-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI European Closing FI Analysis: Bunds Shrug As Equities Dive

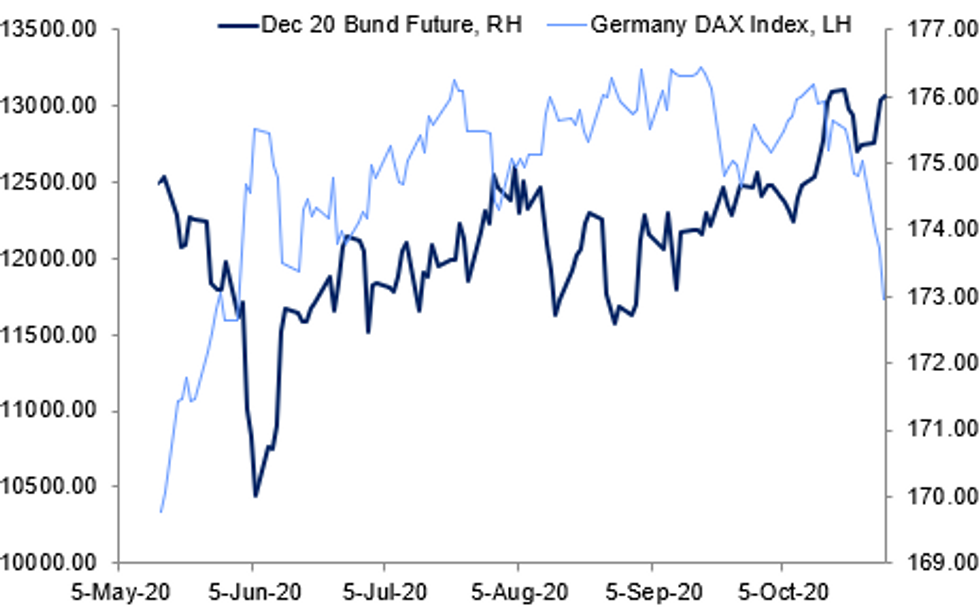

Fig. 1: Bunds Recede From Highs Despite Equity Plummet

EGB SUMMARY: Peripheral spreads continue to widen but Bunds ignore equity rout

- As concerns about lockdowns in France and Germany continue to dominate the market, peripheral spreads have continued to widen through the day with BTP-Bund 10-year spreads 8.7bp wider on the day at the time of writing.

- Despite the one way move in peripheral spreads and in equities (and also in FX markets), core fixed income markets have seen proportionally much smaller moves. In fact, Bund futures are 30 ticks off their highs of the day at the time of writing.

- Headlines have been hitting the wires about an agreement of a German one month lockdown over the past few minutes and French President Macron is due to announce new restrictions tonight at 19:00GMT.

- Bund futures are up 0.14 today at 176.08 with 10y Bund yields down -0.9bp at -0.625% and Schatz yields down -1.4bp at -0.794%.

- BTP futures are down -0.83 today at 148.83 with 10y yields up 7.5bp at 0.774% and 2y yields up 5.3bp at -0.326%.

- OAT futures are down -0.17 today at 169.69 with 10y yields up 0.9bp at -0.320% and 2y yields down -0.7bp at -0.725%.

GILT SUMMARY: Giving Back Early Gains

Having sharply bull flattened earlier in the session, gilts have given back some of the gains.

Cash yields are now within 2bp of yesterday's close. Last yields: 2-year -0.0563%, 5-year -0.0629%, 10-year 0.2188%, 30-year 0.7612%.- The Dec-20 gilt future trades at 136.12, towards the bottom end of the day's range (L: 136.07 / H: 136.33).

- The DMO earlier sold GBP2.5bn of the 0.375% Oct-30 Gilt with a further GBP584.999mn taken up through the PAOF.

- The BoE bought GBP1.473bn of medium-term gilts with an offer-to-cover ratio of 1.85x.

- Tomorrow will see the publication of money supply, consumer credit and mortgage approval data for September, which are unlikely to be market moving.

- Although the focus tomorrow will be on the ECB meeting, no material change in policy is expected and the gilt market should be unaffected.

