MNI INTERVIEW:Support Needed To Boost Future China GDP-Advisor - Bonds & Currency News | Market News) A former member of the PBOC's Monetary Policy Committee also told MNI that authorities may need to adopt more aggressive expansionary macroeconomic policies, including more fiscal spending and rate cuts. (See MNI INTERVIEW: More Stimulus Needed To Counter China Slowdown - Bonds & Currency News | Market News)

However the economy plays out, traders don’t anticipate surprises from the PBOC in coming months, with the outlook for both policy bias and clarity from the central bank little changed on the previous month. The MNI China PBOC Policy Bias Index stood at 35.9, while the MNI China Guidance Clarity Index was little changed at 51.3, following 53.8 in September, with 87% of participants saying they clearly understood the PBOC policy intentions.

RATES UP

With the signalled improvement in the economic outlook, rates crept higher. The MNI China 7-Day Repo Rate Index rose to 47.4 in September, compared with 26.9 in August, while the MNI China 10-year CGB Yield Index read 39.7, up from 34.6. previously.

The full report, including the latest special question, is here:

MNI China Liquidity Index September 2023.pdf

For full database history on the MNI China Liquidity Index™, please contact:sales@marketnews.com

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.