DEBT FUTURES/OPTIONS:

- ERM1 100.50 put x 1.5 v 100.625 call (v 100.54, 78d), sells put at 2.25 in 18.75k x 12.5k

- ERH1 100.50/100.625 call spread v 3RH1 100.50/100.625 call spread bought for 0.25 in 1.25k (+front, -blue)

- 0RU1 100.625^ sold at 18 in 1k

- 2LU1 99.875/100.125 ^^ sold at 21.5 in 1k

- LH1 100.125 calls bought for 1.75 in 4k (v 99.98, 18d)

- LU1 100.00/100.125/100.25 call fly bought for 1.5 in 1k

- LZ0 99.875 put bought for 0.5 in 5k

- DUZ0 112.40/112.30/112.20 put fly bought for 2.5 in 2k

- DUZ0 112.40/112.50/112.60 call fly bought for 2.75 in 10k

- OEZ0 135.50/135.75 1x2 call spread bought for -10 in 1k

- RXZ0 176.00/175.00/174.00 put fly bought for 15 / 16 in 2k

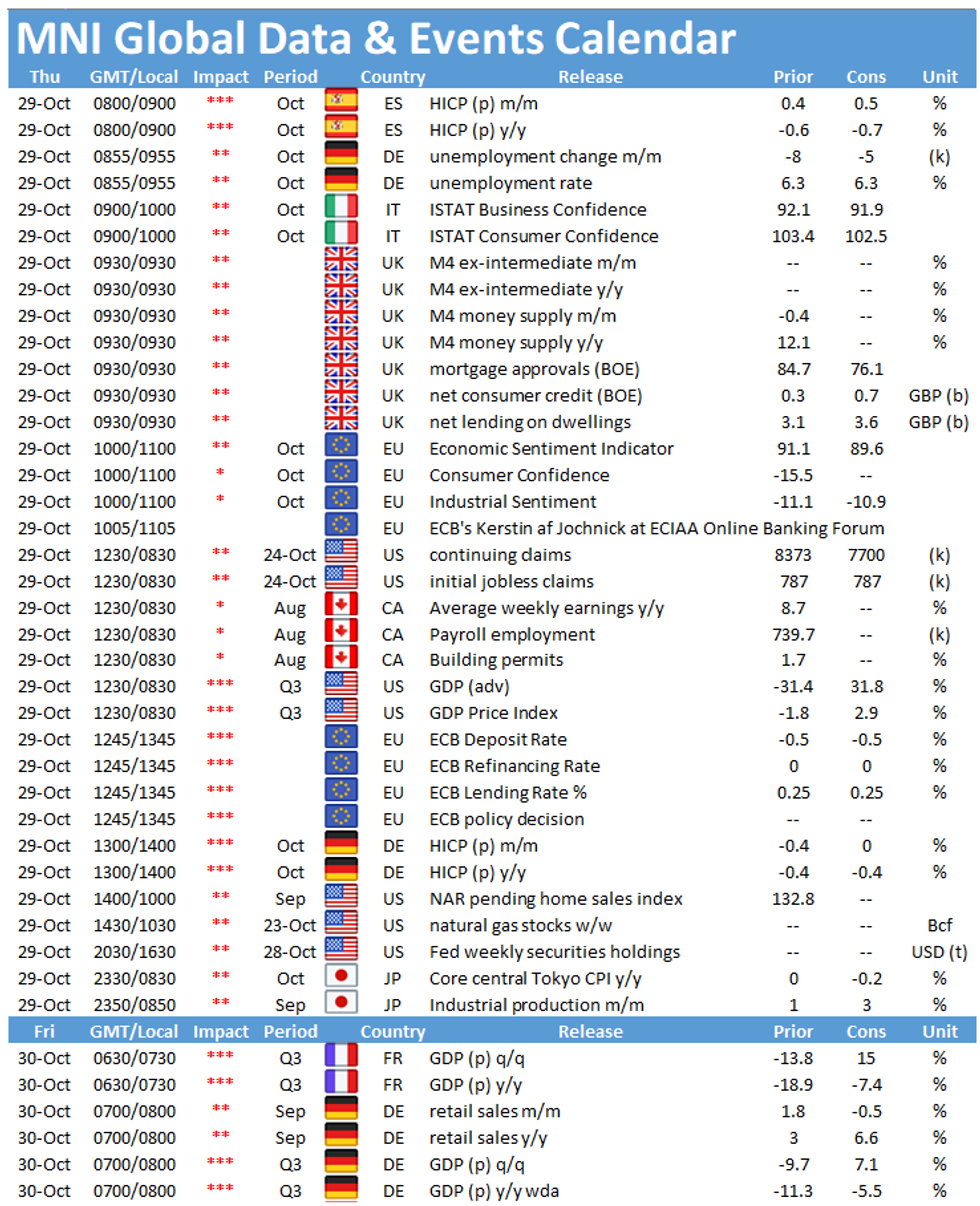

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.